As filed with the Securities and Exchange

Commission on March 28, 2022

Registration No. 333-262614

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Titan

Pharmaceuticals, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware |

2836 |

94-3171940 |

| (State or other jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

| incorporation or organization) |

Classification Code Number) |

Identification Number) |

400 Oyster Point Blvd., Suite 505

South San Francisco, California 94080

(650) 244-4990

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Kate Beebe DeVarney, Ph.D., President and Chief Operating Officer

Titan Pharmaceuticals, Inc.

400 Oyster Point Blvd., Suite 505

South San Francisco, California 94080

(650) 244-4990

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Fran

Stoller

Loeb & Loeb LLP

345 Park Avenue

New York, New York 10154

Telephone: (212) 407-4000

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box. x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of

1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering.¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

Indicate by check mark whether the Registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act of 1934.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| Non-accelerated filer |

x |

Smaller reporting company |

x |

|

|

Emerging growth company |

¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities

and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary

prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities

and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, nor does it seek an offer

to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION,

DATED MARCH 28, 2022

6,004,855 shares of common stock

This prospectus of relates to the resale from time to time of up to

6,004,855 shares of our common stock, $0.001 par value per share, including 5,953,834 issuable upon the exercise of outstanding warrants

held by the selling stockholders named herein (the “Selling Stockholders”).

The Selling Stockholders may offer the shares of common stock from

time to time directly or through underwriters, broker or dealers and in one or more public or private transactions at market prices prevailing

at the time of sale, at fixed prices, at negotiated prices, at various prices determined at the time of sale or at prices related to prevailing

market prices, as further described herein. If the shares of common stock are sold through underwriters, broker-dealers or agents, the

Selling Stockholders or purchasers of the shares will be responsible for underwriting discounts or commissions or agents’ commissions.

The timing and amount of any sale is within the sole discretion of the Selling Stockholders.

We will not receive any proceeds from the sale of these shares by the

Selling Stockholders.

Our

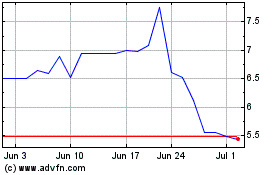

common stock is listed on The NASDAQ Capital Market under the symbol “TTNP.” On _____ __, 2022, the last reported sale price

of our common stock on The Nasdaq Capital Market was $__ per share.

Investing in our common stock involves a high

degree of risk. Before buying any of our securities, you should carefully read “Risk Factors” on page 4 of this prospectus,

and under similar headings in the other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is ___________, 2022

TABLE OF CONTENTS

You should rely only on the information contained in or incorporated

by reference into this prospectus. Neither we nor the Selling Stockholders have authorized, and no underwriter is expected to authorize,

anyone to provide you with information that is different. This prospectus is not an offer to sell or solicitation of an offer to buy these

securities in any circumstances under which the offer or solicitation is unlawful. The Selling Stockholders are offering to sell, and

seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. You should not assume that the information

we have included in this prospectus is accurate as of any date other than the date of this prospectus, or that any information we have

incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the

time of delivery of this prospectus or of any of our securities. Our business, financial condition, results of operations, and prospects

may have changed since that date.

We further note that the representations, warranties and covenants

made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely

for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties thereto,

and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants

were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately

representing the current state of our affairs.

The Titan design logo and the marks “Titan,” “Titan

Pharmaceuticals,” “Probuphine®” and “ProNeura®” are the property of Titan. This prospectus supplement

contains additional trade names, trademarks and service marks of ours and of other companies. We do not intend our use or display of other

companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these

other companies.

SUMMARY

This summary provides an overview of selected

information contained elsewhere or incorporated by reference in this prospectus and does not contain all of the information you should

consider before investing in our securities. You should carefully read this prospectus and the registration statement of which this prospectus

is a part in their entirety before investing in our securities, including the information discussed under “Risk Factors” and

our financial statements and notes thereto that are incorporated by reference in this prospectus. Unless otherwise indicated herein, the

terms “Titan,” “we,” “our,” “us,” or “the Company” refer to Titan Pharmaceuticals, Inc.

Our Company

We are a pharmaceutical company developing therapeutics utilizing our

proprietary long-term drug delivery platform, ProNeura®, for the treatment of select chronic diseases for which steady state delivery

of a drug has the potential to provide an efficacy and/or safety benefit. ProNeura consists of a small, solid implant made from a mixture

of ethylene-vinyl acetate, or EVA, and a drug substance. The resulting product is a solid matrix that is designed to be administered subdermally

in a brief, outpatient procedure and is removed in a similar manner at the end of the treatment period. These procedures may be performed

by trained health care providers, or HCPs, including licensed and surgically qualified physicians, nurse practitioners, and physician’s

assistants in a HCP’s office or other clinical setting.

Our first product based on our ProNeura technology was Probuphine®

(buprenorphine implant), which is approved in the United States, Canada and the European Union, or EU, for the maintenance treatment of

opioid use disorder in clinically stable patients taking 8 mg or less a day of oral buprenorphine. While Probuphine continues to be commercialized

in Canada and in the EU (as Sixmo™) by other companies that have either licensed or acquired the rights from Titan, we discontinued

commercialization of the product in the U.S. during the fourth quarter of 2020. Discontinuation of our commercial operations has allowed

us to focus our limited resources on important product development programs and transition back to a product development company.

ProNeura Continuous Drug Delivery Platform

Our ProNeura continuous drug delivery system consists

of a small, solid rod-shaped implant made from a mixture of EVA and a given drug substance. The resulting product is a solid matrix that

is placed subdermally, normally in the inside part of the upper arm in a short physician office-based procedure using a local anesthetic

and is removed in a similar manner at the end of the treatment period. The drug substance is released continuously through the process

of dissolution-controlled diffusion. This results in a continuous, steady rate of release generally similar to intravenous administration.

We believe that such long-term, near linear release characteristics are desirable as they avoid the fluctuating peak and trough drug levels

seen with oral dosing that often poses treatment problems in a range of diseases.

