Current Report Filing (8-k)

December 11 2018 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of

1934

Date of Report (Date of earliest event reported): December 7,

2018

Tenax

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-34600

|

|

26-2593535

|

|

(State

or other jurisdiction of incorporation)

|

|

(CommissionFile

Number)

|

|

(IRS

EmployerIdentification No.)

|

ONE Copley Parkway, Suite 490

Morrisville, NC 27560

(Address

of principal executive offices) (Zip Code)

919-855-2100

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (17 CFR

230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17

CFR 240.12b-2).

Emerging

growth company

☐

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01

Entry

Into a Material Definitive Agreement.

On December 7, 2018, Tenax Therapeutics, Inc. (the

“Company”) entered into an underwriting agreement (the

“Underwriting Agreement”) with Ladenburg

Thalmann & Co. Inc. (the “Underwriter”),

pursuant to which the Company agreed to issue and sell, in an

underwritten offering by the Company (the “Offering”),

5,181,346 units (the “Units”), with each Unit

consisting of (a) one share of Series A convertible preferred

stock, par value $0.0001 per share (the “Series A Preferred

Stock”), (b)

a two-year warrant to

purchase one share of common stock, exercisable at a price of $1.93

(the “Series 1 Warrants”), and (c) a five-year warrant

to purchase one share of common stock, exercisable at a price of

$1.93 (the “Series 2 Warrants” and collectively with

the Series 1 Warrants, the

“Warrants”)

, with

each Unit to be offered at an offering price of $1.93 per Unit. The

initial conversion price of the Series A Preferred Stock is $1.93

per share. The Company agreed to pay the Underwriter an aggregate

fee equal to 8.0% of the gross proceeds received in the Offering

and to reimburse the Underwriter for up to $95,000 of expenses

incurred by the Underwriter in connection with the Offering. The

Offering closed on December 11, 2018.

The Units were offered by the Company pursuant to a registration

statement

on Form S-1 (File No. 333-228212), as

amended, as initially filed with the Securities and Exchange

Commission (the “Commission”) on November 6, 2018 and

declared effective by the Commission on December 7, 2018 (the

“Registration Statement”).

The Series A Preferred Stock has full ratchet price-based

anti-dilution protection as described further below. The exercise

price of the warrants is fixed and the warrants do not contain any

variable pricing features or any price-based anti-dilutive

features. The securities comprising the Units are immediately

separable and have been issued separately. The conversion price of

the Series A Preferred Stock and exercise price of the warrants is

subject to appropriate adjustment in the event of recapitalization

events, stock dividends, stock splits, stock combinations,

reclassifications, reorganizations or similar events affecting the

Company’s common stock.

The net proceeds to the Company from the Offering, after deducting

Underwriter fees and expenses and the Company’s estimated

Offering expenses, and excluding the proceeds, if any, from the

exercise of the Warrants issued in the Offering, are expected to be

approximately $9 million. The Company currently intends

to use the net proceeds of the Offering to further its clinical

trials and efforts to obtain regulatory approval of levosimendan,

for research and development and for general corporate purposes,

including working capital and potential acquisitions.

The Underwriting Agreement contains representations and warranties

that the parties made to, and solely for the benefit of, the other

in the context of all of the terms and conditions of that agreement

and in the context of the specific relationship between the

parties. The provisions of the Underwriting Agreement,

including the representations and warranties contained therein, are

not for the benefit of any party other than the parties to such

agreements and are not intended as documents for investors and the

public to obtain factual information about the current state of

affairs of the parties to those documents and agreements. Rather,

investors and the public should look to other disclosures contained

in the Company’s filings with the Commission.

The Company also entered into a warrant agency agreement with

Direct Transfer LLC, who will act as warrant agent for the Company,

setting forth the terms and conditions of the Warrants sold in the

Offering (the “Warrant Agency Agreement”).

The foregoing summaries of the terms of the Underwriting Agreement,

the form of Warrants, and the Warrant Agency Agreement are subject

to, and qualified in their entirety by reference to, the

Underwriting Agreement, the form of Warrants and the Warrant Agency

Agreement which are filed as Exhibits 1.1, 4.3 and 4.4,

respectively, to this Current Report on Form 8-K (this

“Report”) and are incorporated herein by

reference.

Item 3.02 Unregistered Sales of Equity Securities.

Under

the terms of the Underwriting Agreement, upon closing of the

Offering on December 11, 2018, the Company issued to the

Underwriter a five-year warrant (the “Representative

Warrant”) to purchase 207,253 shares of the Company’s

common stock, which is equal to 4% of the aggregate number of

shares of common stock issuable upon conversion of the Series A

Preferred Stock, as partial compensation for the

Underwriter’s services in connection with the Offering. The

Representative Warrant has an exercise price of $2.4125 per share,

which is equal to 125% of the offering price for the Units sold in

the Offering. Pursuant to FINRA Rule 5110(g), the Representative

Warrants and any shares issued upon exercise of the Representative

Warrant shall not be sold, transferred, assigned, pledged, or

hypothecated, or be the subject of any hedging, short sale,

derivative, put or call transaction that would result in the

effective economic disposition of the securities by any person for

a period of 180 days immediately following the date of

effectiveness or commencement of sales of the Offering, except for

transfers in certain limited circumstances.

The

Representative Warrant was issued in a private placement

transaction exempt from registration in reliance on Section 4(a)(2)

of the Securities Act of 1933, as amended (the “Securities

Act”), as a transaction by an issuer not involving any public

offering.

The

foregoing summary of the terms of the Representative Warrant is

subject to, and qualified in its entirety by reference to the

Representative Warrant which is filed as Exhibit 4.2 to this Report

and incorporated herein by reference.

