Current Report Filing (8-k)

June 18 2019 - 8:35AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

June 14, 2019

TUCOWS INC

.

(Exact Name of Registrant Specified in Charter)

|

Pennsylvania

(State or Other

Jurisdiction of

Incorporation)

|

0-28284

(Commission File

Number)

|

23-2707366

(IRS Employer

Identification No.)

|

|

|

|

|

96 Mowat Avenue, Toronto, Ontario, Canada

|

|

|

M6K 3M1

|

|

(Address of Principal Executive Offices)

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(416) 535-0123

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

TCX

|

|

NASDAQ

|

Item 1.01 Entry into a Material Definitive Agreement.

On June 14, 2019, the Company and its wholly owned subsidiaries, Tucows.com Co., Ting Fiber, Inc., Ting Inc., Tucows (Delaware) Inc. and Tucows (Emerald), LLC (each, a “Borrower” and together, the “Borrowers”and, collectively with Tucows, “the Company”), entered into an Amended and Restated Senior Secured Credit Agreement (the “Amended 2019 Credit Agreement”) with Royal Bank of Canada, as administrative agent, and the lenders party thereto (collectively, the “Lenders”) to refinance and replace the Company’s existing credit agreement.

The obligations of the Company under the Amended 2019 Credit Agreement will be secured by a first priority lien on substantially all of the personal property and assets of the Company. The Amended 2019 Credit Agreement has a four year term and provides the Company with access to an aggregate of up to $240 million (inclusive of a $60 million accordion facility).

Borrowings under the Amended 2019 Credit Agreement will accrue interest and standby fees based on the Company’s Total Funded Debt (as defined in the Amended 2019 Credit Agreement) to EBITDA (as defined in the Amended 2019 Credit Agreement) and the availment type as follows:

If Total Funded Debt to EBITDA is less than 1.00, then:

|

|

-

|

Canadian dollar borrowings based on Canadian Dollar Offered Rate (“CDN$ Offered Rate Borrowings”) or U.S. dollar borrowings based on LIBOR (“US$ LIBOR Borrowings”) will be at 1.50% margin;

|

|

|

-

|

Canadian dollar borrowings based on Prime Rate (“CDN$ Prime Rate Borrowings”), Canadian dollar borrowings based on Base Rate (as defined in the Amended 2019 Credit Agreement) (“CDN$ Base Rate Borrowings”) and U.S. dollar borrowings based on Base Rate (“US$ Base Rate Borrowings”) will be at 0.25% margin; and

|

|

|

-

|

Standby fees will be at 0.30%.

|

If Total Funded Debt to EBITDA is greater than or equal to 1.00 and less than 2.00, then:

|

|

-

|

CDN$ Offered Rate Borrowings or US$ LIBOR Borrowings will be at 1.85% margin;

|

|

|

-

|

CDN$ Prime Rate Borrowings, CDN$ Base Rate Borrowings or US$ Base Rate Borrowings will be at 0.60% margin; and

|

|

|

-

|

Standby fees will be at 0.37%.

|

If Total Funded Debt to EBITDA is greater than or equal to 2.00 and less than 2.50, then:

|

|

-

|

CDN$ Offered Rate Borrowings or US$ LIBOR Borrowings will be at 2.35% margin;

|

|

|

-

|

CDN$ Prime Rate Borrowings, CDN$ Base Rate Borrowings or US$ Base Rate Borrowings will be at 1.10% margin; and

|

|

|

-

|

Standby fees will be at 0.47%.

|

If Total Funded Debt to EBITDA is greater than or equal to 2.50, then:

|

|

-

|

CDN$ Offered Rate Borrowings or US$ LIBOR Borrowings will be at 2.85% margin;

|

|

|

-

|

CDN$ Prime Rate Borrowings, CDN$ Base Rate Borrowings or US$ Base Rate Borrowings will be at 1.60% margin; and

|

|

|

-

|

Standby fees will be at 0.57%.

|

The Amended 2019 Credit Agreement is revolving with interest only payments and no scheduled repayments during the term. The Amended 2019 Credit Agreement requires the Company to maintain a leverage ratio of Total Funded Debt to Adjusted EBITDA (as defined in the Amended 2019 Credit Agreement) ratio of not more than 3.50:1.00 at all times and Interest Coverage Ratio (as defined in the Amended 2019 Credit Agreement), as at the end of the financial quarter, of not less than 3.00:1.00.

The Amended 2019 Credit Agreement contains customary representations and warranties, affirmative and negative covenants, and events of default. The Amended 2019 Credit Agreement requires that the Company comply with certain customary non-financial covenants and restrictions.

The foregoing description of the Amended 2019 Credit Agreement does not purport to be complete and is subject to and qualified in its entirety by reference to the full text of the Amended 2019 Credit Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of Registrant.

The information disclosed above in Item 1.01 is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

|

Exhibit

No.

|

|

Exhibit Title

|

|

10.1*

|

|

Amended and Restated Senior Secured Credit Agreement, dated as of June 14, 2019, by and among Tucows.com Co., Ting Fiber, Inc., Ting Inc., Tucows (Delaware) Inc., Tucows (Emerald), LLC, as Borrowers, Tucows Inc., as parent, Royal Bank of Canada, as Administrative Agent, and Royal Bank of Canada, Bank of Montreal, Bank of Nova Scotia, HSBC Bank Canada and Canadian Imperial Bank of Commerce, as Lenders.

|

*Schedules to the agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company undertakes to furnish supplementally copies of any of the omitted schedules upon request by the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TUCOWS INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Davinder Singh

|

|

|

|

|

Davinder Singh

Chief Financial Officer

|

|

Dated: June 18, 2019

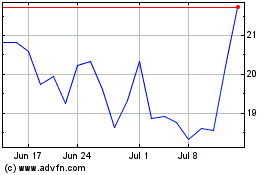

Tucows (NASDAQ:TCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

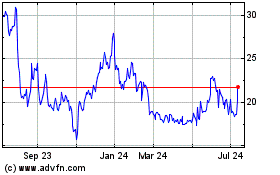

Tucows (NASDAQ:TCX)

Historical Stock Chart

From Apr 2023 to Apr 2024