T-Mobile's Top Engineer Took Risks to Develop 5G Network -- Journal Report

March 23 2021 - 4:42PM

Dow Jones News

By Drew FitzGerald

Before T-Mobile US Inc. executive Neville Ray began building 5G

networks, he first had to tackle color TV.

The British engineer earned some of his first paychecks more

than three decades ago by working on radio masts, oil rigs and

television-broadcast towers in the Middle East for a Dubai-based

contractor. Some areas in the region had only recently replaced

black-and-white TV broadcasts, while others were deploying

expensive digital mobile-phone service.

As a "young college kid looking for exciting stuff, looking for

travel, that was a great avenue for me to explore," the 58-year-old

Mr. Ray, president of technology at T-Mobile, says about his early

career. "So much was happening and was starting to happen."

The latest renovation project for Mr. Ray, who is responsible

for managing and developing T-Mobile's wireless network, is

prepping up to 85,000 cellular stations for equipment that can

carry 5G signals. It's an expensive, complex undertaking

complicated by the company's ongoing integration with former rival

Sprint.

That process demands careful planning so that existing customers

can keep using their existing phones while technicians install

equipment that supports newer 5G specifications.

T-Mobile has ambitious plans for its 5G service, including

eventually using it to serve devices such as connected cars,

factory machines and farm sensors. This month, the company launched

a new product called WFX Solutions that lets business customers

send workers a dedicated Wi-Fi hot spot backed by 4G and 5G

connections. The effort could help T-Mobile grow its relatively

small share of business customers by connecting homebound workers

over the air instead of through often-busy cable networks.

T-Mobile's 5G network benefits from a large cache of wireless

licenses spread across the radio spectrum, from low-frequency

airwaves suited for rural settings to ultrahigh-frequency

millimeter wave signals that are typically used in cities. Midrange

spectrum sandwiched in the middle gives the company a swath of

frequencies that balance high data speeds with geographic coverage.

Mr. Ray calls this stack a "layer cake" strategy.

Mr. Ray is relying on the usual suspects, as Nokia Corp. and

Ericsson AB, to supply much of the electronics for his network

upgrades. The carrier in 2018 signed two contracts totaling $7

billion to buy 5G equipment and services from the Scandinavian

suppliers, and it awarded them more business earlier this year.

T-Mobile representatives declined to share details about the annual

values of the contracts, which cover several years of upgrade

work.

"Obviously, it takes time to deploy those investments," Mr. Ray

says. Network upgrades demand constant adherence to tight

schedules, coupled with patience for the fruits of those efforts,

he adds.

Mr. Ray's work for his current employer started in 2000 at

predecessor VoiceStream Wireless, a relatively small Seattle-area

company later bought by Germany's Deutsche Telekom AG and renamed

T-Mobile. The carrier spent much of the following two decades

beefing up its infrastructure and expanding wireless coverage in

rural and suburban areas where more established rivals started with

a firstcomer's advantage.

"I'd like to think we only took smart risks, but we took risks,"

Mr. Ray says, citing decisions to invest in technology and wireless

frequencies that took years to deliver results. "In wireless, it's

fierce. You have to stay on your toes and you can never be

complacent."

Mr. FitzGerald is a reporter for The Wall Street Journal in

Washington, D.C. Email him at andrew.fitzgerald@wsj.com.

(END) Dow Jones Newswires

March 23, 2021 16:27 ET (20:27 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

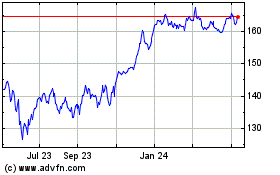

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

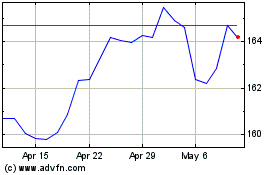

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2023 to Apr 2024