vTv Therapeutics Inc. (Nasdaq:VTVT) today reported financial

results for the first quarter that ended March 31, 2019, and

provided an update on recent achievements and upcoming events.

“We continue to make significant progress with our operational

plans and look forward to announcing in the second quarter results

from part 1 of our phase 2 Simplici-T1 trial in patients with type

1 diabetes, and the initiation of a phase 2 clinical trial of

azeliragon in patients with mild-Alzheimer’s disease (AD) and type

2 diabetes,” said Steve Holcombe, chief executive officer, vTv

Therapeutics.

Recent Achievements and Outlook

- Simplici-T1 Study

enrolling patients with type 1 diabetes. We completed

enrollment of part 1 of the phase 2 Simplici-T1 Study, a 12-week

study to evaluate TTP399 as an add-on to insulin therapy for

patients with type 1 diabetes, and expect to report results in June

2019. We also began screening patients in the part 2 confirmatory

phase 2 and expect to report results for that portion of the study

in the latter part of the first quarter of 2020. In the previous

AGATA Study, a phase 2 study in type 2 diabetes patients, TTP399

demonstrated statistically significant reductions in HbA1c levels.

Importantly, TTP399 has been well tolerated in all clinical studies

to date with negligible incidences of hypoglycemia and

hyperlipidemia and no occurrences of ketoacidosis.

- Screening for Phase 2 clinical trial

of azeliragon expected to begin in June 2019. We are performing

start-up activities for a clinical trial to evaluate azeliragon as

a potential treatment of mild-AD in patients with type 2 diabetes

that consists of sequential phase 2 and phase 3 studies

operationally conducted under a single clinical trial protocol. The

phase 2 study is designed to enroll approximately 100 patients to

evaluate the impact of six months of treatment with azeliragon on

cognitive performance as measured by the change from baseline in

the Alzheimer’s Disease Assessment Scale – Cognitive Subscale

(“ADAS-COG14”). We expect to begin screening patients in June 2019

for the phase 2 clinical trial and to report top-line results from

the phase 2 study by the end of the fourth quarter of 2020. The

phase 3 study is designed to enroll approximately 200 patients to

evaluate the efficacy of 18 months of treatment with azeliragon on

cognition and global function as measured by the change from

baseline in the ADAS-COG14 and Clinical Dementia Rating Scale Sum

of Boxes. The design of the phase 3 study may be adapted based on

the results of the phase 2 study.

- Publication of paper discussing the

discovery and development of TTP399. In the first quarter, we

announced the publication of a paper in Science Translational

Medicine showcasing the discovery and development of TTP399. The

paper reviewed the scientific rationale underpinning the

development of TTP399 and detailed its progression from preclinical

to clinical development.

First Quarter 2019 Financial Results

- Cash Position: Cash and

cash equivalents as of March 31, 2019, were $5.0 million

compared to $1.7 million as of December 31, 2018.

- R&D Expenses: Research

and development expenses were $2.8 million in each of the

first quarter of 2019 and the fourth quarter of 2018.

- G&A Expenses: General

and administrative expenses were $2.4 million and $2.1 million in

the first quarter of 2019 and the fourth quarter of 2018,

respectively.

- Net Loss Before Non-Controlling

Interest: Net loss before non-controlling interest

was $4.0 million for the first quarter of 2019 compared to net

loss before non-controlling interest of $2.3 million for the

fourth quarter of 2018.

- Net Loss Per Share: GAAP

net loss per share was $0.26 and $0.10 for the three months ended

March 31, 2019 and December 31, 2018, respectively, based on

weighted-average shares of 22.9 million and 17.6 million for the

three month periods ended March 31, 2019 and December 31, 2018,

respectively. Adjusted pro forma net loss per fully exchanged share

was $0.09 and $0.06 for the three months ended March 31, 2019 and

December 31, 2018, respectively, based on adjusted pro forma fully

exchanged weighted-average shares of 46.0 million and 40.7 million

for the three months ended March 31, 2019 and December 31, 2018,

respectively.

vTv Therapeutics Inc.

