By Drew FitzGerald

Lawyers delivered their final arguments in the antitrust fight

over the merger of T-Mobile US Inc. and Sprint Corp., as Wall

Street grows more nervous about the wireless deal's fate.

U.S. District Judge Victor Marrero closed the trial by promising

to try to render a decision "as soon as possible." He didn't offer

a public timeline.

Shares of Sprint are trading at a more than 40% discount to the

value of T-Mobile's proposed all-stock deal, which is now worth

about $34 billion after steady gains in T-Mobile's market value. It

is the widest gap since the merger of the two cellular providers

was struck nearly two years ago.

The discount has doubled in recent months as the companies have

tangled in court with a group of state antitrust officials led by

California and New York, a sign of growing doubts about the

deal.

"The market's getting more pessimistic," said Ric Prentiss, an

analyst at investment bank Raymond James. He said investors are

waking up to the risk that "if this deal doesn't go through,

Sprint's going to go down pretty hard."

The states argue that combining the country's third- and

fourth-biggest cellphone carriers would hurt consumers. They have

maintained their opposition to the deal despite a series of

concessions that the Justice Department and the Federal

Communications Commission wrested from both companies last

year.

Officials from 13 states and the District of Columbia -- all

Democrats -- took the case to trial in December, forcing several

high-profile industry executives to testify about the transaction's

merits.

T-Mobile boss John Legere returned to the courtroom Wednesday to

hear the closing arguments along with Sprint Chairman Marcelo

Claure and CEO Michel Combes. New York Attorney General Letitia

James and officials from several other states also attended the

hearing, which stretched over four hours.

"I understand that the plaintiffs have brought out the big

guns," Judge Marrero quipped at the start of the hearing, referring

to Ms. James -- jokingly asking whether the defense was expecting

the U.S. Attorney General in its own corner.

The Justice Department in a court filing last month defended the

merger subject to certain conditions, but didn't join as a party in

the antitrust trial. The litigation has exposed tensions between

the Trump administration's top antitrust cops and their state-level

counterparts.

Makan Delrahim, the head of the Justice Department's antitrust

division, said he worries the merger market could suffer if the

states prevail. Expert federal agencies found problems with the

merger -- and fixed them, he said.

"I think if the states win, it creates major uncertainty in

M&A," Mr. Delrahim said in an interview with the Journal,

adding that he hopes the companies will appeal if they lose.

Speaking Wednesday outside the courthouse before closing

arguments began, New York's Ms. James said she was confident the

coalition had proven its case.

Either side could appeal Judge Marrero's decision. But the

merger agreement has lapsed, allowing either Sprint or T-Mobile to

walk away without paying a penalty. The diverging fortunes of the

two companies and current market realities could prompt the

companies to renegotiate the terms if they extend the deal.

Asked if there might be a pattern of state attorneys general

intervening in deals, Ms. James said she would work with

counterparts across the country to uphold the law.

"I don't know if it's going to be a pattern. I just know that

New York state attorney general and other attorneys general all

across this nation will continue to stand up for the law," she

said, adding that the group was operating within its sovereign

powers.

Both sides' attorneys on Wednesday offered the judge competing

arguments about the states' authority to challenge a consequential

transaction that federal officials already reviewed.

"The states stand in the shoes of a private litigant here,"

T-Mobile attorney David Gelfand said. "They're not entitled to any

special treatment."

Glenn Pomerantz, a lawyer for the states, said the states

brought the case on behalf of their residents under established

legal precedents. He said the state coalition wasn't convinced the

Justice Department's solution would do enough to protect

competition in the market for consumer cellphone plans.

"Your honor, let them compete," Mr. Pomerantz said.

Sprint shares ended Tuesday at $4.86. T-Mobile closed at $80.27.

Japan's SoftBank Group Corp. owns more than 80% of Sprint's shares

while Deutsche Telekom AG controls T-Mobile. Sprint's relatively

small number of shares floated on the open market has deepened its

latest stock swoon.

T-Mobile and Sprint have argued that joining forces would create

a stronger and more efficient competitor to market leaders Verizon

Communications Inc. and AT&T Inc. Many of the benefits stem

from their complementary spectrum-license holdings, which would

lower the combined company's costs for streaming music, videos and

other data to its customers.

Wall Street analysts say T-Mobile stands to gain billions of

dollars in market value if it clinches the merger, though it is

also considered a relatively safe bet without Sprint. The company

added more than one million cellphone subscribers in the fourth

quarter, continuing a trend of customer gains at competitors'

expense.

T-Mobile's merger partner faces a worse prognosis. Sprint hasn't

yet reported the last quarter's results, but the company has

struggled to hold on to its most lucrative customers. It has lost

money in four of the past five fiscal years.

Sprint's Mr. Combes testified in December that his company

offers "an inferior product" that puts it in a "vicious cycle" of

customer losses and dwindling resources. But he and other

executives stopped short of saying the company would disappear in

the next two years.

The states challenged the companies' direst predictions during

the trial, drawing parallels between T-Mobile's weak footing in

2011, after government opposition forced it to scuttle a planned

tie-up with AT&T, and Sprint's current predicament. A recent

court filing from the states took a glass-half-full view of its

situation.

"With the right leadership and a commitment to innovation,

Sprint can follow T-Mobile's precedent and strengthen its

competitive position," the states wrote.

--Sarah Krouse and Brent Kendall contributed to this

article.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

January 15, 2020 18:14 ET (23:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

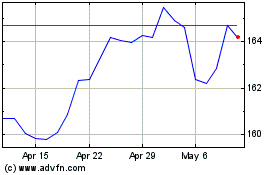

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

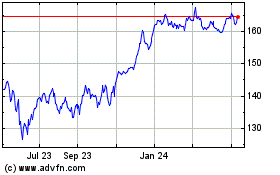

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2023 to Apr 2024