Superior Group of Companies, Inc. Reports Operating Results for the Third Quarter Ended September 30, 2019

October 23 2019 - 7:00AM

Superior Group of Companies, Inc. (NASDAQ: SGC), today announced

its third quarter operating results for 2019.

The Company announced that for the third quarter

ended September 30, 2019, net sales decreased 7.0 percent to $89.5

million, compared to third quarter 2018 net sales of $95.9 million.

Pretax Income was $4.6 million compared to $7.3 million in 2018.

Net income was $3.9 million or $0.26 per diluted share, compared to

$0.39 per diluted share in 2018.

Michael Benstock, Chief Executive Officer

commented “We are very pleased with the performance at BAMKO and

The Office Gurus whose businesses continued to grow significantly

in very competitive environments. Uniform segment sales were down

between comparable periods, largely the result of initiatives taken

by the company to reduce merchandise levels, resulting in fewer

receipts, and lower revenues based upon current revenue recognition

standards. Also during the quarter we experienced sales

disruption at CID caused by a warehouse system implementation. On

an overall basis, we made good progress and remain on schedule on

our ERP integration initiatives intended to align infrastructure,

support enterprise growth and value creation for all stakeholders”

concluded Mr. Benstock.

CONFERENCE CALL

Superior Group of Companies will hold a

conference call on Wednesday, October 23, 2019 at 2:00 p.m. Eastern

Time to discuss the Company’s results. Interested individuals may

join the teleconference by dialing (844) 861-5505 for U.S. dialers

and (412) 317-6586 for International dialers. The Canadian Toll

Free number is (866) 605-3852. Please ask to be joined into the

Superior Group of Companies call. The live webcast and archived

replay can also be accessed in the investor information section of

the Company’s website at www.superiorgroupofcompanies.com.

A telephone replay of the teleconference will be available one

hour after the end of the call through 2:00 p.m. Eastern Time on

November 6, 2019. To access the replay, dial (877) 344-7529 in the

United States or (412) 317-0088 from international locations.

Canadian dialers can access the replay at (855) 669-9658.

Please reference conference number 10135411 for

all replay access.

About Superior Group of Companies, Inc.

(SGC):

Superior Group of Companies™, formerly Superior

Uniform Group, established in 1920, is a combination of companies

that help customers unlock the power of their brands by creating

extraordinary brand experiences for employees and customers. It

provides customized support for each of its divisions through its

shared services model.

Fashion Seal Healthcare®, HPI™ and CID Resources

are signature uniform brands of Superior Group of Companies. Each

is one of America’s leading providers of uniforms and image apparel

in the markets it serves. They specialize in innovative uniform

program design, global manufacturing, and state-of-the-art

distribution. Every day, more than 6 million Americans go to work

wearing a uniform from Superior Group of Companies.

BAMKO®, Tangerine Promotions® and Public

Identity® are signature promotional products and branded

merchandise brands of Superior Group of Companies. They provide

unique custom branding, design, sourcing, and marketing solutions

to some of the world’s most successful brands.

The Office Gurus® is a global provider of custom

call and contact center support. As a true strategic partner, The

Office Gurus implements customized solutions for its customers in

order to accelerate their growth and improve their customers’

service experiences.

SGC’s commitment to service, technology, quality

and value-added benefits, as well as its financial strength and

resources, provides unparalleled support for its customers’ diverse

needs while embracing a “Customer 1st, Every Time!” philosophy and

culture in all of its business segments.

Visit www.superiorgroupofcompanies.com for more information.

Contact:Michael Attinella Chief Financial Officer &

Treasurer(727) 803-7170

OR

Hala ElsherbiniHalliburton Investor Relations(972) 458-8000

Comparative figures are as follows:

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| |

|

|

|

|

Three Months Ended September 30, |

|

(Unaudited) |

|

(In thousands, except shares and per share data) |

| |

|

|

|

|

|

|

2019 |

|

|

2018 |

| |

|

|

|

| Net sales |

$ |

89,466 |

|

$ |

95,870 |

| |

|

|

|

| Costs and expenses: |

|

|

|

|

Cost of goods sold |

|

58,015 |

|

|

62,070 |

|

Selling and administrative expenses |

|

25,260 |

|

|

25,482 |

|

Other periodic pension costs |

|

476 |

|

|

96 |

|

Interest expense |

|

1,085 |

|

|

940 |

| |

|

84,836 |

|

|

88,588 |

| Income before taxes on

income |

|

4,630 |

|

|

7,282 |

| Income tax expense |

|

709 |

|

|

1,160 |

| Net income |

$ |

3,921 |

|

$ |

6,122 |

| |

|

|

|

| Net income per share: |

|

|

|

|

Basic |

$ |

0.26 |

|

$ |

0.41 |

|

Diluted |

$ |

0.26 |

|

$ |

0.39 |

| |

|

|

|

| Weighted average number of

shares outstanding during the period |

|

|

|

|

Basic |

|

14,947,552 |

|

|

15,010,660 |

|

Diluted |

|

15,266,850 |

|

|

15,499,894 |

| |

|

|

|

| Cash dividends per common

share |

$ |

0.10 |

|

$ |

0.10 |

| |

|

|

|

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| |

|

|

|

|

Nine Months Ended September 30, |

|

(Unaudited) |

|

(In thousands, except shares and per share data) |

| |

|

|

|

|

|

|

2019 |

|

|

2018 |

| |

|

|

|

| Net sales |

$ |

268,288 |

|

$ |

251,349 |

| |

|

|

|

| Costs and expenses: |

|

|

|

|

Cost of goods sold |

|

174,226 |

|

|

163,396 |

|

Selling and administrative expenses |

|

78,008 |

|

|

69,991 |

|

Other periodic pension costs |

|

1,282 |

|

|

289 |

|

Interest expense |

|

3,514 |

|

|

1,974 |

| |

|

257,030 |

|

|

235,650 |

| Income before taxes on

income |

|

11,258 |

|

|

15,699 |

| Income tax expense |

|

2,180 |

|

|

3,310 |

| Net income |

$ |

9,078 |

|

$ |

12,389 |

| |

|

|

|

| Net income per share: |

|

|

|

|

Basic |

$ |

0.61 |

|

$ |

0.83 |

|

Diluted |

$ |

0.59 |

|

$ |

0.80 |

| |

|

|

|

| Weighted average number of

shares outstanding during the period |

|

|

|

|

Basic |

|

14,942,565 |

|

|

14,929,513 |

|

Diluted |

|

15,272,287 |

|

|

15,505,642 |

| |

|

|

|

| Cash dividends per common

share |

$ |

0.30 |

|

$ |

0.29 |

| |

|

|

|

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(Unaudited) |

|

(In thousands, except share and par value data) |

| |

|

|

|

| |

|

|

|

| |

September 30, |

|

December 31, |

|

|

|

2019 |

|

|

|

2018 |

|

| |

|

|

|

|

ASSETS |

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

5,452 |

|

|

$ |

5,362 |

|

|

Accounts receivable, less allowance for doubtful accounts of $2,259

and $2,042, respectively |

|

75,597 |

|

|

|

64,017 |

|

|

Accounts receivable - other |

|

1,262 |

|

|

|

1,744 |

|

|

Inventories |

|

66,076 |

|

|

|

67,301 |

|

|

Contract assets |

|

38,030 |

|

|

|

49,236 |

|

|

Prepaid expenses and other current assets |

|

16,481 |

|

|

|

9,552 |

|

|

Total current assets |

|

202,898 |

|

|

|

197,212 |

|

| |

|

|

|

| Property, plant and equipment,

net |

|

31,725 |

|

|

|

28,769 |

|

| Operating lease right-of-use

assets |

|

4,576 |

|

|

|

- |

|

| Intangible assets, net |

|

63,491 |

|

|

|

66,312 |

|

| Goodwill |

|

36,252 |

|

|

|

33,961 |

|

| Other assets |

|

10,443 |

|

|

|

8,832 |

|

|

Total assets |

$ |

349,385 |

|

|

$ |

335,086 |

|

| |

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

| |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

30,768 |

|

|

$ |

24,685 |

|

|

Other current liabilities |

|

16,110 |

|

|

|

14,767 |

|

|

Current portion of long-term debt |

|

15,286 |

|

|

|

6,000 |

|

|

Current portion of acquisition-related contingent liabilities |

|

1,374 |

|

|

|

941 |

|

|

Total current liabilities |

|

63,538 |

|

|

|

46,393 |

|

| |

|

|

|

| Long-term debt |

|

103,812 |

|

|

|

111,522 |

|

| Long-term pension

liability |

|

8,422 |

|

|

|

8,705 |

|

| Long-term acquisition-related

contingent liabilities |

|

3,753 |

|

|

|

5,422 |

|

| Long-term operating lease

liabilities |

|

2,590 |

|

|

|

- |

|

| Deferred tax liability |

|

6,620 |

|

|

|

8,475 |

|

| Other long-term

liabilities |

|

4,230 |

|

|

|

3,648 |

