Fourth Quarter Revenue of $177.1 million and

$663.2 million for full year 2018

Fourth Quarter GAAP net income of $6.3 million,

or $0.12 per diluted share, and non-GAAP net income of $11.3

million, or $0.21 per diluted share

Generated $18.7 million of cash from operations

during the quarter, and a record $63.7 million in cash from

operations in full year 2018

Company releases full year 2019 earnings

guidance

Stratasys Ltd. (NASDAQ: SSYS) announced financial results for

the fourth quarter and full year of 2018.

Q4 2018 Financial Results Summary:

Revenue for the fourth quarter of 2018 was $177.1 million,

compared to $179.3 million for the same period last year.

- GAAP gross margin was 49.1% for the

quarter, compared to 48.7% for the same period last year.

- Non-GAAP gross margin was 52.2% for the

quarter, compared to 52.5% for the same period last year.

- GAAP operating loss for the quarter was

$3.8 million, compared to operating loss of $6.0 million for the

same period last year.

- Non-GAAP operating income for the

quarter was $12.8 million, compared to operating income of $13.5

million for the same period last year.

- GAAP net income for the quarter was

$6.3 million, or $0.12 per diluted share, compared to a net loss of

$10.0 million, or ($0.19) per diluted share, for the same period

last year.

- Non-GAAP net income for the quarter was

$11.3 million, or $0.21 per diluted share, compared to Non-GAAP net

income of $8.4 million, or $0.16 per diluted share, reported for

the same period last year.

- The Company generated $18.7 million in

cash from operations during the fourth quarter and ended the period

with $393.2 million in cash and cash equivalents.

“We are pleased with our fourth quarter and full year

profitability, and finished 2018 with record cash flow from

operations as we continue to build a strong operational foundation

for future growth opportunities and to invest in accelerating new

product introductions to expand our addressable markets,” said

Elchanan (Elan) Jaglom, Interim Chief Executive Officer of

Stratasys. “Our consolidated top line results this quarter reflect

continued positive traction in high-end system and materials sales

for our PolyJet and FDM technology platforms, primarily in North

America, offset partially by the impact late in the quarter of the

government shutdown in the United States and what we believe is

temporary weakness in the Automotive sector in Europe.”

Fiscal 2018 Financial Results Summary:

- Revenue for fiscal 2018 was $663.2

million compared to $668.4 million for fiscal 2017.

- GAAP operating loss for fiscal 2018 was

$8.8 million, compared to a loss of $30.5 million for fiscal

2017.

- Non-GAAP operating income for fiscal

2018 was $36.5 million, compared to $36.7 million for fiscal

2017.

- GAAP net loss for fiscal 2018 was $11.0

million, or ($0.22) per diluted share, compared to a loss of $40.0

million, or ($0.75) per diluted share, for fiscal 2017.

- Non-GAAP net income for fiscal 2018 was

$27.8 million, or $0.52 per diluted share, compared to non-GAAP net

income of $24.2 million, or $0.45 per diluted share, reported for

fiscal 2017.

- The Company generated a record $63.7

million in cash from operations in fiscal 2018.

Financial Guidance:

Stratasys today provided the following information regarding the

Company’s guidance for projected revenue and net income for the

fiscal year ending December 31, 2019:

- Revenue guidance of $670 to $700

million.

- GAAP net loss of $22 to $12 million, or

($0.40) to ($0.22) per diluted share.

- Non-GAAP net income of $30 to $38

million, or $0.55 to $0.70 per diluted share.

Stratasys also provided the following guidance regarding the

Company’s projected performance and strategic plans for 2019:

- Non-GAAP operating margins of 5.5% to

6.5%.

- Capital expenditures are projected at

$45 to $60 million.

Given the expected ongoing negative impact of not recording a

tax benefit on U.S. tax losses on the Company’s non-GAAP net

income, the Company believes that the rate of growth in its

non-GAAP operating income is the best measure of its

performance.

Non-GAAP earnings guidance excludes $32 million of projected

amortization of intangible assets; $20 to $22 million of

share-based compensation expense; reorganization related and other

expense of $1 to $2 million; and includes ($3) to ($4) million in

tax expenses related to non-GAAP adjustments.

“We are entering into 2019 with an impressive roadmap of new

technology and products, and continued, steady progress in customer

adoption of our additive manufacturing solutions for advanced

applications in our target verticals of aerospace, automotive,

healthcare, and high-realism rapid prototyping,” continued Jaglom.

“We are excited about our recent and upcoming new product

introductions and believe that we will see accelerated growth

beginning in 2020.”

Stratasys Ltd. Q4 2018 Conference Call Details

The Company plans to hold the conference call to discuss its

third quarter financial results on Thursday, March 7, 2019 at 8:30

a.m. (ET).

