Notice of Exempt Solicitation. Definitive Material. (px14a6g)

May 06 2019 - 3:20PM

Edgar (US Regulatory)

PROXY MEMORANDUM

|

|

To:

|

Vertex Pharmaceutical Shareholders

|

|

|

Subject:

|

Shareholder resolution on extent to which risks related to public concern over drug pricing are

integrated into incentive compensation policies for senior executives

|

|

|

Contact:

|

Catherine Rowan, Director, Socially Responsible Investments, Trinity Health

<rowancm@trinity-health.org>

|

At the upcoming Vertex Pharmaceuticals

Incorporated (“Vertex” or “the “Company”) annual shareholders’ meeting on June 5, 2019, shareholders

will have the opportunity to vote on a Proposal (the “Proposal”) asking Vertex to disclose how it considers risks stemming

from public concern over high drug prices in setting incentive pay arrangements for senior executives.

We urge you to vote FOR

Item #6 as described below.

RESOLVED, that shareholders of Vertex Pharmaceuticals Incorporated

(“Vertex”) urge the Compensation Committee (the “Committee”) to report annually to shareholders on the

extent to which risks related to public concern over drug pricing strategies are integrated into Vertex’s incentive compensation

policies, plans and programs (“arrangements”) for senior executives. The report should include, but need not be limited

to, discussion of whether (i) incentive compensation arrangements reward, or not penalize, senior executives for adopting pricing

strategies, or making and honoring commitments about pricing, that incorporate public concern regarding prescription drug prices;

and (ii) such concern is considered when setting financial targets for incentive compensation arrangements.

The Proponent submitted

the Proposal to Vertex because we believe shareholders would benefit from a fuller understanding of whether senior executive incentive

compensation arrangements reward price increases, or discourage policies of price restraint, both of which can boost short-term

performance, even though long-term success could depend on pricing moderation. In our view, Vertex’s pricing strategies are

likely to lead to backlash from payers, policy makers and the public.

We believe that incentive compensation

programs should not just encourage executives to achieve financial objectives, but also to manage key business risks effectively.

According to the Company’s 2019 proxy statement, approximately 90% of Vertex’s NEO compensation is tied to performance.

1

30% is through stock options, 35% through time-based stock units, and 35% through performance stock units (PSUs).

One-half of PSUs are based on a one-year financial metric – cystic fibrosis net product revenue over a one-year period -

and the other half is based on three years of non-financial metrics.

2

In the Detailed Discussion of Company Performance

Rating Factors and Achievements section of the proxy statement, there is no disclosure as to whether the Management Development

and Compensation Committee of the Company’s Board considers risks associated with drug pricing, among other things. Such

disclosure would assure shareholders that compensation plans take into account drug pricing risks when setting targets.

_____________________________

1

Vertex Pharmaceutical Incorporated Proxy Statement, p. 49 https://www.sec.gov/Archives/edgar/data/875320/000130817919000189/lvrt2019_def14a.htm#lvrta033

2

ibid.

p. 53

Sponsored by Catholic Health

Ministries | 20555 Victor Parkway • Livonia, MI 48152 • 734-343-1000 • trinity-health.org

Reactions of the public, health care payers,

policymakers and prescribers to high drug prices pose a serious challenge, in our view, to sustainable value creation by pharmaceutical

companies. High drug prices may create several kinds of risk:

|

|

§

|

Legislative and regulatory risk. At least

30 pieces of legislation addressing prescription drug prices have been introduced in the 116th Congress and various Congressional

committees have held high-profile hearings.

34

In 2018, at least 24 states passed legislation to curb rising drug

costs.

5

|

|

|

§

|

Officials from New York State’s

Medicaid program have said that the cystic fibrosis medicine

Orkambi

is not worth the price, a case “that is being

closely watched around the country.”

6

|

|

|

·

|

The Company has been involved in a long-running

dispute with the National Health Service England and the National Institute of Care and Excellence (NICE) over the pricing of

Orkambi

.

This has led to negative press, with headlines such as “Vertex destroys nearly 8,000 Orkambi packs over pricing standoff.”

7

|

We are concerned that Vertex’s

incentive pay arrangements may overlook the pricing pressure risks the Company faces and not take into account these risks in compensation

arrangements. Vertex’s statement in opposition to the Proposal defends Vertex’s pricing decisions, touts its patient

assistance programs and points to generic risk factor disclosure in the Company’s 10-K, but does not address the Proposal’s

central request.

Vertex’s existing disclosures do

not mention drug pricing-related risks, but rather describe compensation arrangements. We believe that the information sought by

the Proposal would give shareholders valuable insight about how Vertex’s executive pay practices balance financial goals

and management of pricing-related risks.

We therefore urge shareholders to vote FOR Item #6.

_____________________________

3

https://www.govtrack.us/congress/bills/subjects/prescription_drugs/6184?congress=99#congress=116&text=prescription&terms2=__ALL__

4

https://www.nytimes.com/2019/02/26/us/politics/prescription-drug-prices.html?module=inline

5

https://www.nytimes.com/2018/08/18/us/politics/states-drug-costs.html

6

https://www.nytimes.com/2018/06/24/health/drug-prices-orkambi-new-york.html

7

https://www.fiercepharma.com/pharma/vertex-destroys-nearly-8-000-orkambi-packs-amid-u-k-pricing-standoff

Sponsored by Catholic Health

Ministries | 20555 Victor Parkway • Livonia, MI 48152 • 734-343-1000 • trinity-health.org

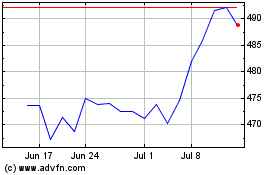

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

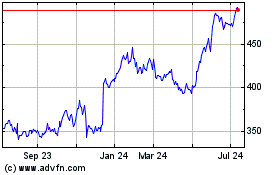

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Apr 2023 to Apr 2024