Stratus Properties Inc. (NASDAQ: STRS), a diversified real

estate company with multi-family and single-family residential real

estate development, real estate leasing, hotel and entertainment

businesses in the Austin, Texas area and other select, fast-growing

markets in Texas, today reported year ended December 31, 2018

results.

Financial Highlights:

- Net loss attributable to common

stockholders totaled $4.0 million, $0.49 per share, for 2018,

compared with net income attributable to common stockholders of

$3.9 million, $0.47 per share, for 2017.

- Adjusted earnings before interest,

taxes, depreciation and amortization (Adjusted EBITDA) totaled

$10.8 million for 2018, compared with $9.7 million for 2017. For a

reconciliation of net (loss) income attributable to common

stockholders to Adjusted EBITDA, see the supplemental schedule,

“Adjusted EBITDA,” on page V.

- Real estate operations revenues

increased by 51 percent to $16.8 million and operating income

increased by 150 percent to $1.3 million. During 2018, Stratus sold

17 developed properties for a total of $16.5 million, including 3

Amarra Drive Phase II lots, 9 Amarra Drive Phase III

lots, 4 Amarra Villas townhomes and 1 condominium at the

W Austin Hotel & Residences.

- Increased aggregate borrowing

capacity of revolving credit facility with Comerica Bank from

$52.5 million to $60.0 million and extended maturity date

from November 30, 2018 to June 29, 2020. As of December 31, 2018,

consolidated debt totaled $295.5 million and consolidated cash

totaled $19.0 million, with $7.6 million available under Stratus’

credit facility.

- Capital expenditures and

purchases and development of real estate increased to $105.6

million in 2018, compared with $48.5 million in 2017, primarily

reflecting investment in development projects.

Operational Highlights:

- Completed construction of the first

phase at Lantana Place, a mixed-use development in southwest

Austin, and the first phase of the retail component of Jones

Crossing, a mixed-use development in College Station.

- Substantially completed construction of

Santal Phase II, a 212-unit multi-family project located

directly adjacent to the previously completed Santal Phase

I, a 236-unit multi-family project, in Barton Creek. As of

December 31, 2018, 33 percent of Phase II’s total units were

leased and 95 percent of Phase I was leased.

- Obtained project financing and

commenced construction of The Saint Mary, a 240-unit luxury

garden-style apartment project in the Circle C community.

- Purchased a 54-acre tract of land,

obtained project financing and commenced construction of

Kingwood Place, an H-E-B, L.P. (HEB)-anchored, mixed-use

project in Kingwood, Texas.

- In partnership with HEB, purchased a

38-acre tract of land in New Caney, Texas, for the future

development of an HEB-anchored, mixed-use project.

- As of December 31, 2018, had

executed commercial leases for (1) 68 percent of West Killeen

Market, an HEB-anchored retail development project, (2) 71

percent of the retail space at Lantana Place as well as a

ground lease for an AC Hotel by Marriott, and (3) 87 percent of the

retail space at Jones Crossing.

William H. Armstrong III, Chairman, President and Chief

Executive Officer, stated, “We remained focused on execution of our

strategy throughout 2018 and made significant progress in advancing

our active development projects on schedule and within budget. We

completed construction of the initial phases of Lantana Place and

Jones Crossing and substantially completed construction of Santal

Phase II. We obtained construction financing and broke ground on

The Saint Mary and Kingwood Place projects. In addition, we

expanded our portfolio of development projects with the addition of

Kingwood Place and New Caney.”

Armstrong continued, “The city of Austin continues to

flourish. Despite the increased competition from new hotels in

downtown Austin, the W Austin Hotel and our entertainment venues

finished the year strong. As a diversified real estate company with

a strong reputation and solid relationships in our markets, we are

pleased to see high-profile tech companies expand into and drive

excellent growth opportunities in Austin and beyond. Looking ahead

to 2019, our full cycle active development program of acquiring,

developing and stabilizing, and then preparing properties for sale

or refinancing remains the focus of our strategy. We currently have

projects in each of these stages and we are well positioned to take

advantage of favorable market conditions in Texas generally, and in

Austin in particular, in order to create value for our

stockholders.”

