recurring nature, necessary to fairly state the financial position and results of operations and cash flows for the interim periods presented.

The Company’s business is subject to seasonal fluctuation. Significant portions of the Company’s net sales and net income are realized during the fourth quarter of the fiscal year due to the holiday selling season. The results for the 13 weeks ended May 4, 2019 are not necessarily indicative of the results to be expected for the fiscal year ending February 1, 2020, or for any other future interim period or for any future year.

These interim consolidated financial statements and the related notes should be read in conjunction with the consolidated financial statements and notes included in the Company’s Annual Report on Form 10‑K for the year ended February 2, 2019. All amounts are stated in thousands, with the exception of per share amounts and number of stores.

2.

Summary of significant accounting policies

Information regarding the Company’s significant accounting policies is contained in Note 2, “Summary of significant accounting policies,” to the consolidated financial statements in the Company’s Annual Report on Form 10‑K for the year ended February 2, 2019. Presented below and in the following notes is supplemental information that should be read in conjunction with “Notes to Consolidated Financial Statements” in the Annual Report.

Fiscal quarter

The Company’s quarterly periods are the 13 weeks ending on the Saturday closest to April 30, July 31, October 31, and January 31. The Company’s first quarter in fiscal 2019 and 2018 ended on May 4, 2019 and May 5, 2018, respectively.

Reclassifications

Certain prior year amounts have been reclassified to conform to the current year presentation.

Recent accounting pronouncements not yet adopted

Intangibles – Goodwill and Other-Internal-Use Software

In August 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2018-15, Intangibles – Goodwill and Other-Internal-Use Software (Subtopic 350-40): Customers Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That is a Service Contract, which clarifies and aligns the accounting for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software. This guidance is effective for interim and annual reporting periods beginning after December 15, 2019 and should be applied either retrospectively or prospectively to all implementation costs incurred after the date of adoption. Early adoption is permitted. The adoption of ASU 2018-15 is not expected to have a material impact on the Company’s consolidated financial position, results of operations, or cash flows.

Recently adopted accounting pronouncements

Leases

In February 2016, the FASB issued ASU 2016‑02, Leases (Topic 842). The guidance in ASU 2016-02 and subsequently issued amendments requires lessees to capitalize virtually all leases with terms of more than twelve months on the balance sheet as a right-of-use asset and recognize an associated lease liability. The right-of-use asset represents the lessee’s right to use, or control the use of, a specified asset for the specified lease term. The lease liability represents the lessee’s obligation to make lease payments arising from the lease, measured on a discounted basis. Based on certain characteristics, leases are classified as financing or operating leases and their classification impacts the recognition of expense in the income statement. Entities are allowed to apply the modified retrospective approach (1) retrospectively to each comparative period presented or (2) retrospectively at the beginning of the period of adoption through a cumulative-effect adjustment.

The Company adopted the new standard on February 3, 2019 using the modified retrospective approach by recognizing and measuring leases without revising comparative period information or disclosures. The Company elected the transition package of three practical expedients permitted within the standard, which among other things, allows for the carryforward of historical lease classifications. In addition, the Company elected to apply the practical expedient that allows for the combination of lease and non-lease components for all asset classes. The Company made an accounting policy election to keep leases with terms of twelve months or less off the balance sheet and recognize those lease payments on a straight-line basis over the lease term.

The adoption of ASU 2016‑02, resulted in the recording of operating lease assets and liabilities of $1,460,866 and $1,839,970 within the consolidated balance sheet, respectively, as of February 3, 2019. As part of the adoption, the Company recorded an adjustment to retained earnings of $2,375. The standard did not materially impact the Company’s consolidated results of operations and had no impact on cash flows. See Note 6, “Leases,” for further details.

The impact to the Company’s opening consolidated balance sheet as of February 3, 2019 was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported

|

|

Effect of Adopting

|

|

Balance at

|

|

(In thousands)

|

|

February 2, 2019

|

|

ASC 842

|

|

February 3, 2019

|

|

Assets

|

|

|

|

|

|

|

(Unaudited)

|

|

Receivables, net

|

|

$

|

136,168

|

|

$

|

(17,468)

|

|

$

|

118,700

|

|

Prepaid expenses and other current assets

|

|

|

138,116

|

|

|

(25,260)

|

|

|

112,856

|

|

Property and equipment, net

|

|

|

1,226,029

|

|

|

(16,983)

|

|

|

1,209,046

|

|

Operating lease assets

|

|

|

—

|

|

|

1,460,866

|

|

|

1,460,866

|

|

Liabilities and stockholders’ equity

|

|

|

|

|

|

|

|

|

|

|

Accrued liabilities

|

|

|

220,666

|

|

|

(1,460)

|

|

|

219,206

|

|

Current operating lease liabilities

|

|

|

—

|

|

|

210,721

|

|

|

210,721

|

|

Deferred rent

|

|

|

434,980

|

|

|

(434,980)

|

|

|

—

|

|

Non-current operating lease liabilities

|

|

|

—

|

|

|

1,629,249

|

|

|

1,629,249

|

|

Retained earnings

|

|

|

1,105,863

|

|

|

(2,375)

|

|

|

1,103,488

|

3.

Acquisitions

The Company continues to make investments to evolve the customer experience, with a strong emphasis on integrating technology across the business. To support these efforts, the Company paid $13,606 to acquire two technology companies in fiscal 2018.

On September 10, 2018, the Company acquired QM Scientific, an artificial intelligence technology company. The acquisition is not material to the Company’s consolidated financial statements.

On October 29, 2018, the Company acquired GlamST, an augmented reality technology company. The acquisition is not material to the Company’s consolidated financial statements.

Other intangible assets with finite useful lives are amortized over their useful lives. The Company reviews the recoverability of long-lived assets whenever events or changes in circumstances indicate the carrying amount of such assets may not be recoverable.

6.