The investor conference call will be available via live webcast

on the Stratasys Web site at www.stratasys.com under the

"Investors" tab; or directly at the following web address:

https://edge.media-server.com/m6/p/znvsr248.

To participate by telephone, the domestic dial-in number is

(866) 394-5776 and the international dial-in is (409) 350-3596. The

access code is 2462328.

Investors are advised to dial into the call at least ten minutes

prior to the call to register. The webcast will be available for 90

days on the "Investors" page of the Stratasys Website or by

accessing the provided web address.

Stratasys is a global leader in additive manufacturing or

3D printing technology, and is the manufacturer of FDM® and

PolyJet™ 3D Printers. The Company’s technologies are used to create

prototypes, manufacturing tools, and production parts for

industries, including aerospace, automotive, healthcare, consumer

products and education. For 30 years, Stratasys products have

helped manufacturers reduce product-development time, cost, and

time-to-market, as well as reduce or eliminate tooling costs and

improve product quality. The Stratasys 3D printing ecosystem of

solutions and expertise includes: 3D printers, materials, software,

expert services, and on-demand parts production. Online

at: www.stratasys.com, http://blog.stratasys.com and

LinkedIn.

Stratasys is a registered trademark and the Stratasys signet is

a trademark of Stratasys Ltd. and/or its subsidiaries or

affiliates. All other trademarks are the property of their

respective owners.

Cautionary Statement Regarding Forward-Looking

Statements

The statements in this press release regarding Stratasys'

strategy, and the statements regarding its projected future

financial performance, including the financial guidance concerning

its expected results for 2019, are forward-looking statements

reflecting management's current expectations and beliefs. These

forward-looking statements are based on current information that

is, by its nature, subject to rapid and even abrupt change. Due to

risks and uncertainties associated with Stratasys' business, actual

results could differ materially from those projected or implied by

these forward-looking statements. These risks and uncertainties

include, but are not limited to: the degree of market acceptance of

our 3D printers, high-performance systems and consumables, and the

software and technology included in those systems; potential

declines in the demand for, or the prices of, our products and

services, or volume of our sales, due to decreased demand either

for them specifically or in the 3D printing market generally;

potential shifts in our product mix to lower-margin products or in

our revenues mix towards our AM services business; potential

further charges against earnings that we could be required to take

due to impairment of additional goodwill or other intangible

assets; potential failure to successfully consummate acquisitions

or investments in new businesses, technologies, products or

services; the impact of competition and new technologies; risks

related to our relationships with our suppliers, resellers and

independent sales agents, and our operations at our manufacturing

sites; risks related to the international scope of our operations

and regulatory compliance (including reporting, environmental,

anti-corruption and other regulatory compliance) related to that

scope of operations; risks related to the security of our

information systems (including risks related to potential

cyber-attacks); changes in the overall global economic environment

or in political and economic conditions in the countries in which

we operate; changes in our strategy; costs and potential liability

relating to litigation and regulatory proceedings; and those

additional factors referred to in Item 3.D “Key Information - Risk

Factors”, Item 4, “Information on the Company”, Item 5, “Operating

and Financial Review and Prospects,” and all other parts of our

Annual Report on Form 20-F for the year ended December 31, 2018

(the “2018 Annual Report”), filed with the Securities and

Exchange Commission (the “SEC”) on March 7th, 2019. Readers

are urged to carefully review and consider the various disclosures

made throughout our 2018 Annual Report that attaches Stratasys’

unaudited, condensed consolidated financial statements as of, and

for the quarter and full year ended, December 31, 2018, and its

review of its results of operations and financial condition for

those periods, which has been furnished to the SEC on or about the

date hereof, and our other reports filed with or furnished to the

SEC, which are designed to advise interested parties of the risks

and factors that may affect our business, financial condition,

results of operations and prospects. Any guidance provided, and

other forward-looking statements made, in this press release are

made as of the date hereof, and Stratasys undertakes no obligation

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

Use of non-GAAP financial

measures

The non-GAAP data included herein, which excludes certain items

as described below, are non-GAAP financial measures. Our management

believes that these non-GAAP financial measures are useful

information for investors and shareholders of our Company in

gauging our results of operations (x) on an ongoing basis after

excluding mergers, acquisitions and divestments related expense or

gains and reorganization-related charges or gains, and (y)

excluding non-cash items such as stock-based compensation expenses,

acquired intangible assets amortization, including intangible

assets amortization related to equity method investments,

impairment of long-lived assets, changes in fair value of

obligations in connection with acquisitions and the corresponding

tax effect of those items. These non-GAAP adjustments either do not

reflect actual cash outlays that impact our liquidity and our

financial condition or have a non-recurring impact on the statement

of operations, as assessed by management. These non-GAAP financial

measures are presented to permit investors to more fully understand

how management assesses our performance for internal planning and

forecasting purposes. The limitations of using these non-GAAP

financial measures as performance measures are that they provide a

view of our results of operations without including all items

indicated above during a period, which may not provide a comparable

view of our performance to other companies in our industry.

