Current Report Filing (8-k)

March 27 2020 - 4:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

March 27, 2020

TD Holdings, Inc.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

|

001-36055

|

|

45-4077653

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

Room 104, No. 33 Section D,

No. 6 Middle Xierqi Road,

Haidian District, Beijing, China

(Address of Principal Executive Offices)

+86 (010) 59441080

(Issuer’s telephone number)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001

|

|

GLG

|

|

Nasdaq Capital Market

|

|

Item 7.01

|

Regulation FD Disclosure.

|

TD Holdings, Inc. (formerly known as Bat Group,

Inc., the “Company”) is providing the following update on the filing of its Form 10-K for the fiscal year ended

December 31, 2019. As a result of the global outbreak of the COVID-19 virus, the Company’s luxury car rental business (the

“Luxury Car Business”) and commodities trading business (the “Commodities Trading Business”)

offices located in Beijing and Shenzhen, respectively, were ordered by their respective local governments to stay closed until

February 10, 2020. In addition, out of an abundance of caution, all of the Company’s employees were recommended to work from

home until at least February 20, 2020. On February 22, 2020, our Commodities Trading Business resumed its on-site operations. However,

as of the date of this Current Report on Form 8-K, our Luxury Car Business employees are still working from home due to stricter

governmental regulations in Beijing.

Friedman LLP (“Friedman”),

the Company’s independent registered public accounting firm was scheduled to perform an on-site audit in February 2020, which

was supposed to be approximately three weeks. However, during most of February 2020, Friedman was unable to conduct the on-site

audit due to the travel restriction and quarantine requirement. Although the Company has been cooperating with Friedman in an attempt

to conduct the audit remotely, this has resulted in significant delays to the audit process.

The Company had initially planned to avail

itself of the fifteen day filing extension provided by Rule 12b-25 under the Securities Exchange Act of 1934, as amended (“Exchange

Act”) to file its Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the “Annual Report”).

In light of the impact of the additional factors described above, Friedman and the Company now believe that the Company will not

be able to complete the audit in order to permit the Company to file the Annual Report by the prescribed date, taking into account

the extension normally available under Rule 12b-25 under the Exchange Act, without unreasonable effort or expense.

On March 4, 2020 the

Securities and Exchange Commission (the “Commission”) issued an Order (Release No. 34-88318) under Section 36

of the Exchange Act granting exemptions from specified provisions of the Exchange Act and certain rules thereunder (the “Order”).

The Order provides that a registrant subject to the reporting requirements of Exchange Act Section 13(a) or 15(d), and any person

required to make any filings with respect to such a registrant, is exempt from any requirement to file or furnish materials with

the Commission under Exchange Act Sections 13(a), 13(f), 13(g), 14(a), 14(c), 14(f), 15(d) and Regulations 13A, Regulation 13D-G

(except for those provisions mandating the filing of Schedule 13D or amendments to Schedule 13D), 14A, 14C and 15D, and Exchange

Act Rules 13f-1, and 14f-1, as applicable, where certain conditions are satisfied.

Based on the foregoing, the Company is hereby

relying on the Order and expects to file the Annual Report on or around May 1, 2020 but no later than May 14, 2020.

The Company is supplementing the risk factors

previously disclosed in its most recent periodic reports filed under the Exchange Act with the following risk factor:

Our business, results of operations and

financial condition may be adversely affected by global public health epidemics, including the strain of coronavirus known as COVID-19.

In light of the uncertain and rapidly evolving

situation relating to the spread of the coronavirus (COVID-19), we have taken temporary precautionary measures intended to help

minimize the risk of the virus to our employees, our customers, and the communities in which we participate, which could negatively

impact our business. To this end, we are evaluating alternative working arrangements, including requiring all employees to work

remotely, and we have suspended all non-essential travel for our employees and limiting in-person work-related meetings.

In addition, with the extended Chinese business

shutdowns that resulted from the outbreak of COVID-19, we may experience delays or the inability to service our customers on a

timely basis in both our Luxury Car Business and our Commodities Trading Business. The disruptions to our supply chain and business

operations, or to our suppliers’ or customers’ supply chains and business operations, could include disruptions from

the closure of our luxury car rental facilities, interruptions in the supply of commodities, personnel absences, and restrictions

on the luxury car rental services or delivery and storage of commodities, any of which could have adverse ripple effects on our

Luxury Car Business and our Commodities Trading Business. If we need to close any of our facilities or a critical number of our

employees become too ill to work, our ability to provide our products and services to our customers could be materially adversely

affected in a rapid manner. Similarly, if our customers experience adverse business consequences due to COVID-19, or any other

pandemic, demand for our products and services could also be materially adversely affected in a rapid manner. Global health concerns,

such as COVID-19, could also result in social, economic, and labor instability in the localities in which we or our suppliers and

customers operate within China.

While the potential economic impact brought

by and the duration of COVID-19 may be difficult to assess or predict, a widespread pandemic could result in significant disruption

of global financial markets, reducing our ability to access capital, which could in the future negatively affect our liquidity.

In addition, a recession or market correction resulting from the spread of COVID-19 could materially affect our business and the

value of our common stock. While it is too early to tell whether COVID-19 will have a material effect on our business over time,

we continue to monitor the situation as it unfolds. The extent to which COVID-19 affects our results will depend on many factors

and future developments, including new information about COVID-19 and any new government regulations which may emerge to contain

the virus, among others.

Forward-Looking

Statements

Statements in

this Current Report on Form 8-K are “forward-looking statements” as the term is defined under applicable

securities laws. These statements include the anticipated timing of the filing of Company’s quarterly and annual statements

under the Exchange Act; the expected impact of the COVID-19 virus outbreak on the Company’s financial reporting

capabilities and its operations generally and the potential impact of such virus on the Company’s customers, distribution

partners, advertisers and production facilities and other third parties. These and other forward-looking statements are subject

to risks, uncertainties and other factors that could cause actual results to differ materially from those statements. Such risks

and uncertainties are, in many instances, beyond the Company’s control. Forward-looking statements, which are presented as

of the date of this filing, will not be updated to reflect events or circumstances after the date of this statement except as required

by law.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

TD HOLDINGS, INC.

|

|

|

|

|

|

Date: March 27, 2020

|

By:

|

/s/ Renmei Ouyang

|

|

|

Name:

|

Renmei Ouyang

|

|

|

Title:

|

Chief Executive Officer

|

TD (NASDAQ:GLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

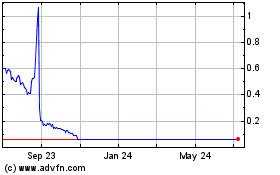

TD (NASDAQ:GLG)

Historical Stock Chart

From Apr 2023 to Apr 2024