SunOpta Enters Into an Extension of Its $360 Million Revolving Asset-Based Credit Facility

January 30 2020 - 7:30AM

Business Wire

SunOpta Inc. ("SunOpta" or the “Company”) (Nasdaq:STKL)

(TSX:SOY), a leading global company focused on plant-based foods

and beverages, fruit-based foods and beverages, and organic

ingredient sourcing announced today that it has entered into an

extension of its senior secured asset-based revolving credit

facility in the maximum aggregate principal amount of $360 million,

subject to the borrowing base. The extension moves the maturity

date for the revolving tranches to March 31, 2022, while the

maturity date for the FILO tranche will be set at June 30, 2020 to

coincide with the date of the final amortization payment thereof.

The credit facility continues to be used to support the working

capital and general corporate needs of SunOpta’s global operations,

in addition to funding strategic initiatives.

“We are pleased with the extension of the credit facility and

appreciate the support of our banking partners as we continue to

execute our strategic plans to deliver improved profit

performance,” said Scott Huckins, Chief Financial Officer of

SunOpta. “The extended credit facility provides enhanced

flexibility and increased liquidity to support our operational

initiatives. We have many high return projects, especially in our

plant-based beverage platform, and this new credit facility will

allow us to continue to drive double-digit growth in beverages as

we seek to double this business over the coming years.”

Borrowings under the credit facility bear interest based on

various reference rates including LIBOR plus an applicable margin.

The applicable margin in the new facility ranges from 1.25% to

1.75% for loans bearing interest based on LIBOR, plus, if

applicable, an additional 0.50% when the Company’s total leverage

ratio exceeds an agreed threshold. The applicable margin is set

quarterly based on average borrowing availability. The obligations

of the borrowers under the facility are guaranteed by substantially

all of SunOpta’s subsidiaries and, subject to certain exceptions,

such obligations are secured by first priority liens on

substantially all assets of SunOpta and the other borrowers and

guarantors. The credit facility contains customary covenants and

borrowing availability requirements. The facility is provided by a

syndicate of banks, including Bank of America, N.A., Rabobank

Nederland, Canadian Branch, Bank of Montreal, JP Morgan Chase Bank,

N.A., and Wells Fargo Bank, National Association.

About SunOpta Inc.

SunOpta Inc. is a leading global company focused on plant-based

foods and beverages, fruit-based foods and beverages, and organic

ingredient sourcing. SunOpta specializes in the sourcing,

processing and packaging of organic, natural and non-GMO food

products, integrated from seed through packaged products; with a

focus on strategic vertically integrated business models.

Forward-Looking Statements

Certain statements included in this press release may be

considered "forward-looking statements" within the meaning of the

United States Private Securities Litigation Reform Act of 1995 and

applicable Canadian securities legislation. These forward-looking

statements include, but are not limited to, the Company’s ability

to consummate the extension of the senior secured asset-based

revolving credit facility, and the definitive documentation

thereof, as planned and described herein. Terms and phrases such as

“will”, “may”, "expects", “intends”, "continue" and other similar

terms and phrases are intended to identify these forward-looking

statements. Forward-looking statements are based on information

available to us on the date of this release and are based on

estimates and assumptions made by the Company in light of our

experience and perception of historical trends, current conditions

and expected future developments as well as other factors we

believe are appropriate in the circumstances. The Company makes no

representation that reasonable business people in possession of the

same information would reach the same conclusions. Whether actual

timing and results will agree with expectations and predications of

the Company is subject to many risks and uncertainties including

adverse fluctuations in applicable interest rates, the risk of

potential covenant breaches under the credit facility and other

factors that might limit or affect the expected benefits of

improved borrowing rates and increased availability of funds, as

well as other risks described from time to time under "Risk

Factors" in our Annual Report on Form 10-K and its Quarterly

Reports on Form 10-Q (available at www.sec.gov). Consequently, all

forward-looking statements made herein are qualified by these

cautionary statements and there can be no assurance that the actual

results or developments that we anticipate will be realized.

Source: SunOpta Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200130005075/en/

Scott Van Winkle ICR 617-956-6736 scott.vanwinkle@icrinc.com

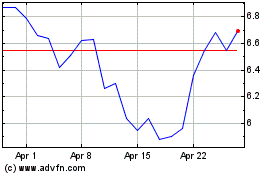

SunOpta (NASDAQ:STKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

SunOpta (NASDAQ:STKL)

Historical Stock Chart

From Apr 2023 to Apr 2024