Bat Group, Inc. (Nasdaq: GLG) (the "Company"), an emerging used

luxurious car rental service provider headquartered in Beijing,

China, today announced its financial results for the second fiscal

quarter ended June 30, 2019.

Mr. Jiaxi Gao, CEO and President of Bat Group,

Inc., comments, “We are pleased to report our financial results for

the second quarter of 2019. For the six months ended June 30, 2019

we increased our income from operating lease from $96,721 to

$940,894 as we grew our luxurious car rental business. We will

continue to allocate our resources into growth as we plan to

increase our inventory of high-end cars and expand our operations

into other cities in China for the remaining two quarters of 2019.

We are optimistic that customers will respond positively to our

brand and high-quality services as we continue our expansion.”

Second Quarter of 2019 Financial Highlights

- Income from operating lease increased by 456%

to $0.54 million, from $0.10 million for the second quarter of

2018.

- Net income from discontinued operations was

nil, compared with $9.90 million for the second quarter of

2018.

- Net loss was $1.04 million, compared with net

income of $9.50 million for the second quarter of 2018.

- Basic and diluted loss per share was $0.14,

compared with basic and diluted earnings per share of $2.14 for the

second quarter of 2018.

Six Months Ended June 30, 2019 Financial

Highlights

- Income from operating lease increased by 873%

to $0.94 million, from $0.10 million for the six months ended June

30, 2018.

- Net income from discontinued operations was

nil, compared with $10.07 million for the six months ended June 30,

2018.

- Net loss was $2.87 million, compared with net

income of $9.12 million for the six months ended June 30,

2018.

- Basic and diluted loss per share was $0.45,

compared with basic and diluted earnings per share of $2.16 for the

six months ended June 30, 2018.

Second Quarter of 2019 Financial Results

Income from operating lease

Income from operating lease increased by $0.44

million, or 456% to $0.54 for the three months ended June 30, 2019

from $0.10 million for the same period of last year. The increase

was mainly attributable to increased number of owned used luxurious

cars, and diversified lease income generated from both owned cars

and leased cars.

Operating lease expenses

The cost of operating lease was comprised of car

related expenses arising from lease of cars. With diversified lease

income generated from leased cars which was launched in January

2019, the Company recorded car related expenses of $0.32

million.

Depreciation expenses on operating lease assets

The depreciation expenses on operating lease

assets increased by $42,863, or 344% to $55,321 for the three

months ended June 30, 2019, from $12,458 for the same period of

last year. The increase was mainly caused by the Company’s

continuous investments in used luxurious cars. As of June 30, 2019,

the Company had thirteen used luxurious cars, as compared with six

cars as of June 30, 2018.

Selling, general, and administrative expenses

Selling, general, and administrative expenses

increased by $0.70 million, or 152% to $1.16 million for the three

months ended June 30, 2019, from $0.46 million for the same period

of last year. Operating expenses primarily consisted of salary and

employee surcharge, office rental expense, business tax and

surcharge, changes in fair value of other noncurrent liabilities,

professional service fees, and other office supplies. The increase

was mainly attributable to combined effects of an increase in

promotion expenses of $53,129, an increase in car-related expenses

of $97,091 and expenses incurred for direct offering in April and

May 2019, consisting of an increase of audit related fees of

$161,815, an increase of commission of $100,000 to a third party

vendor for referral of underwriters, and other expenses of

$132,575.

Net income from discontinued operations

During the three months ended June 30, 2018, the

net income was comprised of a net income of $0.10 million from

discontinued operations of microcredit service and a gain of $9.79

million from disposal of the discontinued operations of microcredit

service.

Net (loss)income

Net loss was $1.04 million for the three months

ended June 30, 3019, compared with net income of $9.50 million for

the same period of last year. Basic and diluted loss per share was

$0.14 for the three months ended June 30, 2019, compared with basic

and diluted earnings per share of $2.14 for the same period of last

year.

Six Months Ended June 30, 2019 Financial

Results

Income from operating lease

Income from operating lease increased by $0.84

million, or 873% to $0.94 for the six months ended June 30, 2019

from $0.10 million for the same period of last year. The increase

was mainly attributable to increased number of owned used luxurious

cars, and diversified lease income generated from both owned cars

and leased cars.

