Current Report Filing (8-k)

March 11 2019 - 4:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K

CURRENT REPORT

PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 5,

2019

SUNOPTA INC.

(Exact name of

registrant as specified in its charter)

|

Canada

|

001-34198

|

Not Applicable

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

2233 Argentia Road, Suite 401

Mississauga, Ontario, L5N 2X7, Canada

(Address of Principal

Executive Offices)

(905) 821-9669

(Registrant's telephone number,

including area code)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

[ ] Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2

of this chapter).

Emerging growth

company [ ]

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to

Section 13(a) of the Exchange Act. [ ]

|

ITEM 5.02

|

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS;

ELECTION OF

DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS;

COMPENSATORY

ARRANGEMENTS OF CERTAIN OFFICERS.

|

As previously reported, SunOpta Inc. (the “Company”) terminated the employment of Mr. David Colo as

President and Chief Executive Officer of the Company on February 21, 2019. In

connection with his termination, the Company entered into a Letter Agreement and

Final Release (the “Separation Agreement”) with Mr. Colo on March 5, 2019.

Pursuant to the Separation Agreement, Mr. Colo will be entitled to receive the

following:

-

A pro-rated portion of base salary of $17,500, representing unpaid

salary through the final effective date of the termination of Mr.

Colo’s employment, which was deemed to be February 26, 2019 (the “Termination Date”) for purposes of the Separation Agreement;

-

Severance pay in the total gross amount of $1,050,000 to be paid within

60 days from the Termination Date;

-

All unvested Special RSUs previously granted to Mr. Colo will vest as

of the Termination Date and be settled in accordance with the terms of

the applicable award agreement;

-

Reimbursement for any properly incurred but unreimbursed business

expenses through the Termination Date.

All unvested Special Options

and Special PSUs previously granted to Mr. Colo were immediately forfeited and

cancelled effective as of the Termination Date in accordance with the Employment

Agreement, dated February 2, 2017, between Mr. Colo and the Company (the

“Employment Agreement”), and Mr. Colo will not be entitled to any payment in

lieu of the forfeited and cancelled Special Options or Special PSUs.

The Company will apply

standard tax and other applicable withholdings to payments made to Mr. Colo. The

Company also will pay Mr. Colo accrued but unused vacation.

Mr. Colo’s right to receive

the consideration and benefits is contingent upon Mr. Colo agreeing to (and not

revoking) a release of claims against the Company, and to that end the

Separation Agreement contains a release and waiver of claims for the benefit of

the Company, pursuant to which Mr. Colo agrees to release the Company and

certain other parties from any and all claims, charges, causes of action and

damages arising on or prior to his execution of the Separation Agreement.

In consideration for the

payment and benefits provided under the Separation Agreement, Mr. Colo agrees to

continue to be bound by certain non-competition, non-solicitation and

confidentiality provisions set forth in the Employment Agreement.

Mr. Colo shall have the right

to revoke the Separation Agreement by giving written notice to the Company

within fifteen (15) days after signing the Separation Agreement. In the event of

any such revocation, the Separation Agreement will no longer be effective and

Mr. Colo will not receive the payment and benefits listed above.

The foregoing summary of the Separation

Agreement is qualified in its entirety by the full text of the Separation

Agreement, a copy of which is filed as Exhibit 10.1 hereto.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

SUNOPTA INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jill Barnett

|

|

|

|

Jill Barnett

|

|

|

|

General Counsel and Corporate Secretary

|

|

|

|

|

|

|

Date:

|

March 11, 2019

|

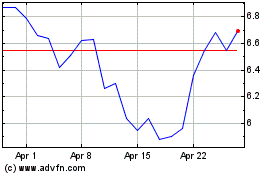

SunOpta (NASDAQ:STKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

SunOpta (NASDAQ:STKL)

Historical Stock Chart

From Apr 2023 to Apr 2024