|

| Commitments and contingencies

(Note 5) |

|

|

|

| Shareholders' equity: |

|

|

|

|

Preferred stock, $.001 par value - authorized 300,000 shares (none

issued) |

|

- |

|

|

|

- |

|

|

Common stock, $.001 par value - authorized 50,000,000 shares,

issued and outstanding 15,240,317 and 15,202,387 shares,

respectively. |

|

15 |

|

|

|

15 |

|

|

Additional paid-in capital |

|

57,077 |

|

|

|

55,859 |

|

|

Retained earnings |

|

106,426 |

|

|

|

103,032 |

|

|

Accumulated other comprehensive income (loss), net of tax: |

|

|

|

|

Pensions |

|

(6,475 |

) |

|

|

(7,673 |

) |

|

Cash flow hedges |

|

97 |

|

|

|

113 |

|

|

Foreign currency translation adjustment |

|

(720 |

) |

|

|

(425 |

) |

|

Total shareholders’ equity |

|

156,420 |

|

|

|

150,921 |

|

|

Total liabilities and shareholders’ equity |

$ |

349,385 |

|

|

$ |

335,086 |

|

| |

|

|

|

|

SUPERIOR GROUP OF COMPANIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

Nine Months Ended September 30, |

|

(Unaudited) |

|

(In thousands) |

| |

|

|

|

| |

|

|

|

|

|

|

2019 |

|

|

|

2018 |

|

| |

|

|

|

| CASH FLOWS FROM OPERATING

ACTIVITIES |

|

|

|

|

Net income |

$ |

9,078 |

|

|

$ |

12,389 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

|

6,339 |

|

|

|

5,745 |

|

|

Provision for bad debts - accounts receivable |

|

719 |

|

|

|

409 |

|

|

Share-based compensation expense |

|

997 |

|

|

|

1,867 |

|

|

Deferred income tax benefit |

|

(2,136 |

) |

|

|

(278 |

) |

|

Gain on sale of property, plant and equipment |

|

(5 |

) |

|

|

- |

|

|

Change in fair value of acquisition-related contingent

liabilities |

|

(272 |

) |

|

|

(1,212 |

) |

|

Changes in assets and liabilities, net of acquisition of

business: |

|

|

|

|

Accounts receivable - trade |

|

(12,251 |

) |

|

|

(5,542 |

) |

|

Accounts receivable - other |

|

481 |

|

|

|

(401 |

) |

|

Contract assets |

|

11,206 |

|

|

|

(3,779 |

) |

|

Inventories |

|

(595 |

) |

|

|

5,742 |

|

|

Prepaid expenses and other current assets |

|

(7,051 |

) |

|

|

(226 |

) |

|

Other assets |

|

(2,233 |

) |

|

|

(2,343 |

) |

|

Accounts payable and other current liabilities |

|

5,523 |

|

|

|

(1,077 |

) |

|

Long-term pension liability |

|

1,292 |

|

|

|

292 |

|

|

Other long-term liabilities |

|

750 |

|

|

|

(283 |

) |

|

Net cash provided by operating activities |

|

11,842 |

|

|

|

11,303 |

|

| |

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES |

|

|

|

|

Additions to property, plant and equipment |

|

(6,424 |

) |

|

|

(3,881 |

) |

|

Proceeds from disposals of property, plant and equipment |

|

5 |

|

|

|

- |

|

|

Acquisition of businesses, net of acquired cash |

|

- |

|

|

|

(85,597 |

) |

|

Net cash used in investing activities |

|

(6,419 |

) |

|

|

(89,478 |

) |

| |

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES |

|

|

|

|

Proceeds from borrowings of debt |

|

125,121 |

|

|

|

170,713 |

|

|

Repayment of debt |

|

(123,600 |

) |

|

|

(91,423 |

) |

|

Payment of cash dividends |

|

(4,533 |

) |

|

|

(4,335 |

) |

|

Payment of acquisition-related contingent liability |

|

(961 |

) |

|

|

(3,032 |

) |

|

Proceeds received on exercise of stock options |

|

283 |

|

|

|

432 |

|

|

Tax benefit from vesting of acquisition-related restricted

stock |

|

30 |

|

|

|

445 |

|

|

Tax withholding on exercise of stock rights |

|

- |

|

|

|

(17 |

) |

|

Common stock reacquired and retired |

|

(1,243 |

) |

|

|

(268 |

) |

|

Net cash provided by (used in) financing activities |

|

(4,903 |

) |

|

|

72,515 |

|

| |

|

|

|

|

Effect of currency exchange rates on cash |

|

(430 |

) |

|

|

(174 |

) |

|

Net increase (decrease) in cash and cash equivalents |

|

90 |

|

|

|

(5,834 |

) |

| Cash and cash equivalents

balance, beginning of year |

|

5,362 |

|

|

|

8,130 |

|

| Cash and cash equivalents

balance, end of period |

$ |

5,452 |

|

|

$ |

2,296 |

|

| |

|

|

|

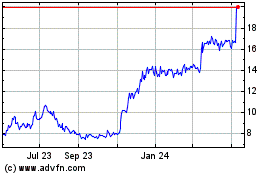

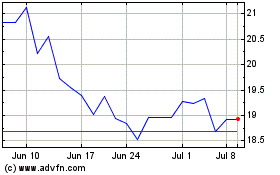

Superior Group of Compan... (NASDAQ:SGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Superior Group of Compan... (NASDAQ:SGC)

Historical Stock Chart

From Apr 2023 to Apr 2024