Item 3.03 Material Modification to Rights of Security

Holders.

To the

extent required by Item 3.03 of Form 8-K, the information

contained in Item 5.03 of this Report is incorporated herein by

reference.

Item 5.03 Amendments to Articles of Incorporation or

Bylaws; Change in Fiscal Year.

In connection with the Offering, the Company filed a Certificate of

Designation of Preferences, Rights and Limitations of the Series A

Preferred Stock (the “Certificate of Designation”) on

December 10, 2018, with the Secretary of State of the State of

Delaware which became effective upon filing.

The Series A

Preferred Stock issued under the Certificate of Designation has no

dividend rights (except to the extent that dividends are also paid

on the common stock), liquidation preference or other preferences

over common stock, and has no voting rights, except in certain

limited situations.

Each share of Series A Preferred Stock is convertible, subject to

the beneficial ownership limitation, at any time at the

holder’s option into one share of common stock (based on a

stated value of $1.93 per share of Series A Preferred Stock and a

conversion price of $1.93) which conversion ratio will be subject

to adjustment in the event of recapitalization events, stock

dividends, stock splits, stock combinations, reclassifications,

reorganizations or similar events affecting the Company’s

common stock as specified in the Certificate of Designation.

Notwithstanding the foregoing, the Certificate of Designation

further provides that the Company shall not effect any conversion

of Series A Preferred Stock, with certain exceptions, to the extent

that, after giving effect to an attempted conversion, the holder of

Series A Preferred Stock (together with such holder’s

affiliates, and any persons acting as a group together with such

holder or any of such holder’s affiliates) would beneficially

own a number of shares of common stock in excess of 4.99% (or, at

the election of the holder prior to the issuance date, 9.99%) of

the shares of common stock then outstanding after giving effect to

such exercise. At the holder’s option, upon notice to the

Company, the holder may increase or decrease this beneficial

ownership limitation not to exceed 9.99% of the shares of common

stock then outstanding, with any such increase becoming effective

upon 61 days’ prior notice to the Company.

Until such time as 85% of the aggregate shares of Series A

Preferred Stock issued to all holders on the original issue date

have been converted to common stock, the Series A Preferred Stock

has full ratchet price-based anti-dilution protection, subject to

customary carve outs, in the event of a down-round financing at a

price per share below the conversion price of the Series A

Preferred Stock. If during any 30 consecutive trading days the

volume weighted average price of the Company’s common stock

exceeds 300% of the then-effective conversion price of the Series A

Preferred Stock and the daily dollar trading volume for each

trading day during such period exceeds $175,000, the anti-dilution

protection in the Series A Preferred Stock will expire and cease to

apply.

Additionally,

subject to certain exceptions, at any time after the issuance of

the Series A Preferred Stock, and subject to the beneficial

ownership limitation, the Company will have the right to cause each

holder of the Series A Preferred Stock to convert all or part of

such holder

’

s Series A

Preferred Stock in the event that (i) the volume weighted average

price of our common stock for any 30 consecutive trading days (the

“Measurement Period”)

,

exceeds 300% of the initial conversion

price of the Series A Preferred Stock (subject to adjustment for

forward and reverse stock splits, recapitalizations, stock

dividends and similar transactions), (ii) the average daily trading

volume for such Measurement Period exceeds $175,000 per trading day

and (iii) the holder is not in possession of any information that

constitutes or might constitute, material non-public information

which was provided by the Company. The Company’s right to

cause each holder of the Series A Preferred Stock to convert all or

part of such holder

’

s

Series A Preferred Stock shall be exercised ratably among the

holders of the then outstanding preferred

stock.

The terms of the Series A Preferred Stock are set forth in the

Certificate of Designation, and the foregoing summary of the terms

of the Certificate of Designation is subject to, and qualified in

its entirety by reference to, the Certificate of Designation which

is filed as Exhibit 4.1 to this Report and is incorporated herein

by reference.

Item 8.01 Other Events.

On December 11, 2018, the Company announced the closing of the

Offering. A copy of the press release announcing these events is

attached as Exhibit 99.1 to this Report and is hereby incorporated

herein by reference.

Following the completion of the Offering, as of 4:00 p.m. New York

City time on December 11, 2018, the Company had outstanding

3,017,249 shares of common stock (which includes 1,551,753 shares

of common stock issued upon conversion of shares of the Series A

Preferred Stock) and 3,629,593 shares of Series A Preferred

Stock.

Item

9.01

Financial

Statements and Exhibits.

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

Underwriting

Agreement dated as of December 7, 2018 by and between Tenax

Therapeutics, Inc. and Ladenburg Thalmann & Co.

Inc.

|

|

|

|

|

|

|

|

Certificate

of Designation of Series A Convertible Preferred Stock

|

|

|

|

|

|

|

|

Representative’s

Warrant to Purchase Shares of Common Stock

|

|

|

|

|

|

|

|

Form of

Warrant to Purchase Shares of Common Stock

|

|

|

|

|

|

|

|

Warrant

Agency Agreement

|

|

|

|

|

|

|

|

Press

Release dated December 11, 2018

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date: December 11, 2018

|

Tenax Therapeutics, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

By:

/

s

/

Michael B. Jebsen

|

|

|

|

Michael

B. Jebsen

|

|

|

|

President

and Chief Financial Officer

|

|

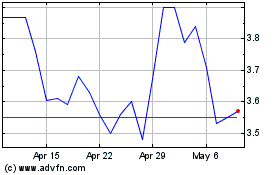

Tenax Therapeutics (NASDAQ:TENX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tenax Therapeutics (NASDAQ:TENX)

Historical Stock Chart

From Apr 2023 to Apr 2024