UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

|

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

|

|

|

Stock Yards Bancorp, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

1040 East Main Street

Louisville, Kentucky 40206

502.582.2571

March 13, 2020

Dear Shareholder:

We invite you to attend the 2020 Annual Meeting of Shareholders of Stock Yards Bancorp, Inc., to be held at 10:00 a.m., Eastern Time, on Thursday, April 23, 2020, at The Olmsted, 3701 Frankfort Avenue, Louisville, Kentucky 40206. There is a map provided on the back cover for your reference.

The enclosed Notice and Proxy Statement contain complete information about matters to be considered at the Annual Meeting, at which we will also review Stock Yards Bancorp’s business and operations. Only shareholders of record on the record date for the meeting and their proxies are entitled to vote at the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting of Shareholders, we hope you will vote as soon as possible. You may vote your shares via a toll free number, over the Internet, or by completing, signing and returning the enclosed proxy card in the envelope provided. Instructions regarding each of the three methods of voting are contained in the Proxy Statement.

Thank you for your support of Stock Yards Bancorp. If your schedule permits, I hope you will join us at the meeting.

Sincerely yours,

/s/ David P. Heintzman

David P. Heintzman

Chairman of the Board

Important Notice Regarding the Availability of Proxy Materials for the Shareholders Meeting to Be Held on April 23, 2020: The Notice and Proxy Statement and Annual Report are available at http://irinfo.com/sybt/sybt.html.

Stock Yards Bancorp, Inc.

1040 East Main Street

Louisville, Kentucky 40206

NOTICE OF THE

2020 ANNUAL MEETING OF SHAREHOLDERS

March 13, 2020

To our Shareholders:

The Annual Meeting of Shareholders of Stock Yards Bancorp, Inc., a Kentucky corporation, will be held on Thursday, April 23, 2020 at 10:00 a.m., Eastern Time, at The Olmsted, 3701 Frankfort Avenue, Louisville, Kentucky 40206 for the following purposes:

|

|

(1)

|

To elect eleven directors to serve until the next Annual Meeting of Shareholders and until their respective successors are duly elected and qualified;

|

|

|

(2)

|

To ratify the selection of BKD, LLP as the independent registered public accounting firm for Stock Yards Bancorp, Inc. for the year ending December 31, 2020;

|

|

|

(3)

|

To approve a non-binding resolution to approve the compensation of Stock Yards Bancorp’s named executive officers; and

|

|

|

(4)

|

To transact such other business as may properly come before the meeting.

|

The record date for the determination of the shareholders entitled to vote at the meeting or at any adjournment thereof is the close of business on February 28, 2020.

Your vote is important. Whether or not you plan to attend the Annual Meeting of Shareholders, we hope you will vote as soon as possible. Please review the instructions with respect to each of your voting options as described in the Proxy Statement. The Board of Directors of Stock Yards Bancorp appreciates your cooperation in directing proxies to vote at the meeting.

|

|

|

|

|

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

|

|

/s/ James A. Hillebrand

|

|

|

|

|

|

|

|

|

|

James A. Hillebrand

|

|

|

|

|

Chief Executive Officer

|

|

WE URGE SHAREHOLDERS TO VOTE AS SOON AS POSSIBLE

Stock Yards Bancorp, Inc.

1040 East Main Street

Louisville, Kentucky 40206

PROXY STATEMENT

FOR THE 2020 ANNUAL MEETING OF SHAREHOLDERS

General Information about the Annual Meeting

Why have I received these materials?

We are mailing this Proxy Statement and the accompanying proxy to shareholders on or about March 13, 2020. The proxy is solicited by the Board of Directors of Stock Yards Bancorp, Inc. (referred to throughout this Proxy Statement as “Stock Yards Bancorp”, “Bancorp”, “the Company” or “we”, “us” or “our”) in connection with our Annual Meeting of Shareholders that will take place on Thursday, April 23, 2020. We invite you to attend the Annual Meeting and request you to vote on the proposals described in this Proxy Statement.

What am I voting on?

|

|

●

|

Electing eleven directors to serve until the next Annual Meeting of Shareholders and until their respective successors are duly elected and qualified;

|

|

|

●

|

Ratifying the selection of BKD, LLP as the independent registered public accounting firm for Stock Yards Bancorp, Inc. for the year ending December 31, 2020; and

|

|

|

●

|

Approving a non-binding resolution to approve the compensation of the Company’s named executive officers.

|

Where can I find more information about these voting matters?

|

|

●

|

Information about the nominees for election as directors is contained in Item 1;

|

|

|

●

|

Information about the ratification of the selection of BKD, LLP as the independent registered public accounting firm is contained in Item 2; and

|

|

|

●

|

Information about the non-binding resolution to approve the compensation of Stock Yards Bancorp’s named executive officers is contained in Item 3.

|

What is the relationship of Stock Yards Bancorp and Stock Yards Bank & Trust Company?

Stock Yards Bancorp is the holding company for Stock Yards Bank & Trust Company (referred to throughout this Proxy Statement as “the Bank”). Stock Yards Bancorp owns 100% of Stock Yards Bank & Trust Company. Because Stock Yards Bancorp has no significant operations of its own, its business and that of Stock Yards Bank & Trust Company are essentially the same.

Who is entitled to vote at the Annual Meeting?

Holders of record of Common Stock (“Common Stock”) of Stock Yards Bancorp as of the close of business on February 28, 2020 will be entitled to vote at the Annual Meeting. On February 28, 2020, there were 22,637,670 shares of Common Stock outstanding and entitled to one vote on all matters presented for vote at the Annual Meeting.

How do I vote my shares?

If you are a “record” shareholder of Common Stock (that is, if you hold Common Stock in your own name in Stock Yards Bancorp’s stock records maintained by our transfer agent), you may vote your shares by using one of the following three options:

|

|

●

|

By Internet – If you have Internet access, we encourage you to vote on www.proxyvote.com by following instructions on the proxy card;

|

|

|

●

|

By Telephone – By making a toll-free telephone call from the U.S. or Canada to 1(800) 690-6903; or

|

|

|

●

|

By Mail – You can vote by completing, signing and returning the enclosed proxy card in the postage-paid envelope provided.

|

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the beneficial owner of those shares. This Notice of Annual Meeting and Proxy Statement and any accompanying documents have been forwarded to you by your broker, bank or other holder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote your shares by using the voting instruction card provided by them or by following their instructions for voting by telephone or over the Internet. Beneficial owners who wish to vote at the Annual Meeting will need to obtain a proxy form from the institution that holds your shares and follow the voting instructions on such form.

If you are a participant in the Stock Yards Bank & Trust Company 401(k) and Employee Stock Ownership Plan (“KSOP”), you have the option of receiving your voting information either electronically or by regular postal mail. Plan participants who have elected to receive their voting information electronically should follow the instructions contained in the electronic communication. If you have not affirmatively elected to receive voting information for your KSOP shares electronically, you will receive a paper version of the proxy card via postal mail that will include the shares you own through your KSOP account. That proxy card will serve as a voting instruction card for the trustee of the plan. If you own shares through the plan and do not vote electronically or by mail, the plan trustee will be instructed by the plan’s administrative committee to vote the plan shares as the Board of Directors recommend.

