Vicor Corporation (NASDAQ: VICR) today reported financial results

for the fourth quarter and year ended December 31, 2018.

These results will be discussed later today at 5:00 p.m. (Eastern

Time) during management’s quarterly investor conference call.

The details for accessing the call are presented below.

Revenues for the fourth quarter ended December

31, 2018 totaled $73.7 million, a 25.4% increase from $58.8 million

for the corresponding period a year ago, and a 5.5% sequential

decrease from $78.0 million for the third quarter of 2018. Revenues

for the year ended December 31, 2018 were $291.2 million, an

increase of 27.8% from $227.8 million the prior year.

Gross margin increased to $33.9 million for the

fourth quarter of 2018, compared to $26.9 million for the

corresponding period a year ago, and decreased sequentially from

$39.0 million for the third quarter of 2018. Gross margin, as

a percentage of revenue, increased to 45.9% for the fourth quarter

of 2018, compared to 45.8% for the corresponding period a year ago

and decreased from 50.0% for the third quarter of 2018.

Net income for the fourth quarter was $6.9

million, or $0.17 per diluted share, compared to net income of $1.6

million, or $0.04 per share, for the corresponding period a year

ago, and net income of $13.0 million, or $0.32 per diluted share,

for the third quarter of 2018. Net income for 2018 was $31.7

million, or $0.78 per diluted share, compared to net income of

$167,000, or $0.00 per diluted share, for the prior year.

Cash and cash equivalents sequentially increased

by $2.4 million to approximately $70.6 million at the end of the

fourth quarter of 2018, from $68.2 million at the end of the third

quarter of 2018. Capital expenditures for the fourth quarter

totaled $11.3 million, up from $3.3 million for the third quarter

and $2.4 million for the corresponding period a year ago.

Fourth quarter bookings decreased 15.2% to $60.5

million, from $71.3 million for the corresponding period a year

ago, and decreased sequentially 33.6% from $91.1 million for the

third quarter of 2018. Total backlog at the end of the fourth

quarter of 2018 was $103.0 million, up 41% from $73.1 million at

the end of 2017.

Commenting on the fourth quarter, Dr. Patrizio

Vinciarelli, Chief Executive Officer, stated: “Our Q4 results

reflect sudden headwinds including temporary softness in data

center spending and the impact of tariffs on imports by

China. Our revenue was lower than forecast as orders were

delayed and deliveries rescheduled. Lower production volumes and

inefficiency caused by shifting mix caused a sequential decline in

gross margins. Nevertheless, year-over-year Vicor recorded a 28%

increase in revenue and a 41% increase in backlog.”

Dr. Vinciarelli continued: “AI ASICs and GPUs

drawing hundreds of Amperes below 1 Volt are adopting Vicor’s

Power-on-Package™ (“PoP”) solutions. PoP design-in activity

using MCMs recently took on a new dimension with design wins

leveraging Geared MCMs, or “GCMs”. By providing efficient Vertical

Power Delivery, GCMs support peak currents in the thousands of

Amperes fueling the computational power necessary to make AI even

smarter. Advanced solutions are extending Vicor’s lead over

competition anchored by legacy 12V infrastructure or confused by

misinformed claims about GaN.”

“In automotive, Vicor is getting significant

traction with OEMs and Tier 1 suppliers challenged by

electrification and the advent of the 48V bus. Our value

proposition importantly includes the high density and modular

flexibility needed by advanced autonomous driving systems. Based on

the trajectory of early engagements, we expect that within a few

years our growth in the automotive segment will be comparable to

the growth we are now experiencing powering AI and servers in

datacenters.”

“In general, across key growth markets, Vicor is

recognized for unrivaled technological leadership in high

performance power system solutions. We are addressing major

opportunities and scaling up capacity to support forecast

production requirements.”

For more information on Vicor and its products,

please visit the Company’s website at www.vicorpower.com.

Earnings Conference Call

Vicor will be holding its investor conference

call as scheduled, on Tuesday, February 26, 2019 at 5:00 p.m.

Eastern Time. Shareholders interested in participating in the

call should call 888-339-2688 at approximately 4:50 p.m. and use

the Passcode 64676641. Internet users may listen to a

real-time audio broadcast of the conference call on the Investor

Relations section of Vicor’s website at www.vicorpower.com.

Please go to the website at least 15 minutes prior to the call to

register, download and install any necessary software. For

those who cannot participate in the conference call, a replay will

be available, shortly after the conclusion of the call, through

March 13, 2019. The replay dial-in number is 888-286-8010 and

the Passcode is 10247812. In addition, a webcast replay of

the conference call will also be available on the Investor

Relations section of Vicor’s website at www.vicorpower.com

beginning shortly after the conclusion of the call.

