Current Report Filing (8-k)

February 27 2020 - 4:42PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 21, 2020

Streamline Health Solutions, Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

0-28132

|

31-1455414

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

1175 Peachtree Street NE, 10th

Floor

Atlanta, GA 30361

(Address of principal executive offices)

(Zip Code)

|

Registrant’s telephone number, including area code:

|

(888) 997-8732

|

Securities registered or to be registered pursuant to Section

12(b) of the Act.

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

STRM

|

The NASDAQ Capital Market

|

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

Emerging growth company

|

¨

|

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 2.01.

|

Completion of Acquisition or Disposition of Assets.

|

On February 24, 2020,

Streamline Health Solutions, Inc. (the “Company”) consummated the previously-announced sale of the Company’s

legacy Enterprise Content Management business (the “ECM Business”) pursuant to that certain Asset Purchase Agreement,

dated December 17, 2019, as amended (the “Asset Purchase Agreement”), by and between Hyland Software, Inc. (the

“Purchaser”), the Company, and Streamline Health, Inc., a wholly-owned subsidiary of the Company (and together

with the Company, the “Seller”). The Asset Purchase Agreement was previously filed as an exhibit to the Company’s

Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “Commission”) on December

18, 2019, and was described in the Company’s definitive proxy statement filed with the Commission on January 21, 2020 (the

“Proxy Statement”).

Pursuant to the Asset

Purchase Agreement, the Purchaser has acquired the ECM Business and assumed certain liabilities of the Seller for a purchase price

of $16.0 million, subject to certain adjustments for customer prepayments as set forth in the Asset Purchase Agreement.

In addition, $800,000

of the purchase price will be held in a third party escrow account, with a scheduled release date on the 15-month anniversary of

the closing date to satisfy potential indemnification liabilities of the Seller.

In connection with

the consummation of the sale of the ECM Business, the Company is required to prepay the Term Advance of approximately $4.0 million

in full under the Loan and Security Agreement, dated as of December 11, 2019, between the Seller and Western Alliance Bank (the

“Loan and Security Agreement”). The Loan and Security Agreement was previously filed as an exhibit to the Company’s

Quarterly Report on Form 10-Q filed with the Commission on January 7, 2020.

Attached hereto as

Exhibit 99.1 and Exhibit 99.2, and incorporated by reference herein, are certain unaudited pro forma financial statements of the

Company in connection with the sale of the ECM Business and certain financial statements of the ECM Business, respectively.

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

|

Replacement of Principal Accounting

Officer

On February 21, 2020,

the Company and Luciana Mullen, the Company’s Controller & Principal Accounting Officer, entered into a separation and

release agreement under which Ms. Mullen will cease to serve as the Company’s Controller & Principal Accounting Officer,

effective March 31, 2020, but continue to provide services to the Company through her separation date to facilitate an orderly transition

of her duties and job responsibilities.

In

connection with the separation of Ms. Mullen, the Company’s Board of Directors (the “Board”) approved

the appointment of Thomas J. Gibson, the Company’s Chief Financial Officer as the Company’s Principal Accounting Officer,

effective March 31, 2020. In this modified role, Mr. Gibson will serve as the Company’s Principal Financial and Accounting

Officer until the earlier of his cessation of employment or the Board’s appointment of his successor.

Mr.

Gibson, age 56, joined the Company as Senior Vice President and Chief Financial Officer in September 2018 and has strongly contributed

to the Company’s activities during his tenure, including the Company’s previously-announced (i) private placement used

for the full redemption of the Company’s convertible preferred stock in October 2019, (ii) transition to a new credit provider

in December 2019, and (iii) sale of the ECM Business. From April 2013 to December 2013, Mr. Gibson served as Principal Accounting

Officer, Senior Vice President of Finance and Corporate Controller at R1 RCM (previously Accretive Health, Inc.), a healthcare

revenue cycle management company. In his role at R1 RCM, Mr. Gibson oversaw the company’s accounting operations and financial

reporting functions. Prior to his service with R1 RCM, Mr. Gibson served as Chief Financial Officer of Vivex Biomedical, Inc.,

a regenerative biologics company from December 2013 to December 2015 and of Citra Health Solutions, a leading healthcare services

and technology firm, from December 2015 to September 2018, where he was primarily responsible for the respective company’s

financial reporting, treasury and financial business operations. Mr. Gibson received his bachelor’s degree from the University

of South Alabama.

There

are no family relationships between Mr. Gibson and any Company director or executive officer, and no arrangements or understandings

between Mr. Gibson and any other person pursuant to which he was selected as an officer.

|

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

On

February 21, 2020, the Company held a special meeting (the “Special Meeting”) of its stockholders at which the

following proposals were submitted: (1) the approval of the sale of the ECM Business pursuant to the Asset Purchase Agreement,

and (2) the approval of the adjournment or postponement of the Special Meeting to a later date, if necessary or appropriate, to

allow for the solicitation of additional proxies in favor of the sale of the ECM Business if there are insufficient votes to approve

the sale of the ECM Business. Each of the foregoing proposals is described in the Company’s Proxy Statement.

At

the Special Meeting, of the 30,744,847 shares of common stock outstanding and entitled to vote, 20,145,491 shares were represented,

constituting a quorum. The final results for each of the matters submitted to a vote of stockholders at the Special Meeting, as

certified by the Inspector of Elections for the Special Meeting, are as follows:

|

|

For

|

Against

|

Abstain

|

|

Proposal 1

|

20,093,650

|

34,191

|

17,650

|

|

Proposal 2

|

20,005,700

|

123,062

|

16,729

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

The following exhibits are filed herewith:

|

Exhibit No.

|

|

Description of Exhibit

|

|

2.1

|

|

Asset Purchase Agreement, dated December 17, 2019, between the Company, Streamline Health, Inc. and Hyland Software, Inc. (incorporated by reference to Exhibit 2.1 of the Form 8-K, as filed with the Commission on December 18, 2019).

|

|

|

|

|

|

10.1

|

|

Loan and Security Agreement, dated as of December 11, 2019, between the Company, Streamline Health, Inc. and Western Alliance Bank (incorporated by reference to Exhibit 10.5 of the Form 10-Q, as filed with the Commission on January 7, 2020).

|

|

|

|

|

|

99.1

|

|

Pro Forma Financial Information of the Company.

|

|

|

|

|

|

99.2

|

|

Financial Information of the ECM Business.

|

|

|

|

|

|

99.3

|

|

Press Release Announcing Closing of the Sale of ECM Business, dated February 25, 2020.

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

Streamline Health Solutions, Inc.

|

|

|

|

|

Date: February 27, 2020

|

By:

|

/s/ Wyche T. “Tee” Green, III

|

|

|

|

Wyche T. “Tee” Green, III

|

|

|

|

President & Chief Executive Officer

|

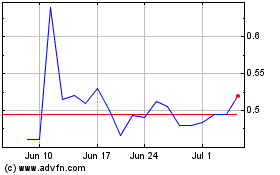

Streamline Health Soluti... (NASDAQ:STRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

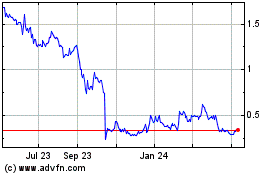

Streamline Health Soluti... (NASDAQ:STRM)

Historical Stock Chart

From Apr 2023 to Apr 2024