Judge Puts T-Mobile Merger Trial on Fast Track -- 4th Update

December 09 2019 - 6:42PM

Dow Jones News

By Drew FitzGerald

A federal judge told lawyers fighting over T-Mobile US Inc.'s

more than $26 billion bid for Sprint Corp. to skip their customary

opening arguments so they could start questioning witnesses, a sign

he is seeking a speedy trial.

As the case began Monday, U.S. District Judge Victor Marrero

asked both sides to trim their lists of witnesses to avoid beating

him "over the head" with testimony. The bench trial is scheduled to

carry into Christmas week but could last longer.

"What value do you see in opening statements in these

circumstances?" Judge Marrero asked one of the attorneys

representing T-Mobile.

Judge Marrero has heard high-profile cases dealing with

President Trump's tax returns, the USA Patriot Act and hedge-fund

manager Steven A. Cohen. His latest case will affect the structure

of a wireless market that serves hundreds of millions of cellphone

users.

A group of 14 attorneys general, led by New York and California,

sued in June to stop the wireless deal, which would combine the

country's third- and fourth-largest carriers by subscribers.

Federal antitrust and telecommunications officials approved the

deal in July, saying the merger's shortcomings were addressed

through concessions the officials required from T-Mobile and

Sprint. Legal experts say it is unprecedented for the states to

reject such a settlement and sue to block a merger of this size and

national scope without the support or involvement of federal

authorities.

Thirteen states and the District of Columbia decided to continue

their litigation despite the Justice Department settlement, which

required that Sprint divest itself of some assets to Dish Network

Corp. to help build its fledgling wireless unit.

Some states later dropped out of the lawsuit and joined the

Justice Department, though the core group of officials leading the

lawsuit remained unmoved. They also recruited a few more states

that hadn't initially joined the litigation.

California Deputy Attorney General Paula Blizzard said the

solution the federal government devised didn't fix the problem and

called Dish a struggling satellite-television company that lacks

the wireless-industry experience to replace Sprint's position as a

competitive force. "We have yet to be shown how going from four

competitors to three competitors would be good for consumers,"

California Attorney General Xavier Becerra said during a call with

reporters before the trial.

T-Mobile and Sprint announced their merger proposal in April

2018 after several months of stop-and-start talks. T-Mobile is

controlled by Deutsche Telekom AG, while Sprint is mostly owned by

SoftBank Group Corp. of Japan.

The companies scrapped an earlier effort to join forces in 2014

after Obama administration officials signaled opposition to the

deal.

The states' first witness, Sprint marketing chief Roger Solé,

testified to the company's efforts to lure subscribers away from

rivals, including T-Mobile. He was followed by Boost Mobile

executive Angela Rittgers, who explained how the prepaid service

pursues price-conscious customers.

The states also called Deutsche Telekom CEO Timotheus Höttges,

who answered questions about how the German telecom giant turned a

struggling U.S. subsidiary into the country's fastest growing

competitor.

Glenn Pomerantz, a lawyer for the states, said T-Mobile's parent

"dug into its pockets," plowed billions of dollars into the

company's network, and turned around its performance -- a point the

plaintiffs have highlighted to argue that Sprint and SoftBank could

do the same if left to keep fending for themselves.

Mr. Höttges acknowledged his company's help, though he also said

T-Mobile benefited from another key turn when AT&T Inc.'s

planned takeover of the carrier collapsed in 2011. That setback

armed T-Mobile with a $3 billion breakup fee, he said, the "real

ignition" for its eight-year success story.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

December 09, 2019 18:27 ET (23:27 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

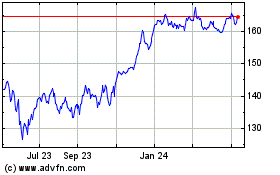

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

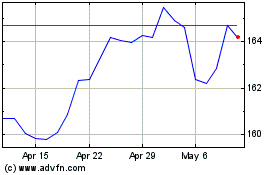

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2023 to Apr 2024