Leases

The Company determines whether an arrangement is or contains a lease at contract inception. The Company leases retail stores, distribution centers, and corporate offices under non-cancellable operating leases with various expiration dates through 2032. Leases generally have an initial lease term of 10 years and include renewal options under substantially the same terms and conditions as the original leases. Leases do not contain any material residual value guarantees or material restrictive covenants.

The lease classification evaluation begins at the commencement date. The lease term used in the evaluation includes the non-cancellable period for which the Company has the right to use the underlying asset, together with renewal option periods when the exercise of the renewal option is reasonably certain and failure to exercise such option would result in an economic penalty. All r

etail store, distribution center, and corporate office

leases are classified as operating leases. The Company does not have any finance leases.

Total rent payable is recorded during the lease term, including rent escalations in which the amount of future rent is certain or fixed on the straight-line basis over the term of the lease (including the rent holiday period beginning upon control of the premises, and any fixed payments stated in the lease). For leases with an initial term greater than 12 months, a related lease liability is recorded on the balance sheet at the present value of future payments discounted at the estimated fully collateralized incremental borrowing rate (discount rate) corresponding with the lease term. In addition, a right-of-use asset is recorded as the initial amount of the lease liability, plus any lease payments made to the lessor before or at the lease commencement date and any initial direct costs incurred, less any tenant improvement allowance incentives received. The difference between the minimum rents paid and the straight-line rent (deferred rent) is reflected within the associated right-of-use asset.

Operating lease expense is recognized on a straight-line basis over the lease term.

Certain leases contain provisions that require additional rent payments based upon sales volume (“variable lease cost”). Contingent rent is accrued each period as the liabilities are incurred, in addition to the straight-line rent expense. This results in some variability in lease expense as a percentage of revenues over the term of the lease in stores where contingent rent is paid.

Leases with an initial term of 12 months or less (“short-term leases”) are not recorded on the balance sheet. Short-term lease expense is recognized on a straight-line basis over the lease term.

The Company subleases certain real estate to third parties for stores with excess square footage space.

The Company does not separate lease and non-lease components (e.g., common area maintenance).

As the interest rate implicit in the lease is not readily determinable, the Company uses its incremental borrowing rate corresponding with the lease term. As there are no outstanding borrowings under the Company’s credit facility, this rate is estimated based on prevailing market conditions, comparable company and credit analysis, and judgment. The incremental borrowing rate is reassessed if there is a change to the lease term or if a modification occurs and it is not accounted for as a separate contract.

Maturity of lease liabilities

The following table presents maturities of operating lease liabilities as of May 4, 2019:

|

|

|

|

|

|

|

|

Fiscal year

|

|

|

|

(In thousands)

|

|

2019 (1)

|

|

|

|

$

|

200,921

|

|

2020

|

|

|

|

|

327,521

|

|

2021

|

|

|

|

|

314,307

|

|

2022

|

|

|

|

|

296,353

|

|

2023

|

|

|

|

|

260,928

|

|

2024 and thereafter

|

|

|

|

|

775,085

|

|

Total lease payments

|

|

|

|

$

|

2,175,115

|

|

Less: Imputed interest

|

|

|

|

|

(309,282)

|

|

Present value of operating lease liabilities

|

|

|

|

$

|

1,865,833

|

|

|

(1)

|

|

Excluding the 13 weeks ended May 4, 2019.

|

Included in the table above is $57,216 of future lease payments for operating leases executed but not yet commenced.

7.

Commitments and contingencies

The Company is involved in various legal proceedings that are incidental to the conduct of the business including both class action and single plaintiff litigation. In the opinion of management, the amount of any liability with respect to these proceedings, either individually or in the aggregate, will not have a material adverse effect on the Company’s consolidated financial position, results of operations or cash flows.

8.

Notes payable

On August 23, 2017, the Company entered into a Second Amended and Restated Loan Agreement (the Loan Agreement) with Wells Fargo Bank, National Association, as Administrative Agent, Collateral Agent and a Lender thereunder, Wells Fargo Bank, National Association and JPMorgan Chase Bank, N.A., as Lead Arrangers and Bookrunners, JPMorgan Chase Bank, N.A., as Syndication Agent and a Lender, PNC Bank, National Association, as Documentation Agent and a Lender, and the other lenders party thereto. The Loan Agreement matures on August 23, 2022, provides maximum revolving loans equal to the lesser of $400,000 or a percentage of eligible owned inventory (which borrowing base may, at the election of the Company and satisfaction of certain conditions, include a percentage of eligible owned receivables and qualified cash), contains a $20,000 subfacility for letters of credit and allows the Company to increase the revolving facility by an additional $50,000, subject to the consent by each lender and other conditions. The Loan Agreement contains a requirement to maintain a fixed charge coverage ratio of not less than 1.0 to 1.0 during such periods when availability under the Loan Agreement falls below a specified threshold. Substantially all of the Company’s assets are pledged as collateral for outstanding borrowings under the Loan Agreement. Outstanding borrowings bear interest at either a base rate or the London Interbank Offered Rate plus 1.25%, and the unused line fee is 0.20% per annum.

As of May 4, 2019, February 2, 2019, and May 5, 2018, the Company had no borrowings outstanding under the credit facility and the Company was in compliance with all terms and covenants of the Loan Agreement.

9.

Fair value measurements

The carrying value of cash and cash equivalents, accounts receivable, and accounts payable approximates their estimated fair values due to the short maturities of these instruments.

Fair value is measured using inputs from the three levels of the fair value hierarchy, which are described as follows:

|

|

·

|

|

Level 1 – observable inputs such as quoted prices for identical instruments in active markets.

|

|

|

·

|

|

Level 2 – inputs other than quoted prices in active markets that are observable either directly or indirectly through corroboration with observable market data.

|

|

|

·

|

|

Level 3 – unobservable inputs in which there is little or no market data, which would require the Company to develop its own assumptions.

|

As of May 4, 2019, February 2, 2019, and May 5, 2018, the Company held financial liabilities included in other long-term liabilities on the consolidated balance sheets of $25,648, $19,615, and $19,346, respectively, related to its non-qualified deferred compensation plan. The liabilities have been categorized as Level 2 as they are based on third-party reported values, which are based primarily on quoted market prices of underlying assets of the funds within the plan.

