Issuer Free Writing Prospectus dated

October 24, 2019 Relating to Preliminary Prospectus Supplement dated Oct. 23, 2019 Filed Pursuant to Rule 433 Registration No. 333-226452 TherapeuticsMD, Inc. October 24, 2019 Building a Premier Women’s Health

Portfolio

Forward-Looking Statements This

presentation by TherapeuticsMD, Inc. (referred to as “we” and “our”) may contain forward-looking statements. Forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and

strategies, as well as statements, other than historical facts, that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future. These statements are often characterized by

terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,”

“project,” “positioned,” “strategy” and similar expressions and are based on assumptions and assessments made in light of our managerial experience and perception of historical trends, current conditions, expected

future developments and other factors we believe to be appropriate. Forward-looking statements in this presentation are made as of the date of this presentation, and we undertake no duty to update or revise any such statements, whether as a result

of new information, future events or otherwise. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, many of which may be outside of our control. Important factors that could cause actual

results, developments and business decisions to differ materially from forward-looking statements are described in the sections titled “Risk Factors” in our filings with the Securities and Exchange Commission (SEC), including our most

recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, as well as our current reports on Form 8-K, and include the following: our ability to maintain or increase sales of our products; our ability to develop and commercialize IMVEXXY,

ANNOVERA, BIJUVA and its hormone therapy drug candidates and obtain additional financing necessary therefor; our ability to access up to an additional $100 million under our term loan credit facility upon the achievement of certain conditions prior

to December 31, 2019; the potential of adverse side effects or other safety risks that could adversely affect the commercialization of our current or future approved products or preclude the approval of our future drug candidates; the length, cost

and uncertain results of future clinical trials; our reliance on third parties to conduct our clinical trials, research and development and manufacturing; the ability of our licensees to commercialize and distribute our products; the effects of

laws, regulations and enforcement; the competitive nature of the industries in which we conduct our business; the availability of reimbursement from government authorities and health insurance companies for our products; the impact of product

liability lawsuits; the influence of extensive and costly government regulation; the volatility of the trading price of our common stock; and the concentration of power in our stock ownership. This non-promotional presentation is intended for

investor audiences only. TherapeuticsMD has filed a registration statement (including a prospectus) with the SEC for the offering of common stock to which this presentation relates. The offering will be made only by means of a written prospectus and

prospectus supplement that form a part of the registration statement. Before you buy any shares of TherapeuticsMD common stock in the offering, you should read the prospectus supplement and the accompanying prospectus, together with the information

incorporated therein. These documents contain important information that you should consider when making your investment decision. A preliminary prospectus supplement relating to and describing the terms of the offering has been filed with the SEC

and is available on the SEC's website at www.sec.gov. Copies of the preliminary prospectus supplement relating to these securities may also be obtained from the offices of J.P. Morgan Securities LLC, Attention: Broadridge Financial Solutions, 1155

Long Island Avenue, Edgewood, NY 11717, or by telephone at 1-866-803-9204, or by email at prospectus-eg_fi@jpmchase.com. This presentation also includes financial amounts which are unaudited and preliminary, and do not present all information

necessary for an understanding of our financial condition as of September 30, 2019. The review of our consolidated financial statements for the three months ended September 30, 2019 is ongoing and could result in changes to these amounts due to the

completion of financial closing procedures, final adjustments and other developments that may arise between now and the time the consolidated financial statements for the three months ended September 30, 2019 are finalized and publicly released. Our

independent registered public accounting firm, Grant Thornton LLP, has not audited, reviewed, or compiled these estimates. See “Risk factors,” “Cautionary statement about forward looking information,”

“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes included elsewhere in the reports we file from time to time with the SEC.

