Amended Current Report Filing (8-k/a)

October 09 2020 - 4:24PM

Edgar (US Regulatory)

SYNAPTICS Inc DE true 0000817720 0000817720 2020-07-31 2020-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

July 31, 2020

Date of Report (Date of earliest event reported)

SYNAPTICS INCORPORATED

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

DELAWARE

|

|

000-49602

|

|

77-0118518

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

1251 McKay Drive

San Jose, California 95131

(Address of Principal Executive Offices) (Zip Code)

(408) 904-1100

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $.001 per share

|

|

SYNA

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

As previously disclosed by Synaptics Incorporated (the “Company” or “Synaptics”) under Item 2.01 of its Current Report on Form 8-K filed on July 31, 2020 (the “Original 8-K”), the Company completed the previously announced merger of Falcon Merger Sub, Inc., a Washington corporation and a wholly owned subsidiary of the Company (“Merger Sub”) with and into DisplayLink Corp., a Washington corporation (“DisplayLink”), with DisplayLink continuing as the surviving corporation and a wholly owned subsidiary of the Company (the “Merger”). The Company completed the Merger pursuant to the terms of the Agreement and Plan of Merger (the “Merger Agreement”) by and among the Company, Merger Sub, DisplayLink, certain holders of equity securities of DisplayLink that became parties to the Merger Agreement by execution of a Joinder Agreement (the “Sellers”) and Shareholder Representative Services LLC, a Colorado limited liability company, solely in its capacity as the representative, agent and attorney-in-fact of the Sellers.

This Current Report on Form 8-K/A amends the Original 8-K to file the financial information required by Items 9.01(a) and 9.01(b) of Form 8-K.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(a) Financial Statements of Business Acquired.

The audited consolidated financial statements of DisplayLink and subsidiaries as of and for the year ended December 31, 2019, and the notes related thereto are attached hereto as Exhibit 99.1 and are incorporated herein by reference.

The unaudited condensed consolidated balance sheet of DisplayLink and subsidiaries, as of June 30, 2020, and December 31, 2019, the unaudited condensed consolidated statements of operations, statement of stockholders’ equity and cash flows for the six-month periods ended June 30, 2020 and 2019, and the notes related thereto, are attached hereto as Exhibit 99.2 and are incorporated herein by reference.

(b) Pro Forma Financial Information.

The required unaudited pro forma financial information for Synaptics, after giving effect to the acquisition of DisplayLink and adjustments described in such pro forma financial information, as of and for the fiscal year ended June 27, 2020 is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

(d) Exhibits.

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

23.1

|

|

Consent of PricewaterhouseCoopers LLP

|

|

|

|

|

99.1

|

|

Audited consolidated financial statements of DisplayLink and subsidiaries, as of and for the year ended December 31, 2019, and the notes related thereto

|

|

|

|

|

99.2

|

|

Unaudited condensed consolidated balance sheet of DisplayLink and subsidiaries, as of June 30, 2020, and December 31, 2019, the unaudited condensed consolidated statements of operations, statement of stockholders’ equity and cash flows for the six-month periods ended June 30, 2020 and 2019, and the notes related thereto

|

|

|

|

|

99.3

|

|

Unaudited pro forma financial information for Synaptics, after giving effect to the acquisition of DisplayLink, as of and for the fiscal year ended June 27, 2020

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SYNAPTICS INCORPORATED

|

|

|

|

|

|

|

Date: October 9, 2020

|

|

|

|

By:

|

|

/s/ Dean Butler

|

|

|

|

|

|

|

|

Dean Butler

|

|

|

|

|

|

|

|

Senior Vice President and Chief Financial Officer

|

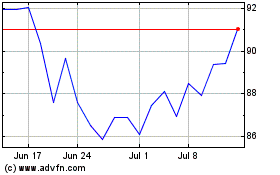

Synaptics (NASDAQ:SYNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

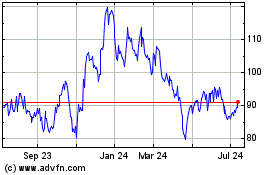

Synaptics (NASDAQ:SYNA)

Historical Stock Chart

From Apr 2023 to Apr 2024