Summary Financial

Results

Years Ended December 31, 2018 2017 (In Thousands,

Except Per Share Amounts)

Revenues

Real estate operations $ 16,831 $ 11,144 Leasing operations 11,319

8,856 Hotel 38,222 38,681 Entertainment 22,691 23,232 Corporate,

eliminations and other (1,463 ) (1,573 ) Total Consolidated Revenue

$ 87,600 $ 80,340

Operating income

(loss):

Real estate operations $ 1,305 a $ 522 Leasing operations 2,897

24,217 b Hotel 6,348 6,553 Entertainment 3,426 4,045 Corporate,

eliminations and other (11,803 ) (12,100 ) Total Consolidated

Operating Income $ 2,173 $ 23,237 Net (loss)

income attributable to common stockholdersc $ (3,982 ) d $ 3,879

Diluted net (loss) income per share $ (0.49 ) $ 0.47

Dividends declared per share of common stock $ — $ 1.00

Adjusted EBITDA $ 10,803 $ 9,741 Capital expenditures and

purchases and development of real estate properties $ 105,592 $

48,474 Diluted weighted average shares of common stock

outstanding 8,153 8,171

a. Includes $0.4 million of reductions to cost of sales

associated with collection of prior-years’ assessments of

properties in Barton Creek.

b. Includes gains of $25.4 million ($16.4 million to net income

attributable to common stockholders or $2.01 per share) associated

with the recognition of the majority of the gain on the sale of The

Oaks at Lakeway and the sale of a bank building and an adjacent

undeveloped 4.1 acre tract of land in Barton Creek, partly offset

by a charge of $2.5 million ($1.6 million to net income

attributable to common stockholders or $0.20 per share) for profit

participation associated with the sale of The Oaks at Lakeway.

c. Includes tax charges totaling $0.2 million ($0.03 per share)

for 2018 and $7.6 million ($0.93 per share) for 2017 associated

with U.S. tax reform.

d. Includes $1.15 million ($0.14 per share) from equity in

unconsolidated affiliates’ income reflecting Stratus’ interest in

Crestview Station. During 2018, Crestview Station sold its last

tract of land and its multi-family entitlements.

The 51 percent increase in revenue and 150 percent increase in

operating income from the Real Estate Operations segment in

2018, compared with 2017, primarily reflects higher revenues from

the sales of higher priced residential units, including Amarra

Villas townhomes and a W Austin Hotel & Residences condominium.

Stratus sold three Amarra Drive Phase II lots, nine Amarra Drive

Phase III lots, four Amarra Villas townhomes and one condominium at

the W Austin Hotel & Residences for $16.5 million during 2018.

Since December 31, 2018, Stratus closed on the sales of one

Amarra Villas townhome and two Amarra Drive Phase III lots for $2.9

million. Ten Amarra Drive Phase III lots and one Amarra Villas

townhome are currently under contract.

The 28 percent increase in revenue from the Leasing

Operations segment for 2018, compared with 2017, primarily

reflects the commencement of leases at Stratus’ recently completed

properties, Lantana Place, West Killeen Market, Santal Phase I and

Phase II, and Jones Crossing. The 88 percent decrease in operating

income for 2018, compared with 2017, primarily reflects the 2017

recognition of a portion ($24.3 million) of the deferred gain

associated with the sale of The Oaks at Lakeway. During 2017,

Stratus also had a $2.5 million profit participation charge

associated with the sale of the Oaks at Lakeway, partly offset by a

$1.1 million gain on the sale of a 3,085-square-foot bank building

and an adjacent 4.1 acre undeveloped tract of land in Barton

Creek.

Revenue and operating income from the Hotel segment

decreased slightly in 2018, compared with 2017, primarily as a

result of a lower number of reservations made by large groups.

Revenue per available room (RevPAR), which is calculated by

dividing total room revenue by the average number of total rooms

available during the year, was $245 in 2018, compared with $253 in

2017. According to a report published by the city of Austin’s hotel

and motel association, between 2010 (the year the W Austin Hotel

opened) and 2018, the central business district room count

increased from 6,226 rooms to 10,660 rooms, or by 71 percent. While

Stratus remains positive on the long-term outlook of the W Austin

Hotel based on continued population growth and increased tourism in

the Austin market, a continued increase in competition resulting

from the anticipated opening of additional hotel rooms in downtown

Austin during 2019 is expected to have an ongoing impact on

Stratus’ hotel revenues.