The ProNeura platform was developed to address

the need for a simple, practical method to achieve continuous long-term drug delivery, and, depending on the characteristics of the compound

to be delivered, can potentially provide treatment on an outpatient basis over extended periods of up to 12 months. We believe that the

benefits of this technology have been demonstrated by the clinical results seen to date with Probuphine, and, in addition, that the development

and regulatory process have been affirmed by the U.S. Food and Drug Administration, or FDA, the European Medicines Agency, or EMA, and

Health Canada approvals of this product. We have further demonstrated the feasibility of the ProNeura platform with small molecules,

hormones, and bio-active peptides. The delivery system works with both hydrophobic and hydrophilic molecules. We have also shown the

flexibility of the platform by experimenting with the release characteristics of the EVA implants, layering the implants with varying

concentrations of drug, and generating implants of different sizes and porosity to achieve a desired delivery profile. We have recently

received a grant from the Bill and Melinda Gates Foundation to undertake preliminary work on a long-acting implant capable of delivering

dual compounds- a human immunodeficiency virus, or HIV, preventative therapeutic and a contraceptive for women and girls in developing

countries.

Development Programs

Several years ago, we began limited non-clinical

laboratory experiments in collaboration with JT Pharmaceuticals, Inc., or JT Pharma, to assess the feasibility of delivering JT Pharma’s

kappa opioid agonist peptide, or TP-2021, utilizing our ProNeura system. We successfully manufactured a prototype implant containing TP-2021

(TP-2021- ProNeura) to be used in appropriate small animal models. While our initial work focused on TP-2021’s ability to activate

peripheral kappa opioid receptors, potentially providing a non-addictive treatment for certain types of pain, in January 2021, our

research pivoted to explore the feasibility of using TP-2021 in the treatment of chronic pruritus, a severe and debilitating condition

defined as itching of the skin lasting longer than six weeks. According to a 2015 review by Mollanazar, N., et al., an estimated 23 –

44 million Americans suffer from chronic pruritus in the setting of both cutaneous and systemic conditions. Current treatments include

antihistamines, corticosteroids, and over-the-counter lotions, all of which are relatively ineffective and/or have undesirable side-effect

profiles. The antipruritic effect of kappa opioid agonists is thought to be related to their binding to kappa opioid receptors on keratinocytes,

immune cells, and peripheral itch neurons.

In February 2021, we announced that early

non-clinical studies of TP-2021 showed very high affinity and specificity for the human kappa opioid receptor and demonstrated potent

antipruritic activity when injected subcutaneously in a mouse model for moderate to severe pruritus. TP-2021 ProNeura implants were then

formulated and tested in this model. In November 2021, data presented at the annual meeting of the Society for Neuroscience demonstrated

that significant reduction in scratching behavior in this proven animal model for pruritus was maintained in mice who received the TP-2021ProNeura

implant through Day 56 post-implantation, when compared with control untreated mice, with no safety issues observed for the implanted

animals over the three-month duration of treatment. Subsequently, efficacy in this pruritus model has been extended through Day 84 post-implantation.

In addition, the TP-2021 ProNeura implant provided sustained supra-therapeutic plasma levels of the peptide through Day 84 post-implantation

in a separate pharmacokinetic study in mice. We believe that subdermal implantation of TP-2021- ProNeura could potentially deliver therapeutic

concentrations of TP-2021 in human subjects for up to six months or longer following a single in-office procedure. We will need to conduct

Investigational New Drug, or IND, enabling non-clinical safety and pharmacology studies in preparation for regulatory approval to enter

human clinical studies.

Pursuant to a research and option license agreement

with the Medical University of South Caroline Foundation for Research Development, we are also synthesizing a limited number of new peptides

designed, like TP-2021, to bind to peripheral kappa opioid receptors. We will consider further development of any of these newly synthesized

compounds that meet the criteria for high-affinity receptor bonding and antipruritic activity to enhance our intellectual property position.

We are also assessing the feasibility of non-implant biodegradable depot formulations of these kappa opioid receptor agonist peptides

to provide antipruritic activity for shorter (e.g., 1 – 3 months) sustained periods. We have allocated a substantial portion of

the proceeds of this offering to fund our kappa opioid agonist peptide program through the IND submission, which we estimate can be accomplished

within 18 to 24 months.

Nalmefene Development Program

In September 2019, the National Institute

for Drug Addiction, or NIDA, awarded us an approximately $8.7 million grant over two years for our nalmefene implant development program

for the prevention of opioid relapse following detoxification of patients suffering opioid use disorder, or OUD. An injectable formulation

of nalmefene was approved by the FDA in 1995 for the management and reversal of opioid overdose, including respiratory depression, but

this is no longer marketed in the U.S. Oral nalmefene was approved by the EMA in 2013 for treating alcohol dependence. A nasal formulation

of nalmefene is currently in clinical development by another company for the treatment of opioid overdose.

The NIDA grant provides funds for the completion

of implant formulation development, cGMP manufacturing and non-clinical studies required for filing an Investigational New Drug application,

or IND. In early 2020, following a meeting with the FDA to review our non-clinical development plans and obtain guidance regarding filing

an IND, the FDA provided clear guidance on the type of development plan that we should follow. Specifically, that this product development

should follow the more expansive 505(b)(1) regulatory pathway rather than the shorter, more streamlined 505(b)(2) regulatory

pathway we had been pursuing. Based on this input, we determined that collection of all the requisite non-clinical chronic toxicology

data would require an additional six-month rodent chronic toxicity study and a three month increase in the duration of an ongoing six-month

non-rodent chronic toxicity study, resulting in a delay of the IND filing. We discussed the change in development plan with NIDA and

they accepted our plan to reallocate previously approved funds for conduct of such studies and extended the existing grant term through

August 2022. In September 2021, the FDA advised that it was reconsidering the regulatory pathway for the nalmefene implant

and could ultimately determine that the 505(b)(2) process is potentially appropriate. We expect to submit the IND for this program

in the second quarter of 2022. If accepted, we would be eligible for the third through fifth year grant funding from NIDA. However, this

funding availability is dependent on a progress review at NIDA. Additional funding from external sources for progression of the clinical

program will be separately sought but will be dependent on finding a suitable partner.

Other programs

In October 2021, we received an approximately

$500,000 grant from the Bill and Melinda Gates Foundation to demonstrate the ability to deliver a combination HIV preventative therapeutic

and a contraceptive from a single ProNeura implant for women and adolescent girls in low- and middle-income countries.