TRANSACTION OVERVIEW Issuer

TherapeuticsMD, Inc. Ticker / Exchange TXMD / Nasdaq Global Select Market Offering Size 22,000,000 shares of Common Stock Option to Purchase Additional Shares 15% Securities Offered Common stock (100% primary) Use of Proceeds Commercialization of

IMVEXXY, BIJUVA and ANNOVERA, including to maximize ANNOVERA’s consumer-focused commercialization strategy Working capital and general corporate purposes Lock-Up 90 days for Company, officers and directors Expected Pricing Week of October 21st

Sole Bookrunner J.P. Morgan Lead Manager Stifel

Focused on lifespan of the patient and

healthcare provider’s needs Innovative products, chronic conditions, large markets 200 sales representatives focused on single call point Products transition from one to the next through various stages of life contraception à prenatal

vitamins à contraception à vasomotor symptoms à vulvar and vaginal atrophy Patient cost conscious portfolio Products with patient out-of-pocket costs as little as $35 with copay programs* Possibility of no out-of-pocket costs for

ANNOVERA Portfolio Approach to Women’s Health Sum of the Parts Prenatal Vitamins * Copay as little as $35 with commercial coverage. Offer not valid for patients enrolled in Medicare, Medicaid, or other federal or state health care programs

(including any state pharmaceutical assistance programs). Program Terms, Conditions, and Eligibility Criteria apply.

32 million women1,2 36 million women4

>$20B3 >$25B3,5 Approved May 29, 2018 Launched August 2018 Approved October 28, 2018 Launched April 2019 43 million women6 $5B7 Approved August 10, 2018 Test & Learn Introduction: 4Q19 Full scale launch expected: 1Q20 Affected US

Population US TAM Opportunity Status Easy to use, lowest approved dose, designed to support patient compliance First and only FDA-approved bio-identical combination product Key Value Proposition First and only long-lasting (one year/13 cycles),

procedure-free, patient-controlled, reversible birth control product 1) The North American Menopause Society. Management of symptomatic vulvovaginal atrophy: 2013 position statement of The North American Menopause Society. Menopause.

2013;20(9):888–902. 2) Gass ML, Cochrane BB, Larson JC, et al. Patterns and predictors of sexual activity among women in the hormone therapy trials of the Women’s Health Initiative. Menopause. 2011;18(11):1160–1171. 3) Based on

market pricing of current FDA-approved HT products. 4) Derived from U.S. Census data on women in the age group who normally experience symptoms. 5) Based on pre-WHI annual scripts of FDA-approved HT products. 6) Contraceptive Use in the United

States, Guttmacher, July 2018. IQVIA Patient Tracker. 7) QuintilesIMS MIDAS, QuintilesIMS Analysis, Company filings. Long acting reversible contraceptive market includes: Nexplanon/Implanon, Mirena family, Paragard and Liletta. Net sales as reported

in company filings. (TXMD) Focused on developing and commercializing products for women throughout their life cycles

The Power of A Women’s Health

Portfolio Market Opportunity1 Overlapping Prescribers & Patients The Power of 3 Even though there are over 400,000 total writers for these products2 ~26,000 targets we call on represent over 60% of market opportunity for each product2

REPRODUCTIVE Portfolio MENOPAUSE PORTFOLIO 5.4M units IMVEXXY 15.9M units BIJUVA 28M units ANNOVERA 1) Symphony Health Integrated Dataverse. 2) IQVIA National Prescriber Level Data.

Financial Overview

3Q19 Preliminary Financial Information

FDA-Approved Products Net Revenue Prenatal Vitamins Net Revenue Total TXMD Net Revenue 3Q2019 Guidance1 3Q2019 Preliminary Financial Information $4.50 - 6.50M $2.25 - 2.50M $6.75 - 9.00M As our sales force focus shifts to our FDA-approved products

and payer headwinds continue to increase for prenatal vitamins, we anticipate prenatal vitamins will continue to become a smaller percentage of overall company revenues $5.32 - 5.70M $2.50 - 2.60M $7.82 - 8.30M Estimated Cash and Cash Equivalents at

September 30, 2019: $155.3M 1 As stated in the Company’s press release dated August 6, 2019.