Operating lease expenses

The cost of operating lease was comprised of car

related expenses arising from lease of cars. With diversified lease

income generated from leased cars which was launched in January

2019, the Company recorded car related expenses of $0.53 million

for the six months ended June 30, 2019.

Depreciation expenses on operating lease assets

The depreciation expenses on operating lease

assets increased by $89,721, or 720% to $102,179 for the three

months ended June 30, 2019, from $12,458 for the same period of

last year. The increase was mainly caused by the Company’s

continuous investments in used luxurious cars. As of June 30, 2019,

the Company had thirteen used luxurious cars, as compared with six

cars as of June 30, 2018.

Selling, general, and administrative expenses

Selling, general, and administrative expenses

increased by $2.17 million, or 248% to $3.04 million for the six

months ended June 30, 2019, from $0.87 million for the same period

of last year. Operating expenses primarily consisted of salary and

employee surcharge, office rental expense, business tax and

surcharge, changes in fair value of other noncurrent liabilities,

professional service fees, and other office supplies. The increase

was mainly attributable to combined effects The increase was mainly

attributable to combined effects of an increase of promotion

expenses of $96,250, an increase of car-related expenses of

$143,485, an increase of legal and consulting expenses of

$1,284,101 as a result of issuance of 502,391 restricted shares as

compensations to service providers, and expenses incurred for

direct offering in April and May 2019, consisting of an increase of

audit related fees of $192,378, an increase of commission of

$100,000 to a third party vendor for referral of underwriters, and

other expenses of $194,004.

Net income from discontinued operations

During the six months ended June 30, 2018, the

net income was comprised of a net income of $0.28 million from

discontinued operations of microcredit service and a gain of $9.79

million from disposal of the discontinued operations of microcredit

service. Net (loss) income

Net loss was $2.87 million for the six months

ended June 30, 3019, compared with net income of $9.12 million for

the same period of last year. Basic and diluted loss per share was

$0.45 for the six months ended June 30, 2019, compared with basic

and diluted earnings per share of $2.16 for the same period of last

year.

Financial Conditions

As of June 30, 2019, the Company had cash and cash equivalents

of $1.31 million, compared with $1.48 million as of

December 31, 2018.

Net cash used in operating activities was $1.74 million for the

six months ended June 30, 2019, compared to $0.03 million for the

same period of last year.

Net cash used in investing activities was $5.10 million for the

six months ended June 30, 2019, compared to $3.23 million for the

same period of last year.

Net cash provided by financing activities was $6.72 million for

the six months ended June 30, 2019, compared to $3.27 million for

the same period of last year.

About Bat Group, Inc.

Bat Group, Inc. (Nasdaq: GLG) is an emerging

used luxurious car rental service provider in China. The used

luxurious car business is conducted under the brand name “BatCar”

by the Company’s VIE entity, Tianxing Kunlun Technology Co. Ltd,

from its headquarters in Beijing. Utilizing a streamlined, digital,

transaction process, the Company endeavors to provide the best

possible rental experience for its customers. For more information

please visit ir.imbatcar.com

Safe Harbor Statement

This press release may contain certain

"forward-looking statements" relating to the business of China

Commercial Credit, Inc. and its subsidiary companies. All

statements, other than statements of historical fact included

herein are "forward-looking statements." These forward-looking

statements are often identified by the use of forward-looking

terminology such as "believes," "expects" or similar expressions,

involve known and unknown risks and uncertainties. Although the

Company believes that the expectations reflected in these

forward-looking statements are reasonable, they do involve

assumptions, risks and uncertainties, and these expectations may

prove to be incorrect. Investors should not place undue reliance on

these forward-looking statements, which speak only as of the date

of this press release. The Company's actual results could differ

materially from those anticipated in these forward-looking

statements as a result of a variety of factors, including those

discussed in the Company's periodic reports that are filed with the

Securities and Exchange Commission and available on its website at

http://www.sec.gov. All forward-looking statements attributable to

the Company or persons acting on its behalf are expressly qualified

in their entirety by these factors. Other than as required under

the securities laws, the Company does not assume a duty to update

these forward-looking statements.