In October 2021, we entered into a research

and option license agreement, or MUSC Agreement, with the MUSC Foundation for Research Development, or MUSC FRD. Under the terms of the

MUSC Agreement, we will conduct certain research, evaluation, proof of concept development and testing of at least three tetrapeptide

kappa-opioid receptor agonist compounds related to the provisional U.S. patent application previously assigned to FRD by the Medical University

of South Carolina (“MUSC”) and entitled “Opioid Agonists and Methods of Use Thereof.” In exchange, FRD has granted

Titan the option to acquire an exclusive worldwide, commercial license to the inventions related to MUSC’s compounds.

Corporate Information

We were incorporated under the laws of the State

of Delaware in February 1992. Our principal executive offices are located at 400 Oyster Point Blvd., Suite 505, South San Francisco,

CA 94080. Our telephone number is (650) 244-4990.We make our SEC filings available on the Investor Relations page of our website,

http://titanpharm.com/. Information contained on our website is not part of this prospectus.

RISK

FACTORS

Investing in our securities involves a high

degree of risk. You should carefully consider the risks described below and all of the information contained or incorporated by reference

in this prospectus. Our business, financial condition, results of operations and prospects could be materially and adversely affected

by these risks.

Risks Related to This Offering

You

may experience future dilution as a result of future equity offerings and other issuances of our common stock or other securities. In

addition, this offering and future equity offerings and other issuances of our common stock or other securities may adversely affect our

common stock price.

In order to raise additional capital, we may in

the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices

that may not be the same as the price per share in this offering. We may not be able to sell shares or other securities in any other offering

at a price per share that is equal to or greater than the price per share paid by the investor in this offering, and investors purchasing

shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional

shares of our common stock or securities convertible into common stock in future transactions may be higher or lower than the price per

share in this offering. You will incur dilution upon exercise of any outstanding stock options, warrants or upon the issuance of shares

of common stock under our stock incentive programs. In addition, the sale of shares in this offering and any future sales of a substantial

number of shares of our common stock in the public market, or the perception that such sales may occur, could adversely affect the price

of our common stock. We cannot predict the effect, if any, that market sales of those shares of common stock or the availability of those

shares for sale will have on the market price of our common stock.

Our share price may be volatile, which could

prevent you from being able to sell your shares at or above your purchase price.

The market price of shares of our common stock

has been and may continue to be subject to wide fluctuations in response to many risk factors listed in this section, and others beyond

our control, including:

| |

· |

results of our product development efforts; |

| |

· |

regulatory actions with respect to our products under development or our competitors’ products; |

| |

|

|

| |

· |

actual or anticipated fluctuations in our financial condition and operating results; |

| |

· |

actual or anticipated fluctuations in our competitors’ operating results or growth rate; |

| |

· |

announcements by us, our potential future collaborators or our competitors of significant acquisitions, strategic collaborations, joint ventures, or capital commitments; |

| |

· |

issuance of new or updated research or reports by securities analysts; |

| |

· |

fluctuations in the valuation of companies perceived by investors to be comparable to us; |

| |

· |

inconsistent trading volume levels of our shares; |

| |

· |

additions or departures of key personnel; |

| |

· |

disputes or other developments related to proprietary rights, including patents, litigation matters and our ability to obtain patent protection for our technologies; |

| |

· |

announcement or expectation of additional financing efforts; |

| |

· |

sales of our common stock by us, our insiders or our other stockholders; |

| |

· |

market conditions for biopharmaceutical stocks in general; and |

| |

· |

general economic and market conditions. |

The stock markets have experienced extreme price

and volume fluctuations that have affected and continue to affect the market prices of equity securities of many companies. These fluctuations

often have been unrelated or disproportionate to the operating performance of those companies. These broad market and industry fluctuations,

as well as general economic, political and market conditions such as recessions, interest rate changes or international currency fluctuations,

may negatively impact the market price of shares of our common stock and could subject us to securities class action litigation.

If securities or industry analysts do not

publish research or publish inaccurate or unfavorable research about our business, our share price and trading volume could decline.

The trading market for our common stock will depend

on the research and reports that securities or industry analysts publish about us or our business. We do not have any control over these

analysts. There can be no assurance that analysts will cover us or provide favorable coverage. If one or more of the analysts who cover

us downgrade our stock or change their opinion of our stock, our share price would likely decline. If one or more of these analysts cease

coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which could cause

our share price or trading volume to decline.

Provisions in our corporate charter documents

and under Delaware law could make an acquisition of our company, which may be beneficial to our stockholders, more difficult and may prevent

attempts by our stockholders to replace or remove our current management.

Provisions in our certificate of incorporation

and our bylaws may discourage, delay or prevent a merger, acquisition or other change in control of our company that stockholders may

consider favorable, including transactions in which you might otherwise receive a premium for your shares. These provisions could also

limit the price that investors might be willing to pay in the future for shares of our common stock, thereby depressing the market price

of our common stock. In addition, because our board of directors is responsible for appointing the members of our management team, these

provisions may frustrate or prevent any attempts by our stockholders to replace or remove our current management by making it more difficult

for stockholders to replace members of our board of directors. Among other things, these provisions provide that:

| |

· |

the authorized number of directors can be changed only by resolution of our board of directors; |

| |

· |

our bylaws may be amended or repealed by our board of directors or our stockholders; |

| |

· |

stockholders may not call special meetings of the stockholders or fill vacancies on the board of directors; |

| |

· |

our board of directors is authorized to issue, without stockholder approval, preferred stock, the rights of which will be determined at the discretion of the board of directors and that, if issued, could operate as a “poison pill” to dilute the stock ownership of a potential hostile acquirer to prevent an acquisition that our board of directors does not approve; |

| |

· |

our stockholders do not have cumulative voting rights, and therefore our stockholders holding a majority of the shares of common stock outstanding will be able to elect all of our directors; and |

| |

· |

our stockholders must comply with advance notice provisions to bring business before or nominate directors for election at a stockholder meeting. |

Our failure to meet the continued listing requirements of Nasdaq

could result in a de-listing of our common stock.

During 2020, we received several notices from the Listing Qualifications

Department the Nasdaq Stock Market, or Nasdaq, regarding the fact that the market price of our common stock was below the $1.00 minimum

bid price requirement for continued listing. As a result of the reverse stock split we effected on November 30, 2020, we were able

to regain compliance with the minimum bid requirement and remain listed on Nasdaq. We have also previously received notices of noncompliance

due to our failure to maintain the $2,500,000 minimum stockholders’ equity requirement for continued listing. We were able to regain

compliance with that requirement through capital raises and our discontinuation of the expenses associated with Probuphine commercial

operations. There can be no assurance that we will continue to meet all of the criteria necessary for Nasdaq to allow us to remain listed.