10.

Investments

The Company’s short-term investments as of May 4, 2019 and May 5, 2018 consist of $195,000 and $237,193, respectively, in certificates of deposit. The Company did not have any short-term investments as of February 2, 2019. Short-term investments are carried at cost, which approximates fair value and are

recorded in the consolidated balance sheets in short-term investments.

11.

Stock-based compensation

The Company measures stock-based compensation expense on the grant date, based on the fair value of the award, and recognizes the expense on a straight-line basis over the requisite service period for awards expected to vest. The Company estimated the grant date fair value of stock options using a Black-Scholes valuation model using the following weighted-average assumptions for the periods indicated:

|

|

|

|

|

|

|

|

|

13 Weeks Ended

|

|

|

|

May 4,

|

|

May 5,

|

|

|

|

2019

|

|

2018

|

|

Volatility rate

|

|

31.0%

|

|

29.0%

|

|

Average risk-free interest rate

|

|

2.3%

|

|

2.4%

|

|

Average expected life (in years)

|

|

3.5

|

|

3.4

|

|

Dividend yield

|

|

None

|

|

None

|

The Company granted 97 and 163 stock options during the 13 weeks ended May 4, 2019 and May 5, 2018, respectively. The stock-based compensation expense against operating income for stock options was $2,120 and $2,208 for the 13 weeks ended May 4, 2019 and May 5, 2018, respectively. The weighted-average grant date fair value of these stock options was $89.91 and $50.10 for the 13 weeks ended May 4, 2019 and May 5, 2018, respectively. At May 4, 2019, there was approximately $22,944 of unrecognized stock-based compensation expense related to unvested stock options.

The Company issued 39 and 83 restricted stock units during the 13 weeks ended May 4, 2019 and May 5, 2018, respectively. The stock-based compensation expense charged against operating income for restricted stock units was $2,821 and $2,505 for the 13 weeks ended May 4, 2019 and May 5, 2018, respectively. At May 4, 2019, there was approximately $28,810 of unrecognized stock-based compensation expense related to restricted stock units.

The Company issued 21 and 33 performance-based restricted stock units during the 13 weeks ended May 4, 2019 and May 5, 2018, respectively. The stock-based compensation expense charged against operating income for performance-based restricted stock units was $1,711 and $1,457 for the 13 weeks ended May 4, 2019 and May 5, 2018, respectively. At May 4, 2019, there was approximately $15,198 of unrecognized stock-based compensation expense related to performance-based restricted stock units.

12.

Income taxes

Income tax expense reflects the federal statutory tax rate and the weighted average state statutory tax rate for the states in which the Company operates stores. Income tax expense of $47,365 for the 13 weeks ended May 4, 2019 represents an effective tax rate of

19.8%

, compared to $46,771 of tax expense representing an effective tax rate of 22.1% for the 13 weeks ended May 5, 2018. The lower effective tax rate is primarily due to income tax accounting for share-based compensation.

13.

Net income per common share

The following is a reconciliation of net income and the number of shares of common stock used in the computation of net income per basic and diluted share:

|

|

|

|

|

|

|

|

|

|

|

13 Weeks Ended

|

|

|

|

May 4,

|

|

May 5,

|

|

(In thousands, except per share data)

|

|

2019

|

|

2018

|

|

Numerator for diluted net income per share – net income

|

|

$

|

192,221

|

|

$

|

164,396

|

|

|

|

|

|

|

|

|

|

Denominator for basic net income per share – weighted-average common shares

|

|

|

58,631

|

|

|

60,610

|

|

Dilutive effect of stock options and non-vested stock

|

|

|

362

|

|

|

299

|

|

Denominator for diluted net income per share

|

|

|

58,993

|

|

|

60,909

|

|

|

|

|

|

|

|

|

|

Net income per common share:

|

|

|

|

|

|

|

|

Basic

|

|

$

|

3.28

|

|

$

|

2.71

|

|

Diluted

|

|

$

|

3.26

|

|

$

|

2.70

|

The denominator for diluted net income per common share for the 13 weeks ended May 4, 2019 and May 5, 2018 excludes 152 and 461 employee stock options and restricted stock units, respectively, due to their anti-dilutive effects.

Outstanding performance-based restricted stock units are included in the computation of dilutive shares only to the extent that the underlying performance conditions are satisfied prior to the end of the reporting period or would be considered satisfied if the end of the reporting period were the end of the related contingency period and the results would be dilutive under the treasury stock method.

14.

Share repurchase program

On March 9, 2017, the Company announced that the Board of Directors authorized a share repurchase program (the 2017 Share Repurchase Program) pursuant to which the Company could repurchase up to $425,000 of the Company’s common stock. The 2017 Share Repurchase Program authorization revoked the previously authorized but unused amount of $79,863 from the earlier share repurchase program. The 2017 Share Repurchase Program did not have an expiration date but provided for suspension or discontinuation at any time.

On March 15, 2018, the Company announced that the Board of Directors authorized a new share repurchase program (the 2018 Share Repurchase Program) pursuant to which the Company may repurchase up to $625,000 of the Company’s common stock. The 2018 Share Repurchase Program authorization revoked the previously authorized but unused amount of $41,317 from the 2017 Share Repurchase Program. The 2018 Share Repurchase Program did not have an expiration date but provided for suspension or discontinuation at any time.

On March 14, 2019, the Company announced that the Board of Directors authorized a new share repurchase program (the 2019 Share Repurchase Program) pursuant to which the Company may repurchase up to $875,000 of the Company’s common stock. The 2019 Share Repurchase Program authorization revoked the previously authorized but unused amount of $25,435 from the 2018 Share Repurchase Program. The 2019 Share Repurchase Program does not have an expiration date and may be suspended or discontinued at any time.