The decrease in revenue and operating income from the

Entertainment segment for 2018, compared with 2017,

primarily reflects lower event attendance. The ACL Live venue

hosted 240 events and sold approximately 285,900 tickets in 2018,

compared with 224 events and the sale of approximately 297,100

tickets in 2017. As of February 28, 2019, ACL Live had events

booked through December 2020. The ACL Live entertainment space is

promoted through the broadcast of Austin City Limits by KLRU, a

local public television station. In 2018, ACL Live extended its

agreement with KLRU and Austin City Limits for an additional ten

years. The 3TEN ACL Live venue hosted 216 events in 2018 with

estimated attendance of 38,100, compared with 228 events in 2017

with estimated attendance of 40,600. As of February 28, 2019,

3TEN ACL Live had events booked through December 2019.

Debt and Liquidity

At December 31, 2018, consolidated debt totaled $295.5

million and consolidated cash totaled $19.0 million, compared with

consolidated debt of $221.5 million and consolidated cash of $14.6

million at December 31, 2017.

Purchases and development of real estate properties (included in

operating cash flows) and capital expenditures (included in

investing cash flows) totaled $105.6 million for 2018, primarily

related to the purchase of the Kingwood Place land and development

of Santal Phase II, Lantana Place, Jones Crossing and The Saint

Mary projects. This compares with $48.5 million for 2017, primarily

for the development of Barton Creek properties, Lantana Place,

Santal Phase II, West Killeen Market and Jones Crossing.

Stockholder Return

The cumulative total stockholder return of 45 percent on

Stratus' common stock over the five years ending December 31, 2018,

was comparable to the returns of the S&P 500 Index (50 percent)

and the Dow Jones U.S. Real Estate Index (47 percent) and

significantly exceeded the returns of a group of peer real

estate-related companies, which had a 24 percent loss. The peer

group is comprised of Alexander & Baldwin, Inc.,

Consolidated-Tomoka Land Co., Forestar Group Inc., The Howard

Hughes Corporation, Maui Land & Pineapple Company, Inc., The

St. Joe Company and Tejon Ranch Co. This comparison assumes $100.00

invested at December 31, 2013, with all dividends reinvested. The

stock price performance is not necessarily indicative of future

performance.

----------------------------------------------

Conference Call

Information

Stratus will conduct an investor conference call to discuss its

year ended December 31, 2018, financial and operating results

today, March 18, 2019, at 11:00 a.m. ET. The public is invited

to listen to the conference call by dialing (877) 418-4843 for

domestic access and (412) 902-6766 for international access. A

replay of the conference call will be available at the conclusion

of the call for five days by dialing (877) 344-7529 for domestic

access and by dialing (412) 317-0088 for international

access. Please use replay ID: 10128653. The replay will be

available on Stratus’ website at stratusproperties.com until March

23, 2019.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND

REGULATION G DISCLOSURE.

This press release contains forward-looking statements in which

Stratus discusses factors it believes may affect its future

performance. Forward-looking statements are all statements other

than statements of historical fact, such as statements regarding

projections or expectations related to the planning, financing,

development, construction, completion and stabilization of Stratus’

development projects, plans to sell or refinance properties

(including, but not limited to, Amarra Drive lots, Amarra Villas

townhomes, West Killeen Market, the retail building at Barton Creek

Village, The Saint Mary, and Santal), operational and financial

performance, expectations regarding future cash flows, municipal

utility district reimbursements for infrastructure costs,

regulatory matters, leasing activities, estimated costs and

timeframes for development and stabilization of properties,

liquidity, tax rates, the impact of interest rate changes, capital

expenditures, financing plans, possible joint venture, partnership,

strategic relationships or other arrangements, Stratus’ projections

with respect to its obligations under the master lease agreements

entered into in connection with the sale of The Oaks at Lakeway,

other plans and objectives of management for future operations and

development projects, and future dividend payments and share

repurchases. The words “anticipates,” “may,” “can,” “plans,”

“believes,” “potential,” “estimates,” “expects,” “projects,”

“targets,” “intends,” “likely,” “will,” “should,” “to be” and any

similar expressions are intended to identify those assertions as

forward-looking statements.