What if I return my proxy card but do not provide voting instructions?

If you vote by proxy card, your shares will be voted as you instruct. If you return your proxy card but do not mark your voting instructions on your signed card, James A. Hillebrand, Chief Executive Officer, and Philip S. Poindexter, President, as proxies named on the proxy card, will vote your shares FOR the election of the eleven director nominees, FOR the ratification of BKD, LLP and FOR the approval of the compensation of the named executive officers.

Can I change my vote after I have voted?

Yes. You may change your vote at any time before the polls close at the Annual Meeting. You may do this by:

|

|

●

|

Signing another proxy card with a later date and returning it to us prior to the Annual Meeting;

|

|

|

●

|

Voting again by telephone or through the Internet prior to 11:59 p.m., Eastern Time, on April 22, 2020;

|

|

|

●

|

Giving written notice of revocation to our Secretary of the Company prior to the Annual Meeting; or

|

|

|

●

|

Voting again at the Annual Meeting.

|

Your attendance at the Annual Meeting will not have the effect of revoking a proxy unless you notify our Corporate Secretary in writing before the polls close that you wish to revoke a previously submitted proxy.

What is a broker non-vote?

If you are a beneficial owner whose shares are held of record by a broker, you must instruct the broker how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any proposal on which the broker does not have the discretionary authority to vote. This is called a “broker non-vote.” In these cases the broker can register your shares as being present at the Annual Meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required under the rules of the New York Stock Exchange (“NYSE”) that govern brokers.

If you are a beneficial owner whose shares are held of record by a broker, your broker has discretionary voting authority to vote your shares on the ratification of BKD, LLP (Item 2) even if the broker does not receive voting instructions from you. However, your broker does not have discretionary authority to vote on the election of directors (Item 1) or the approval of executive compensation (Item 3) without instructions from you, in which case a broker non-vote will occur and your shares will not be voted on these matters.

What constitutes a quorum for purposes of the Annual Meeting?

The presence at the Annual Meeting in person or by proxy of the holders of more than 50 percent of the voting power of all outstanding shares of Common Stock entitled to vote shall constitute a quorum for the transaction of business. Proxies marked as abstaining (including proxies containing broker non-votes) on any matter to be acted upon by shareholders will be treated as present at the meeting for purposes of determining a quorum but will not be counted as votes cast on such matters.

What vote is required to approve each item?

You may vote “FOR” each nominee for director or “AGAINST” each nominee, or “ABSTAIN” from voting on one or more nominees. Unless you mark “AGAINST” or “ABSTAIN” with respect to a particular nominee or nominees or for all nominees, your proxy will be voted “FOR” each of the director nominees named in this Proxy Statement. A nominee will be elected as a director if the number of “FOR” votes exceeds the number of “AGAINST” votes.

The selection of the independent registered public accounting firm will be ratified if the votes cast for it exceed the votes cast against it.

The proposal to approve the compensation of our named executive officers disclosed in this Proxy Statement will pass if votes cast for it exceed votes cast against it. Because this vote is advisory, it will not be binding upon Bancorp or the Board of Directors.

Any other item to be voted upon at the Annual Meeting will pass if votes cast for it exceed votes cast against it.

Who counts the votes?

Broadridge Financial Solutions will count votes cast by proxy at the Annual Meeting. They will also certify the results of the voting and will also determine whether a quorum is present at the meeting. Any votes cast in person at the Annual Meeting will be included in the final voting tally.

How are abstentions and broker non-votes treated?

You may abstain from voting on one or more nominees for director. You may also abstain from voting on any or all other proposals. Abstentions will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but will not be counted in the number of votes cast for or against any nominee or with respect to any other matter. If a broker does not receive voting instructions from the beneficial owner of shares on a particular matter and indicates on the proxy that it does not have discretionary authority to vote on that matter, we will treat these shares as present at the meeting for purposes of determining a quorum but the shares will not count as votes cast on the matter. Abstentions and broker non-votes will not affect the outcome of any matters to be voted on at the Annual Meeting.

What information do I need to attend the Annual Meeting?

We do not require tickets for admission to the Annual Meeting. If you are voting in person, we may request photo identification.

How does the Board recommend that I vote my shares?

The Board recommends a vote FOR each of the nominees for director set forth in this document, FOR the ratification of the selection of the independent registered accounting firm and FOR the approval of the compensation of the named executive officers.

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion in the best interests of Stock Yards Bancorp. At the date this Proxy Statement went to press, the Board of Directors had no knowledge of any business other than that described herein that would be presented for consideration at the Annual Meeting.

Who will bear the expense of soliciting proxies?

Stock Yards Bancorp will bear the cost of soliciting proxies in the form enclosed. In addition to the solicitation by mail, proxies may be solicited personally or by telephone, facsimile or electronic transmission by our employees. We reimburse brokers holding Common Stock in their names or in the names of their nominees for their expenses in sending proxy materials to the beneficial owners of such Common Stock. The Company has engaged the services of Laurel Hill Advisory Group, LLC., a professional proxy solicitation firm, to aid in the solicitation of proxies from certain brokers, bank nominees and other institutional owners. The Company’s costs for such services will not exceed $7,500 plus reasonable out of pocket expenses.

Is there any information that I should know about future annual meetings?

Any shareholder who intends to present a proposal at the 2021 Annual Meeting of Shareholders must deliver the proposal to the Corporate Secretary at 1040 East Main Street, Louisville, Kentucky 40206 no later than November 13, 2020, if the proposal is submitted for inclusion in our proxy materials for that meeting pursuant to Rule 14a-8 under the Securities Exchange Act of 1934. In addition, our Bylaws impose certain advance notice requirements on a shareholder nominating a director or submitting a proposal to an Annual Meeting. Such notice must be submitted to the Secretary of Stock Yards Bancorp no later than January 23, 2021. The notice must contain information prescribed by the Bylaws, copies of which are available from the Secretary. These requirements apply even if the shareholder does not desire to have his or her nomination or proposal included in our Proxy Statement.

CORPORATE GOVERNANCE AND RELATED MATTERS

Role of the Board and Governance Principles

The Stock Yards Bancorp’s Board of Directors represents shareholders’ interests in perpetuating a successful business including optimizing shareholder returns. The Directors are responsible for determining that the Company is managed to ensure this result. This is an active responsibility, and the Board monitors the effectiveness of policies and decisions including the execution of the Company’s business strategies. Strong corporate governance guidelines form the foundation for Board practices. As a part of this foundation, the Board believes that high ethical standards in all Company matters are essential to earning the confidence of investors, customers, employees and vendors. Accordingly, Stock Yards Bancorp has established a framework that exercises appropriate measures of oversight at all levels of the Company and clearly communicates that the Board expects all actions be consistent with its fundamental principles of business ethics and other corporate governance guidelines. The Company’s governance guidelines and other related matters are published on the Company’s website: www.syb.com under the Investor Relations section.

