Current Report Filing (8-k)

May 04 2021 - 9:17AM

Edgar (US Regulatory)

0001289460

false

0001289460

2021-05-04

2021-05-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

May 4, 2021

TEXAS ROADHOUSE, INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

000-50972

|

|

20-1083890

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

6040 Dutchmans Lane, Louisville, KY

|

|

40205

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code (502) 426-9984

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

|

Title of each Class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

|

TXRH

|

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

As previously disclosed, Texas Roadhouse, Inc. and certain of its subsidiaries

are parties to the Amended and Restated Credit Agreement dated August 7, 2017 (the “Amended Credit Agreement”). The

Amended Credit Agreement is a revolving credit agreement under which we can borrow up to $200.0 million with the option to increase the

credit facility by an additional $200.0 million (subject to certain limitations set forth in the Amended Credit Agreement). The material

terms of the Amended Credit Agreement are described under “Note 5 – Long-term Debt” of the Notes to Consolidated Financial

Statements for Texas Roadhouse, Inc. and its subsidiaries, which Note 5 is included in our Annual Report on Form 10-K for the fiscal year

ended December 29, 2020, filed with the Securities and Exchange Commission on February 26, 2021, and which description is incorporated

herein by reference.

As further disclosed, the Amended Credit Agreement was previously amended

by the Amendment No. 1 to Amended and Restated Credit Agreement dated May 11, 2020 (the “Amendment No. 1”). The Amendment

No.1 provided for a senior 364-day incremental revolving credit facility of up to $82.5 million.

On May 4, 2021, we entered into the Amendment No. 2 to Amended

and Restated Credit Agreement (the “Amendment No. 2”) further amending the Amended Credit Agreement with a syndicate of

commercial lenders led by JPMorgan Chase Bank, N.A. and PNC Bank, National Association for the purposes of extending the

maturity date as further described below and increasing the amount in which we can borrow by an additional $100.0 million as further

described below. The Amended Credit Agreement (as amended by the Amendment No. 1 and the Amendment No. 2) remains an unsecured,

revolving credit agreement under which we can borrow up to $300.0 million with the option to increase the credit facility by an

additional $200.0 million, subject to certain limitations set forth in the Amended Credit Agreement, including approval by the

syndicate of lenders.

The Amendment No.2 also extends the maturity date of our credit

facility until May 1, 2026. The existing indebtedness in the amount of $190.0 million under the original credit facility will

continue following the execution of the Amendment No. 2. On May 4, 2021, the existing indebtedness in the amount of $50 million under

the incremental credit facility was repaid from cash on hand.

Under the Amended Credit Agreement (as amended by the Amendment No.

1 and the Amendment No. 2), we are required to pay interest on outstanding borrowing at LIBOR plus 0.875% to 1.875% and to pay a commitment

fee of 0.125% to 0.300% per year for any unused portion of the credit facility, in each case depending on our leverage ratio. The

Amended Credit Agreement (as amended by the Amendment No. 1 and the Amendment No. 2) imposes the financial covenants of maintaining a

fixed charge coverage ratio to be less than 2.00 to 1.00 and a maximum leverage ratio to be less than 3.00 to 1.00. The lenders’

obligations to extend credit under the Amended Credit Agreement (as amended by the Amendment No. 1 and the Amendment No. 2) will depend

upon our compliance with these covenants.

Fees and expenses incurred in connection with the Amended Credit Agreement

were paid from cash on hand.

The Obligations pursuant to the Amended Credit Agreement (as

amended by the Amendment No. 1 and the Amendment No. 2) can be accelerated upon an Event of Default, as such terms are defined in

the Amended Credit Agreement. The description of the Amended Credit Agreement (as amended by the Amendment No. 1 and the Amendment

No. 2) is qualified in its entirety by (i) the copy thereof which is attached as Exhibit 10.1 to our Current Report on Form 8-K

dated August 7, 2017, (ii) the copy of the Amendment No. 1 which is attached as Exhibit 10.1 to our Current Report on Form 8-K dated

May 11, 2020 and (iii) the copy of the Amendment No. 2 which is attached hereto as Exhibit 10.1 to this report, copies of all of

which are incorporated herein by reference.

ITEM

2.03. CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT

The information above described under “Item 1.01. Entry into

a Material Definitive Agreement” is hereby incorporated herein by reference.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) EXHIBITS

|

|

104

|

Cover Page Interactive Data File: The cover page XBRL tags are embedded within the inline XBRL document (contained in Exhibit 101).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

TEXAS ROADHOUSE, INC.

|

|

|

|

|

|

|

|

|

|

Date: May 4, 2021

|

By:

|

/s/ Tonya Robinson

|

|

|

|

Tonya Robinson

|

|

|

|

Chief Financial Officer

|

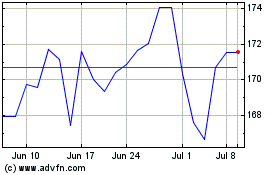

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Mar 2024 to Apr 2024

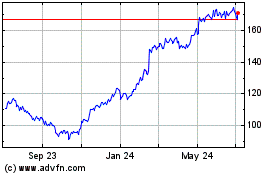

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Apr 2023 to Apr 2024