Condensed Consolidated Balance

Sheets

(in thousands)

March 31, December 31, 2019 2018

(Unaudited) Assets Current assets: Cash and cash

equivalents $ 4,959 $ 1,683 Prepaid expenses and other current

assets 419 666 Current deposits 34 1,124 Total

current assets 5,412 3,473 Restricted cash and cash equivalents,

long-term 2,500 2,500 Property and equipment, net 62 70 Operating

lease right-of-use assets 246 — Long-term investments 2,480 2,480

Long-term deposits 36 36 Total assets $ 10,736 $

8,559

Liabilities, Redeemable Noncontrolling Interest and

Stockholders’ Deficit Current liabilities: Accounts payable and

accrued expenses $ 6,244 $ 7,702 Operating lease liabilities 259 —

Current portion of deferred revenue 839 1,752 Current portion of

notes payable 9,167 9,383 Total current liabilities

16,509 18,837 Notes payable, net of current portion 4,014 6,330

Deferred revenue, net of current portion 1,067 1,067 Warrant

liability, related party 1,515 2,436 Other liabilities 260

260 Total liabilities 23,365 28,930 Commitments and

contingencies Redeemable noncontrolling interest 45,106 62,482

Stockholders’ deficit: Class A Common Stock 273 203 Class B Common

Stock 232 232 Additional paid-in capital 162,249 150,595

Accumulated deficit (220,489 ) (233,883 ) Total

stockholders’ deficit attributable to vTv Therapeutics Inc.

(57,735 ) (82,853 ) Total liabilities, redeemable

noncontrolling interest and stockholders’ deficit $ 10,736 $ 8,559

vTv Therapeutics Inc.

Condensed Consolidated Statements of

Operations - Unaudited

(in thousands, except per share

data)

Three Months Ended March 31, 2019

December 31, 2018 Revenue $ 921 $ 4,522 Operating expenses:

Research and development 2,822 2,800 General and administrative

2,386 2,073 Total operating expenses 5,208

4,873 Operating loss (4,287 ) (351 ) Interest income 10 14

Interest expense (626 ) (743 ) Other income (expense), net

921 (1,248 ) Loss before income taxes and noncontrolling

interest (3,982 ) (2,328 ) Income tax provision — —

Net loss before noncontrolling interest (3,982 ) (2,328 ) Less: net

loss attributable to noncontrolling interest (1,827 )

(1,237 ) Net loss attributable to vTv Therapeutics Inc. $ (2,155 )

$ (1,091 ) Net loss attributable to vTv Therapeutics Inc. common

shareholders $ (5,883 ) $ (1,830 )

Net loss per share of vTv Therapeutics

Inc. Class A Common Stock, basic and diluted

$ (0.26 ) $ (0.10 )

Weighted-average number of vTv

Therapeutics Inc. Class A Common Stock, basic and diluted

22,862,907 17,635,159

vTv Therapeutics Inc.

Condensed Consolidated Statements of

Operations - Unaudited

(in thousands, except per share

data)

Three Months Ended March 31, 2019

2018 Revenue $ 921 $ 2,064 Operating expenses: Research and

development 2,822 8,943 General and administrative 2,386

2,255 Total operating expenses 5,208 11,198

Operating loss (4,287 ) (9,134 ) Interest income 10 18 Interest

expense (626 ) (855 ) Other income (expense), net 921

11 Loss before income taxes and noncontrolling interest (3,982 )

(9,960 ) Income tax provision — — Net loss before

noncontrolling interest (3,982 ) (9,960 ) Less: net loss

attributable to noncontrolling interest (1,827 )

(7,008 ) Net loss attributable to vTv Therapeutics Inc. $ (2,155 )

$ (2,952 ) Net loss attributable to vTv Therapeutics Inc. common

shareholders $ (5,883 ) $ (2,952 )

Net loss per share of vTv Therapeutics

Inc. Class A Common Stock, basic and diluted

$ (0.26 ) $ (0.30 )

Weighted-average number of vTv

Therapeutics Inc. Class A Common Stock, basic and diluted

22,862,907 9,699,721

About vTv Therapeutics

vTv Therapeutics Inc. is a clinical-stage biopharmaceutical

company engaged in the discovery and development of orally

administered small molecule drug candidates to fill significant

unmet medical needs. vTv has a pipeline of clinical drug candidates

led by programs for the treatment of Alzheimer’s disease, diabetes,

and inflammatory disorders.

Forward-Looking Statements

This release contains forward-looking statements, which involve

risks and uncertainties. These forward-looking statements can be

identified by the use of forward-looking terminology, including the

terms “anticipate,” “believe,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “target,” “will,” “would” and, in each case, their

negative or other various or comparable terminology. All statements

other than statements of historical facts contained in this

release, including statements regarding the timing of our clinical

trials, our strategy, future operations, future financial position,

future revenue, projected costs, prospects, plans, objectives of

management and expected market growth are forward-looking

statements. These statements involve known and unknown risks,

uncertainties and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements. Important factors that

could cause our results to vary from expectations include those

described under the heading “Risk Factors” in our Annual Report on

Form 10-K and our other filings with the SEC. These forward-looking

statements reflect our views with respect to future events as of

the date of this release and are based on assumptions and subject

to risks and uncertainties. Given these uncertainties, you should

not place undue reliance on these forward-looking statements. These

forward-looking statements represent our estimates and assumptions

only as of the date of this release and, except as required by law,

we undertake no obligation to update or review publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise after the date of this release. We

anticipate that subsequent events and developments will cause our

views to change. Our forward-looking statements do not reflect the

potential impact of any future acquisitions, merger, dispositions,

joint ventures or investments we may undertake. We qualify all of

our forward-looking statements by these cautionary statements.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with generally accepted

accounting principles in the U.S. (“GAAP”), we use adjusted pro

forma earnings per fully exchanged share, which is a non-GAAP

financial measure. Adjusted pro forma earnings per fully exchanged

share is defined as net loss attributable to vTv Therapeutics Inc.

common shareholders including the loss attributable to the

non-controlling interest and assuming the exchange of all the Class

B common stock of vTv Therapeutics Inc. and an equal number of

non-voting common units of vTv Therapeutics LLC (“vTv Units”) for

shares of Class A common stock of vTv Therapeutics Inc.

Additionally, we have adjusted this metric for the non-cash deemed

distributions that were made in connection with our letter

agreements with MacAndrews & Forbes Group LLC. We believe that

this measure provides useful information to investors as it

eliminates the variability of non-controlling interest resulting

from the exchanges of Class B common stock and vTv Units into Class

A common stock and excludes the impact of the non-cash deemed

distribution. This measure is not intended to be considered in

isolation or as a substitute for, or superior to, financial

measures prepared and presented in accordance with GAAP.

The following is a reconciliation of adjusted pro forma earnings

per fully exchanged share, basic and diluted to its most directly

comparable GAAP measure, net loss attributable to vTv Therapeutics

Inc. common shareholders, basic and diluted and the computation of

the components of this non-GAAP measure:

Three Months Ended March 31, 2019

December 31, 2018 Numerator: Net loss attributable to vTv

Therapeutics Inc. common shareholders $ (5,883 ) $ (1,830 ) Deemed

distribution to related party 3,728 739

Reallocation of net income attributable to

non-controlling interest from the assumed exchange of Class B

shares (1)

(1,827 ) (1,237 ) Net loss before noncontrolling

interest $ (3,982 ) $ (2,328 ) Denominator:

Weighted-average number of vTv

Therapeutics Inc. Class A Common Stock, basic and diluted

22,862,907 17,635,159 Assumed exchange of Class B Common Stock (1)

23,094,221 23,094,221

Adjusted pro forma fully exchanged

weighted-average shares of Class A common stock outstanding, basic

and diluted

45,957,128 40,729,380

Adjusted pro forma earnings per fully

exchanged share, basic and diluted

$ (0.09 ) $ (0.06 )

Three Months Ended March

31, 2019 2018 Numerator: Net loss attributable to

vTv Therapeutics Inc. common shareholders $ (5,883 ) $ (2,952 )

Deemed distribution to related party 3,728 —

Reallocation of net income attributable to

non-controlling interest from the assumed exchange of Class B

shares (1)

(1,827 ) (7,008 ) Net loss before noncontrolling

interest $ (3,982 ) $ (9,960 ) Denominator:

Weighted-average number of vTv

Therapeutics Inc. Class A Common Stock, basic and diluted

22,862,907 9,699,721 Assumed exchange of Class B Common Stock (1)

23,094,221 23,115,631

Adjusted pro forma fully exchanged

weighted-average shares of Class A common stock outstanding, basic

and diluted

45,957,128 32,815,352

Adjusted pro forma earnings per fully

exchanged share, basic and diluted

$ (0.09 ) $ (0.30 )

(1)

Assumes the exchange of all outstanding

Class B common stock, resulting in the elimination of the

non-controlling interest and recognition of the net income

attributable to non-controlling interests.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190501005900/en/

Investors:vTv Therapeutics Inc.IR@vtvtherapeutics.com

or

Media:Josh Vlasto, 212-572-5969PR@vtvtherapeutics.com

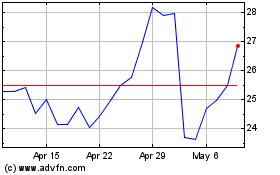

vTv Therapeutics (NASDAQ:VTVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

vTv Therapeutics (NASDAQ:VTVT)

Historical Stock Chart

From Apr 2023 to Apr 2024