Board Leadership Structure

The Board of Directors modified the Company’s leadership structure during 2018 in connection with the retirement of David P. Heintzman as Chief Executive Officer. Mr. Heintzman had previously held the positions of Chairman of the Board and Chief Executive Officer. He retired as Chief Executive Officer effective September 30, 2018, and James A. Hillebrand, previously President of the Company, was appointed to succeed Mr. Heintzman as Chief Executive Officer. Mr. Heintzman remained employed in the role of Executive Chairman until his retirement from the Company at the end of 2018. The Company entered into an Executive Transition Agreement with Mr. Heintzman which provides that he would serve as a non-executive Chairman of the Board for the remainder of his then-current Board term and thereafter as a member of the Board if nominated and elected by the Company’s shareholders.

The Board of Directors believes that the most effective leadership structure for the Company at the present time is to separate the roles of Chairman of the Board and Chief Executive Officer. With his deep knowledge of the Company’s business and the banking industry generally, the Board believes that Mr. Heintzman is the best person to lead and advise the Board in its consideration of important strategic and operational matters affecting the Company and the Bank. Additionally, Mr. Heintzman has been and will continue to be a significant resource for Mr. Hillebrand in his role as Chief Executive Officer.

In connection with this new leadership structure, the Board of Directors revised the Company’s corporate governance documents to address the separation of the roles of Chairman of the Board and Chief Executive Officer. The Board will annually elect one of its members to serve as Chairman of the Board. The Chairman will preside at all meetings of the shareholders and of the Board of Directors, and generally consult with the Board on matters pertaining to the Company’s business and affairs. Both positions may, but need not, be held by the same person. The decision as to whether the offices of Chairman of the Board and Chief Executive Officer should be combined or separated will be made from time to time by the Board of Directors at its discretion. The Board’s decision will be made in its business judgment and based upon its consideration of all relevant factors and circumstances at the time, including the specific needs of the Company’s business and the current composition of the Board.

If the individual elected as Chairman of the Board is also the Chief Executive Officer, or if the Chairman of the Board is not an independent director, the Board will elect a lead independent director to help ensure strong independent leadership on the Board.

In addition to an independent lead director, three committees of the Board provide independent oversight of management – the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each is composed entirely of independent directors.

If a lead independent director is called for under the Company’s governance documents, the Chair of the Nominating and Corporate Governance Committee acts in that role. Stephen M. Priebe currently serves as lead director because Mr. Heintzman, as a former executive officer of the Company, does not qualify as an independent director under the Board’s independence standards. The lead director presides at executive sessions of the Board which consist of independent and non-management directors and are held at least two times annually. He has authority to call special meetings of the independent directors and committees of the Board, serves as liaison between the Chief Executive Officer and board members and is available to discuss with any director concerns he or she may have regarding the Board, the Company or the management team. The lead independent director is responsible for providing advice and consultation to the Chief Executive Officer and informing him of decisions reached and suggestions made during executive sessions of the Board of Directors. The lead director reviews and approves matters such as agendas and schedules for Board meetings and executive sessions, and information distributed to board members. The lead director will be available to consult and communicate with shareholders where appropriate.

Board Evaluation Process

The Board conducts an annual self-assessment to enhance its effectiveness. Through regular evaluation of its policies, practices and procedures, the Board identifies areas for further consideration and improvement. The evaluation process is led by the Nominating and Corporate Governance Committee. Each year, that Committee discusses and decides upon the process to be followed for the upcoming year. Each director may be requested to complete a questionnaire and provide feedback on a range of issues, including his or her assessment of the Board’s overall effectiveness and performance; its committee structure; priorities for future Board discussion and attention; the composition of the Board and the background and skills of its members; the quality, timing and relevance of information received from management; the nature and scope of agenda items; and his or her individual contributions to the Board. The lead director then meets with each director individually either to discuss his or her questionnaire responses or, if directors were not requested to complete a questionnaire, to discuss thoughts and suggestions the director may have regarding the Board’s overall effectiveness or specific Board practices or policies. The lead director prepares a summary of findings drawn from the questionnaire responses and director interviews for presentation to the full Board of Directors. Each of the Committees also conducts their own self-assessments led by the respective committee chairs.

Board Oversight of Risk Management

The Board of Directors has a significant role in the oversight of risk management. The Board receives information regarding risks facing the Company, their relative magnitude and management’s plan for mitigating these risks. Primary risks facing the Company are credit, operational, interest rate, liquidity, compliance/legal, strategic and reputational risks. After assessment by management, reports are made to committees of the Board. Credit risk is addressed by the Risk Committee of Bancorp. Operational and compliance/legal risks are addressed by the Audit Committee and the Risk Committee of Bancorp. Interest rate and liquidity risks are addressed by the Asset/Liability Committee comprised of Bank management and reports are made to the Board at each of its regular meetings. Strategic and reputational risk is addressed by the above committees in addition to the Compensation Committee of Bancorp along with other executive compensation matters. Oversight of the trust department is addressed by the Trust Committee of the Bank. Corporate governance matters are addressed by the Nominating and Corporate Governance Committee of Bancorp. The full Board receives reports from each of these committees at the Board meeting immediately following the Committee meeting. The Bank’s Director of Internal Audit has a direct reporting line to the Audit Committee of the Board. The Chief Risk Officer, Information Security Officer and Compliance Officer make regular reports to the Audit and Risk Committees and the full Board when appropriate.

Shareholder Communications with the Board of Directors

Shareholders may communicate directly to the Board of Directors in writing by sending a letter to the Board at: Stock Yards Bancorp Board of Directors, P.O. Box 32890, Louisville, KY 40232-2890. Communications directed to the Board of Directors will be received by the Chairman and processed by the Nominating and Corporate Governance Committee when the communications concern matters related to the duties and responsibilities of the Board of Directors.

BOARD OF DIRECTORS’ MEETINGS AND COMMITTEES

During 2019, the Board of Directors of Stock Yards Bancorp held nine regularly scheduled meetings. All directors of Stock Yards Bancorp are also directors of the Bank. During 2019, the Bank’s Board of Directors also held nine regularly scheduled meetings.

All directors attended at least 75% of the number of meetings of the Board and committees of the Board on which they served that were held during the period he or she served as a director. All directors are encouraged to attend annual meetings of shareholders, and all attended the 2019 Annual Meeting.

Stock Yards Bancorp maintains an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and a Risk Committee of the Board of Directors. The Bank maintains a Trust Committee of the Board of Directors.

Audit Committee

The Board of Directors of Stock Yards Bancorp maintains an Audit Committee comprised of directors who are not officers of Stock Yards Bancorp. For 2019, the Audit Committee was comprised of Messrs. Herde (Chairman), Lechleiter and Schutte. Each of these individuals meets the Securities and Exchange Commission (“SEC”) and NASDAQ independence requirements for membership on an audit committee and each is financially literate within the meaning of the NASDAQ listing rules. The Board of Directors has adopted a written charter for the Audit Committee, and this charter is available on Stock Yards Bancorp’s website: www.syb.com.