Under Stratus’ loan agreement with Comerica Bank, Stratus is not

permitted to pay dividends on common stock without Comerica’s prior

written consent. The declaration of dividends is at the discretion

of Stratus’ Board of Directors (Board), subject to restrictions

under Stratus’ loan agreement with Comerica Bank, and will depend

on Stratus’ financial results, cash requirements, projected

compliance with covenants in its debt agreements, outlook and other

factors deemed relevant by the Board.

Stratus cautions readers that forward-looking statements are not

guarantees of future performance, and its actual results may differ

materially from those anticipated, expected, projected or assumed

in the forward-looking statements. Important factors that can cause

Stratus’ actual results to differ materially from those anticipated

in the forward-looking statements include, but are not limited to,

Stratus’ ability to refinance and service its debt, the

availability and terms of financing for development projects and

other corporate purposes, Stratus’ ability to enter into and

maintain joint venture, partnership, strategic relationships or

other arrangements, Stratus’ ability to effect its business

strategy successfully, including its ability to sell properties at

prices its Board considers acceptable, Stratus’ ability to obtain

various entitlements and permits, a decrease in the demand for real

estate in the Austin, Texas area and other select markets in Texas

where Stratus operates, changes in economic, market and business

conditions, reductions in discretionary spending by consumers and

businesses, competition from other real estate developers, hotel

operators and/or entertainment venue operators and promoters,

challenges associated with booking events and selling tickets and

event cancellations at Stratus’ entertainment venues, the

termination of sales contracts or letters of intent due to, among

other factors, the failure of one or more closing conditions or

market changes, Stratus’ ability to secure qualifying tenants for

the space subject to the master lease agreements entered into in

connection with the sale of The Oaks at Lakeway and to assign such

leases to the purchaser and remove the corresponding property from

the master leases, the failure to attract customers or tenants for

its developments or such customers’ or tenants’ failure to satisfy

their purchase commitments or leasing obligations, increases in

interest rates and the phase out of the London Interbank Offered

Rate, declines in the market value of Stratus’ assets, increases in

operating costs, including real estate taxes and the cost of

building materials and labor, changes in external perception of the

W Austin Hotel, changes in consumer preferences, industry risks,

changes in laws, regulations or the regulatory environment

affecting the development of real estate, opposition from special

interest groups or local governments with respect to development

projects, weather-related risks, loss of key personnel,

cybersecurity incidents and other factors described in more detail

under the heading “Risk Factors” in Stratus’ Annual Report on Form

10-K for the year ended December 31, 2018, filed with the U.S.

Securities and Exchange Commission.

This press release also includes Adjusted EBITDA, which is not

recognized under U.S. generally accepted accounting principles

(GAAP). Stratus believes this measure can be helpful to investors

in evaluating its business. Adjusted EBITDA is a financial measure

frequently used by securities analysts, lenders and others to

evaluate Stratus’ recurring operating performance. Adjusted EBITDA

is intended to be a performance measure that should not be regarded

as more meaningful than a GAAP measure. Other companies may

calculate Adjusted EBITDA differently. As required by SEC

Regulation G, a reconciliation of Stratus’ net loss attributable to

common stockholders to Adjusted EBITDA is included in the

supplemental schedules of this press release.

Investors are cautioned that many of the assumptions upon which

Stratus’ forward-looking statements are based are likely to change

after the forward-looking statements are made, some of which

Stratus may not be able to control. Further, Stratus may make

changes to its business plans that could affect its results.

Stratus cautions investors that it does not intend to update its

forward-looking statements more frequently than quarterly

notwithstanding any changes in its assumptions, business plans,

actual experience, or other changes, and Stratus undertakes no

obligation to update any forward-looking statements.

A copy of this release is available on Stratus’

website, stratusproperties.com.