For example, our share price has recently fallen below the $1.00 minimum bid price requirement for continued listing.

If our common stock is delisted from Nasdaq, our common stock would

likely then trade only in the over-the- counter market. If our common stock were to trade on the over-the-counter market, selling our

common stock could be more difficult because smaller quantities of shares would likely be bought and sold, transactions could be delayed,

and we could face significant material adverse consequences, including: a limited availability of market quotations for our securities;

reduced liquidity with respect to our securities; a determination that our shares are a “penny stock,” which will require

brokers trading in our securities to adhere to more stringent rules, possibly resulting in a reduced level of trading activity in the

secondary trading market for our securities; a reduced amount of news and analyst coverage for our Company; and a decreased ability to

issue additional securities or obtain additional financing in the future. These factors could result in lower prices and larger spreads

in the bid and ask prices for our common stock and would substantially impair our ability to raise additional funds and could result in

a loss of institutional investor interest and fewer development opportunities for us.

In addition to the foregoing, if our common stock is delisted from

Nasdaq and it trades on the over-the- counter market, the application of the “penny stock” rules could adversely affect

the market price of our common stock and increase the transaction costs to sell those shares. The Securities and Exchange Commission,

or SEC, has adopted regulations which generally define a “penny stock” as an equity security that has a market price of less

than $5.00 per share, subject to specific exemptions. If our common stock is delisted from Nasdaq and it trades on the over-the- counter

market at a price of less than $5.00 per share, our common stock would be considered a penny stock. The SEC’s penny stock rules require

a broker-dealer, before a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure

document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer must also provide the

customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and the salesperson in the transaction,

and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny

stock rules generally require that before a transaction in a penny stock occurs, the broker-dealer must make a special written determination

that the penny stock is a suitable investment for the purchaser and receive the purchaser’s agreement to the transaction. If applicable

in the future, these rules may restrict the ability of brokers-dealers to sell our common stock and may affect the ability of investors

to sell their shares, until our common stock no longer is considered a penny stock.

Risks Related to Our Business and Industry

Our ProNeura development programs are at

very early stages and will require substantial additional resources that may not be available to us.

To

date, other than our work on Probuphine in OUD, and our work on nalmefene, we have conducted only limited research and development activities

assessing our ProNeura delivery system’s applicability in other potential indications. While the nalmefene program is being funded

in large part by NIDA, there is no assurance that NIDA will continue to provide the necessary funding to complete the regulatory approval

process for this product candidate. We will also require substantial additional funds to advance our kappa opioid agonist program

beyond the proof-of-concept stage and to support further research and development activities, including the

anticipated costs of nonclinical studies and clinical trials, regulatory approvals, and eventual commercialization of any therapeutic

based on our ProNeura platform technology. If we are unable to obtain substantial government grants or enter into third party collaborations

to fund our ProNeura programs, we will need to seek additional sources of financing, which may not be available on favorable terms, if

at all. If we are unsuccessful in obtaining the requisite funding for our ProNeura programs, we could be forced to discontinue product

development. Furthermore, funding arrangements with collaborative partners or others may require us to relinquish rights to technologies,

product candidates or products that we would otherwise seek to develop or commercialize ourselves or license rights to technologies, product

candidates or products on terms that are less favorable to us than might otherwise be available.

Our ability to successfully develop

any future product candidates based on our ProNeura drug delivery technology is subject to the risks of failure and delay inherent in

the development of new pharmaceutical products, including: delays in product development, clinical testing, or manufacturing; unplanned

expenditures in product development, clinical testing, or manufacturing; failure to receive regulatory approvals; emergence of superior

or equivalent products; inability to manufacture on our own, or through any others, product candidates on a commercial scale; and failure

to achieve market acceptance. Because of these risks, our research and development efforts may not result in any commercially viable products

and our business, financial condition, and results of operations could be materially harmed.

Clinical

trials required for new product candidates are expensive and time-consuming, and their outcome is uncertain.

Conducting clinical trials is a lengthy, time-consuming,

and expensive process. The length of time may vary substantially according to the type, complexity, novelty, and intended use of the product

candidate, and often can be several years or more per trial. Delays associated with products for which we are directly conducting clinical

trials may cause us to incur additional operating expenses. The commencement and rate of completion of clinical trials may be delayed

by many factors, including, for example:

| |

• |

inability to manufacture sufficient quantities of qualified materials under cGMP for use in clinical trials; |

| |

• |

slower than expected rates of patient recruitment; |

| |

• |

failure to recruit a sufficient number of patients; modification of clinical trial protocols; |

| |

• |

changes in regulatory requirements for clinical trials; |

| |

• |

the lack of effectiveness during clinical trials; |

| |

• |

the emergence of unforeseen safety issues; |

| • | delays,

suspension, or termination of the clinical trials due to the institutional review board responsible for overseeing the study at a particular

study site; and |

| |

• |

government or regulatory delays or “clinical holds” requiring suspension or termination of the trials. |

The results from early clinical trials are not

necessarily predictive of results obtained in later clinical trials. Accordingly, even if we obtain positive results from early clinical

trials, we may not achieve the same success in future clinical trials. Clinical trials may not demonstrate statistically significant safety

and effectiveness to obtain the requisite regulatory approvals for product candidates. The failure of clinical trials to demonstrate safety

and effectiveness for the desired indications could cause us to abandon a product candidate and could delay development of other product

candidates. Any delay in, or termination of, our clinical trials could materially harm our business, financial condition, and results

of operations.

We

face risks associated with third parties conducting preclinical studies and clinical trials of our products.

We depend on third-party laboratories and medical

institutions to conduct preclinical studies and clinical trials for our products and other third-party organizations to perform data collection

and analysis, all of which must maintain both good laboratory and good clinical practices. We also depend upon third party manufacturers

for the production of any products we may successfully develop to comply with cGMP of the FDA, which are similarly outside our direct

control. If third party laboratories and medical institutions conducting studies of our products fail to maintain both good laboratory

and clinical practices, the studies could be delayed or have to be repeated.

We

face risks associated with product liability lawsuits that could be brought against us.

