T-Mobile-Sprint Deal Concern Mounts on Wall Street

January 15 2020 - 5:59AM

Dow Jones News

By Drew FitzGerald

Wall Street is growing more nervous about the fate of the

proposed merger of T-Mobile US Inc. and Sprint Corp., as lawyers

for the companies prepare to make final arguments Wednesday in

defense of their deal.

Shares of Sprint are trading at a more than 40% discount to the

value of T-Mobile's proposed all-stock deal, which is now worth

about $34 billion after steady gains in T-Mobile's market value. It

is the widest gap since the merger of the two cellular providers

was struck nearly two years ago.

The discount has doubled in recent months as the two companies

have tangled in court with a group of state antitrust officials led

by California and New York, a sign of growing doubts about the

deal.

"The market's getting more pessimistic," said Ric Prentiss, an

analyst at investment bank Raymond James. He said investors are

waking up to the risk that "if this deal doesn't go through,

Sprint's going to go down pretty hard."

Representatives for Sprint and T-Mobile declined to comment.

The states argue that combining the country's third- and

fourth-biggest cellphone carriers would hurt consumers. They have

maintained their opposition to the deal despite a series of

concessions that the Justice Department and the Federal

Communications Commission wrested from both companies last

year.

Officials from 13 states and the District of Columbia -- all

Democrats -- took the case to trial in December, forcing several

high-profile industry executives to testify about the transaction's

merits. U.S. Judge Victor Marrero is scheduled to hear both sides'

closing statements Wednesday morning in Manhattan. He could render

an opinion within weeks.

Sprint shares ended Tuesday at $4.86, and T-Mobile closed at

$79.80. Japan's SoftBank Group Corp. owns more than 80% of Sprint's

shares while Deutsche Telekom AG controls T-Mobile. Sprint's

relatively small number of shares floated on the open market has

deepened its latest stock swoon.

T-Mobile and Sprint have argued that joining forces would create

a stronger and more efficient competitor to market leaders Verizon

Communications Inc. and AT&T Inc. Many of the benefits stem

from their complementary spectrum-license holdings, which would

lower the combined company's costs for streaming music, videos and

other data to its customers.

Wall Street analysts say T-Mobile stands to gain billions of

dollars in market value if it clinches the merger, though it is

also considered a relatively safe bet without Sprint. The company

added more than one million cellphone subscribers in the fourth

quarter, continuing a trend of customer gains at competitors'

expense.

T-Mobile's merger partner faces a worse prognosis. Sprint hasn't

yet reported the last quarter's results, but the company has

struggled to hold on to its most lucrative customers. It has lost

money in four of the past five fiscal years.

Sprint Chief Executive Michel Combes testified in December that

his company offers "an inferior product" that puts it in a "vicious

cycle" of customer losses and dwindling resources. But he and other

executives stopped short of saying the company would disappear in

the next two years.

The states challenged the companies' direst predictions during

the trial, drawing parallels between T-Mobile's weak footing in

2011, after government opposition forced it to scuttle a planned

tie-up with AT&T, and Sprint's current predicament. A recent

court filing from the states took a glass-half-full view of its

situation.

"With the right leadership and a commitment to innovation,

Sprint can follow T-Mobile's precedent and strengthen its

competitive position," the states wrote.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

January 15, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

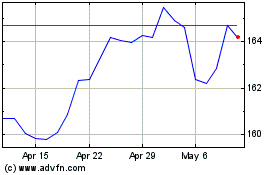

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

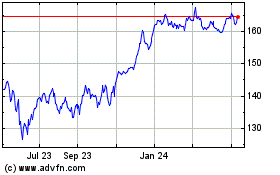

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2023 to Apr 2024