This press release contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Any statement in

this press release that is not a statement of historical fact is a

forward-looking statement, and, the words “believes,” “expects,”

“anticipates,” “intends,” “estimates,” “plans,” “assumes,” “may,”

“will,” “would,” “should,” “continue,” “prospective,” “project,”

and other similar expressions identify forward-looking

statements. Forward-looking statements also include

statements regarding bookings, shipments, revenue, profitability,

targeted markets, increase in manufacturing capacity and

utilization thereof, future products and capital resources. These

statements are based upon management’s current expectations and

estimates as to the prospective events and circumstances that may

or may not be within the company’s control and as to which there

can be no assurance. Actual results could differ materially

from those projected in the forward-looking statements as a result

of various factors, including those economic, business, operational

and financial considerations set forth in Vicor’s Annual Report on

Form 10-K for the year ended December 31, 2017, under Part I, Item

I — “Business,” under Part I, Item 1A — “Risk Factors,” under

Part I, Item 3 — “Legal Proceedings,” and under

Part II, Item 7 — “Management’s Discussion and Analysis

of Financial Condition and Results of Operations.” The risk

factors set forth in the Annual Report on Form 10-K may not be

exhaustive. Therefore, the information contained in the

Annual Report on Form 10-K should be read together with other

reports and documents filed with the Securities and Exchange

Commission from time to time, including Forms 10-Q, 8-K and 10-K,

which may supplement, modify, supersede or update those risk

factors. Vicor does not undertake any obligation to update

any forward-looking statements as a result of future events or

developments.

Vicor Corporation designs, develops,

manufactures and markets modular power components and complete

power systems based upon a portfolio of patented

technologies. Headquartered in Andover, Massachusetts, Vicor

sells its products to the power systems market, including

enterprise and high performance computing, industrial equipment and

automation, telecommunications and network infrastructure, vehicles

and transportation, aerospace and defense.

For further information

contact:

James A. Simms, Chief Financial OfficerVoice:

978-470-2900Facsimile:

978-749-3439invrel@vicorpower.com

|

|

| VICOR

CORPORATION |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS |

|

|

|

| (Thousands

except for per share amounts) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

QUARTER

ENDED |

|

YEAR

ENDED |

| |

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

| |

DEC

31, |

|

DEC

31, |

|

DEC

31, |

|

DEC

31, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net

revenues |

$ 73,720 |

|

|

$ 58,771 |

|

|

$ 291,220 |

|

$ 227,830 |

|

| Cost of

revenues |

|

39,847 |

|

|

|

31,840 |

|

|

|

152,249 |

|

|

126,174 |

|

|

Gross margin |

|

33,873 |

|

|

|

26,931 |

|

|

|

138,971 |

|

|

101,656 |

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

15,731 |

|

|

|

15,033 |

|

|

|

62,224 |

|

|

58,092 |

|

|

Research and development |

|

11,066 |

|

|

|

11,442 |

|

|

|

44,286 |

|

|

44,924 |

|

|

Severance and other charges |

|

62 |

|

|

|

- |

|

|

|

402 |

|

|

- |

|

|

Total operating expenses |

|

26,859 |

|

|

|

26,475 |

|

|

|

106,912 |

|

|

103,016 |

|

| |

|

|

|

|

|

|

|

| Income (loss)

from operations |

|

7,014 |

|

|

|

456 |

|

|

|

32,059 |

|

|

(1,360 |

) |

| |

|

|

|

|

|

|

|

| Other income

(expense), net |

|

256 |

|

|

|

268 |

|

|

|

874 |

|

|

1,262 |

|

| |

|

|

|

|

|

|

|

| Income (loss)

before income taxes |

|

7,270 |

|

|

|

724 |

|

|

|

32,933 |

|

|

(98 |

) |

| |

|

|

|

|

|

|

|

|

Less: (Benefit)

provision for income taxes |

|

363 |

|

|

|

(895 |

) |

|

|

1,087 |

|

|

(356 |

) |

| |

|

|

|

|

|

|

|

| Consolidated

net income |

|

6,907 |

|

|

|

1,619 |

|

|

|

31,846 |

|

|

258 |

|

| |

|

|

|

|

|

|

|

|

Less: Net income

(loss) attributable to |

|

|

|

|

|

|

|

|

noncontrolling interest |

|

(3 |

) |

|

|

8 |

|

|

|

121 |

|

|

91 |

|

| |

|

|

|

|

|

|

|

| Net income

attributable to |

|

|

|

|

|

|

|

|

Vicor Corporation |

$6,910 |

|

|

$1,611 |

|

|

$31,725 |

|

$167 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net income per

share attributable |

|

|

|

|

|

|

|

|

to Vicor Corporation: |

|

|

|

|

|

|

|

|

Basic |

$0.17 |

|

|

$0.04 |

|

|

$0.80 |

|

$0.00 |

|

|

Diluted |

$0.17 |

|

|

$0.04 |

|

|

$0.78 |

|

$0.00 |

|

| |

|

|

|

|

|

|

|

| Shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

40,182 |

|

|

|

39,383 |

|

|

|

39,872 |

|

|

39,228 |

|

|

Diluted |

|

40,981 |

|

|

|

40,135 |

|

|

|

40,729 |

|

|

39,933 |

|

| |

|

|

|

|

|

|

| VICOR

CORPORATION |

|

|

|

| |

|

|

|

|

CONDENSED CONSOLIDATED BALANCE

SHEET |

|

|

|

(Thousands) |

|

|

|

| |

|

|

|

|

|

|

|

|

| |

DEC

31, |

|

DEC

31, |

| |

2018 |

|

2017 |

| |

(Unaudited) |

|

(Unaudited) |

|

Assets |

|

|

|

| |

|

|

|

|

Current

assets: |

|

|

|

| Cash and cash

equivalents |

$ |

70,557 |

|

|

$ |

44,230 |

|

| Accounts receivable,

net |

|

43,673 |

|

|

|

34,487 |

|

| Inventories,

net |

|

47,370 |

|

|

|

36,499 |

|

| Other current

assets |

|

3,460 |

|

|

|

3,616 |

|

| Total current

assets |

|

165,060 |

|

|

|

118,832 |

|

| |

|

|

|

| Long-term

deferred tax assets |

|

265 |

|

|

|

210 |

|

| Long-term

investment, net |

|

2,526 |

|

|

|

2,525 |

|

| Property, plant

and equipment, net |

|

50,432 |

|

|

|

41,356 |

|

| Other

assets |

|

2,785 |

|

|

|

2,801 |

|

| |

|

|

|

| Total assets |

$ |

221,068 |

|

|

$ |

165,724 |

|

| |

|

|

|

| Liabilities and

Equity |

|

|

|

| |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable |

$ |

16,149 |

|

|

$ |

9,065 |

|

| Accrued compensation and

benefits |

|

10,657 |

|

|

|

9,891 |

|

| Accrued

expenses |

|

2,631 |

|

|

|

2,989 |

|

| Sales

allowances |

|

548 |

|

|

|

- |

|

| Accrued severance and other

charges |

|

234 |

|

|

|

- |

|

| Income taxes

payable |

|

710 |

|

|

|

300 |

|

| Deferred

revenue |

|

5,069 |

|

|

|

5,791 |

|

| |

|

|

|

| Total current

liabilities |

|

35,998 |

|

|

|

28,036 |

|

| |

|

|

|

| Long-term

deferred revenue |

|

232 |

|

|

|

303 |

|

| Contingent

consideration obligations |

|

408 |

|

|

|

678 |

|

| Long-term

income taxes payable |

|

238 |

|

|

|

195 |

|

| Other long-term

liabilities |

|

102 |

|

|

|

93 |

|

| Total

liabilities |

|

36,978 |

|

|

|

29,305 |

|

| |

|

|

|

|

Equity: |

|

|

|

| Vicor Corporation

stockholders' equity: |

|

|

|

| Capital stock |

|

193,977 |

|

|

|

181,914 |

|

| Retained

earnings |

|

129,000 |

|

|

|

93,605 |

|

| Accumulated other

comprehensive loss |

|

(394 |

) |

|

|

(478 |

) |

| Treasury

stock |

|

(138,927 |

) |

|

|

(138,927 |

) |

| Total Vicor Corporation

stockholders' equity |

|

183,656 |

|

|

|

136,114 |

|

| Noncontrolling

interest |

|

434 |

|

|

|

305 |

|

| Total equity |

|

184,090 |

|

|

|

136,419 |

|

| |

|

|

|

| Total liabilities and

equity |

$ |

221,068 |

|

|

$ |

165,724 |

|

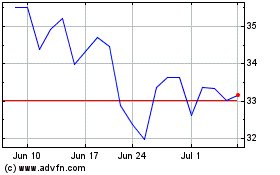

Vicor (NASDAQ:VICR)

Historical Stock Chart

From Mar 2024 to Apr 2024

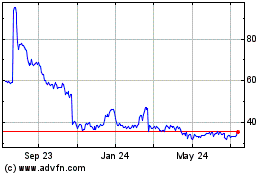

Vicor (NASDAQ:VICR)

Historical Stock Chart

From Apr 2023 to Apr 2024