The Audit Committee oversees Stock Yards Bancorp’s financial reporting process on behalf of the Board of Directors. Management has primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Committee, among other matters, considers the appointment of the external auditors for Stock Yards Bancorp, reviews with the auditors the plan and scope of the audit and audit fees, monitors the adequacy of reporting and internal controls, meets regularly with internal and external auditors, reviews the independence of the external auditors, reviews Stock Yards Bancorp’s financial results as reported in SEC filings, and approves all audit and permitted non-audit services performed by its external auditors. The Committee reviews and evaluates identified related party transactions and discusses with management the Company’s major financial risk exposures and the steps management has taken to monitor and control those exposures. The Audit Committee meets with our management at least quarterly to consider the adequacy of our internal controls and the objectivity of our financial reporting. This Committee also meets with the external auditors and with our internal auditors regarding these matters. Both the independent auditors and the internal auditors regularly meet privately with this Committee and have unrestricted access to this Committee. The Audit Committee held six meetings during 2019.

The Board of Directors has determined that Messrs. Herde and Lechleiter are audit committee financial experts for Stock Yards Bancorp and are independent as described in the paragraph above. See “REPORT OF THE AUDIT COMMITTEE” for more information.

Nominating and Corporate Governance Committee

The Board of Directors of Stock Yards Bancorp maintains a Nominating and Corporate Governance Committee. Members of this Committee are Messrs. Priebe (Chairman), Brown and Herde, all of whom are non-employee directors meeting the NASDAQ independence requirements for membership on a nominating and governance committee. Responsibilities of the Committee are set forth in a written charter satisfying the NASDAQ’s corporate governance standards, requirements of federal securities law and incorporating other best practices. The Board of Directors has adopted a written charter for the Nominating and Corporate Governance Committee, and this charter is available on Stock Yards Bancorp’s website: www.syb.com.

Among the Committee’s duties are identifying and evaluating candidates for election to the Board of Directors, including consideration of candidates suggested by shareholders. To submit a candidate for consideration by the Committee, a shareholder must provide written communication to the Committee. The Committee would apply the same board membership criteria to shareholder-nominated candidates as it would to Committee-nominated candidates. The Committee also assists the Board in determining the composition of Board committees, assessing the Board’s effectiveness and developing and implementing the Company’s corporate governance guidelines. This Committee held three meetings during 2019.

Compensation Committee

The Board of Directors of Stock Yards Bancorp maintains a Compensation Committee. Members of this Committee are Messrs. Lechleiter (Chairman), Priebe, Schutte and Tasman, all of whom meet the NASDAQ independence requirements for membership on the Compensation Committee. The Board of Directors has adopted a written charter for the Compensation Committee, and this charter is available on Stock Yards Bancorp’s website: www.syb.com. The responsibilities of this Committee include oversight of executive and Board compensation and related programs. The Compensation Committee held seven meetings during 2019. See “REPORT ON EXECUTIVE COMPENSATION” for more information.

Risk Committee

The Board of Directors of Stock Yards Bancorp maintains a Risk Committee. This Committee is responsible for monitoring the Bank’s commercial and consumer loan portfolio and the related credit risk. The Committee reviews and discusses with management its assessment of asset quality and trends in asset quality, credit quality administration and underwriting standards and the effectiveness of portfolio risk management systems. The Committee is also responsible for reviewing and approving significant lending and credit policies and compliance with those policies. Additionally, the Risk Committee has oversight responsibility for a wide range of enterprise-related risks within the Bank, including regulatory compliance, information security, cybersecurity, insurance and physical security. Members of this Committee are Messrs. Tasman (Chairman), Bickel, Heintzman and Ms. Heitzman. The Risk Committee held six regular meetings and one special meeting in 2019.

Trust Committee

The Board of Directors of Stock Yards Bank maintains a Trust Committee. The members of the Trust Committee are Ms. Heitzman (Chair) and Messrs. Bickel, Brown and Heintzman. The Trust Committee oversees the operations of the wealth management and trust department of the Bank to help ensure it operates in accordance with sound fiduciary principles and is in compliance with pertinent laws and regulations. This Committee held six meetings in 2019.

ITEM 1. ELECTION OF ELEVEN DIRECTORS

The Board of Directors presently consists of eleven members. Directors serve a one-year term and hold office until the Annual Meeting following the year of their election and until his or her successor is elected and qualified, subject to his or her death, resignation, retirement, removal or disqualification.

The eleven directors nominated by the Nominating and Corporate Governance Committee of the Board of Directors for election this year to hold office until the 2021 Annual Meeting and until their respective successors are elected and qualified are:

|

Name, Age and Year

Individual Became Director (1)

|

|

Principal Occupation;

Certain Directorships (2) (3)

|

|

|

|

|

|

Paul J. Bickel III

|

|

President, U.S. Specialties

|

|

Age 64

|

|

|

|

Director since 2017

|

|

|

|

|

|

|

|

J. McCauley Brown

|

|

Retired Vice President, Brown-Forman Corporation

|

|

Age 67

|

|

|

|

Director since 2015

|

|

|

|

|

|

|

|

David P. Heintzman (4)

|

|

Chairman of the Boards and Retired Chief Executive Officer,

|

|

Age 60

Director since 1992

|

|

Stock Yards Bancorp, Inc. and Stock Yards Bank & Trust Company

|

|

|

|

|

|

Donna L. Heitzman (4)

Age 67

Director since 2016

|

|

Retired Portfolio Manager,

KKR Prisma Capital

|

|

|

|

|

|

Carl G. Herde

Age 59

|

|

Vice President/Financial Policy,

Kentucky Hospital Association

|

|

Director since 2005

|

|

|

|

|

|

|

|

James A. Hillebrand

|

|

Chief Executive Officer,

|

|

Age 51

|

|

Stock Yards Bancorp, Inc. and Stock Yards Bank & Trust Company

|

|

Director since 2008

|

|

|

|

|

|

|

|

Richard A. Lechleiter (3)

|

|

President, Catholic Education Foundation of Louisville

|

|

Age 61

|

|

|

|

Director since 2007

|

|

|

|

Name, Age and Year

Individual Became Director (1)

|

|

Principal Occupation;

Certain Directorships (2) (3)

|

|

|

|

|

|

Stephen M. Priebe

|

|

President, Hall Contracting of Kentucky

|

|

Age 56

|

|

|

|

Director since 2012

|

|

|

|

|

|

|

|

John L. Schutte

|

|

Chief Executive Officer,

|

|

Age 56

|

|

GeriMed, Inc.

|

|

Director since 2018

|

|

|

|

|

|

|

|

Norman Tasman

|

|

President, Tasman Industries, Inc. and

|

|

Age 68

|

|

Tasman Hide Processing, Inc.

|

|

Director since 1995

|

|

|

|

|

|

|

|

Kathy C. Thompson

|

|

Senior Executive Vice President, Stock Yards Bancorp, Inc.

|

|

Age 58

|

|

and Stock Yards Bank & Trust Company, Manager of

|

|

Director since 1994

|

|

the Bank’s Wealth Management and Trust Department

|

|

|

|

|

|

(1)

|

Ages listed are as of December 31, 2019.

|

|

(2)

|

Each nominee has been engaged in his or her chief occupation for five years or more with the exception of Messrs. Brown, Heintzman, Herde, Hillebrand and Lechleiter and Ms. Heitzman as described below.

|

|

(3)

|

Mr. Lechleiter is a director of Amedisys, Inc., a publicly-traded healthcare services company. No other nominee holds, or at any time in the last five years has held, any directorship in a company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934 or subject to the requirements of Section 15(d) of such Act or any company registered as an investment company under the Investment Company Act of 1940, other than Stock Yards Bancorp.

|

|

(4)

|

There is no family relationship between Mr. Heintzman and Ms. Heitzman.

|

Our Board of Directors, through a process managed by the Nominating and Corporate Governance Committee, conducts an annual review of director independence. During this review, the Nominating and Corporate Governance Committee considers transactions and relationships between each director or any member of his or her immediate family and the Company. The purpose of this review is to determine whether any such relationships or transactions are inconsistent with a determination that the director is independent.

As a result of this review, and based upon the advice and recommendations of the Nominating and Corporate Governance Committee, the Board of Directors has affirmatively determined that Messrs. Bickel, Brown, Herde, Lechleiter, Priebe, Schutte and Tasman and Ms. Heitzman satisfy the independence requirements of the NASDAQ Stock Market. Mr. Heintzman served as an executive officer of the Bank until December 31, 2018 and does not satisfy these requirements. As current employees of the Bank, Mr. Hillebrand and Ms. Thompson also do not satisfy these requirements.

In performing its independence review, the Nominating and Corporate Governance Committee noted that the Bank and Mr. Heintzman have in the past made charitable donations to the Catholic Education Foundation of Louisville, of which Mr. Lechleiter is the President. However, the Committee determined that these relationships were not material to the director or his affiliated organization.

Our Articles of Incorporation and Bylaws require majority voting for the election of directors in uncontested elections. This means that the director nominees in an uncontested election for directors must receive a number of votes cast “for” his or her election that exceeds the number of votes cast “against.” The Company’s corporate governance guidelines further provide that any incumbent director who does not receive a majority of “for” votes in an uncontested election must, within five days following the certification of the election results, tender to the Chairman of the Board his or her resignation from the Board. The resignation will specify that it is effective upon the Board’s acceptance of the resignation. The Board will, through a process managed by the Nominating and Corporate Governance Committee and excluding the nominee in question, accept or reject the resignation within 90 days after certification of the shareholder vote. The Board will promptly communicate any action taken on the resignation.

Additional Information Regarding the Background and Qualifications of Director Nominees

The Nominating and Corporate Governance Committee considers the particular experience, qualifications, attributes and expertise of each nominee for election to the Board. Having directors with different points of view, professional experience, education and skills provides broader perspectives and more diverse considerations valuable to the directors as they fulfill their leadership roles. Potential Board candidates are evaluated based upon various criteria, including:

|

●

|

Direct industry knowledge, broad-based business experience, or professional skills that indicate the candidate will make a significant and immediate contribution to the Board’s discussion and decision-making in the array of complex issues facing Bancorp;

|

|

●

|

Behavior and reputation that indicate he or she is committed to the highest ethical standards and the values of Bancorp;

|

|

●

|

Special skills, expertise, and background that add to and complement the range of skills, expertise, and background of the existing directors;

|

|

●

|

The ability to contribute to broad Board responsibilities, including succession planning, management development, and strategic planning; and

|

|

●

|

Confidence that the candidate will effectively, consistently, and appropriately take into account and balance the legitimate interests and concerns of all Bancorp’s shareholders in reaching decisions.

|

Directors must have time available to devote to Board activities and to enhance their knowledge of Stock Yards Bancorp and the banking industry.

All non-management directors are required to own stock equal in value to at least $200,000 within three years of joining the Board and to maintain that minimum ownership level for the remainder of their service as a director. The Nominating and Corporate Governance Committee may exercise its discretion in enforcing the guidelines when the accumulation of Common Stock is affected by the price of Bancorp stock or changes in director compensation. Management directors also have ownership targets as set forth elsewhere in this Proxy Statement. All directors’ ownership positions exceed the requirement, and some of the more tenured directors are among the Company’s largest shareholders.

The Nominating and Corporate Governance Committee of the Board of Directors has presented a slate of eleven nominees for election as directors at the 2020 Annual Meeting. If elected, we expect that all of the aforementioned nominees will serve as directors and hold office until the 2021 annual meeting of shareholders and until their respective successors have been elected and qualified. However, if for any reason a nominee should become unable or unwilling to serve, proxies may be voted for another person nominated as a substitute by the Board of Directors, or the Board may reduce the number of directors to be elected.

All eleven nominees are standing for re-election and were last elected to the Board of Directors by shareholders at the 2019 Annual Meeting. Below is a summary of the Committee’s consideration and evaluation of each director nominee.

Mr. Bickel is founder and President of U.S. Specialties, a commercial building supply company. He has served as the managing member of several real estate development organizations in the Louisville area over the past 30 years. Outside of commercial endeavors, Mr. Bickel has been very active in the Louisville community, serving in a leadership capacity on numerous area non-profit boards. Mr. Bickel serves on the Risk Committee of Bancorp and the Bank’s Trust Committee.

Mr. Brown retired as a Vice President of Brown-Forman Corporation, a Fortune 1,000 company, in 2015. His extensive experience in business, management and accounting, and his deep ties to the Louisville community, bring valuable local and global perspectives to our Board. Additionally, his widespread commitment to community organizations in Louisville and beyond gives him a strong sense of the needs, prospects and potential of our region. Mr. Brown serves on the Nominating and Corporate Governance Committee of Bancorp and the Bank’s Trust Committee.

Mr. Heintzman retired as Chief Executive Officer of Bancorp and the Bank as of September 30, 2018. From October 1, 2018 through December 31, 2018, he held the position of Executive Chairman. Mr. Heintzman holds an accounting degree, and prior to joining the Bank, worked as a certified public accountant for an international accounting firm. He joined the Bank in 1985 and, prior to his appointment as Chief Executive Officer, held a series of executive positions, including Chief Financial Officer, Executive Vice President and President. In January 2005 he assumed the position of Chairman and Chief Executive Officer. Mr. Heintzman was instrumental in the Bank’s growth strategies and profitable execution. His commitment to ethical standards set the example for the Bank and its employees, and his tenure and experience in all areas of the business provide a unique perspective of the business and strategic direction of the Company. Mr. Heintzman serves on the Risk Committee of Bancorp and the Bank’s Trust Committee.

Ms. Heitzman, Certified Public Accountant, Chartered Financial Analyst, with expertise in the institutional credit markets and experience with investment strategies, provides our Board with a deep knowledge and understanding of capital markets, finance and accounting. Ms. Heitzman retired in 2016 as a portfolio manager for New York City based KKR Prisma Capital. She joined that company in 2004 to help construct and manage customized portfolios. Before joining KKR Prisma, Ms. Heitzman served in various capacities at AEGON USA, previously Providian Capital. As a portfolio manager in capital market strategies, she facilitated significant growth and broad diversification of a $1 billion fund portfolio. Ms. Heitzman serves on the Risk Committee of Bancorp and chairs the Bank’s Trust Committee.

Mr. Herde holds an accounting degree, is a Certified Public Accountant and joined Baptist Healthcare System, Inc., one of the largest not-for-profit health care systems in Kentucky, in 1984 as controller. He served as the Chief Financial Officer from 1993 until his retirement from Baptist in September 2016. He now serves as the Vice President/Financial Policy for the Kentucky Hospital Association. He has extensive experience in financial reporting and corporate finance. Mr. Herde chairs the Audit Committee of Bancorp and has been designated by the Board of Directors as an audit committee financial expert. He also serves on the Nominating and Corporate Governance Committee of Bancorp.

Mr. Hillebrand was appointed Chief Executive Officer of Bancorp and the Bank effective October 1, 2018. He joined Stock Yards Bank in 1996 as director and developer of the private banking group. Prior to joining the Bank, he was with a regional bank and a community bank where he specialized in private banking. He has directed the expansion of the Bank into the Indianapolis and Cincinnati markets and was named President in 2008.

Mr. Lechleiter is the President of the Catholic Education Foundation of Louisville. From February 2002 until his retirement in January 2014, he served as the Executive Vice President and Chief Financial Officer of Kindred Healthcare, Inc., a Fortune 500 healthcare services company based in Louisville. Mr. Lechleiter also served in senior financial positions at other large publicly held healthcare services companies such as Humana Inc. and HCA, Inc. during his professional financial career spanning nearly 35 years. His extensive experience in business leadership, financial reporting, corporate finance, investor relations, mergers and acquisitions and corporate governance is valuable to the Board. Mr. Lechleiter serves on the Audit Committee of Bancorp and has been designated by the Board of Directors as an audit committee financial expert. He also chairs the Compensation Committee of Bancorp.

Mr. Priebe is President of Hall Contracting of Kentucky, which provides construction services in the areas of heavy construction, asphalt, civil, pipeline, and highway and bridge construction. A registered professional civil engineer, he began his career at Hall in 1986. Mr. Priebe has had extensive involvement with many civic organizations throughout his career. He has worked with the Kentucky Transportation Cabinet Disadvantaged Business Enterprise Training Program and is actively mentoring a local electric contractor. Mr. Priebe’s business acumen and familiarity with the local and regional economic climate bring valuable perspective to the Board. Mr. Priebe serves on the Compensation Committee and chairs the Nominating and Corporate Governance Committee of Bancorp.

Mr. Schutte is Chief Executive Officer of GeriMed, Inc., a nationwide group purchasing organization specializing in long-term care pharmacy services for independent pharmacies that serve long-term care providers, such as nursing homes, assisted living facilities, and hospice, as well as prison populations. In February 2017, he founded MainPointe Pharmaceuticals, a national company that markets and distributes pharmaceuticals as well as over-the-counter products and supplements. He also previously served as Chairman of the Board of VistaPharm, for which he was the largest shareholder, until it was sold in December 2015. Mr. Schutte is also involved in numerous commercial real estate development projects in the Louisville area and elsewhere. His entrepreneurial skills and insights and strong reputation in the Louisville business community are beneficial to the Board. He serves on the Audit Committee and Compensation Committee of Bancorp.

Mr. Tasman is President of Tasman Industries, Inc. and Tasman Hide Processing headquartered in Louisville. This family-owned business was founded in 1947 and operates 14 locations in North America with offices in Europe and Asia. The company produces leather and finished products used by the military and general population. Mr. Tasman’s extensive knowledge of consumer demands and global business trends brings a unique perspective to the Board. He serves on the Compensation Committee and chairs the Risk Committee of Bancorp.

Ms. Thompson joined the Bank in 1992 as Manager of the Wealth Management and Trust Department, at which time the trust department had $200 million in assets under management. Under her leadership, the department has grown to $3.3 billion in assets under management and is one of the most profitable bank-owned trust companies in the country. Prior to joining the Company, Ms. Thompson practiced estate planning law and worked in a regional bank’s trust department where she specialized in investment management and estate and personal financial planning.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF EACH OF THESE NOMINEES

ITEM 2. RATIFICATION OF THE SELECTION OF THE INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected BKD, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020 and has directed that management submit the selection of the independent registered public accounting firm to shareholders for ratification at the Annual Meeting. The firm of BKD, LLP has served as the Company’s auditors since June 7, 2018. Representatives of BKD, LLP are expected to be present at the meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Shareholder ratification of the selection of BKD, LLP as the Company’s independent registered public accounting firm is not required by the Company’s Bylaws or otherwise. However, we are submitting the selection of BKD, LLP to the shareholders for ratification as a matter of sound corporate practice. If the shareholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain BKD, LLP. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent audit firm at any time during the year if it is determined that such a change would be in the best interests of the Company and its shareholders.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE RATIFICATION OF THE SELECTION OF BKD, LLP

ITEM 3. ADVISORY VOTE ON EXECUTIVE COMPENSATION

We are asking our shareholders to provide an advisory vote on the compensation of the named executive officers disclosed in the REPORT ON EXECUTIVE COMPENSATION section of this Proxy Statement. We have included this proposal among the items to be considered at the Annual Meeting pursuant to the requirements of Section 14A of the Securities Exchange Act of 1934. While this vote is non-binding on our Company and the Board of Directors, it will provide the Compensation Committee with information regarding investor sentiment regarding our executive compensation philosophy, policies and practices which the Committee will be able to consider when determining future executive compensation arrangements. Our current policy is to hold an advisory vote on executive compensation each year. We expect to hold the next advisory vote at our 2021 Annual Meeting of Shareholders. Following is a summary of some of the key points of our 2019 executive compensation program. See the REPORT ON EXECUTIVE COMPENSATION section of this Proxy Statement for more information.

The pay-for-performance compensation philosophy of the Compensation Committee supports Stock Yards Bancorp’s primary objective of creating value for its shareholders. The Committee strives to ensure that compensation of Stock Yards Bancorp’s executive officers is market-competitive to attract and retain talented individuals to lead Stock Yards Bancorp and the Bank to growth and higher profitability while maintaining stability and capital strength. Our executive compensation program has been designed to align managements’ interests with those of our shareholders. In addition, the program seeks to mitigate risks related to compensation. In designing the 2019 compensation program, the Compensation Committee used key performance measurements to motivate our executive officers to achieve short-term and long-term business goals after reviewing peer and market data and the Company’s business expectations for 2019.

We believe that the information provided regarding executive compensation in this Proxy Statement demonstrates that our executive compensation program was designed appropriately and is working to maximize shareholder return while mitigating risk and aligning managements’ interests with our shareholders. Accordingly, the Board of Directors recommends that shareholders approve the following advisory resolution:

RESOLVED, that the shareholders of Stock Yards Bancorp, Inc. approve, on an advisory basis, the compensation paid to the Company’s named executive officers as disclosed in the Stock Yards Bancorp, Inc. Proxy Statement pursuant to the executive compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other executive compensation tables and related narratives.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DESCRIBED IN THIS PROXY STATEMENT

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Set forth in the following table is the beneficial ownership of our Common Stock as of December 31, 2019 for each person or entity known by us to beneficially own more than five percent of the outstanding shares of our Common Stock; all our directors and executive officers as a group; and directors, executive officers and employees as a group. “Executive officer” means the chairman, president, any vice president in charge of a principal business unit, division or function, or other officer who performs a policy making function or any other person who performs similar policy making functions and is so designated by the Board of Directors. For a description of the voting and investment power with respect to the shares beneficially owned by the current directors, nominees for election as directors and named executive officers of Stock Yards Bancorp, see the following tables.

|

Name of Beneficial Owner

|

|

Amount and Nature

of Beneficial

Ownership

|

|

|

Percent of Stock

Yards Bancorp

Common Stock (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

BlackRock, Inc.

|

|

|

1,571,146(2)

|

|

|

|

7.0%

|

|

|

55 East 52nd Street

|

|

|

|

|

|

|

|

|

|

New York, NY 10055

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock Yards Bank & Trust Company

|

|

|

1,293,068(3)

|

|

|

|

5.7%

|

|

|

1040 East Main Street

|

|

|

|

|

|

|

|

|

|

Louisville, KY 40206

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors and executive officers of Bancorp and

|

|

|

1,535,130(4)

|

|

|

|

6.7%

|

|

|

the Bank as a group (17 persons)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors, executive officers, and employees of

|

|

|

2,203,685(4) (5)

|

|

|

|

9.6%

|

|

|

Bancorp and the Bank as a group (542 persons)

|

|

|

|

|

|

|

|

|

|

(1)

|

Shares of Stock Yards Bancorp Common Stock subject to outstanding stock appreciation rights (“SARs”) that are currently exercisable or may become exercisable within the following 60 days under Stock Yards Bancorp’s Stock Incentive Plans are deemed outstanding for purposes of computing the percentage of Stock Yards Bancorp Common Stock beneficially owned by the person and group holding such SARs but are not deemed outstanding for purposes of computing the percentage of Stock Yards Bancorp Common Stock beneficially owned by any other person or group.

|

|

(2)

|

Based upon Schedule 13G/A filed with the SEC as of December 31, 2019.

|

|

(3)

|

The Bank holds these shares in its various fiduciary capacities as agent, personal representative, custodian and trustee. Of these shares, (a) all are held with sole voting power, (b) 887,280 shares are held with sole investment power, and (c) 188,777 shares are held with shared investment power.

|

|

(4)

|

Includes 412,522 shares held by directors and executive officers subject to outstanding SARs that are currently exercisable or may become exercisable within the following 60 days and 96,925 shares held in KSOP accounts.

|

|

(5)

|

The shares held by the group include those described in note (4) above and 271,932 shares held by non-executive officers and employees of the Bank. In addition, includes 26,775 shares subject to outstanding SARs that are currently exercisable or may become exercisable within the following 60 days held by non-executive officers of the Bank and 369,848 shares held by non-executive officers and employees of the Bank in their KSOP accounts, with sole voting power and investment power. Stock Yards Bancorp has not undertaken the expense and effort of compiling the number of shares other officers and employees of the Bank may hold other than directly in their own name.

|

The following table shows the beneficial ownership of Stock Yards Bancorp, Inc.’s Common Stock as of December 31, 2019 by each current director, each nominee for election as director and each named executive officer.

|

Name

|

|

Number of Shares

Beneficially

Owned(1) (2) (3) (4)

|

|

Percent of Stock

Yards Bancorp

Common Stock

|

|

Paul J. Bickel III

|

|

|

12,248

|

(6)

|

|

|

(5)

|

|

|

J. McCauley Brown

|

|

|

12,533

|

(7)

|

|

|

(5)

|

|

|

Nancy B. Davis

|

|

|

130,603

|

|

|

|

(5)

|

|

|

William M. Dishman III

|

|

|

60,659

|

(8)

|

|

|

(5)

|

|

|

David P. Heintzman

|

|

|

310,903

|

(9)

|

|

|

1.36%

|

|

|

Donna L. Heitzman

|

|

|

9,465

|

(10)

|

|

|

(5)

|

|

|

Carl G. Herde

|

|

|

55,545

|

|

|

|

(5)

|

|

|

James A. Hillebrand

|

|

|

207,932

|

(11)

|

|

|

(5)

|

|

|

Richard A. Lechleiter

|

|

|

26,540

|

(12)

|

|

|

(5)

|

|

|

Philip S. Poindexter

|

|

|

89,923

|

(13)

|

|

|

(5)

|

|

|

Stephen M. Priebe

|

|

|

21,894

|

|

|

|

(5)

|

|

|

John L. Schutte

|

|

|

81,533

|

(14)

|

|

|

(5)

|

|

|

T. Clay Stinnett

|

|

|

85,434

|

(15)

|

|

|

(5)

|

|

|

Norman Tasman

|

|

|

310,361

|

(16)

|

|

|

1.35%

|

|

|

Kathy C. Thompson

|

|

|

68,934

|

|

|

|

(5)

|

|

|

(1)

|

Includes, where noted, shares in which members of the director’s, nominee’s or executive officer’s immediate family have a beneficial interest. The column does not, however, include the interest of certain of the listed directors, nominees or executive officers in shares held by other non-dependent family members in their own right. In each case, the principal disclaims beneficial ownership of any such shares, and declares that the listing in this Proxy Statement should not be construed as an admission that the principal is the beneficial owner of any such securities.

|

|

(2)

|

Includes shares subject to outstanding SARs that are currently exercisable or may become exercisable within the following 60 days and unvested restricted shares issued under Stock Yards Bancorp’s Stock Incentive Plan(s) as follows:

|

|

Name

|

|

Number of

SARs

|

|

Number of

Unvested Restricted

Stock Grants

|

|

Bickel

|

|

|

200

|

|

|

|

894

|

|

|

Brown

|

|

|

1,200

|

|

|

|

894

|

|

|

Davis

|

|

|

30,966

|

|

|

|

-

|

|

|

Dishman

|

|

|

31,476

|

|

|

|

-

|

|

|

Heintzman

|

|

|

133,149

|

|

|

|

894

|

|

|

Heitzman

|

|

|

600

|

|

|

|

894

|

|

|

Herde

|

|

|

-

|

|

|

|

894

|

|

|

Hillebrand

|

|

|

107,005

|

|

|

|

-

|

|

|

Lechleiter

|

|

|

-

|

|

|

|

894

|

|

|

Poindexter

|

|

|

48,136

|

|

|

|

-

|

|

|

Priebe

|

|

|

1,500

|

|

|

|

894

|

|

|

Schutte

|

|

|

200

|

|

|

|

894

|

|

|

Stinnett

|

|

|

42,538

|

|

|

|

-

|

|

|

Tasman

|

|

|

-

|

|

|

|

894

|

|

|

Thompson

|

|

|

12,652

|

|

|

|

-

|

|

|

(3)

|

Includes shares held in Directors’ Deferred Compensation Plan as follows:

|

|

|

|

Number

|

|

Name

|

|

of Shares

|

|

Bickel

|

|

|

3,074

|

|

|

Brown

|

|

|

2,600

|

|

|

Heitzman

|

|

|

5,071

|

|

|

Herde

|

|

|

24,053

|

|

|

Hillebrand

|

|

|

452

|

|

|

Lechleiter

|

|

|

20,256

|

|

|

Priebe

|

|

|

16,775

|

|

|

Schutte

|

|

|

1,779

|

|

|

Tasman

|

|

|

68,804

|

|

|

(4)

|

Includes shares held in the Company’s KSOP as follows:

|

|

|

|

Number

|

|

Name

|

|

of Shares

|

|

Dishman

|

|

|

6,624

|

|

|

Hillebrand

|

|

|

22,651

|

|

|

Poindexter

|

|

|

12,986

|

|

|

Stinnett

|

|

|

11,808

|

|

|

Thompson

|

|

|

33,640

|

|

|

(5)

|

Less than one percent of outstanding Stock Yards Bancorp Common Stock.

