T-Mobile Plans Public Offering of Senior Notes

March 16 2021 - 8:25AM

Dow Jones News

By Michael Dabaie

T-Mobile US Inc. unveiled a proposed public offering of senior

notes.

The company said its T-Mobile USA Inc. subsidiary plans to offer

up to $3 billion aggregate principal amount of senior notes, to be

issued in three tranches with maturities in 2026, 2029 and

2031.

T-Mobile USA plans to use $2 billion of the net proceeds to

acquire spectrum licenses under the Federal Communications

Commission's Auction 107, with any remainder to be used to redeem

its 6.50% Senior Notes due 2026 and then for refinancing existing

indebtedness.

Credit Suisse Securities (USA) LLC, Citigroup Global Markets

Inc., Deutsche Bank Securities Inc., Goldman Sachs & Co. LLC,

Barclays Capital Inc., J.P. Morgan Securities LLC, Morgan Stanley

& Co. LLC and RBC Capital Markets LLC are the joint

book-running managers for the offering of the notes.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

March 16, 2021 08:10 ET (12:10 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

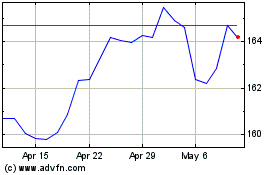

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

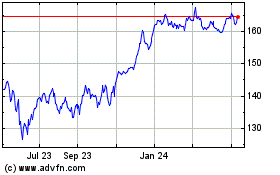

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2023 to Apr 2024