The testing, manufacturing, marketing and sale

of human therapeutic products entail an inherent risk of product liability claims. We currently have a limited amount of product liability

insurance, which may not be sufficient to cover claims that may be made against us in the event that the use or misuse of our product

candidates causes, or merely appears to have caused, personal injury or death. In the event we are forced to expend significant funds

on defending product liability actions, and in the event those funds come from operating capital, we will be required to reduce our business

activities, which could lead to significant losses. Adequate insurance coverage may not be available in the future on acceptable terms,

if at all. If available, we may not be able to maintain any such insurance at sufficient levels of coverage and any such insurance may

not provide adequate protection against potential liabilities. Whether or not a product liability insurance policy is obtained or maintained

in the future, any claims against us, regardless of their merit, could severely harm our financial condition, strain our management and

other resources or destroy the prospects for commercialization of the product which is the subject of any such claim.

We

may be unable to protect our patents and proprietary rights.

Our future success will depend to a significant

extent on our ability to:

| |

• |

obtain and keep patent protection for our products, methods and technologies on a domestic and international basis; |

| |

• |

enforce our patents to prevent others from using our inventions; |

| |

• |

maintain and prevent others from using our trade secrets; and |

| |

• |

operate and commercialize products without infringing on the patents or proprietary rights of others. |

We cannot assure you that our patent rights will

afford any competitive advantages, and these rights may be challenged or circumvented by third parties. Further, patents may not be issued

on any of our pending patent applications in the U.S. or abroad. Because of the extensive time required for development, testing and regulatory

review of a potential product, it is possible that before a potential product can be commercialized, any related patent may expire or

remain in existence for only a short period following commercialization, reducing or eliminating any advantage of the patent. If we sue

others for infringing our patents, a court may determine that such patents are invalid or unenforceable. Even if the validity of our patent

rights is upheld by a court, a court may not prevent the alleged infringement of our patent rights on the grounds that such activity is

not covered by our patent claims.

In addition, third parties may sue us for infringing

their patents. In the event of a successful claim of infringement against us, we may be required to:

| |

• |

pay substantial damages; |

| |

• |

stop using our technologies and methods; |

| |

• |

stop certain research and development efforts; |

| |

• |

develop non-infringing products or methods; and |

| |

• |

obtain one or more licenses from third parties. |

If required, we cannot assure you that we will

be able to obtain such licenses on acceptable terms, or at all. If we are sued for infringement, we could encounter substantial delays

in development, manufacture and commercialization of our product candidates. Any litigation, whether to enforce our patent rights or to

defend against allegations that we infringe third party rights, will be costly, time consuming, and may distract management from other

important tasks.

We also rely in our business on trade secrets,

know-how and other proprietary information. We seek to protect this information, in part, through the use of confidentiality agreements

with employees, consultants, advisors and others. Nonetheless, we cannot assure you that those agreements will provide adequate protection

for our trade secrets, know-how or other proprietary information and prevent their unauthorized use or disclosure. To the extent that

consultants, key employees or other third parties apply technological information independently developed by them or by others to our

proposed products, disputes may arise as to the proprietary rights to such information, which may not be resolved in our favor.

We

must comply with extensive government regulations.

The research, development, manufacture, labeling, storage, record-keeping,

advertising, promotion, import, export, marketing and distribution of pharmaceutical products are subject to an extensive regulatory approval

process by the FDA in the U.S. and comparable health authorities in foreign markets. The process of obtaining required regulatory approvals

for drugs is lengthy, expensive and uncertain. Approval policies or regulations may change, and the FDA and foreign authorities have substantial

discretion in the pharmaceutical approval process, including the ability to delay, limit or deny approval of a product candidate for many

reasons. Despite the time and expense invested in clinical development of product candidates, regulatory approval is never guaranteed.

Regulatory approval may entail limitations on the indicated usage of a drug, which may reduce the drug’s market potential. Even

if regulatory clearance is obtained, post-market evaluation of the products, if required, could result in restrictions on a product’s

marketing or withdrawal of the product from the market, as well as possible civil and criminal sanctions. Of the large number of drugs

in development, only a small percentage successfully complete the regulatory approval process and are commercialized.

We

face intense competition.

With respect to our product development programs, we face competition

from numerous companies that currently market, or are developing, products for the treatment of the diseases and disorders we have targeted,

many of which have significantly greater research and development capabilities, experience in obtaining regulatory approvals and manufacturing,

marketing, financial and managerial resources than we have. We also compete with universities and other research institutions in the development

of products, technologies and processes, as well as the recruitment of highly qualified personnel. Our competitors may succeed in developing

technologies or products that are more effective than the ones we have under development or that render our proposed products or technologies

noncompetitive or obsolete. In addition, our competitors may achieve product commercialization or patent protection earlier than we will.

We

depend on a small number of employees and consultants.

We are highly dependent on the services of a limited number of

personnel and the loss of one or more of such individuals could substantially impair our ongoing commercialization efforts. We compete

in our hiring efforts with other pharmaceutical and biotechnology companies, and it may be difficult and could take an extended period

of time because of the limited number of individuals in our industry with the range of skills and experience required and because of

our limited resources.

In addition, we retain scientific and clinical advisors and consultants

to assist us in all aspects of our business. Competition to hire and retain consultants from a limited pool is intense. Further, because

these advisors are not our employees, they may have commitments to, or consulting or advisory contracts with, other entities that may

limit their availability to us, and typically they will not enter into non-compete agreements with us. If a conflict of interest arises

between their work for us and their work for another entity, we may lose their services. In addition, our advisors may have arrangements

with other companies to assist those companies in developing products or technologies that may compete with ours.

We

face potential liability related to the privacy of health information we obtain from clinical trials sponsored by us or our collaborators,

from research institutions and our collaborators, and directly from individuals.

Numerous federal and state laws, including state security breach notification

laws, state health information privacy laws, and federal and state consumer protection laws, govern the collection, use, and disclosure

of personal information. In addition, most health care providers, including research institutions from which we or our collaborators obtain

patient health information, are subject to privacy and security regulations promulgated under the Health Insurance Portability and Accountability

Act of 1996, or HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act. Although we are not directly

subject to HIPAA, we could potentially be subject to criminal penalties if we, our affiliates, or our agents knowingly obtain or disclose

individually identifiable health information maintained by a HIPAA-covered entity in a manner that is not authorized or permitted by HIPAA.