For more information, please

contact:

Ms. Tina XiaoAscent Investor Relations LLCEmail:

tina.xiao@ascent-ir.com

BAT GROUP, INC.UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2019 |

|

|

2018 |

|

| |

|

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| Cash |

|

$ |

1,307,186 |

|

|

$ |

1,484,116 |

|

| Loans receivable from third

parties |

|

|

1,103,769 |

|

|

|

- |

|

| Other current assets |

|

|

159,753 |

|

|

|

87,922 |

|

| Total current

assets |

|

|

2,570,708 |

|

|

|

1,572,038 |

|

| |

|

|

|

|

|

|

|

|

| Investment security |

|

|

200,000 |

|

|

|

- |

|

| Deposits for investments in

equity investees |

|

|

582,513 |

|

|

|

|

|

| Investment in an equity

investee |

|

|

291,256 |

|

|

|

- |

|

| Investments in financial

products |

|

|

1,000,000 |

|

|

|

- |

|

| Property and equipment,

net |

|

|

5,090 |

|

|

|

5,524 |

|

| Right-of-use lease assets,

net |

|

|

63,481 |

|

|

|

- |

|

| Prepayments for operating

lease assets |

|

|

235,918 |

|

|

|

- |

|

| Operating lease assets,

net |

|

|

3,085,073 |

|

|

|

1,634,018 |

|

| Total noncurrent

assets |

|

|

5,463,331 |

|

|

|

1,639,542 |

|

| |

|

|

|

|

|

|

|

|

| Total

Assets |

|

$ |

8,034,039 |

|

|

$ |

3,211,580 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

|

|

| Advances from customers |

|

$ |

39,319 |

|

|

$ |

6,208 |

|

| Third parties loans |

|

|

2,257,237 |

|

|

|

218,100 |

|

| Operating lease

liabilities |

|

|

63,481 |

|

|

|

- |

|

| Due to a related party |

|

|

8,254 |

|

|

|

- |

|

| Other current liabilities |

|

|

213,052 |

|

|

|

185,049 |

|

| Total

Liabilities |

|

|

2,581,343 |

|

|

|

409,357 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Shareholders’

Equity |

|

|

|

|

|

|

|

|

| Series A Preferred Stock (par

value $0.001 per share, 1,000,000 shares authorized at June 30,

2019 and December 31, 2018, respectively; nil shares issued and

outstanding at June 30, 2019 and December 31, 2018,

respectively) |

|

$ |

- |

|

|

$ |

- |

|

| Series B Preferred Stock (par

value $0.001 per share, 5,000,000 shares authorized at June 30,

2019 and December 31, 2018, respectively; nil shares issued and

outstanding at June 30, 2019 and December 31, 2018,

respectively) |

|

|

- |

|

|

|

- |

|

| Common stock (par value $0.001

per share, 100,000,000 shares authorized; 8,646,297 and 5,023,906

shares issued and outstanding at June 30, 2019 and December 31,

2018, respectively)* |

|

|

8,646 |

|

|

|

5,024 |

|

| Additional paid-in

capital |

|

|

34,299,372 |

|

|

|

28,765,346 |

|

| Accumulated deficit |

|

|

(28,326,750 |

) |

|

|

(25,457,090 |

) |

| Accumulated other

comprehensive loss |

|

|

(528,081 |

) |

|

|

(511,057 |

) |

| Total BAT Group,

Inc.’s Shareholders’ Equity |

|

|

5,453,187 |

|

|

|

2,802,223 |

|

| |

|

|

|

|

|

|

|

|

| Non-controlling interests |

|

|

(491 |

) |

|

|

- |

|

| Total

Equity |

|

|

5,452,696 |

|

|

|

2,802,223 |

|

| Total Liabilities and

Equity |

|

$ |

8,034,039 |

|

|

$ |

3,211,580 |

|

BAT GROUP, INC.UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

ANDCOMPREHENSIVE (LOSS) INCOME

|

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operating

lease |

|

$ |

540,895 |

|

|

$ |

96,721 |

|

|

$ |

940,894 |

|

|

$ |

96,721 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating lease expenses |