STRATUS PROPERTIES INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited)

(In Thousands, Except Per Share

Amounts)

Years Ended December 31, 2018

2017 Revenues: Real estate operations $ 16,800 $ 11,001 Leasing

operations 10,389 7,981 Hotel 37,905 38,360 Entertainment 22,506

22,998 Total revenues 87,600 80,340 Cost of sales:

Real estate operations 15,277 10,378 Leasing operations 5,056 4,797

Hotel 28,160 28,478 Entertainment 17,089 17,121 Depreciation 8,571

7,853 Total cost of sales 74,153 68,627 General and

administrative expenses 11,274 11,401 Profit participation in sale

of The Oaks at Lakeway — 2,538 Gain on sale of assets —

(25,463 ) Total 85,427 57,103 Operating income 2,173

23,237 Interest expense, net (7,856 ) (6,742 ) Gain on interest

rate derivative instruments 187 293 Loss on early extinguishment of

debt — (532 ) Other income, net 55 1,581 (Loss)

income before income taxes and equity in unconsolidated affiliates’

income (loss) (5,441 ) 17,837 Equity in unconsolidated affiliates’

income (loss) 1,150 a (49 ) Benefit from (provision for) income

taxes 305 (13,904 ) Net (loss) income (3,986 ) 3,884 Net

loss (income) attributable to noncontrolling interests in

subsidiaries 4 (5 ) Net (loss) income attributable to common

stockholders $ (3,982 ) $ 3,879 Net (loss) income per

share attributable to common stockholders: Basic $ (0.49 ) $ 0.48

Diluted $ (0.49 ) $ 0.47 Weighted-average

shares of common stock outstanding: Basic 8,153 8,122

Diluted 8,153 8,171 Dividends declared per

share of common stock $ — $ 1.00

a. Represents Stratus’ interest in their unconsolidated

affiliate, Crestview Station, and reflects the sale of Crestview

Station’s last tract of land and its multi-family entitlements

during 2018.

STRATUS PROPERTIES INC. CONSOLIDATED BALANCE

SHEETS (Unaudited)

(In Thousands)

December 31, 2018 2017 ASSETS

Cash and cash equivalents $ 19,004 $ 14,611 Restricted cash 19,915

24,779 Real estate held for sale 16,396 22,612 Real estate under

development 136,678 118,484 Land available for development 24,054

14,804 Real estate held for investment, net 253,074 188,390

Deferred tax assets 11,834 11,461 Other assets 15,538 10,852

Total assets $ 496,493 $ 405,993

LIABILITIES AND EQUITY Liabilities: Accounts payable $ 20,602 $

22,809 Accrued liabilities, including taxes 11,914 13,429 Debt

295,531 221,470 Deferred gain 9,270 11,320 Other liabilities 12,525

9,575 Total liabilities 349,842 278,603

Commitments and contingencies Equity: Stratus

stockholders’ equity: Common stock 93 93 Capital in excess of par

value of common stock 186,256 185,395 Accumulated deficit (41,103 )

(37,121 ) Common stock held in treasury (21,260 ) (21,057 ) Total

stockholders’ equity 123,986 127,310 Noncontrolling interests in

subsidiaries 22,665 a 80 Total equity 146,651

127,390 Total liabilities and equity $ 496,493 $

405,993

a. Includes $18.0 million of capital contributions from the

Class B limited partners in the Kingwood Place and The Saint Mary

limited partnerships and $4.6 million received from HEB for its

contribution for the purchase of the land for the future New Caney

project.

STRATUS PROPERTIES INC. CONSOLIDATED STATEMENTS OF

CASH FLOWS (Unaudited)

(In Thousands)

Years Ended December 31, 2018

2017 Cash flow from operating activities: Net (loss) income

$ (3,986 ) $ 3,884 Adjustments to reconcile net (loss) income to

net cash (used in) provided by operating activities: Depreciation

8,571 7,853 Cost of real estate sold 10,283 5,774 Gain on sale of

assets — (25,463 ) U.S. tax reform charge 215 7,580 Gain on

interest rate derivative contracts (187 ) (293 ) Loss on early

extinguishment of debt — 532 Debt issuance cost amortization and

stock-based compensation 1,859 1,573 Equity in unconsolidated

affiliates’ (income) loss (1,150 ) 49 Return on investment in

unconsolidated affiliate 1,251 — Increase (decrease) in deposits

507 (1,322 ) Deferred income taxes, excluding U.S. tax reform

charge (588 ) (1,675 ) Purchases and development of real estate

properties (43,660 ) (14,395 ) Municipal utility districts

reimbursements — 13,799 (Increase) decrease in other assets (4,038

) 4,750 (Decrease) increase in accounts payable, accrued

liabilities and other (966 ) 10,126 Net cash (used in)

provided by operating activities (31,889 ) 12,772

Cash flow from investing activities: Capital expenditures (61,932 )

