Flat World Knowledge, the largest publisher of free and open

college textbooks for students worldwide, today announced it has

secured $15 million in Series B funding led by Bertelsmann Digital

Media Investments (BDMI), a wholly owned subsidiary of Bertelsmann

AG, a leading international media company, and Bessemer Venture

Partners, a top global investment firm. Also joining the round are

returning investors Valhalla Partners, GSA Venture Partners

(formerly Greenhill SAVP), High Peaks Venture Partners, and several

angel investors.

"Flat World Knowledge has the potential to significantly

transform the $8 billion college textbook publishing industry,"

said Keith Titan, a principal at BDMI, who will be joining the

company's board. "Among the players in this space, Flat World is

uniquely positioned to fully capitalize on the Internet with an

open textbook model that dramatically lowers costs for students and

provides professors with greater control over the content, which is

written by top academic authors. Flat World represents a compelling

and innovative model for the future of publishing in higher

education."

Flat World is a commercial pioneer within the growing open

content movement to make educational materials freely available

online and accessible to everyone. Under its open textbook model,

students can read peer-reviewed textbooks in their entirety online

for free or purchase print and digital versions. The company

generates revenue through the sale of print books, e-books for

devices like the iPad and Kindle, audio books, PDF downloads and

interactive study aids.

"This company is laser-focused on the fastest-growing sector of

the higher education market -- community and state colleges --

where the financial pain of overpriced textbooks is greatest," said

Christopher Gabrieli, a partner at Bessemer Venture Partners, who

will also join the company's board. "Expanding economic and

educational opportunities for students has never been more

important. Flat World has stepped up to the challenge with

expertise, creativity, and a bold approach that removes a major

barrier to student success."

With students spending an average of $1,137 in 2010-11 for

textbooks and supplies, according to The College Board, professors,

administrators and policy-makers are looking to educational

entrepreneurs like Flat World Knowledge for innovative ways to

solve the textbook affordability crisis.

"We're bringing textbook publishing into the 21st century," said

Jeff Shelstad, Flat World Knowledge CEO and co-founder. "With our

new partners, we are accelerating our growth to meet the tremendous

demand for world-class educational content that's free of the

constraints of conventional textbooks."

To date, more than 1,600 professors at over 900 colleges have

adopted Flat World texts, ranging from Cornell University to

Columbus State Community College to California State University.

Demand is also growing internationally. Students in 44 countries,

including India, the United Kingdom, Australia and China are among

the 100,000 who will use Flat World Knowledge books this 2010-11

academic year.

The new funding will help the rapid expansion of Flat World's

catalog beyond business and economics to include books for the 125

highest-enrolled courses on college campuses. The company recently

published titles for three of the largest general education

courses: introductory sociology, introductory psychology and

college success, which have a combined enrollment of more than four

million students annually. Over the next few months, the company

will also publish new textbooks for English composition, algebra,

chemistry and American government, among others.

Open Model Redefines the Textbook In

contrast to traditional publishing's "all rights reserved"

copyright license, Flat World publishes under a Creative Commons

open license, which eliminates many of the restrictions for how a

textbook can be used and distributed. Students can read open

textbooks online for free for as long as they like. Professors can

reorder and edit content, and add new material and interactive

media. Armed with an open license and Flat World's sophisticated

online editing platform, faculty are free to create the "perfect

book" for their course.

For authors, the open publishing model represents greater income

potential in the long-term, since new unit sales aren't

cannibalized by used books, textbook rentals, gray market editions

and online piracy sites. More than 100 top academic authors have

signed with Flat World, such as Steve Barkan, professor and chair

of the department of sociology at the University of Maine, and

author of five market-leading textbooks.

"A major reason I decided to write an open textbook is that

increasingly my students couldn't afford to buy their books," said

Barkan, who recently published Sociology: Understanding and

Changing the Social World with Flat World. "From an author's

perspective, there's an incredibly high-quality review and

development process that's been a real plus. And I stand to be

well-compensated. It's win-win for everybody."

Textbook Licensing Addresses Cost at the

Institutional Level As enrollments continue to soar and

education budgets shrink, colleges are seeking new and more

aggressive ways to lower student costs and improve completion

rates. Flat World recently launched an institutional textbook

licensing model to help colleges achieve these goals. The company

has several agreements in place, including one with Virginia State

University, which embraced this licensing model as a way to reverse

its high drop-out rate among business school students, most of whom

are on financial aid and can't afford to buy expensive textbooks

that can cost as much as $200 each.

Akin to the way colleges purchase software licenses,

institutions buy per-student, per-course seat licenses for digital

access to textbooks, and charge students a small fee as part of

tuition. Unlike other licensing models, Flat World gives students

unlimited access to the digital files, along with print options,

and the ability to transfer the content from device to device.

"Our students have always had the ability and intellect," said

Dr. Mirta Martin, dean of VSU's Reginald F. Lewis School of

Business. "Now with open textbooks, they finally have the

resources."