We

face risks related to health epidemics, such as the current COVID-19 global pandemic, that could adversely affect our operations or financial

results.

The spread of COVID-19, the novel coronavirus, including restrictions

on travel, “shelter in place” orders, and quarantine policies put into place by businesses and state and local governments

to mitigate its transmission, may have a material adverse effect on our business. While the duration of the pandemic and its potential

economic impact are difficult to predict, it already has caused significant disruption in the healthcare industry and is likely to have

continuing impacts as it continues. The travel restrictions, “shelter in place” orders, quarantine policies, and general concerns

about the spread of COVID-19 was a significant factor in our decision to wind down our commercial operations because of the resulting

disruptions in the delivery of healthcare to patients, our sales and marketing efforts and REMS training activities, as well as the operations

of the various parts of our supply and distribution chain. The ultimate impact of the COVID-19 pandemic, or any other health epidemic,

is highly uncertain and subject to change. We do not yet know the full extent of potential impacts on our business, healthcare systems

or the global economy as a whole. As the pandemic continues, it may result in a sustained economic downturn that could affect our ability

to access capital on reasonable terms, or at all.

We are increasingly dependent on information technology systems,

infrastructure and data. Cybersecurity breaches could expose us to liability, damage our reputation, compromise our confidential information

or otherwise adversely affect our business.

We are increasingly dependent upon information technology systems,

infrastructure and data. Our computer systems may be vulnerable to service interruption or destruction, malicious intrusion and random

attack. Security breaches pose a risk that sensitive data, including intellectual property, trade secrets or personal information may

be exposed to unauthorized persons or to the public. Cyber-attacks are increasing in their frequency, sophistication and intensity, and

have become increasingly difficult to detect. Cyber-attacks could include the deployment of harmful malware, denial-of service, social

engineering and other means to affect service reliability and threaten data confidentiality, integrity and availability. Our key business

partners face similar risks, and a security breach of their systems could adversely affect our security posture. While we continue to

invest in data protection and information technology, there can be no assurance that our efforts will prevent service interruptions, or

identify breaches in our systems, that could adversely affect our business and operations and/or result in the loss of critical or sensitive

information, which could result in financial, legal, business or reputational harm.

Risks Related to Our Financial Condition and Need for Additional

Capital

We have incurred net losses in almost every year since our

inception, which losses will continue for the foreseeable future.

We have incurred net losses in almost every year since our inception.

Our financial statements have been prepared assuming that we will continue as a going concern. For the years ended December 31, 2021

and 2020, we had net losses of approximately $8.8 million and $18.2 million, respectively, and had net cash used in operating activities

of approximately $7.9 million and $17.2 million, respectively. These net losses and negative cash flows have had, and will continue to

have, an adverse effect on our stockholders’ equity and working capital. We expect to continue to incur net losses and negative

operating cash flow for the foreseeable future as we focus on development of ProNeura based products. The amount of future net losses

will depend, in part, on the rate of future growth of our expenses and our ability to obtain government or third-party funding for our

development programs.

We will require additional proceeds to fund our product development

programs and working capital requirements.

We currently estimate that our available cash and cash equivalents

will be sufficient to fund our working capital needs and product development efforts only to the end of the third quarter of 2022. We

will require additional funds to advance our kappa opioid agonist program beyond the proof-of-concept stage, and to fund any of our ProNeura

development programs, including nalmefene, into the clinic and to complete the regulatory approval process necessary to commercialize

any products we might develop. While we are currently evaluating the alternatives available to us, including government grants, third-party

collaborations for one or more of our ProNeura programs and potential merger opportunities, our efforts to address our liquidity requirements

may not be successful. Furthermore, there can be no assurance that any source of capital will be available to us on acceptable terms.

or will not involve substantial dilution to our stockholders. Our failure to obtain substantial funds in the next several months would

likely result in the cessation of one or more of our development programs or the wind-down of our business.

Our net operating losses and research and development tax credits

may not be available to reduce future federal and state income tax payments.

At December 31, 2021, we had federal net operating loss and tax

credit carryforwards of approximately $258.9 million and approximately $7.5 million, respectively, and state net operating loss and tax

credit carryforwards of approximately $110.6 million and approximately $9.2 million, respectively, available to offset future taxable

income, if any. Current federal and state tax laws include substantial restrictions on the utilization of net operating loss and tax

credits in the event of an ownership change and we cannot assure you that our net operating loss and tax carryforwards will continue

to be available.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking

statements” that involve substantial risks and uncertainties. All statements other than statements of historical facts contained

in this prospectus, including statements regarding our future results of operations and financial position, strategy and plans, and our

expectations for future operations, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We have

attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,”

“continue,” “could,” “estimates,” “expects,” “intends,” “may,”

“plans,” “potential,” “predicts,” “should,” or “will” or the negative of these

terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis

for doing so, we cannot guarantee their accuracy. Forward-looking statements included or incorporated by reference in this prospectus

or our other filings with the Securities and Exchange Commission, or the SEC, include, but are not necessarily limited to, those relating

to uncertainties relating to:

| · | our ability to raise capital when needed; |

| · | difficulties or delays in the product development process, including the results of preclinical studies

or clinical trials; |

| · | financing and strategic agreements and relationships; |

| · | difficulties or delays in the regulatory approval process; |

| · | adverse side effects or inadequate therapeutic efficacy of our drug candidates that could slow or prevent

product development or commercialization; |

| · | dependence on third party suppliers; |

| · | uncertainties relating to manufacturing, sales, marketing and distribution of our drug candidates that

may be successfully developed and approved for commercialization; |

| · | the uncertainty of protection for our patents and other intellectual property or trade secrets; and |

| · | competition. |

These statements are only predictions and involve

known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in

this prospectus, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed

or implied by these forward-looking statements.

Forward-looking statements should not be read

as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, that performance

or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management’s

good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance

or results to differ materially from what is expressed in or suggested by the forward-looking statements.

Forward-looking statements speak only as of the

date they are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking

statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except

to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn

that we will make additional updates with respect to those or other forward-looking statements. We caution you not to give undue weight

to such projections, assumptions and estimates.

USE OF PROCEEDS

We will not receive any of the proceeds from the

sale of shares of common stock by the Selling Stockholders. However, to the extent that the Private Warrants (as defined herein under

“Selling Stockholders”) are exercised for cash, we will receive proceeds up to an aggregate of $5,317,000. We intend to use

any cash proceeds received from exercise of the Private Warrants for working capital and other general corporate purposes.