ANNOVERA

ANNOVERA Market Update Net revenue for

ANNOVERA estimated at $375,000 to $400,000 for 3Q19 Strong initial commercial net revenue of ~$1,250 per unit with the potential for improvement1 ~7,500 units expected to be available for sale in 4Q19 Building inventory for planned full launch in

Feb. 2020; estimate 100,000+ units available for sale in 2020 Already achieved ~62% unrestricted commercial access2 1 $1,250 assumes patients meeting the criteria of 1) commercially insured patient or 2) approved via a Medical Necessity Letter. Does

not include cash pay sales. 2 MMIT October 2019 (Account Insights) and CVS Preventative Drug List 3

https://www.fda.gov/drugs/regulatory-science-research-and-education/reorganization-office-new-drugs-corresponding-changes-office-translational-sciences-and-office Key Performance Metrics Market Maximization Opportunity Strong initial commercial net

revenue per unit and rapid commercial insurance adoption provide opportunity to maximize ANNOVERA’s consumer-focused commercialization strategy U.S. Food and Drug Administration (FDA) reorganization of Division of Bone Reproductive and

Urologic Products (DBRUP)3 may delay the 19th category of birth control decision for ANNOVERA beyond 4Q19 deadline for credit facility draw trigger

ANNOVERA Market Opportunity Total

Addressable Birth Control Market NRx: 28M Average Net Revenue / Unit 1.0% Total Addressable Birth Control Market NRx 1.5% Total Addressable Birth Control Market NRx 2.0% Total Addressable Birth Control Market NRx 2.5% Total Addressable Birth Control

Market NRx $1,000 $280M $420M $560M $700M $1,250 $350M $525M $700M $875M $1,500 $420M $630M $840M $1.05B $1,750 $490M $735M $980M $1.2B ANNOVERA Net Revenue Opportunity Strong initial commercial net revenue of ~$1,250 per unit with the potential for

improvement1 Current 1 $1,250 assumes patients meeting the criteria of 1) commercially insured patient or 2) approved via a Medical Necessity Letter. Does not include cash pay sales.

ANNOVERA DTC Distribution Options Why

the Payer Landscape for Contraception is Unique Coverage laws are favorable to both doctors and patients in the contraceptive category when there is no generic equivalent Affordable Care Act Implementation (Part XXVI) specifies if an

individual’s attending provider recommends a particular service or FDA-approved contraceptive based on a determination of medical necessity1: “The plan or issuer must cover that service or item without cost sharing. The plan or issuer

must defer to the determination of the attending provider.” “Sufficiently expedient exception process” Multiple well established, consumer focused generic DTC contraceptive platforms currently operate ANNOVERA offers a unique

branded revenue opportunity for these platforms In this class of therapy, doctor/patient choice overrides insurance company formularies when a generic equivalent has not been established TXMD is currently working with multiple platforms to establish

distribution partners for ANNOVERA that are both low cost to TXMD and offer an attractive return to the platforms ANNOVERA Consumer Strategy Low-cost, high touch partner opportunities with multiple direct-to-consumer (DTC) contraceptive platforms 1

https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/faqs/aca-part-xxvi.pdf

ANNOVERA Commercial Payer Update

Already Achieved ~62% Unrestricted Access1 Plan % of Lives2 Status3 CVS 16% Adjudicating with no copay as of October 2019 ESI 16% Adjudicating at T3 as of September 2019 United 8% In discussions Anthem 7% Adjudicating at T3, no copay as of August

2019 Prime 6% In discussions OptumRx 6% In discussions Kaiser 5% In discussions Aetna 4% No copay at in network pharmacies for a majority of lives as of October 2019 Cigna 4% Adjudicating at T3 as of August 2019 EnvisionRx 2% Adjudicating as of

November 2019 Top 10 Plans Account for ~74% of all Commercial Pharmacy Lives1 Adjudication of claim by payer: ANNOVERA is on payer formulary as covered product and is being submitted to insurance company for payment by payer to pharmacy. 1MMIT

October 2019 (Account Insights) and CVS Preventative Drug List 2Plan numbers as of October 2019 3Adjudication status from MMIT October 2019 and Account Insights New Kaiser Washington covering at no copay New New

ANNOVERA Commercial Payer Update Fast

Uptake in Regional Plans Selected Regional Plan Coverage Adjudication of claim by payer: ANNOVERA is on payer formulary as covered product and is being submitted to insurance company for payment by payer to pharmacy. 1Plan numbers as of October 2019

2MMIT October 2019 and Account Insights Plan % of Lives1 Status2 MC-Rx (ProcareRx) 0.64% Adjudicating as of April 2019 Magellan Rx 0.4% Adjudicating as of August 2019 BCBS of Massachusetts 0.47% Adjudicating at no copay as of August 2019

EmblemHealth 0.26% Adjudicating at no copay as of September 2019 Excellus 0.24% Adjudicating as of September 2019 Wellmark 0.23% Adjudicating as of August 2019 Harvard Pilgrim 0.18% Adjudicating at no copay as of August 2019 Independent Health

Association 0.06% Adjudicating as of August 2019 Geisinger 0.05% Adjudicating at no copay as of October 2019 BC of Idaho 0.00% Adjudicating at no copay as of September 2019 Summacare 0.00% Adjudicating at no copay as of September 2019 Clear Script

PBM 0.00% Adjudicating as of August 2019 Univera Healthcare 0.00% Adjudicating as of August 2019 New

11 STATES, plus Washington D.C.,

REQUIRE COVERAGE WITH NO COPAY REGARDLESS OF ACA DECISION (~52 Million women in these states+) ANNOVERA coverage required with no co-pay BIRTH CONTROL STATE LAWS REGARDLESS OF ACA MANDATES 1 Data on file (July 2019). 2 Washington State Office of the

Insurance Commissioner https://www.facebook.com/WSOIC/photos/starting-in-2019-health-plans-in-washington-state-must-cover-all-forms-of-birth-/2485878528095084/ (accessed July 5, 2019). *NY is effective 1/1/2020 + Population numbers identified for

each state are total population numbers, including all genders. 2 1 * New ANNOVERA coverage required with co-pay 1

ANNOVERA coverage required with co-pay

8 STATES REQUIRE COVERAGE WITH COPAY REGARDLESS OF ACA DECISION (~27 Million women in these states+) BIRTH CONTROL STATE LAWS REGARDLESS OF ACA MANDATES 1 1 Data on file (July 2019). + Population numbers identified for each state are total

population numbers, including all genders. ANNOVERA coverage required with no co-pay 1

ANNOVERA Key Attributes Oral

Contraceptives Vaginal Ring NuvaRing® Contraceptive Injection Vaginal System ANNOVERA™ IUDs Duration of Action Daily pill intake 1 month (21/7 regimen) 3 months 1 year (21/7 regimen) 3-10 years Patient Control Stop at any time Removable

at any time Stop at any time, but residual effects for 3 months Removable at any time Procedure required Nulliparous Women Yes Yes Yes Yes Not universally acceptable Product Administration Oral intake Patient administered Flexible vaginal ring

Physician in-office injection every 3 months Patient administered Soft and pliable ring-shaped vaginal system Physician in-office procedure for insertion and removal Patient Convenience Daily pill presents compliance and adherence risks; potential

increase in unplanned pregnancies Monthly pharmacy visit Physician in-office injection, prescriber stocking required Annual pharmacy visit Physician in-office procedure, prescriber stocking required Healthcare Provider Convenience Filled at pharmacy

Filled at pharmacy; Refrigeration required prior to being dispensed Prescriber required to hold inventory Filled at pharmacy; No refrigeration; No inventory or capital outlay Prescriber required to hold inventory Yearly WAC Lo Loestrin® Fe:

$1,829.33 NuvaRing® $2,114.19 Depo-Provera® $799.12 $2,000 Liletta® $749.40 + $590 for insertion/removal Plus office visits and screenings All trademarks are the property of their respective owners.

IMVEXXY

IMVEXXY Results Net revenue for IMVEXXY

estimated at $4.5M to $4.8M for 3Q19 (up from approximately $3.1M for 2Q19) Net revenue continues to grow faster than units due to improving adjudication rates TRx increased approximately 26% to approximately 134,000 for 3Q19 (up from approximately

106,000 for 2Q19) 2Q19 3Q19 Sept 2019 Oct 1-15, 2019 Commercial Adjudication % 50% 55% 62% ~68% Medicare Part D Adjudication % 8% 12% 13% ~16% Key Performance Metrics Target overall adjudication of ~85% as optimization is complete 2H20 Adjudication

Rate Improvement

IMVEXXY Progress Update Achieved ~68%

commercial unrestricted access1 8 of the top 10 commercial payers adjudicating Additional Medicare Part D decisions expected this quarter Copay for patients without insurance increased from $35 to $50 as of October 1, 2019 – not expected to

impact volume Initiatives designed to drive starter pack volume and target competitors using clinical data expected to begin 1Q20 Began distribution optimization process Expect improvement of 3-5% over current distribution costs by 3Q20, including

improved consignment fees and new retail partnerships 1MMIT October 2019 (Account Insights) Payer Progress Levers for Growth

Value of Additional Fills IMVEXXY: 4.0

fills/yr1 (through Sept) Percent of market based on patient count of 2.3M and 4 fills per year Average Net Revenue / Unit 25% 35% 45% 55% $80 $184M $257.6M $331.2M $404.8M $100 $230M $322M $414M $506M 6 Fills/year 5 Fills/year 4 Fills/year Percent

of market based on patient Count of 2.3M and 5 fills per year Average Net Revenue / Unit 25% 35% 45% 55% $80 $230M $322M $414M $506M $100 $287.5M $402.5M $517.5M $632.5M Percent of market based on patient count of 2.3M and 6 fills per year Average

Net Revenue / Unit 25% 35% 45% 55% $80 $276M $386.4M $496.8M $607.2M $100 $345M $483M $621M $759M 1Average number of fills for all patients is calculated as Total Rx / Total Patients. Market opportunity is calculated by multiplying the number of

patients on products annually times the market share times the average number of fills per patient per year times the average potential net revenue per unit. At $100 average net revenue, the value per fill ranges from $57M to $126M, depending on

market share.

Target Adjudication Rate* Over Time for

IMVEXXY Column A Column B Column C IMVEXXY No Insurance Commercial Insurance Medicare Eligible Patients % of Business 4% 62% 33% % Adjudicated 0% 55% 12% Contribution to Overall Adjudication Rate 0% 34% 4% Overall Adjudication Rate 38% (up from 34%

2Q19) 3Q 2019 Actuals Column A Column B Column C IMVEXXY No Insurance Commercial Insurance Medicare Eligible Patients % of Business 3% 62% 35% % Adjudicated 0% 75% 65% Contribution to Overall Adjudication Rate 0% 47% 23% Overall Adjudication Rate

70% Target Overall Adjudication of 70% in Second Half 2020 before Optimization Complete *Adjudication Rate= Percent of Business multiplied by percent of claims being covered. Step 1 Step 2 Column A Column B Column C IMVEXXY No Insurance Commercial

Insurance Medicare Eligible Patients % of Business 3% 62% 35% % Adjudicated 0% 87% 87% Contribution to Overall Adjudication Rate 0% 54% 31% Overall Adjudication Rate 85% Target Overall Adjudication of 85% as Optimization is Complete Step