During the 13 weeks ended May 4, 2019, the Company purchased 318 shares of common stock for $107,399. During the 13 weeks ended May 5, 2018, the Company purchased 619 shares of common stock for $133,051.

Item 2.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and related notes included elsewhere in this quarterly report. This discussion contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, which reflect our current views with respect to, among other things, future events and financial performance. You can identify these forward-looking statements by the use of forward-looking words such as “outlook,” “believes,” “expects,” “plans,” “estimates,” “targets,” “strategies,” or other comparable words. Any forward-looking statements contained in this Form 10‑Q are based upon our historical performance and on current plans, estimates, and expectations. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates, targets, strategies, or expectations contemplated by us will be achieved. Such forward-looking statements are subject to various risks and uncertainties, which include, without limitation:

|

|

·

|

|

changes in the overall level of consumer spending and volatility in the economy;

|

|

|

·

|

|

the possibility that we may be unable to compete effectively in our highly competitive markets;

|

|

|

·

|

|

the possibility that the capacity of our distribution and order fulfillment infrastructure and the performance of our newly opened and to be opened distribution centers may not be adequate to support our recent growth and expected future growth plans;

|

|

|

·

|

|

our ability to sustain our growth plans and successfully implement our long-range strategic and financial plan;

|

|

|

·

|

|

the ability to execute our Efficiencies for Growth cost optimization program;

|

|

|

·

|

|

the possibility that cybersecurity breaches and other disruptions could compromise our information or result in the unauthorized disclosure of confidential information;

|

|

|

·

|

|

the possibility of material disruptions to our information systems;

|

|

|

·

|

|

our ability to gauge beauty trends and react to changing consumer preferences in a timely manner;

|

|

|

·

|

|

changes in the wholesale cost of our products;

|

|

|

·

|

|

the possibility that new store openings and existing locations may be impacted by developer or co-tenant issues;

|

|

|

·

|

|

our ability to attract and retain key executive personnel;

|

|

|

·

|

|

natural disasters that could negatively impact sales;

|

|

|

·

|

|

our ability to successfully execute our common stock repurchase program or implement future common stock repurchase programs; and

|

|

|

·

|

|

other risk factors detailed in our public filings with the Securities and Exchange Commission (the SEC), including risk factors contained in Item 1A, “Risk Factors” of our Annual Report on Form 10‑K for the year ended February 2, 2019, as such may be amended or supplemented in our subsequently filed Quarterly Reports on Form 10‑Q (including this report).

|

Except to the extent required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

References in the following discussion to “we,” “us,” “our,” “Ulta Beauty,” the “Company,” and similar references mean Ulta Beauty, Inc. and its consolidated subsidiaries, unless otherwise expressly stated or the context otherwise requires.

Overview

We were founded in 1990 as a beauty retailer at a time when prestige, mass, and salon products were sold through distinct channels – department stores for prestige products, drug stores and mass merchandisers for mass products, and salons and authorized retail outlets for professional hair care products. We developed a unique specialty retail concept that offers a broad range of brands and price points, a compelling value proposition, and a convenient and welcoming shopping environment. We define our target consumer as a beauty enthusiast, a consumer who is passionate about the beauty category and has high expectations for the shopping experience. We believe our strategy provides us with the competitive advantages that have contributed to our financial performance.

We are the largest beauty retailer in the United States and the premier beauty destination for cosmetics, fragrance, skin care products, hair care products, and salon services. We provide unmatched product breadth, value, and convenience in

a distinctive specialty retail environment. Key aspects of our business include: our ability to offer our guests a unique combination of more than 25,000 beauty products from across the categories of prestige and mass cosmetics, fragrance, haircare, skincare, bath and body products, and salon styling tools, as well as a full-service salon in every store featuring hair, skin, and brow services; our focus on delivering a compelling value proposition to our guests across all of our product categories; and convenience, as our stores are predominantly located in convenient, high-traffic locations such as power centers.

The continued growth of our business and any future increases in net sales, net income, and cash flows is dependent on our ability to execute our strategic imperatives: 1) drive growth across beauty enthusiast consumer groups, 2) deepen Ulta Beauty love and loyalty, 3) deliver a one of a kind, world class beauty assortment, 4) lead the in-store and beauty services experience transformation, 5) reinvent beauty digital engagement, 6) deliver operational excellence and drive efficiencies, and 7) invest in talent that drives a winning culture. We believe that the expanding U.S. beauty products and salon services industry, the shift in distribution channel of prestige beauty products from department stores to specialty retail stores, coupled with Ulta Beauty’s competitive strengths, positions us to capture additional market share in the industry.

Comparable sales is a key metric that is monitored closely within the retail industry. Our comparable sales have fluctuated in the past and we expect them to continue to fluctuate in the future. A variety of factors affect our comparable sales, including general U.S. economic conditions, changes in merchandise strategy or mix, and timing and effectiveness of our marketing activities, among others.

Over the long term, our growth strategy is to increase total net sales through increases in our comparable sales, opening new stores, and increasing omnichannel capabilities. Operating profit is expected to increase as a result of our ability to expand merchandise margin and leverage our fixed store costs with comparable sales increases and operating efficiencies offset by incremental investments in people, systems, and supply chain required to support a 1,500 to 1,700 store chain in the U.S. with successful e-commerce and competitive omnichannel capabilities.

Basis of presentation

The Company has one reportable segment, which includes retail stores, salon services, and e-commerce.

We recognize merchandise revenue at the point of sale in our retail stores. E-commerce merchandise sales are recognized based upon shipment of merchandise to the guest based on meeting the transfer of control criteria. Retail store and e-commerce sales are recorded net of estimated returns. Shipping and handling are treated as costs to fulfill the contract, and as a result, any fees received from guests are included in the transaction price allocated to the performance obligation of providing goods with a corresponding amount accrued within cost of sales for amounts paid to applicable carriers. We provide refunds for merchandise returns within 60 days from the original purchase date. State sales taxes are presented

on a net basis as we consider our self a pass-through conduit for collecting and remitting state sales tax.

Salon service revenue is recognized at the time the service is provided to the guest. Gift card sales revenue is deferred until the guest redeems the gift card. Company coupons and other incentives are recorded as a reduction of net sales. Other revenue sources include the private label credit card and co-branded credit card programs, as well as deferred revenue related to the loyalty program and gift card breakage.

Comparable sales reflect sales for stores beginning on the first day of the 14th month of operation. Therefore, a store is included in our comparable store base on the first day of the period after one year of operations plus the initial one month grand opening period. Non-comparable store sales include sales from new stores that have not yet completed their 13th month of operation and stores that were closed for part or all of the period in either year as a result of remodel activity. Remodeled stores are included in comparable sales unless the store was closed for a portion of the current or prior period. Comparable sales include retail sales, salon services, and e-commerce. There may be variations in the way in which some of our competitors and other retailers calculate comparable or same store sales.

Measuring comparable sales allows us to evaluate the performance of our store base as well as several other aspects of our overall strategy. Several factors could positively or negatively impact our comparable sales results:

|

|

·

|

|

the general national, regional, and local economic conditions and corresponding impact on customer spending levels;

|

|

|

·

|

|

the introduction of new products or brands;

|

|

|

·

|

|

the location of new stores in existing store markets;

|

|

|

·

|

|

our ability to respond on a timely basis to changes in consumer preferences;

|

|

|

·

|

|

the effectiveness of our various merchandising and marketing activities; and

|

|

|

·

|

|

the number of new stores opened and the impact on the average age of all of our comparable stores.

|

Cost of sales includes:

|

|

·

|

|

the cost of merchandise sold, including substantially all vendor allowances, which are treated as a reduction of merchandise costs;

|

|

|

·

|

|

distribution costs including labor and related benefits, freight, rent, depreciation and amortization, real estate taxes, utilities and insurance;

|

|

|

·

|

|

shipping and handling costs;

|

|

|

·

|

|

retail stores occupancy costs including rent, depreciation and amortization, real estate taxes, utilities, repairs and maintenance, insurance, licenses and cleaning expenses;

|

|

|

·

|

|

salon services payroll and benefits; and

|

|

|

·

|

|

shrink and inventory valuation reserves.

|

Our cost of sales may be negatively impacted as we open an increasing number of stores. Changes in our merchandise mix may also have an impact on cost of sales. This presentation of items included in cost of sales may not be comparable to the way in which our competitors or other retailers compute their cost of sales.

Selling, general and administrative expenses include:

|

|

·

|

|

payroll, bonus, and benefit costs for retail stores and corporate employees;

|

|

|

·

|

|

advertising and marketing costs;

|

|

|

·

|

|

occupancy costs related to our corporate office facilities;

|

|

|

·

|

|

stock-based compensation expense;

|

|

|

·

|

|

depreciation and amortization for all assets, except those related to our retail stores and distribution operations, which are included in cost of sales; and

|

|

|

·

|

|

legal, finance, information systems, and other corporate overhead costs.

|

This presentation of items in selling, general and administrative expenses may not be comparable to the way in which our competitors or other retailers compute their selling, general and administrative expenses.

Pre-opening expenses include non-capital expenditures during the period prior to store opening for new, remodeled, and relocated stores including rent during the construction period for new and relocated stores, store set-up labor, management and employee training, and grand opening advertising.

Interest income, net includes both interest income and expense. Interest income represents interest from cash equivalents and short-term investments with maturities of twelve months or less from the date of purchase. Interest expense includes interest costs and facility fees associated with our credit facility, which is structured as an asset-based lending instrument. Our credit facility interest is based on a variable interest rate structure which can result in increased cost in periods of rising interest rates.

Income tax expense reflects the federal statutory tax rate and the weighted average state statutory tax rate for the states in which we operate stores.

Results of operations

Our quarterly periods are the 13 weeks ending on the Saturday closest to April 30, July 31, October 31, and January 31. The Company’s first quarter in fiscal 2019 and 2018 ended on May 4, 2019 and May 5, 2018, respectively. Our quarterly results of operations have varied in the past and are likely to do so again in the future. As such, we believe that period-to-period comparisons of our results of operations should not be relied upon as an indication of our future performance.

The following table presents the components of our consolidated results of operations for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 Weeks Ended

|

|

13 Weeks Ended

|

|

|

|

|

May 4,

|

|

May 5,

|

|

May 4,

|

|

May 5,

|

|

|

(Dollars in thousands)

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

|

Net sales

|

|

$

|

1,743,029

|

|

$

|

1,543,667

|

|

|

100.0%

|

|

|

100.0%

|

|

|

Cost of sales

|

|

|

1,098,182

|

|

|

982,954

|

|

|

63.0%

|

|

|

63.7%

|

|

|

Gross profit

|

|

|

644,847

|

|

|

560,713

|

|

|

37.0%

|

|

|

36.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

403,133

|

|

|

345,624

|

|

|

23.1%

|

|

|

22.4%

|

|

|

Pre-opening expenses

|

|

|

4,174

|

|

|

5,247

|

|

|

0.2%

|

|

|

0.3%

|

|

|

Operating income

|

|

|

237,540

|

|

|

209,842

|

|

|

13.6%

|

|

|

13.6%

|

|

|

Interest income, net

|

|

|

(2,046)

|

|

|

(1,325)

|

|

|

0.1%

|

|

|

0.1%

|

|

|

Income before income taxes

|

|

|

239,586

|

|

|

211,167

|

|

|

13.7%

|

|

|

13.7%

|

|

|

Income tax expense

|

|

|

47,365

|

|

|

46,771

|

|

|

2.7%

|

|

|

3.0%

|

|

|

Net income

|

|

$

|

192,221

|

|

$

|

164,396

|

|

|

11.0%

|

|

|

10.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other operating data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of stores end of period

|

|

|

1,196

|

|

|

1,107

|

|

|

|

|

|

|

|

|

Comparable sales increase

|

|

|

7.0%

|

|

|

8.1%

|

|

|

|

|

|

|

|

Comparison of 13 weeks ended May 4, 2019 to 13 weeks ended May 5, 2018

Net sales

Net sales increased $199.4 million or 12.9%, to $1,743.0 million for the 13 weeks ended May 4, 2019, compared to $1,543.7 million for the 13 weeks ended May 5, 2018. Comparable stores contributed $106.3 million of the total net sales increase and non-comparable stores contributed $89.9 million of the total net sales increase. Other revenue increased $3.2 million compared to the first quarter of 2018.

The total comparable sales increase of 7.0% included a 4.3% increase in transactions and a 2.7% increase in average ticket. We attribute the increase in comparable sales to our successful marketing and merchandising strategies.

Gross profit

Gross profit increased $84.1 million or 15.0%, to $644.8 million for the 13 weeks ended May 4, 2019, compared to $560.7 million for the 13 weeks ended May 5, 2018. Gross profit as a percentage of net sales increased

70 basis points to 37.0% for the 13 weeks ended May 4, 2019, compared to 36.3% for the 13 weeks ended May 5, 2018. The increase in gross profit margin was primarily due to improvement in merchandise margins driven by our marketing and merchandising strategies and leverage in fixed store costs attributed to the impact of higher sales volume, partially offset by investments in our salon services and supply chain operations.

Selling, general and administrative expenses

Selling, general and administrative (SG&A) expenses increased $57.5 million or 16.6%, to $403.1 million for the 13 weeks ended May 4, 2019, compared to $345.6 million for the 13 weeks ended May 5, 2018. SG&A expenses as a percentage of net sales increased 70 basis points to 23.1% for the 13 weeks ended May 4, 2019, compared to 22.4% for

the 13 weeks ended May 5, 2018. The increase is primarily due to deleverage in corporate overhead related to investments in growth initiatives and store labor, partially offset by improvement in variable store and marketing expense attributed to cost efficiencies and higher sales volume.

Pre-opening expenses

Pre-opening expenses decreased $1.0 million to $4.2 million for the 13 weeks ended May 4, 2019, compared to $5.2 million for the 13 weeks ended May 5, 2018. During the 13 weeks ended May 4, 2019, we opened 22 new stores and remodeled one store, compared to the 13 weeks ended May 5, 2018, when we opened 34 new stores and remodeled two stores.

Interest income, net

Interest income, net was $2.0 million for the 13 weeks ended May 4, 2019 compared to $1.3 million for the 13 weeks ended May 5, 2018. Interest income results from cash equivalents and short-term investments with maturities of twelve months or less from the date of purchase. Interest expense represents interest on borrowings and fees related to the credit facility. We did not have any outstanding borrowings on our credit facility as of May 4, 2019 and May 5, 2018.

Income tax expense

Income tax expense of $47.4 million for the 13 weeks ended May 4, 2019 represents an effective tax rate of

19.8%

, compared to $46.8 million of tax expense representing an effective tax rate of 22.1% for the 13 weeks ended May 5, 2018. The lower effective tax rate is primarily due to income tax accounting for share-based compensation.

Net income

Net income increased $27.8 million or 16.9%, to $192.2 million for the 13 weeks ended May 4, 2019, compared to $164.4 million for the 13 weeks ended May 5, 2018. The increase in net income is primarily related to the $84.1 million increase in gross profit partially offset by a $57.5 million increase in SG&A expenses.

Liquidity and capital resources

Our primary cash needs are for rent, capital expenditures for new, remodeled, relocated, and refreshed stores (prestige boutiques and related in-store merchandising upgrades), increased merchandise inventories related to store expansion and new brand additions, in-store boutiques (sets of custom-designed fixtures configured to prominently display certain prestige brands within our stores), supply chain improvements, share repurchases, and continued improvement in our information technology systems.

Our primary sources of liquidity are cash and cash equivalents, short-term investments, cash flows from operations, including changes in working capital, and borrowings under our credit facility. The most significant components of our working capital are merchandise inventories and cash and cash equivalents reduced by related accounts payable and accrued expenses.

Our working capital needs are greatest from August through November each year as a result of our inventory build-up during this period for the approaching holiday season. This is also the time of year when we are at maximum investment levels in our new store class and may not have collected all of the landlord allowances due to us as part of our lease agreements. Based on past performance and current expectations, we believe that cash and cash equivalents, short-term investments, cash generated from operations, and borrowings under the credit facility will satisfy the Company’s working capital needs, capital expenditure needs, commitments, and other liquidity requirements through at least the next twelve months.

The following table presents a summary of our cash flows for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

13 Weeks Ended

|

|

|

|

|

May 4,

|

|

May 5,

|

|

|

(In thousands)

|

|

2019

|

|

2018

|

|

|

Net cash provided by operating activities

|

|

$

|

271,678

|

|

$

|

277,263

|

|

|

Net cash used in investing activities

|

|

|

(279,572)

|

|

|

(191,452)

|

|

|

Net cash used in financing activities

|

|

|

(74,526)

|

|

|

(131,370)

|

|

|

Net decrease in cash and cash equivalents

|

|

$

|

(82,420)

|

|

$

|

(45,559)

|

|

Operating activities

Operating activities consist of net income adjusted for certain non-cash items, including depreciation and amortization, non-cash lease expense, deferred income taxes, stock-based compensation expense, realized gains or losses on disposal of property and equipment, and the effect of working capital changes. The decrease over the prior year is mainly due to the timing of accrued liabilities, accounts payable, and prepaid expenses and other current assets, partially offset by the increase in net income, merchandise inventories, and deferred revenue related to our loyalty and gift card programs.