|

|

(6)

|

Includes 7,500 shares held jointly by Mr. Bickel and his wife.

|

|

(7)

|

Includes 3,987 shares owned by Mr. Brown’s wife.

|

|

(8)

|

Includes 5,055 shares owned by Mr. Dishman’s wife.

|

|

(9)

|

Includes 33,070 shares owned by Mr. Heintzman’s wife.

|

|

(10)

|

Includes 1,700 shares held jointly by Ms. Heitzman and her husband; and 200 shares owned by Ms. Heitzman’s husband.

|

|

(11)

|

Includes 18,153 shares held jointly by Mr. Hillebrand and his wife; 11,634 shares owned by Mr. Hillebrand’s wife; and 586 shares held as custodian for children.

|

|

(12)

|

Includes 1,400 shares held as custodian for children and 1,300 shares owned by Mr. Lechleiter’s mother.

|

|

(13)

|

Includes 291 shares held as custodian for Mr. Poindexter’s children.

|

|

(14)

|

Includes 2,250 shares owned by Mr. Schutte’s wife.

|

|

(15)

|

Includes 405 shares owned by Mr. Stinnett’s wife and 170 shares held as custodian for their children.

|

|

(16)

|

Includes 89,038 shares held jointly by Mr. Tasman and his wife; and 7,027 shares held as custodian for their son.

|

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our executive officers, our directors and persons who own more than 10% of a registered class of Stock Yards Bancorp’s Common Stock to file initial reports of ownership and changes in ownership with the SEC and the NASDAQ. Based solely on a review of the ownership reports filed electronically with the SEC during 2019 and written representations from the applicable executive officers and our directors, all persons subject to the reporting requirements of Section 16(a) filed the required reports on a timely basis for the year ended December 31, 2019, with the exception of Mr. Tasman, who filed one late report in connection with a single transaction. He purchased approximately 145 shares on March 22, 2019 and reported the transaction on March 27, 2019. The purchase was a recurring monthly investment of his director fees and the required report was not filed on a timely basis due to an administrative error.

EXECUTIVE COMPENSATION AND OTHER INFORMATION

REPORT ON EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This compensation discussion and analysis (“CD&A”) describes the philosophy, objectives, process, components and additional aspects of our 2019 executive compensation program. This CD&A is intended to be read in conjunction with the tables and related narrative disclosure that immediately follow this section, which provide further historical compensation information for the following named executive officers (“NEOs”):

|

Name

|

Position

|

|

James A. Hillebrand

|

Chief Executive Officer (“CEO”)

|

|

Philip S. Poindexter

|

President

|

|

T. Clay Stinnett (1)

|

Executive Vice President, Treasurer and Chief Financial Officer (“CFO”)

|

|

Kathy C. Thompson

|

Senior Executive Vice President, Wealth Management Group

|

|

William M. Dishman III

|

Executive Vice President, Chief Risk Officer

|

|

Nancy B. Davis (2)

|

Former Chief Financial Officer

|

|

(1)

|

Mr. Stinnett was appointed CFO effective May 1, 2019.

|

|

(2)

|

Ms. Davis retired from the Company as CFO on April 30, 2019.

|

CD&A Reference Guide

|

Executive Summary

|

Section I

|

|

Compensation Philosophy and Objectives

|

Section II

|

|

Compensation Determination Process

|

Section III

|

|

Components of Our Compensation Program

|

Section IV

|

|

Additional Compensation Policies and Practices

|

Section V

|

2019 Select Business Results

2019 was a very strong year for us, the continuation of a notable streak, with record operating and net income results.

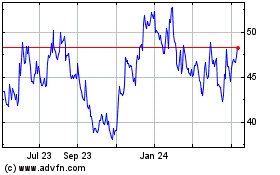

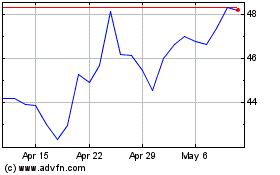

We continued our track record of performing at the top of our peer group on key profitability measures such as return on average assets (“ROAA”) and return on average equity (“ROAE”). The following charts demonstrate the positioning of our ROAA and ROAE compared to the peer group described on page 25 over each of the last five years. As shown below, we ranked in the top 10% of our peer group in every one of the last five years. In addition, our average ROAA and ROAE over that five-year period were both higher than that of any of our peers.

Financial Results

|

●

|

Net income grew 19% to $66.1 million

|

|

●

|

Earnings per share (“EPS”) increased 19% to $2.89 per diluted share

|

|

●

|

ROAE was 17.09%, an increase from 16.00% the prior year

|

|

●

|

ROAA was 1.90%, an increase from 1.76% the prior year

|

Operating Results

|

●

|

Loans increased $297 million, or 12%, driven by record loan production and net loan growth

|

|

●

|

Asset and credit quality remained strong, among the highest relative to our peers

|

|

●

|

Total revenue, comprising fully tax equivalent net interest income and non-interest income, of $175.2 million, surpassed the previous record of $160.1 million in 2018

|

2019 Shareholder Return

|

●

|

1-year total shareholder return (“TSR”): 28.7%; 3-year TSR: -5.6%; and 5-year TSR: 109.4%

|

|

●

|

Substantial and sustained dividend payout ratio; new dividend rate set in May 2019; rate raised 12 times since 2013, including twice per year from 2013 through 2019

|

|

●

|

Acquired King Bancorp, Inc., the holding company for King Southern Bank (“KSB”), on May 1, 2019, with $192 million in total assets

|

Performance Orientation of 2019 Compensation

CEO Compensation Majority Performance-Based (Equity and Total). The Compensation Committee (the “Committee”) of our Board of Directors is responsible for the design and administration of our executive compensation program. The Committee’s philosophy is to place at risk a significant portion of executive officers’ total compensation, making it contingent on Company performance while remaining consistent with our risk management policies. As such, the Committee has structured the majority of the compensation of the CEO as variable, at-risk and subject to the achievement of performance goals in order to be earned. Approximately 52% of the CEO’s total grant date target direct compensation, consisting of base salary, target short-term incentive opportunity and target long-term incentive opportunity, was variable, at-risk and performance-based. 75% of the long-term incentive equity grants were performance-based and were in the form of performance share units (“PSUs”). These PSUs are subject to three-year performance metrics tied to our key operating goals, and will vest at the end of a three-year performance period, subject to a mandatory one-year post-vesting holding period. The other 25% were in the form of time-based stock appreciation rights (“SARs”) that vest over five years.