3

Commercial Payer Status Achieved ~68%

Unrestricted Commercial Access1 8 of the Top 10 Commercial Payers Secured Plan % of Lives2 Status3 CVS 16% Adjudicating as of September 2019 ESI 16% Adjudicating as of 10/1/18 United 8% Adjudicating as of 3/1/19 Anthem 7% Adjudicating as of August

2018 Prime 6% Adjudicating as of 1/1/19 OptumRx 6% Adjudicating as of 1/1/19 Kaiser 5% In discussions Aetna 4% Awaiting decision Cigna 4% Adjudicating as of 12/15/18 EnvisionRx 2% Adjudicating as of 1/1/19 Top 10 Plans Account for ~74% of all

Commercial Pharmacy Lives1 Adjudication of claim by payer: IMVEXXY is on payer formulary as covered product and is being submitted to insurance company for payment by payer to pharmacy. 1MMIT October 2019 (Account Insights) 2Plan numbers as of

October 2019 2Adjudication status from MMIT October 2019 and Account Insights New

Medicare Part D Payer Status Additional

Decisions Expected This Quarter Plan % of Lives2 Status3 United 21% Adjudicating as of 2/1/19 Humana 18% Decision expected 4Q19 CVS Caremark 14% Decision expected 4Q19 Wellcare with Aetna lives 14% Decision expected 4Q19 Express Scripts/ Cigna 8%

Decision expected 4Q19 Kaiser 4% Adjudicating maintenance pack as of 10/1/18 and starter pack as of 3/1/19 Anthem 3% Decision expected 4Q19 Envision 1% Decision expected 4Q19 Top 8 Plans Account for ~83% of all Medicare Part D Pharmacy Lives1

Adjudication of claim by payer: IMVEXXY is on payer formulary as covered product and is being submitted to insurance company for payment by payer to pharmacy. 1MMIT October 2019 (Account Insights) 2Plan numbers as of October 2019 3Adjudication

status from MMIT October 2019 and Account Insights

BIJUVA

Net revenue for BIJUVA estimated at

$450,000 to $500,000 for 3Q19 (up from approximately $134,000 for 2Q19) TRx increased to approximately 15,800 for 3Q19 (up from approximately 4,600 for 2Q19) Achieved ~54% of unrestricted commercial access1 6 of the top 10 commercial payers

currently adjudicating; the remaining 4 decisions expected this quarter Key Performance Metrics BIJUVA Results 2Q19 3Q19 Sept 2019 Oct 1-15, 2019 Commercial Adjudication % 38% 50% 54% 54% Medicare Part D Adjudication % 7% 15% 14% 13% 1MMIT October

2019 (Account Insights) Adjudication Rate Improvement

BIJUVA Update TXMD plans to submit a

New Drug Application (NDA) supplement for the 0.5/100 mg dose of BIJUVA to FDA for approval After meeting with FDA, TXMD plans to submit an NDA efficacy supplement using existing REPLENISH Phase 3 data with new analyses Anticipate no new clinical

trials required Plan to submit efficacy supplement in 4Q19 10 month PDUFA date expected if the efficacy supplement is accepted for review Similar to IMVEXXY, TXMD expects vast majority of prescriptions to be the higher dose (1/100 mg) We believe a

subset of physicians would use a lower dose option when titrating patients off of hormone replacement therapy (HRT), specifically in the BIO-IGNITE channel Plan to Submit BIJUVA 0.5/100 mg Dose Reason for Submission

Process & Status Expect BIJUVA

launch into BIO-IGNITE end of 4Q19 119 Contracting In Vetting Process 70 Live Accounts 136 In Contracting Process 119 BIO-IGNITE Update1 New 1 Information as of October 19, 2019 2 Compounded Bio-Identical Hormone Replacement Therapy 2,641 High-Value

CBHRT2 HCP’s 136 Live Accounts National Reach

BIJUVA Commercial Payer Update

Additional Coverage Decisions Expected This Quarter Plan % of Lives2 Status3 CVS 16% In discussions ESI 16% Adjudicating as of 4/19/19 United 8% Adjudicating as of 8/1/19 Anthem 7% In discussions Prime 6% In discussions OptumRx 6% Adjudicating as of

8/1/19 Kaiser 5% In discussions Aetna 4% Adjudicating as of 4/2019 Cigna 4% Adjudicating as of 9/2019 EnvisionRx 2% Adjudicating as of 11/2019 Top 10 Plans Account for ~74% of all Commercial Pharmacy Lives1 Adjudication of claim by payer: BIJUVA is

on payer formulary as covered product and is being submitted to insurance company for payment by payer to pharmacy. Achieved ~54% Unrestricted Commercial Access1 6 of the Top 10 Commercial Payers Secured1 1MMIT October 2019 and Account Insights

2Plan numbers as of October 2019 3Adjudication status from MMIT October 2019 and Account Insights New New

Column A Column B Column C BIJUVA No

Insurance Commercial Insurance Medicare Eligible Patients % of Business 5% 89% 6% % Adjudicated 0% 50% 15% Contribution to Overall Adjudication Rate 0% 44% 1% Overall Adjudication Rate 45% (up from 34% 2Q19) 3Q 2019 Actuals Column A Column B Column

C BIJUVA No Insurance Commercial Insurance Medicare Eligible Patients % of Business 3% 89% 8% % Adjudicated 0% 75% 65% Contribution to Overall Adjudication Rate 0% 67% 5% Overall Adjudication Rate 72% Target Overall Adjudication in Second Half 2020

before Optimization Complete *Adjudication Rate= Percent of Business multiplied by percent of claims being covered. Step 1 Step 2 Column A Column B Column C BIJUVA No Insurance Commercial Insurance Medicare Eligible Patients % of Business 3% 89% 8%

% Adjudicated 0% 87% 87% Contribution to Overall Adjudication Rate 0% 78% 7% Overall Adjudication Rate 85% Target Overall Adjudication as Optimization is Complete Step 3 Target Adjudication Rate* Over Time for BIJUVA

Total Addressable Birth Control Market

NRx: 28M Average Net Revenue / Unit 1.0% 1.5% 2.0% 2.5% $1,000 $280M $420M $560M $700M $1,250 $350M $525M $700M $875M $1,500 $420M $630M $840M $1.05B $1,750 $490M $735M $980M $1.2B Percent of Market Based on Patient Count of 2.3M and 4 fills per

year Average Net Revenue / Unit 25% 35% 45% 55% $80 $184M $257.6M $331.2M $404.8M $100 $230M $322M $414M $506M Total Addressable FDA Market 3,800,000 : 3.8M Total Addressable Compounding Market 12,000,000 : 12M Percent of Addressable Market Average

Net Revenue / Unit 25% 35% 45% 55% $80 $316M $442.4M $568.8M $695.2M $100 $395M $553M $711M $869M The Power of the Portfolio Multiple Paths to $1B of Peak Sales Diversified risk with 3 FDA-approved products, creating multiple paths to $1B peak sales

opportunity Example: $230M (IMVEXXY), $395M (BIJUVA) and $420M (ANNOVERA) = $1B peak sales potential

REPRODUCTIVE HEALTH MENOPAUSE

MANAGEMENT Prenatal Vitamins The Power of a Women’s Health Portfolio CONTRACEPTION PRENATAL CARE CONTRACEPTION/ Family Planning - Perimenopause VASOMOTOR SYMPTOMS DYSPAREUNIA (Vulvar & Vaginal Atrophy)

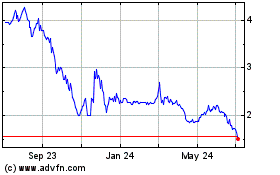

TherapeuticsMD (NASDAQ:TXMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

TherapeuticsMD (NASDAQ:TXMD)

Historical Stock Chart

From Apr 2023 to Apr 2024