Merchandise inventories, net were $1,250.0 million at May 4, 2019, compared to $1,136.8 million at May 5, 2018, representing an increase of $113.2 million or 10.0%. Average inventory per store increased 1.8% compared to prior year. The increase in inventory is primarily due to the following:

|

|

·

|

|

approximately $91 million due to the addition of 89 net new stores opened since May 5, 2018;

|

|

|

·

|

|

approximately $30 million due to the opening of the Company’s distribution center in Fresno, California, partially offset by;

|

|

|

·

|

|

approximately $10 million of productivity benefits from supply chain investments in new systems and merchandise planning tools.

|

Investing activities

We have historically used cash primarily for new, remodeled, relocated, and refreshed stores, supply chain investments, short-term investments, and investments in information technology systems. Investment activities for capital expenditures were $71.8 million during the 13 weeks ended May 4, 2019, compared to $74.3 million during the 13 weeks ended May 5, 2018. As of May 4, 2019, we had $195.0 million of short-term investments, which consist of certificates of deposit with maturities of twelve months or less from the date of purchase.

Financing activities

Financing activities in fiscal 2019 and 2018 consist principally of share repurchases and capital stock transactions. Purchases of treasury shares represent the fair value of common shares repurchased from plan participants in connection with shares withheld to satisfy minimum statutory tax obligations upon the vesting of restricted stock.

We had no borrowings outstanding under our credit facility as of May 4, 2019, February 2, 2019 and May 5, 2018. The zero outstanding borrowings position is due to a combination of factors including strong sales growth, overall performance of management initiatives including expense control, as well as inventory and other working capital reductions. We may require borrowings under the facility from time to time in future periods to support our new store program, share repurchases, and seasonal inventory needs.

Share repurchase plan

On March 9, 2017, we announced that the Board of Directors authorized a new share repurchase program (the 2017 Share Repurchase Program) pursuant to which the Company could repurchase up to $425.0 million of the Company’s common stock. The 2017 Share Repurchase Program authorization revoked the previously authorized but unused amount

of $79.9 million from the earlier share repurchase program. The 2017 Share Repurchase Program did not have an expiration date but provided for suspension or discontinuation at any time.

On March 15, 2018, we announced that the Board of Directors authorized a new share repurchase program (the 2018 Share Repurchase Program) pursuant to which the Company could repurchase up to $625.0 million of the Company’s common stock. The 2018 Share Repurchase Program authorization revoked the previously authorized but unused amount of $41.3 million from the 2017 Share Repurchase Program. The 2018 Share Repurchase Program did not have an expiration date but provided for suspension or discontinuation at any time.

On March 14, 2019, we announced that the Board of Directors authorized a new share repurchase program (the 2019 Share Repurchase Program) pursuant to which the Company may repurchase up to $875.0 million of the Company’s common stock. The 2019 Share Repurchase Program authorization revoked the previously authorized but unused amount of $25.4 million from the 2018 Share Repurchase Program. The 2019 Share Repurchase Program does not have an expiration date and may be suspended or discontinued at any time.

During the 13 weeks ended May 4, 2019, we purchased 318,431 shares of common stock for $107.4 million. During the 13 weeks ended May 5, 2018, we purchased 618,551 shares of common stock for $133.1 million.

Credit facility

On August 23, 2017, we entered into a Second Amended and Restated Loan Agreement (the Loan Agreement) with Wells Fargo Bank, National Association, as Administrative Agent, Collateral Agent and a Lender thereunder, Wells Fargo Bank, National Association and JPMorgan Chase Bank, N.A., as Lead Arrangers and Bookrunners, JPMorgan Chase Bank, N.A., as Syndication Agent and a Lender, PNC Bank, National Association, as Documentation Agent and a Lender, and the other lenders party thereto. The Loan Agreement matures on August 23, 2022, provides maximum revolving loans equal to the lesser of $400.0 million or a percentage of eligible owned inventory (which borrowing base may, at the election of the Company and satisfaction of certain conditions, include a percentage of eligible owned receivables and qualified cash), contains a $20.0 million subfacility for letters of credit and allows the Company to increase the revolving facility by an additional $50.0 million, subject to the consent by each lender and other conditions. The Loan Agreement contains a requirement to maintain a fixed charge coverage ratio of not less than 1.0 to 1.0 during such periods when availability under the Loan Agreement falls below a specified threshold. Substantially all of the Company’s assets are pledged as collateral for outstanding borrowings under the Loan Agreement. Outstanding borrowings bear interest at either a base rate or the London Interbank Offered Rate plus 1.25%, and the unused line fee is 0.20% per annum.

As of May 4, 2019, February 2, 2019, and May 5, 2018, we had no borrowings outstanding under the credit facility and the Company was in compliance with all terms and covenants of the Loan Agreement.

Seasonality

Our business is subject to seasonal fluctuation. Significant portions of our net sales and profits are realized during the fourth quarter of the fiscal year due to the holiday selling season. To a lesser extent, our business is also affected by Mother’s Day, Valentine’s Day, as well as the “Back to School” season. Any decrease in sales during these higher sales volume periods could have an adverse effect on our business, financial condition, or operating results for the entire fiscal year. Our quarterly results of operations have varied in the past and are likely to do so again in the future. As such, we believe that period-to-period comparisons of our results of operations should not be relied upon as an indication of our future performance.

Off-balance sheet arrangements

As of May 4, 2019, we have not entered into any “off-balance sheet” arrangements, as that term is described by the SEC. We do, however, have off-balance sheet purchase obligations incurred in the ordinary course of business.

Contractual obligations

Our contractual obligations consist of operating lease obligations, purchase obligations, and our revolving line of credit. No material changes outside the ordinary course of business have occurred in our contractual obligations during the 13 weeks ended May 4, 2019.

Critical accounting policies and estimates

Management’s discussion and analysis of financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of these consolidated financial statements required the use of estimates and judgments that affect the reported amounts of our assets, liabilities, revenues, and expenses. Management bases estimates on historical experience and other assumptions it believes to be reasonable under the circumstances and evaluates these estimates on an on-going basis. Actual results may differ from these estimates. Other than adoption of the new lease accounting standard as discussed in Note 6 to our consolidated financial statements, “Leases,” there have been no significant changes to the critical accounting policies and estimates included in our Annual Report on Form 10‑K for the fiscal year ended February 2, 2019.

Recent accounting pronouncements not yet adopted

See Note 2 to our consolidated financial statements, “Summary of significant accounting policies – Recent accounting pronouncements not yet adopted.”

Recently adopted accounting pronouncements

See Note 2 to our consolidated financial statements, “Summary of significant accounting policies – Recently adopted accounting pronouncements.”

Item 3.

Quantitative and Qualitative Disclosures About Market Risk

Market risk represents the risk of loss that may impact our financial position due to adverse changes in financial market prices and rates. Our market risk exposure is primarily the result of fluctuations in interest rates. We do not hold or issue financial instruments for trading purposes.

Interest rate risk

We are exposed to interest rate risks primarily through borrowings under our credit facility. Interest on our borrowings is based upon variable rates. We did not have any outstanding borrowings on our credit facility as of May 4, 2019 and May 5, 2018.

Item 4.

Controls and Procedures

Evaluation of disclosure controls and procedures over financial reporting

We have established disclosure controls and procedures to ensure that material information relating to the Company is made known to the officers who certify our financial reports and to the members of our senior management and Board of Directors.

Based on management’s evaluation as of May 4, 2019, our Chief Executive Officer and Chief Financial Officer have concluded that our disclosure controls and procedures, as defined in Rules 13a‑15(e) and 15d‑15(e) under the Securities Exchange Act of 1934, are effective to ensure that the information required to be disclosed by us in our reports that we file or submit under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to our management, including the Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

Changes in internal control over financial reporting

There were no changes to our internal controls over financial reporting during the 13 weeks ended May 4, 2019 that have materially affected, or are reasonably likely to materially affect, our internal controls over financial

reporting

.

We implemented internal controls to ensure we adequately evaluated our contracts and properly assessed the impact of the new lease accounting standard on our financial statements to facilitate adoption of the standard on February 3, 2019. We further completed upgrades to our lease administration software to support our accounting for leases and have integrated the new software functionality with our processes, systems and controls.

Part II - Other Information

Item 1.

Legal Proceedings

See Note 7 to our consolidated financial statements, “Commitments and contingencies,” for information on legal proceedings.

Item 1A.

Risk Factors

In addition to the other information set forth in this report, you should carefully consider the factors discussed in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10‑K for the year ended February 2, 2019, which could materially affect our business, financial condition, financial results, or future performance. There have been no material changes from the risk factors previously disclosed in our Annual Report on Form 10‑K for the year ended February 2, 2019.

Item 2.

Unregistered Sales of Equity Securities and Use of Proceeds

The following table sets forth repurchases of our common stock during the first quarter of 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

Period

|

|

Total number

of shares

purchased (1)

|

|

Average

price paid

per share

|

|

Total number

of shares

purchased as

part of publicly

announced

plans or

programs (2)

|

|

Approximate

dollar value of

shares that may yet

to be purchased

under plans or programs

(in thousands) (2)

|

|

February 3, 2019 to March 2, 2019

|

|

41,647

|

|

$

|

299.93

|

|

41,647

|

|

$

|

33,574

|

|

March 3, 2019 to March 30, 2019

|

|

115,606

|

|

|

331.34

|

|

88,765

|

|

|

853,917

|

|

March 31, 2019 to May 4, 2019

|

|

188,309

|

|

|

349.35

|

|

188,019

|

|

|

788,230

|

|

13 weeks ended May 4, 2019

|

|

345,562

|

|

|

337.37

|

|

318,431

|

|

|

788,230

|

|

|

(1)

|

|

There were 318,431 shares repurchased as part of our publicly announced share repurchase program during the 13 weeks ended May 4, 2019 and there were 27,131 shares transferred from employees in satisfaction of minimum statutory tax withholding obligations upon the vesting of restricted stock during the period.

|

|

|

(2)

|

|

On March 15, 2018, we announced the 2018 Share Repurchase Program pursuant to which the Company could repurchase up to $625.0 million of the Company’s common stock. The 2018 Share Repurchase Program did not have an expiration date, but provided for suspension or discontinuation at any time. On March 14, 2019, we announced the 2019 Share Repurchase Program pursuant to which the Company may repurchase up to $875.0 million of the Company’s common stock. The 2019 Share Repurchase Program authorization revoked the previously authorized but unused amount of $25.4 million from the 2018 Share Repurchase Program. As of May 4, 2019, $788.2 million remained available under the $875.0 million 2019 Share Repurchase Program.

|

Item 3.

Defaults Upon Senior Securities

None

Item 4.

Mine Safety Disclosures

None

Item 5.

Other Information

None

Item 6.

Exhibits

The exhibits listed in the Exhibit Index below are filed as part of this Quarterly Report on Form 10‑Q.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on May 30, 2019 on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

ULTA BEAUTY, INC.

|

|

|

|

|

|

By:

|

/s/ Mary N. Dillon

|

|

|

|

Mary N. Dillon

Chief Executive Officer and Director

|

|

|

|

|

|

By:

|

/s/ Scott M. Settersten

|

|

|

|

Scott M. Settersten

Chief Financial Officer, Treasurer and Assistant Secretary

|

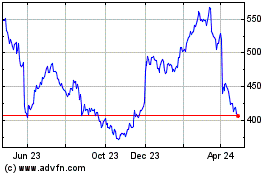

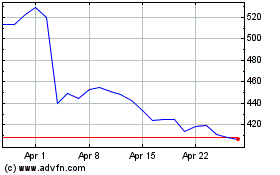

Ulta Beauty (NASDAQ:ULTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ulta Beauty (NASDAQ:ULTA)

Historical Stock Chart

From Apr 2023 to Apr 2024