DIVIDEND POLICY

We have never declared or paid cash dividends

on our common stock. We currently intend to retain all available funds and any future earnings for use in the operation of our business

and do not anticipate paying any cash dividends in the foreseeable future. Any future determination to declare cash dividends will be

made at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements,

general business conditions and other factors that our board of directors may deem relevant.

SELLING

STOCKHOLDERS

On February 2, 2022, we entered into a Securities

Purchase Agreement with a single institutional investor (the “Purchaser”) pursuant to which we issued pre-funded warrants

to purchase an aggregate of 1,289,796 shares of common stock at an exercise price of $0.001 per share (the “Private Pre-Funded Warrants”)

and warrants to purchase an aggregate of 4,664,038 shares of common stock at an exercise price of $1.14 (the “Private Warrants”

and together with the Private Pre-Funded Warrants, the “Placement Warrants””). The Private Warrants are exercisable

until August 4, 2027.

In February 2022, we issued shares to JT

Pharma pursuant to the asset purchase agreement upon the achievement of a clinical milestone.

We agreed to register the shares of common stock

issued to JT Pharma and the shares of common stock issuable upon exercise of the Placement Warrants to permit the Selling Stockholders

and their respective pledgees, donees, transferees and other successors-in-interest that receive their shares from the Selling Stockholders

as a gift, partnership distribution or other non-sale related transfer after the date of this prospectus to resell the shares when and

as they deem appropriate in the manner described in the “Plan of Distribution.”

The information set forth in the following table

regarding the beneficial ownership after resale of shares of common stock is based upon information provided by the Selling Stockholders

and the assumption that the Purchaser will exercise the Placement Warrants in full and sell all of the underlying shares of common stock

covered by this prospectus.

| Name of Selling Stockholder | |

Shares of

common stock

beneficially

owned prior to

offering | | |

Maximum

number of

shares

of

common

stock to be

sold | | |

Number of

shares of

common

stock owned

after offering | | |

Percentage

ownership

after

offering |

| Armistice Capital Master Fund Ltd.(1) | |

| 8,430,736 | (2) | |

| 5,953,834 | | |

| 2,476,902 | | |

(2) |

| JT Pharmaceuticals, Inc. | |

| 51,021 | (3) | |

| 51,021 | | |

| — | | |

* |

* Less than 1%

| (1) | The securities are directly held by Armistice Capital Master Fund Ltd. (the “Master Fund”), a Cayman Islands exempted company,

and may be deemed to be indirectly beneficially owned by Armistice Capital, LLC (“Armistice”), as the investment manager of

the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. Armistice and Steven Boyd disclaim beneficial ownership

of the reported securities except to the extent of their respective pecuniary interest therein. The address of the Master Fund is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

| | | |

| | (2) | Includes 1,300,000 shares underlying registered pre-funded warrants, the shares underlying the Placement

Warrants being registered for resale hereby and 50,000 shares underlying other warrants. The warrants are

each subject to certain beneficial ownership limitations that prohibit the Master Fund from exercising any

portion thereof if, following the exercise, the Master Fund’s ownership of our common stock would exceed

the relevant warrant’s ownership limitation of either 4.99% or 9.99%. |

| (3) | Does not include shares held by James McNab, a member of our board. Mr. McNab is a principal of JT Pharma and has voting and

dispositive power with respect to these shares. |

PLAN

OF DISTRIBUTION

The Selling Stockholders will act independently

of our company in making their decisions with respect to the timing, manner and size of any sales. The Selling Stockholders and any of

their respective pledgees, donees, transferees or other successors-in-interest may, from time to time, sell any or all of the shares of

common stock beneficially owned by them and offered hereby directly or through one or more broker-dealers or agents. The Selling Stockholders

will be responsible for commissions charged by such broker-dealers or agents. Such shares of common stock may be sold in one or more transactions

at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated

prices.

Each Selling Stockholder may use any one or more

of the following methods when selling shares:

• through

underwriters, brokers or dealers (who may act as agent or principal and who may receive compensation in the form of discounts, concessions

or commissions from the Selling Stockholder, the purchaser or such other persons who may be effecting such sales) for resale to the public

or to institutional investors at various times;

• through

negotiated transactions, including, but not limited to, block trades in which the broker or dealer so engaged will attempt to sell the

shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

• through

purchases by a broker or dealer as principal and resale by that broker or dealer for its account;

• on any

national securities exchange or quotation service on which the shares may be listed or quoted at the time of sale at market prices prevailing

at the time of sale, at prices related to such prevailing market prices, or at negotiated prices;

• in private

transactions other than exchange or quotation service transactions;

• short

sales, purchases or sales of put, call or other types of options, forward delivery contracts, swaps, offerings of structured equity-linked

securities or other derivative transactions or securities;

• transactions

with a broker-dealer or its affiliate, whereby the broker-dealer or its affiliate will engage in short sales of shares and may use shares

to close out its short position;

• options

or other types of transactions that require the delivery of shares to a broker-dealer or an affiliate thereof, who will then resell or

transfer the shares;

• loans

or pledges of shares to a broker-dealer or an affiliate, who may sell the loaned shares or, in an event of default in the case of a pledge,

sell the pledged shares;

• through

offerings of securities exercisable, convertible or exchangeable for shares, including, without limitation, securities issued by trusts,

investment companies or other entities;

• offerings

directly to one or more purchasers, including institutional investors;

• through

ordinary brokerage transactions and transactions in which a broker solicits purchasers;

• through

distribution to the security holders of the Selling Stockholder;

• through

a combination of any such methods of sale; or

• through

any other method permitted under applicable law.

Additionally, the Selling Stockholders may resell

all or a portion of its shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that it meets

the criteria and conforms to the requirements of Rule 144.

The Selling Stockholders may be deemed to be statutory

underwriters under the Securities Act. In addition, any other broker-dealers who act in connection with the sale of the shares hereunder

may be deemed to be “underwriters” within the meaning of Section 2(11) of the Securities Act, and any commissions received

by them and profit on any resale of the shares as principal may be deemed to be underwriting discounts and commissions under the Securities

Act. Any other broker-dealers engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Such

broker-dealers and any other participating broker-dealers may, in connection with such sales, be deemed to be underwriters within the

meaning of the Securities Act. If the Selling Stockholders effect such transactions through underwriters, broker-dealers or agents, such

underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from such Selling

Stockholders or commissions from purchasers of the shares of common stock for whom they may act as agent or to whom they may sell as principal,

or both (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be less than or in excess

of those customary in the types of transactions involved). Any discounts or commissions received by any such broker-dealers may be deemed

to be underwriting discounts and commissions under the Securities Act.

