Current Report Filing (8-k)

August 06 2020 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) of the SECURITIES EXCHANGE ACT OF

1934

Date of Report (Date of earliest event reported): August 2, 2020

VistaGen Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

NEVADA

|

000-54014

|

20-5093315

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

|

343 Allerton Ave.

South San Francisco, California 94090

|

|

(Address of principal executive offices)

|

(650) 577-3600

(Registrant’s telephone number, including area

code)

Not Applicable

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

☐ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a

-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d -2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e -4(c))

Securities registered pursuant to Section 12(b) of the

Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which

registered

|

|

Common

Stock, par value $0.001 per share

|

VTGN

|

Nasdaq

Capital Market

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17

CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR 240.12b-2)

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act ☐

Item 1.01 Entry into a Material Definitive Agreement.

On August 2, 2020, VistaGen Therapeutics, Inc.

(the “Company”) entered into an underwriting agreement

(the “Underwriting

Agreement”) with Maxim

Group, LLC as representative of the underwriters named therein

(“the “Underwriter”), pursuant to which the Company agreed to

issue and sell to the Underwriter, in an underwritten public

offering (the “Public

Offering”), an aggregate

of 15,625,000 shares (the “Shares”) of the Company’s common stock, par

value $0.001 per share (“Common

Stock”) for a public

offering price of $0.80 per Share, resulting in gross proceeds to

the Company of $12,500,000. The Public Offering closed on August 5,

2020 at which time the Shares were offered and sold to the

Underwriter. Copies of the press releases announcing the pricing of

the Public Offering and the closing of the Public Offering are

attached to this Current Report on Form 8-K as Exhibits 99.1 and

99.2, respectively.

The

Company expects to use the net proceeds from the Public Offering of

approximately $11,260,000, after deducting underwriting discounts

and commissions and offering expenses payable by the Company but

before any exercise of the Over-Allotment Option (defined below),

for the continued development of its CNS pipeline programs, and for

general research and development, working capital and general

corporate purposes.

Under the terms of the Underwriting Agreement, the

Company granted to the Underwriter a

45-day over-allotment option (the

“Over-Allotment

Option”) to purchase up

to an additional 2,343,750 Shares (the “Option

Shares”) at a public

offering price of $0.80 per share, less discounts and commissions.

On August 5, 2020, the Underwriter delivered notice to the Company

that it has elected to partially exercise the Over-Allotment Option

with respect to an aggregate of 2,243,250 Option Shares, which, if

completed, will result in additional gross proceeds to the Company

of $1,794,600. The closing of the Option Shares is expected to

occur on or about August 7, 2020.

The Shares were, and the Option Shares are, being

sold pursuant to the Company’s effective

shelf registration statement filed with the

Securities and Exchange Commission (“SEC”) on September 30, 2019, and declared

effective on October 7, 2019 (File No. 333-234025).

A prospectus supplement relating to the Public Offering,

including the Over-Allotment Option, was filed with the SEC on

August 5, 2020.

The

Underwriting Agreement contains customary representations,

warranties and agreements by the Company, customary conditions to

closing, indemnification obligations of the Company and the

Underwriter, including for liabilities under the Securities Act of

1933, as amended, other obligations of the parties, and termination

provisions. The representations, warranties and covenants contained

in the Underwriting Agreement were made solely for the benefit of

the parties thereto and may be subject to limitations agreed upon

by the contracting parties. Accordingly, the Underwriting Agreement

is incorporated herein by reference only to provide investors with

information regarding the terms of the Underwriting Agreement and

not to provide investors with any other factual information

regarding the Company or its business, and should be read in

conjunction with the disclosures in the Company’s periodic

reports and other filings with the SEC.

A

copy of the Underwriting Agreement is attached hereto as Exhibit

1.1 and is incorporated herein by reference. The foregoing

description of the material terms of the Underwriting Agreement

does not purport to be complete and is qualified in its entirety by

reference to such exhibit.

A

copy of the legal opinion and consent of Disclosure Law Group, a

Professional Corporation, relating to the Shares and the Option

Shares is attached hereto as Exhibit 5.1.

Item 8.01 Other Events.

Receipt of $5,000,000 Upfront License Payment from

EverInsight

On August 3, 2020, the Company received a

$5,000,000 non-dilutive upfront license payment from EverInsight

Therapeutics Inc. (“EverInsight”), the Company's strategic partner focusing

on development and commercialization of PH94B, the Company's

investigative rapid-onset neurosteroid nasal spray for treatment of

anxiety-related disorders, in multiple key markets in Asia,

pursuant to the terms and conditions of the Company’s license

and collaboration agreement with EverInsight, entered into on June

24, 2020 (the “EverInsight

Agreement”). Additional

disclosure regarding the EverInsight Agreement is available in the

Company’s Current Report on Form 8-K filed with the SEC on

June 26, 2020. A copy of the Company’s press release

regarding receipt of the upfront license payment from EverInsight

is attached to this Current Report on Form 8-K as Exhibit

99.3.