Investors and other readers should consider non-GAAP measures only

as supplements to, not as substitutes for or as superior measures

to, the measures of financial performance prepared in accordance

with GAAP. Reconciliation between results on a GAAP and non-GAAP

basis is provided in a table below.

Stratasys Ltd.

Consolidated Balance Sheets (in thousands,

except share data)

December 31, December

31,

2018

2017 ASSETS

Current assets

Cash and cash equivalents $ 393,167 $ 328,761 Accounts receivable,

net 138,146 132,671 Inventories 123,524 115,717 Net investment in

sales-type leases 2,658 7,208 Prepaid expenses 6,398 7,696 Other

current assets

20,278

22,858 Total current assets

684,171 614,911

Non-current assets

Net investment in sales-type leases - long term 1,552 4,439

Property, plant and equipment, net 188,150 199,951 Goodwill 385,849

387,108 Other intangible assets, net 107,274 142,122 Other

non-current assets 21,258 31,219

Total non-current assets 704,083 764,839

Total assets $ 1,388,254 $ 1,379,750

LIABILITIES AND EQUITY

Current liabilities Accounts payable $ 45,855 $

39,849 Current portion of long term-debt 5,143 5,143 Accrued

expenses and other current liabilities 39,115 30,041 Accrued

compensation and related benefits 31,703 35,356 Deferred revenues

53,965 52,908 Total current

liabilities 175,781 163,297

Non-current liabilities Long-term debt 22,000 27,143

Deferred tax liabilities 1,662 7,069 Deferred revenues - long-term

18,422 15,200 Other non-current liabilities 27,422

32,899 Total non-current liabilities

69,506 82,311

Total liabilities

245,287 245,608

Redeemable non-controlling

interests

852 1,635

Equity

Ordinary shares, NIS 0.01 nominal value,

authorized 180,000 thousands shares; 53,881 thousands shares and

53,631 thousands shares issued and outstanding at December 31, 2018

and December 31, 2017, respectively

146

145

Additional paid-in capital 2,681,048

2,663,274

Accumulated other comprehensive loss (7,753 ) (7,023 ) Accumulated

deficit (1,531,326 ) (1,523,906 ) Equity attributable

to Stratasys Ltd. 1,142,115 1,132,490 Non-controlling interest - 17

Total equity 1,142,115 1,132,507

Total liabilities and equity $ 1,388,254 $

1,379,750

Stratasys Ltd.

Consolidated Statements of Operations (in thousands,

except per share data)

Three Months Ended December

31, Twelve Months Ended December 31, 2018

2017 2018 2017

Net sales

Products $ 124,537 $ 129,777 $ 456,504 $ 474,286 Services

52,582 49,566 206,733

194,076 177,119 179,343 663,237 668,362

Cost of

sales Products 56,502 59,977 203,622 219,020 Services

33,618 32,100 134,391

126,565 90,120 92,077 338,013 345,585

Gross profit 86,999 87,266 325,224 322,777

Operating expenses Research and development, net 24,379

26,585 98,964 96,237 Selling, general and administrative

66,423 66,657 235,107

257,063 90,802 93,242 334,071 353,300

Operating loss (3,803 ) (5,976 ) (8,847 ) (30,523 )

Financial income, net 747 667 633 1,047

Loss before income taxes (3,056 ) (5,309 )

(8,214 ) (29,476 ) Income taxes expense 3,626 4,102 4,736

9,273 Share in profits (losses) of associated companies

12,910 (704 ) 1,725

(1,710 )

Net income (loss) 6,228 (10,081 ) (11,225 )

(40,459 ) Net loss attributable to non-controlling interest

(79 ) (101 ) (261 ) (478 ) Net loss attributable to

Stratasys Ltd. $ 6,307 $ (9,980 ) $ (10,964 ) $ (39,981 )

Net loss per ordinary share attributable to Stratasys

Ltd. Basic $ 0.12 $ (0.19 ) $ (0.22 ) $ (0.75 ) Diluted 0.12

(0.19 ) (0.22 ) (0.75 ) Basic 53,854 53,356 53,751

52,959 Diluted 54,132 53,356 53,751 52,959

Stratasys Ltd. Reconciliation of GAAP to Non-GAAP

Results of Operations Three Months Ended

December 31, 2018 Non-GAAP

2018 2017

Non-GAAP 2017

GAAP

Adjustments

Non-GAAP

GAAP

Adjustments

Non-GAAP

U.S. dollars and shares in thousands (except per share

amounts) Gross profit (1) $ 86,999 $ 5,499 $ 92,498 $

87,266 $ 6,864 $ 94,130 Operating income (loss) (1,2) (3,803 )