There can be no assurance that the Selling Stockholders

will sell any or all of the shares of common stock registered pursuant to the registration statement of which this prospectus forms a

part.

We are not aware of any plans, arrangements or

understandings between the Selling Stockholders and any other underwriter, broker-dealer or agent regarding the sale of shares of common

stock by the Selling Stockholders.

We will pay all expenses incident to the filing

of this registration statement. These expenses include accounting and legal fees in connection with the preparation of the registration

statement of which this prospectus form a part, legal and other fees in connection with the qualification of the sale of the shares under

the laws of certain states (if any), registration and filing fees and other expenses.

LEGAL

MATTERS

The validity of the shares of common stock offered

hereby will be passed upon for us by Loeb & Loeb LLP, New York, New York.

EXPERTS

The financial statements as of and for the years ended December 31,

2021 and 2020 incorporated by reference in this prospectus constituting a part of the registration statement on Form S-1 have been

so incorporated in reliance on the report of WithumSmith+Brown, formerly OUM & Co. LLP, an independent registered public accounting

firm, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We have filed with the Securities and Exchange

Commission a registration statement on Form S-1 under the Securities Act with respect to the securities offered by this prospectus.

This prospectus, which is part of the registration statement, omits certain information, exhibits, schedules and undertakings set forth

in the registration statement. For further information pertaining to us and the securities offered hereby, reference is made to the registration

statement and the exhibits and schedules to the registration statement. Statements contained in this prospectus as to the contents or

provisions of any documents referred to in this prospectus are not necessarily complete, and in each instance where a copy of the document

has been filed as an exhibit to the registration statement, reference is made to the exhibit for a more complete description of the matters

involved.

You may read and copy all or any portion of the

registration statement without charge at the public reference room of the Securities and Exchange Commission at 100 F Street, N.E., Washington,

D.C. 20549. Copies of the registration statement may be obtained from the Securities and Exchange Commission at prescribed rates from

the public reference room of the Securities and Exchange Commission at such address. You may obtain information regarding the operation

of the public reference room by calling 1-800-SEC-0330. In addition, registration statements and certain other filings made with the Securities

and Exchange Commission electronically are publicly available through the Securities and Exchange Commission’s website at www.sec.gov.

The registration statement, including all exhibits and amendments to the registration statement, has been filed electronically with the

Securities and Exchange Commission. You may also read all or any portion of the registration statement and certain other filings made

with the Securities and Exchange Commission on our website at www.heatbio.com. The information contained in, and that can be accessed

through, our website is not incorporated into and is not part of this prospectus.

We are subject to the information and periodic

reporting requirements of the Exchange Act and, accordingly, are required to file annual reports containing financial statements audited

by an independent public accounting firm, quarterly reports containing unaudited financial data, current reports, proxy statements and

other information with the Securities and Exchange Commission. You will be able to inspect and copy such periodic reports, proxy statements

and other information at the Securities and Exchange Commission’s public reference room, the website of the Securities and Exchange

Commission referred to above, and our website at www.titanpharm.com. Except for the specific incorporated reports and documents listed

above, no information available on or through our website shall be deemed to be incorporated in this prospectus or the registration statement

of which it forms a part.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference”

into this prospectus the information we file with it, which means that we can disclose important information to you by referring you to

those documents. The information we incorporate by reference is an important part of this prospectus, and later information that we file

with the SEC will automatically update and supersede some of this information. We incorporate by reference the documents listed below

and any future filings we make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, including filings made

after the date of the initial registration statement, until we sell all of the shares covered by this prospectus or the sale of shares

by us pursuant to this prospectus is terminated. In no event, however, will any of the information that we furnish to, pursuant to Item

2.02 or Item 7.01 of any Current Report on Form 8-K (including exhibits related thereto) or other applicable SEC rules, rather than

file with, the SEC be incorporated by reference or otherwise be included herein, unless such information is expressly incorporated herein

by a reference in such furnished Current Report on Form 8-K or other furnished document. The documents we incorporate by reference

are:

Any statement contained in a document incorporated

or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus

to the extent that a statement contained in this prospectus or any other subsequently filed document that is deemed to be incorporated

by reference into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except

as so modified or superseded, to constitute a part of this prospectus.

We will provide each person to whom a prospectus

is delivered a copy of all of the information that has been incorporated by reference in this prospectus but not delivered with the prospectus.

You may obtain copies of these filings, at no cost, through the “Investor Relations” section of our website (www.titanpharm.com)

and you may request a copy of these filings (other than an exhibit to any filing unless we have specifically incorporated that exhibit

by reference into the filing), at no cost, by writing or telephoning us at the following address:

400 Oyster Point Boulevard, Suite 505

South San Francisco, CA 94080

(650) 244-4990

Information on, or that can be accessed through,

our website is not incorporated into this prospectus or other securities filings and is not a part of these filings.

PART II - INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13. Other Expenses of Issuance and Distribution

We estimate that expenses in connection with the

distribution described in this registration statement (other than fees and commissions charged by the underwriters) will be as set forth

below. We will pay all of the expenses with respect to the distribution, and such amounts, with the exception of the SEC registration

fee and the Financial Industry Regulatory Authority, Inc., or FINRA, filing fee, are estimates.

| SEC registration fee | |

$ | 685 | |

| Legal fees and expenses | |

| 25,000 | |

| Accounting fees and expenses | |

| 12,000 | |

| Printing expenses | |

| 10,000 | |

| Other (including transfer agent and

registrar fees) | |

| 2,315 | |

| Total | |

$ | 50,000 | |

Item 14. Indemnification of Directors and Officers

Subsection (a) of Section 145 of the

General Corporation Law of the State of Delaware, or DGCL, empowers a corporation to indemnify any person who was or is a party or who

is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative

or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director,

officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee

or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees),

judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or

proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests

of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct

was unlawful.

Subsection (b) of Section 145 empowers

a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed