By Trefor Moss

SHANGHAI--Relations between the U.S. and China are at their

lowest point in decades, and the Covid-19 pandemic has rattled

consumers the world over. U.S. companies and brands are doubling

down on China anyway.

To understand why, look no further than the hundreds lined up

around the block in central Shanghai, many of them defying

coronavirus social-distancing advice, to get their hands on chicken

sandwiches from Popeyes Louisiana Kitchen.

Popeyes, the latest U.S. brand to plant its flag in China,

opened on Friday, the first of 1,500 planned locations in

China.

"Chinese people still like America and American brands," said

18-year-old Oliver Kong, one of those waiting in line outside the

new Popeyes. " McDonald's is my favorite, but I'm excited to try

something new."

From Popeyes to Walmart Inc., Tesla Inc. to Exxon Mobil Corp.,

companies are betting that the country's long-term growth potential

still outweighs the mounting case against further

expansion--including geopolitical tensions and slowing growth.

While the pandemic has spurred businesses to rethink supply chains

to reduce dependency on China, companies that are producing in

China for Chinese customers are bulking up their local

presence.

Concern about China's own rising domestic players is an

increasingly important factor, too. Yet China bulls argue that

committing resources to the country is still worth it.

"If you're not active in this market, then China will come to

your market. It's better to battle them here than wait until they

show up on your doorstep," said Jörg Wuttke, president of the

European Union Chamber of Commerce in China. Though some companies

would halt China investments until the long-term picture becomes

clearer, "we have to be optimistic about investing," he said.

The Chinese economy shrank 6.8% in the January-March period, its

first contraction in four decades as the country reeled from the

coronavirus. Economists warn the recovery will be shaky, marked by

surging unemployment and dwindling consumer confidence.

The political risks of operating in China--which have risen as

leader Xi Jinping reasserts the state's grip on society--have been

ratcheted up further by the two-year trade war between Washington

and Beijing, and more recently by public recriminations over the

origins and handling of the coronavirus crisis. Speaking on Fox

News last Thursday, President Trump said the U.S. "could cut off

the whole relationship" with Beijing.

On Friday, the Global Times, a state-run tabloid, said China was

ready to target U.S. companies such as Apple Inc. and Boeing Co. in

retaliation for U.S. moves to curb Huawei Technologies Co.

Business has in many ways remained largely insulated from the

political fireworks. Eager to attract foreign investors, China

continued courting U.S. companies during the pandemic. Early this

year, China introduced a foreign-investment law setting out

protections for brands and intellectual property, and promising

greater regulatory transparency.

Aside from a few flare-ups, most notably with the National

Basketball Association, there has been little lasting consumer

backlash against American products and brands.

"China's government welcomes companies that align with their

strategy and support the industries of the future," said Ker Gibbs,

president of the American Chamber of Commerce in Shanghai. Some

foreign business executives in China privately admit they fear that

could change if the U.S.-China relationship continues to unravel.

But in most cases, U.S. companies remain committed to China, Mr.

Gibbs said.

On Monday, Zhong Shan, China's commerce minister, told reporters

he wasn't worried about foreign companies leaving. "Smart companies

won't give up the huge China market," he said.

U.S. foreign direct investment in China has been stable for the

past decade, averaging $14 billion a year, equivalent to between

10% and 12% of China's total inward FDI, according to official

data.

Some slowdown in investments is likely as companies grow more

bearish on China, according to Rhodium Group. In an April survey of

U.S. companies by the American Chamber of Commerce in China, 40%

said the uncertainty resulting from the Covid-19 pandemic would

decrease their planned investments here, while 36% said they would

stick to investment plans.

Yet the lure of China and its unrivaled pool of 1.4 billion

consumers is undimmed for some.

Tim Hortons, a coffee chain that, like Popeyes, is owned by

Canada's Restaurant Brands International Inc., said last Tuesday it

would open 1,500 coffee shops in China, up from just a few dozen

today. "China is our fastest-growing market," said Sami Siddiqui,

president of RBI Asia-Pacific, and "will become even more relevant"

in the future.

Retailers see similar opportunities to tap into the Chinese

middle class's appetite for new experiences and affordable quality.

Walmart said last month that its plans to more than double its

footprint in China, by opening around 500 new stores over the next

five to seven years, remain unchanged since their announcement in

2019. Costco Wholesale Corp. is preparing to open at least two new

China stores, having opened its first in Shanghai last year to a

warm welcome.

Meanwhile, Tesla is rapidly expanding its Shanghai

factory--which started building the Model 3 sedan in December--as

it prepares for local production of the Model Y compact crossover

vehicle. A May 7 drone video of the factory site posted on YouTube

showed several new structures under way at the site of the $2

billion plant. The company didn't respond to questions.

In a sign of continuing Chinese government support for Tesla,

the auto maker recently secured a $563 million loan from the

state-run Industrial and Commercial Bank of China, according to a

May 7 regulatory filing, to fund the expansion. The company had

borrowed $492 million from Chinese banks last year.

Chemical producers have been moving to take advantage of a

recent rule change allowing foreigners to wholly own chemical

plants in China for the first time. Exxon held a ceremony with

government officials in the southern city of Huizhou last month to

mark progress in talks to build a chemical plant there that the

Chinese have said is valued at $10 billion--though a company

spokesman said details had yet to be completed and that the timing

of some expansion plans are being adjusted due to market

volatility.

Though the pandemic has severely hit demand for leisure and

travel in China, a spokesperson for Universal Parks & Resorts

said the company is sticking with plans to open a $6.5 billion

theme park in Beijing next year.

Write to Trefor Moss at Trefor.Moss@wsj.com

(END) Dow Jones Newswires

May 19, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

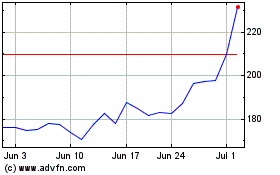

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024