Current Report Filing (8-k)

October 04 2019 - 4:41PM

Edgar (US Regulatory)

false0000885508

0000885508

2019-09-30

2019-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2019

Stratus Properties Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-37716

|

|

72-1211572

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification Number)

|

|

|

|

|

|

|

|

212 Lavaca St., Suite 300

|

|

|

Austin

|

Texas

|

78701

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (512) 478-5788

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

STRS

|

The NASDAQ Stock Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On September 30, 2019 (the “closing date”), Santal, L.L.C. (“Santal”), a wholly owned, indirect subsidiary of Stratus Properties Inc. (“Stratus”), and ACRC Lender LLC, as lender, entered into a loan and security agreement and other related loan documents (collectively, the “Loan Documents”). The Loan Documents provide for a loan in the amount of $75,000,000 (the “Loan”). Approximately $57,900,000 of the proceeds of the Loan were used to refinance The Santal property, a 448-unit, garden-style, multi-family property located in the upscale Barton Creek Community (the “Santal Property”) by repaying, in full, all outstanding indebtedness under the Existing Santal Loan Agreement (as defined in Item 1.02 of this Current Report on Form 8-K). The remaining proceeds of the Loan may be used for general corporate purposes including, but not limited to, paying down a portion of Stratus’ existing Comerica Bank credit facility.

The Loan Documents provide that the maturity date of the Loan is October 5, 2022, with the possibility of two 12-month extensions, subject to satisfying specified conditions. The interest rate applicable to the Loan is the London Interbank Offered Rate (“LIBOR”) plus 2.85 percent (or, if applicable, a replacement rate), provided that at no time shall the interest rate be less than 4.80 percent per annum. Santal entered into an interest rate protection agreement capping LIBOR at 3.00 percent, as required by the Loan Documents. Payments of interest on the Loan are due and payable monthly, through October 5, 2022, the date on which the Loan will mature. During the six months after the closing date, Santal may not prepay any portion of the Loan. Between six and twelve months after the closing date, Santal may prepay the Loan with a pro-rated prepayment fee that assures that the lender receives an amount equal to the interest that would have accrued on the Loan through the first year of the loan term. After the first year of the loan term, Santal may prepay all or any portion of the Loan without premium or penalty, subject to certain costs. Upon the occurrence of certain customary events of default, the lender may accelerate repayments under the Loan and exercise any one or more of the rights and remedies granted to the lender under the Loan Documents.

The Loan is secured by a deed of trust and loan and security agreement that includes as collateral the Santal Property together with all subsequent improvements, leases and rents associated with the Santal Property, and any personal property owned by Santal. In addition, the Loan is non-recourse to Stratus except that Stratus has a limited guaranty for certain non-recourse carveouts and any and all environmental liabilities as set forth in the Loan Documents.

The Loan Documents contain certain financial covenants, including a requirement that Stratus maintain a net asset value of $125,000,000 and liquid assets of not less than $7,500,000. The Loan Documents also contain other affirmative and negative covenants usual and customary for loan agreements of this nature.

The foregoing summary of the Loan does not purport to be complete and is subject to, and qualified in its entirety by, reference to the full text of the loan and security agreement and the note, which are filed as Exhibits 10.1 and 10.2, respectively, and incorporated by reference into this Item 1.01.

Item 1.02. Termination of a Material Definitive Agreement.

On September 30, 2019, in connection with the entry into the Loan Documents as described in Item 1.01 hereto, Stratus terminated the existing Amended and Restated Construction Loan Agreement by and between Santal I, L.L.C., as borrower, and Comerica Bank, as lender, dated September 11, 2017 (the “Existing Santal Loan Agreement”) and repaid all outstanding borrowings thereunder, which consisted of two construction loans totaling approximately $57,900,000, in full with a portion of the proceeds from the Loan.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosures set forth in Item 1.01 above are incorporated by reference into this Item 2.03.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

Exhibit Number

|

Exhibit Title

|

|

|

Loan and Security Agreement by and between Santal, L.L.C., as borrower, and ACRC Lender LLC, as lender, dated September 30, 2019. (*)

|

|

|

Note by and between Santal, L.L.C. and ACRC Lender LLC, dated

September 30, 2019.

|

|

|

Press release dated October 4, 2019, titled "Stratus Properties Inc. Announces Refinancing of The Santal."

|

|

104

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL.

|

(*) The registrant agrees to furnish supplementally to the Securities and Exchange Commission (SEC) a copy of any omitted schedule or exhibit upon the request of the SEC in accordance with Item 601(a)(5) of Regulation S-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Stratus Properties Inc.

By:/s/ Erin D. Pickens

Erin D. Pickens

Senior Vice President and

Chief Financial Officer

(authorized signatory and

Principal Financial Officer)

Date: October 4, 2019

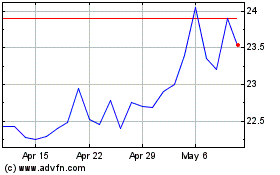

Stratus Properties (NASDAQ:STRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

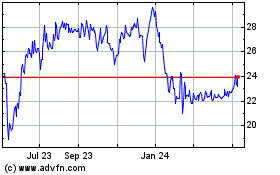

Stratus Properties (NASDAQ:STRS)

Historical Stock Chart

From Apr 2023 to Apr 2024