About Flat World Knowledge Flat World

Knowledge is the largest publisher of free and open college

textbooks for students worldwide. Committed to making higher

education more affordable and accessible, the company provides

students with free online access to complete, peer-reviewed

textbooks, with options to purchase affordable print and digital

formats, including e-books, audio books, PDF downloads and

interactive study aids. Flat World's open license and online

editing platform enable professors to modify the content and create

the "perfect book" for their course. To date, more than 1600

professors at over 900 colleges in 44 countries have used Flat

World open textbooks. Backed by top venture capital firms, Flat

World Knowledge was named one of the information industry's "30 to

Watch" in 2011 by Outsell, Inc. To learn more, visit

www.flatworldknowledge.com; follow us on Facebook at

http://www.facebook.com/flatworldknowledge and on Twitter at

http://twitter.com/flat_world.

About Bertelsmann Digital Media Investments

(BDMI) Bertelsmann Digital Media Investments (BDMI) is a

strategic venture investor focused on innovative digital media

technologies, products and distribution channels across the globe.

BDMI is a wholly owned subsidiary of Bertelsmann AG, a leading

international media company with over $22 billion in revenues and

over 100,000 employees across more than 50 countries. For more

information, visit: www.bdmifund.com.

Bertelsmann AG is an international media company encompassing

television (RTL Group), book publishing (Random House), magazine

publishing (Gruner + Jahr), media services (Arvato), and media

clubs (Direct Group) in more than 50 countries. Bertelsmann's claim

is to inspire people around the world with first-class media and

communications offerings -- entertainment, information and services

-- and occupy leading positions in its respective markets. The

foundation of Bertelsmann's success is a corporate culture based on

partnership, entrepreneurial spirit, creativity, and corporate

responsibility. The company strives to bring creative new ideas to

market and create value. For more information, visit:

www.bertelsmann.com.

About Bessemer Venture Partners Bessemer

Venture Partners is a global investment group with offices in

Silicon Valley, Cambridge, Mass., New York, Mumbai and Herzliya,

Israel. One of the oldest venture-capital practices in the United

States, Bessemer has partnered as an active, hands-on investor in

Ciena, LinkedIn, Postini, Shriram EPC, Skype, Staples, VeriSign and

Yelp. More than 100 Bessemer-funded companies have gone public on

exchanges in the U.S., the U.K., India and Canada. To learn more,

visit www.bvp.com; follow the firm on Facebook at

www.facebook.com/bessemervp and on Twitter at

http://twitter.com/bessemervp.

About Valhalla Partners Valhalla Partners

is a trusted partner and advisor to technology entrepreneurs in

their quest to build world-class companies. Based in Vienna,

Virginia, the firm's management team has made more than 120

investments over the past twenty years and produced almost $1

billion of investment proceeds. Valhalla prefers investments where

the mission of the company is to innovate, challenge and

fundamentally change the dynamics of new and existing markets.

Investments by Valhalla's team include Advertising.com,

CareerBuilder.com, JumpTap, LeftHand Networks, Progress Software,

RealOps, Register.com, Riverbed Technologies, SafeNet, SEPATON,

ServiceBench, Trilogy, and webMethods. Valhalla Partners brings the

full power and network of its experienced team to every investment

it makes, helping companies grow faster and smarter regardless of

size or maturity. For more information, go to

http://www.valhallapartners.com.

About GSA Venture Partners With over $100

million under management, GSA Venture Partners makes early stage

venture investments in technology-enabled services and business

information services companies. Prior fund manager investments

include Medidata Solutions (NASDAQ: MDSO), LivePerson (NASDAQ:

LPSN), OpenWave (NASDAQ: OPWV), YellowJacket (acquired by the

Intercontinental Exchange) (NYSE: ICE), UGO Networks (acquired by

Hearst Corporation), and KnowledgeStorm (acquired by TechTarget)

(NASDAQ: TTGT). For more information about GSA Venture Partners,

please visit www.gsavp.com.

About High Peaks Venture Partners High

Peaks Venture Partners is a venture capital firm focused on

investments in market leading, seed and early stage technology

companies. Founded in 2004, High Peaks began investing its second

fund in 2010. With offices in New York City and Upstate New York,

the firm focuses on investments in the web services, digital media,

software, and medical technology markets. High Peaks is one of 18

affiliates of Village Ventures, a collaborative, nationwide network

of seed and early-stage venture capital funds. For more

information, please visit http://www.hpvp.com.

Add to Digg Bookmark with del.icio.us Add to Newsvine

Media Contact: Carole Walters Flat World Knowledge

973-413-0625 Email Contact

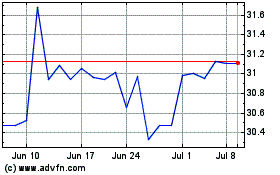

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Aug 2024 to Sep 2024

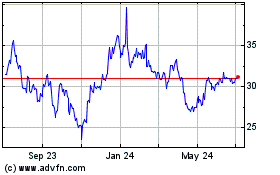

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Sep 2023 to Sep 2024