|

|

318,947 |

|

|

|

- |

|

|

|

533,010 |

|

|

|

- |

|

| Depreciation expenses on

operating lease assets |

|

|

55,321 |

|

|

|

12,458 |

|

|

|

102,179 |

|

|

|

12,458 |

|

| Selling, general, and

administrative expenses |

|

|

1,157,227 |

|

|

|

458,390 |

|

|

|

3,040,276 |

|

|

|

873,277 |

|

| Changes in fair value of

noncurrent liabilities |

|

|

- |

|

|

|

19,000 |

|

|

|

- |

|

|

|

166,540 |

|

| Impairment on operating lease

assets |

|

|

- |

|

|

|

- |

|

|

|

96,318 |

|

|

|

- |

|

| Total operating

expenses |

|

|

1,531,495 |

|

|

|

489,848 |

|

|

|

3,771,783 |

|

|

|

1,052,275 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (expenses)

income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest (expenses)

income |

|

|

(49,725 |

) |

|

|

315 |

|

|

|

(39,262 |

) |

|

|

315 |

|

| Total other (expenses)

income, net |

|

|

(49,725 |

) |

|

|

315 |

|

|

|

(39,262 |

) |

|

|

315 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss from

continuing operations before income taxes |

|

|

(1,040,325 |

) |

|

|

(392,812 |

) |

|

|

(2,870,151 |

) |

|

|

(955,239 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expenses |

|

|

- |

|

|

|

(20 |

) |

|

|

- |

|

|

|

(20 |

) |

| Net loss from

continuing operations |

|

$ |

(1,040,325 |

) |

|

$ |

(392,832 |

) |

|

$ |

(2,870,151 |

) |

|

$ |

(955,259 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income from

discontinued operations |

|

|

- |

|

|

|

9,896,100 |

|

|

|

- |

|

|

|

10,072,629 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)

income |

|

$ |

(1,040,325 |

) |

|

$ |

9,503,268 |

|

|

$ |

(2,870,151 |

) |

|

$ |

9,117,370 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Net loss

attributable to non-controlling interests |

|

|

491 |

|

|

|

- |

|

|

|

491 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income

attributable to BAT Group, Inc.’s Shareholders |

|

$ |

(1,039,834 |

) |

|

$ |

9,503,268 |

|

|

$ |

(2,869,660 |

) |

|

$ |

9,117,370 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive (loss)

income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)

income |

|

$ |

(1,040,325 |

) |

|

$ |

9,503,268 |

|

|

$ |

(2,870,151 |

) |

|

$ |

9,117,370 |

|

| Foreign currency translation

adjustment |

|

|

(74,767 |

) |

|

|

8,135 |

|

|

|

(17,024 |

) |

|

|

(117,085 |

) |

| Reclassified to net income

from discontinued operations |

|

|

- |

|

|

|

(125,220 |

) |

|

|

- |

|

|

|

(125,220 |

) |

| Total comprehensive

(loss) income |

|

|

(1,115,092 |

) |

|

|

9,386,183 |

|

|

|

(2,887,175 |

) |

|

|

8,875,065 |

|

| Less: Total comprehensive loss

attributable to non-controlling interests |

|

|

(491 |

) |

|

|

- |

|

|

|

(491 |

) |

|

|

- |

|

| Comprehensive (loss)