(34,079 ) Proceeds from sales of assets — 117,261 Payments on

master lease obligations (2,112 ) (2,196 ) Return of investment in

(investment in) unconsolidated affiliates 26 (37 ) Net cash

(used in) provided by investing activities (64,018 ) 80,949

Cash flow from financing activities: Borrowings from credit

facility 34,436 47,200 Payments on credit facility (9,981 ) (67,981

) Borrowings from project loans 56,999 15,793 Payments on project

and term loans (6,693 ) (64,761 ) Cash dividend paid (32 ) (8,133 )

Stock-based awards net payments (131 ) (235 ) Noncontrolling

interests’ contributions 22,589 — Financing costs (1,751 ) (1,703 )

Net cash provided by (used in) financing activities 95,436

(79,820 ) Net (decrease) increase in cash, cash equivalents and

restricted cash (471 ) 13,901 Cash, cash equivalents and restricted

cash at beginning of year 39,390 25,489 Cash, cash

equivalents and restricted cash at end of year $ 38,919 $

39,390

STRATUS PROPERTIES INC.BUSINESS

SEGMENTS

Stratus currently has four operating segments: Real Estate

Operations, Leasing Operations, Hotel and Entertainment.

The Real Estate Operations segment is comprised of Stratus’ real

estate assets (developed for sale, under development and available

for development), which includes its properties in Austin, Texas

(the Barton Creek community, including a portion of Santal Phase II

still under development; the Circle C community, including The

Saint Mary; the Lantana community, including a portion of Lantana

Place still under development; and one condominium unit at the W

Austin Hotel & Residences); in Lakeway, Texas, located in the

greater Austin area (Lakeway); in College Station, Texas (a portion

of Jones Crossing still under development); and in Magnolia, Texas

(Magnolia), Kingwood, Texas (Kingwood Place) and New Caney, Texas

(New Caney), located in the greater Houston area.

The Leasing Operations segment includes the office and retail

space at the W Austin Hotel & Residences, Barton Creek Village,

Santal Phase I, West Killeen Market in Killeen, Texas, and

completed portions of the Santal Phase II, Lantana Place and Jones

Crossing projects.

The Hotel segment includes the W Austin Hotel located at the W

Austin Hotel & Residences in downtown Austin, Texas.

The Entertainment segment includes ACL Live, a live music and

entertainment venue, and 3TEN ACL Live, both located at the W

Austin Hotel & Residences. In addition to hosting concerts and

private events, ACL Live is the home of Austin City Limits, the

longest running music series in American television history.

Stratus uses operating income or loss to measure the performance

of each segment. General and administrative expenses, which

primarily consist of employee salaries, wages and other costs, are

managed on a consolidated basis and are not allocated to Stratus’

operating segments. The following segment information reflects

management determinations that may not be indicative of what the

actual financial performance of each segment would be if it were an

independent entity.

Segment information presented below was prepared on the same

basis as Stratus’ consolidated financial statements (in

thousands).

Real EstateOperationsa

LeasingOperations

Hotel Entertainment

Eliminationsand Otherb

Total Year Ended December 31, 2018: Revenues: Unaffiliated

customers $ 16,800 $ 10,389 $ 37,905 $ 22,506 $ — $ 87,600

Intersegment 31 930 317 185 (1,463 ) — Cost of sales, excluding

depreciation 15,276 c 5,088 28,312 17,702 (796 ) 65,582

Depreciation 250 3,334 3,562 1,563 (138 ) 8,571 General and

administrative expenses — — — — 11,274 11,274 Operating

income (loss) $ 1,305 $ 2,897 $ 6,348 $ 3,426 $ (11,803 ) $ 2,173

Capital expenditures and purchases and development of real estate

properties $ 43,660 $ 60,759 $ 775 $ 398 $ — $ 105,592 Total assets

at December 31, 2018 177,617 175,889 100,248 35,899 6,840 496,493

STRATUS PROPERTIES INC. BUSINESS SEGMENTS

(continued)

Real EstateOperationsa

LeasingOperations

Hotel Entertainment

Eliminationsand Otherb

Total Year Ended December 31, 2017: Revenues: Unaffiliated

customers $ 11,001 $ 7,981 $ 38,360 $ 22,998 $ — $ 80,340

Intersegment 143 875 321 234 (1,573 ) — Cost of sales, excluding

depreciation 10,377 4,829 28,584 17,719 (735 ) 60,774 Depreciation

232 2,693 3,544 1,523 (139 ) 7,853 General and administrative

expenses — — — — 11,401 11,401 Profit participation — 2,538 — — —

2,538 Loss (gain) on sales of assets 13 (25,421 ) d — (55 ) —

(25,463 ) Operating income (loss) $ 522 $ 24,217 $

6,553 $ 4,045 $ (12,100 ) $ 23,237 Capital

expenditures and purchases and development of real estate

properties $ 14,395 $ 33,290 $ 506 $ 283 $ — $ 48,474 Total assets

at December 31, 2017 189,832 71,851 102,491 35,446 6,373 405,993

a. Includes sales commissions and other revenues together with

related expenses.

b. Includes consolidated general and administrative expenses and

eliminations of intersegment amounts.

c. Includes $0.4 million of reductions to cost of sales

associated with collection of prior-years’ assessments of

properties in Barton Creek.

d. Includes $24.3 million associated with recognition of the

majority of the gain on the sale of The Oaks at Lakeway.

RECONCILIATION OF NON-GAAP

MEASUREADJUSTED EBITDA

Adjusted EBITDA (earnings before interest, taxes, depreciation

and amortization) is a non-GAAP (U.S. generally accepted accounting

principles) financial measure that is frequently used by securities

analysts, investors, lenders and others to evaluate companies’

recurring operating performance, including, among other things,

profitability before the effect of financing and similar decisions.

Because securities analysts, investors, lenders and others use

Adjusted EBITDA, management believes that Stratus’ presentation of

Adjusted EBITDA affords them greater transparency in assessing

Stratus’ financial performance. This information differs from net

(loss) income attributable to common stockholders determined in

accordance with GAAP and should not be considered in isolation or

as a substitute for measures of performance determined in

accordance with GAAP. Adjusted EBITDA may not be comparable to

similarly titled measures reported by other companies, as different

companies may calculate such measures differently. Management

strongly encourages investors to review Stratus’ consolidated

financial statements and publicly filed reports in their entirety.

A reconciliation of Stratus’ net (loss) income attributable to

common stockholders to Adjusted EBITDA follows (in thousands).

Years Ended December 31, 2018

2017

Net (loss) income attributable to common stockholders $

(3,982 ) $ 3,879 Depreciation 8,571 7,853 Interest expense, net

7,856 6,742 (Benefit from) provision for income taxes (305 ) 13,904

Profit participation in sale of The Oaks at Lakeway — 2,538 Gain on

sales of assets — (25,463 ) Equity in unconsolidated affiliates’

(income) loss (1,150 ) 49 Gain on interest rate derivative

instruments (187 ) (293 ) Loss on early extinguishment of debt —

532

Adjusted EBITDA $ 10,803 $ 9,741

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190318005391/en/

Financial and Media Contact:William H. Armstrong III(512)

478-5788

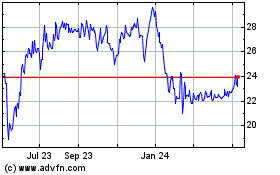

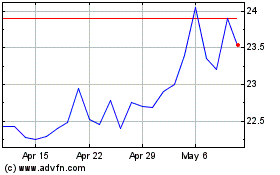

Stratus Properties (NASDAQ:STRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stratus Properties (NASDAQ:STRS)

Historical Stock Chart

From Apr 2023 to Apr 2024