16,574 12,771 (5,976 ) 19,518 13,542

Net income (loss) attributable to

Stratasys Ltd. (1,2,3)

6,307 4,993 11,300 (9,980 ) 18,429 8,449

Net income (loss) per diluted share

attributable to Stratasys Ltd. (4)

$ 0.12 $ 0.09 $ 0.21 $ (0.19 ) $ 0.35 $ 0.16 (1)

Acquired intangible assets amortization expense 5,221 5,687

Non-cash stock-based compensation expense 294 497 Impairment

charges of other intangible assets - 646 Reorganization and other

related costs (16 ) 34 5,499 6,864 (2)

Acquired intangible assets amortization expense 2,532 2,594

Non-cash stock-based compensation expense 3,686 3,092

Impairment charges of intangible assets

and other long lived assets

4,797

3,742

Reorganization and other related costs 60 3,136 Merger and

acquisition related expense - 90

11,075 12,654 16,574

19,518 (3) Corresponding tax effect 1,853

(1,295 )

Gain from equity method divestment,

related write-offs and amortization

(13,434

)

206

$ 4,993 $ 18,429 (4)

Weighted average number of ordinary shares

outstanding- Diluted

54,132 54,132 53,356 53,584

Stratasys Ltd.

Reconciliation of GAAP to Non-GAAP Results of

Operations Twelve Months Ended December

31, 2018 Non-GAAP

2018 2017 Non-GAAP

2017

GAAP

Adjustments

Non-GAAP

GAAP

Adjustments

Non-GAAP

U.S. dollars and shares in thousands (except per share

amounts) Gross profit (1) $ 325,224 $ 22,351 $ 347,575 $

322,777 $ 26,860 $ 349,637 Operating income (loss) (1,2) (8,847 )

45,324 36,477 (30,523 ) 67,226 36,703

Net income (loss) attributable to

Stratasys Ltd. (1,2,3)

(10,964 ) 38,782 27,818 (39,981 ) 64,158 24,177

Net income (loss) per diluted share

attributable to Stratasys Ltd. (4)

$ (0.22 ) $ 0.74 $ 0.52 $ (0.75 ) $ 1.20 $ 0.45 (1)

Acquired intangible assets amortization expense 20,866 22,768

Non-cash stock-based compensation expense 1,474 2,581 Impairment

charges of other intangible assets - 646 Reorganization and other

related costs 11 337 Merger and acquisition related expense

- 528 22,351 26,860 (2) Acquired

intangible assets amortization expense 10,161 10,319

Impairment charges of intangible assets

and other long-lived assets

4,797

3,742

Non-cash stock-based compensation expense 14,212 15,141 Gain from

divestiture, net of transaction costs (7,016 ) -

Change in fair value of obligations in

connection with acquisitions

-

1,378

Reorganization and other related costs 691 5,803 Merger and

acquisition related expense 128 3,983

22,973 40,366 45,324

67,226 (3) Corresponding tax effect

(808 ) (3,866 )

Gain from equity method divestment,

related write-offs and amortization

(5,734

)

798

$ 38,782 $ 64,158 (4)

Weighted average number of ordinary shares

outstanding- Diluted

53,751 53,898 52,959 53,536

Stratasys Ltd.

Reconciliation of GAAP to Non-GAAP Forward Looking

Guidance Fiscal Year 2019 (in millions,

except per share data)

GAAP net loss

($22) to ($12)

Adjustments

Stock-based compensation expense $20 to $22 Intangible assets

amortization expense $32 Reorganization Related Expense $1 to $2

Tax expense (Income) related to Non-GAAP

adjustments

($4) to ($3)

Non-GAAP net income $30 to $38

GAAP diluted

loss per share ($0.40) to ($0.22)

Non-GAAP diluted

earnings per share $0.55 to $0.70

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190307005297/en/

Stratasys Investor RelationsYonah LloydVice President -

Investor RelationsYonah.Lloyd@stratasys.com

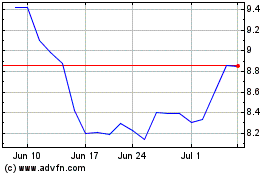

Stratasys (NASDAQ:SSYS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stratasys (NASDAQ:SSYS)

Historical Stock Chart

From Apr 2023 to Apr 2024