income attributable to BAT Group, Inc. |

|

$ |

(1,114,601 |

) |

|

$ |

9,386,183 |

|

|

$ |

(2,886,684 |

) |

|

$ |

8,875,065 |

|

| Loss (income) per

share - basic and diluted |

|

$ |

(0.14 |

) |

|

$ |

2.14 |

|

|

$ |

(0.45 |

) |

|

$ |

2.16 |

|

| Net loss per share from

continuing operations – basic and diluted |

|

$ |

(0.14 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.45 |

) |

|

$ |

(0.23 |

) |

| Net income per share from

discontinued operations – basic and diluted |

|

$ |

- |

|

|

$ |

2.23 |

|

|

$ |

- |

|

|

$ |

2.39 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average

Shares Outstanding-Basic and Diluted |

|

|

7,530,693 |

|

|

|

4,442,320 |

|

|

|

6,348,064 |

|

|

|

4,216,133 |

|

BAT GROUP,

INC.UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

| |

|

For the Six Months Ended June 30, |

|

|

|

|

2019 |

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

| Cash Flows from

Operating Activities: |

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(2,870,151 |

) |

|

$ |

9,117,370 |

|

|

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Depreciation of operating

lease assets |

|

|

102,179 |

|

|

|

12,458 |

|

|

| Depreciation of property and

equipment |

|

|

1,155 |

|

|

|

98 |

|

|

| Impairment on an operating

lease asset |

|

|

96,318 |

|

|

|

- |

|

|

| Restricted shares issued to

service providers |

|

|

884,208 |

|

|

|

- |

|

|

| Gain on disposal of

discontinued operations |

|

|

- |

|

|

|

(9,794,873 |

|

) |

| Shares issued for settlement

against legal proceedings |

|

|

- |

|

|

|

943,860 |

|

|

| Changes in fair value of

noncurrent liabilities |

|

|

- |

|

|

|

166,540 |

|

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

Other current assets |

|

|

(72,394 |

) |

|

|

(931,176 |

|

) |

|

Advances from customers |

|

|

33,497 |

|

|

|

- |

|

|

|

Due to a related party |

|

|

8,352 |

|

|

|

- |

|

|

|

Other current liabilities |

|

|

72,590 |

|

|

|

(1,460 |

|

) |

|

Other noncurrent liabilities |

|

|

- |

|

|

|

(1,311,000 |

|

) |

|

Net cash provided by operating activities from discontinued

operations |

|

|

- |

|

|

|

1,769,566 |

|

|

| Net Cash Used in

Operating Activities |

|

|

(1,744,246 |

) |

|

|

(28,617 |

|

) |

| |

|

|

|

|

|

|

|

|

| Cash Flows from

Investing Activities: |

|

|

|

|

|

|

|

|

| Purchases of property and

equipment |

|

|

(707 |

) |

|

|

(5,376 |

|

) |

| Purchases of operating lease

assets |

|

|

(1,902,529 |

) |

|

|

(1,957,391 |

|

) |

| Investment in one investment

security |

|

|

(200,000 |

) |

|

|

|

|

| Investments in equity

investees |

|

|

(884,225 |

) |

|

|

- |

|

|

| Investments in financial

products |

|

|

(1,000,000 |

) |

|

|

- |

|

|

| Loans to third parties |

|

|

(1,114,225 |

) |

|

|

- |

|

|

| Proceeds from disposal of

discontinued operations |

|

|

- |

|

|

|

500,000 |

|

|

| Cash in connection with

discontinued operations |

|

|

- |

|

|

|

(499,496 |

|

) |

| Net cash used in investing

activities from discontinued operations |

|

|

- |

|

|

|

(1,270,070 |

|

) |

| Net Cash Used in by

Investing Activities |

|

|

(5,101,686 |

) |

|

|

(3,232,333 |

|

) |

| |

|

|

|

|

|

|

|

|

| Cash Flows from

Financing Activities: |

|

|

|

|

|

|

|

|

| Borrowings from third

parties |

|

|

2,063,193 |

|

|

|

- |

|

|

| Cash raised in registered

direct offering, net of transaction costs |

|

|

4,653,440 |

|

|

|

- |

|

|

| Cash raised in private

placement of common stocks |

|

|

- |

|

|

|

3,265,370 |

|

|

| Net Cash Provided by

Financing Activities |

|

|

6,716,633 |

|

|

|

3,265,370 |

|

|

| |

|

|

|

|

|

|

|

|

| Effect of Exchange

Rate Changes on Cash |

|

|

(47,631 |

) |

|

|

(1,332 |

) |

|

| |

|

|

|

|

|

|

|

|

| Net (Decrease) Increase in

Cash |

|

|

(176,930 |

) |

|

|

3,088 |

|

|

| Cash at Beginning of

Period |

|

|

1,484,116 |

|

|

|

1,359,630 |

|

|

| Cash at End of

Period |

|

$ |

1,307,186 |

|

|

$ |

1,362,718 |

|

|

| Non-cash financing

activities |

|

|

|

|

|

|

|

|

| Right-of-use assets obtained

in exchange for operating lease obligations |

|

$ |

64,241 |

|

|

$ |

- |

|

|

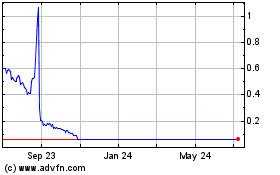

TD (NASDAQ:GLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

TD (NASDAQ:GLG)

Historical Stock Chart

From Apr 2023 to Apr 2024