Compliance with Nasdaq Continued Listing Requirements

On August 3, 2020, the Company received a letter

from the Listing Qualifications Staff (the

“Staff”) of The Nasdaq Stock Market, LLC

(“Nasdaq”) indicating that the Staff has determined

that the Company is now in compliance with the market value of

listed securities standard set forth in Nasdaq Listing Rule

5550(b)(2).

The Company must satisfy the minimum bid price

requirement set forth in Nasdaq Listing Rule 5550(a)(2), pursuant

to which the closing bid price of the Company’s Common Stock

must be at least $1.00 per share or greater for at least 10

consecutive trading days (the “Bid Price

Rule”), by October 12,

2020 to regain full compliance with Nasdaq’s continued

listing standards. If the Company does not regain compliance with

the Bid Price Rule by October 12, 2020, Nasdaq may grant an

additional 180 day period to regain compliance, so long as the

Company meets the remaining Nasdaq Capital Market

continued listing requirements and notifies Nasdaq in

writing of its intention to cure the deficiency during the second

compliance period. However, there can be no assurance that, if

necessary on October 12, 2020, Nasdaq will grant us the second

180-day compliance period to regain. If we do not qualify for the

second 180-day compliance period, or, if granted, we fail to regain

compliance during the second 180-day period,

then Nasdaq will notify us of its determination to delist

our common stock, at which point we would then have an opportunity

to appeal the delisting determination to a hearings

panel.

No

assurance can be given that the Company will meet applicable Nasdaq

continued listing standards. Failure to meet applicable Nasdaq

continued listing standards could result in a delisting of the

Company’s common stock, which could materially reduce the

liquidity of its common stock and result in a corresponding

material reduction in the price of its common stock. In addition,

delisting could harm the Company’s ability to raise capital

through alternative financing sources on terms acceptable to it, or

at all, and may result in the inability to advance its drug

development programs, potential loss of confidence by investors and

employees, and fewer business development

opportunities.

Forward-Looking Statements

This

Current Report on Form 8-K contains forward-looking statements that

involve risks and uncertainties, such as statements related to the

anticipated closing of the partial exercise of the Over-Allotment

Option and the amount of proceeds expected from such exercise. The

risks and uncertainties involved include the Company’s

ability to satisfy certain conditions to closing of the partial

exercise of the Over-Allotment Option on a timely basis or at all,

as well as other risks detailed from time to time in the

Company’s filings with the SEC. You are cautioned not to

place undue reliance on forward-looking statements, which are based

on the Company’s current expectations and assumptions and

speak only as of the date of this report. The Company does not

intend to revise or update any forward-looking statement in this

report to reflect events or circumstances arising after the date

hereof, except as may be required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits Index

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

Underwriting

Agreement, dated August 2, 2020, by and between VistaGen

Therapeutics, Inc. and Maxim Group LLC

|

|

|

|

Opinion of Disclosure Law Group, a Professional

Corporation

|

|

|

|

Consent of Disclosure Law Group, a Professional Corporation

(included in Exhibit 5.1)

|

|

|

|

Press Release issued by VistaGen Therapeutics, Inc. to announce

pricing of the Public Offering, dated August 2, 2020.

|

|

|

|

Press Release issued by VistaGen Therapeutics, Inc. to announce the

closing of the Public Offering, dated August 5, 2020.

|

|

|

|

Press Release issued by VistaGen Therapeutics, Inc. to announce

receipt of the upfront license payment from EverInsight

Therapeutics, Inc., dated August 3, 2020.

|

Signatures

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

|

|

VistaGen

Therapeutics, Inc.

|

|

|

|

|

|

Date:

August 5, 2020

|

By:

|

/s/ Shawn K. Singh

|

|

|

|

Shawn

K. Singh

Chief

Executive Officer

|

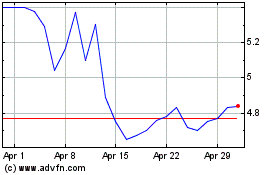

VistaGen Therapeutics (NASDAQ:VTGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

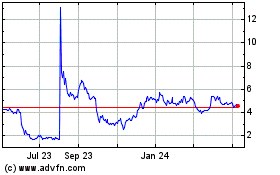

VistaGen Therapeutics (NASDAQ:VTGN)

Historical Stock Chart

From Apr 2023 to Apr 2024