Steve Madden (Nasdaq: SHOO), a leading designer and marketer of

fashion-forward footwear, accessories and apparel for women, men

and children, today announced financial results for the third

quarter and nine months ended September 30, 2019.

Amounts referred to as “Adjusted”

exclude the items that are described under the heading “Non-GAAP

Adjustments.”

For the Third Quarter

2019:

- Net sales increased 8.5% to $497.3 million compared to $458.5

million in the same period of 2018.

- Gross margin was 38.4% compared to 38.2% in the same period

last year, an increase of 20 basis points.

- Operating expenses as a percentage of net sales were 25.2%

compared to 24.0% of net sales in the same period of 2018.

Adjusted operating expenses as a percentage of net sales were 24.3%

compared to 23.9% of net sales in the same period of 2018.

- Income from operations totaled $68.0 million, or 13.7% of net

sales, compared to $70.2 million, or 15.3% of net sales, in the

same period of 2018. Adjusted income from operations was

$72.3 million, or 14.5% of net sales, compared to Adjusted income

from operations of $70.6 million, or 15.4% of net sales, in the

same period of 2018.

- Net income attributable to Steven Madden, Ltd. was $52.5

million, or $0.63 per diluted share, compared to $55.6 million, or

$0.64 per diluted share, in the prior year’s third quarter.

Adjusted net income attributable to Steven Madden, Ltd. was $56.0

million, or $0.67 per diluted share, compared to $55.9 million, or

$0.65 per diluted share, in the prior year’s third quarter.

Edward Rosenfeld, Chairman and Chief Executive

Officer, commented, “We are pleased with our third quarter results,

which included adjusted earnings that significantly exceeded our

expectations driven by strong performance in our Steve Madden and

Blondo brands. We also completed two acquisitions during the

quarter that provide meaningful growth opportunities going

forward: GREATS, a pioneering digitally native sneaker brand,

and BB Dakota, a contemporary women’s apparel company. Based

on the strong performance in third quarter and the continued

momentum in our underlying business, we are raising our 2019 EPS

guidance despite incremental earnings pressure from the

implementation of the 15% tariff on List 4 products from

China. Looking out further, the power of our brands and the

strength of our business model give us confidence that we can

continue to drive earnings growth and create value for shareholders

over the long term.”

Third Quarter 2019

Segment Results

Net sales for the wholesale business increased

8.5% to $421.6 million in the third quarter of 2019, with strong

growth in the wholesale footwear and the wholesale

accessories/apparel segments. Wholesale footwear net sales

rose 6.3% driven by gains in Blondo, Steve Madden Women's and

private label. Wholesale accessories/apparel net sales increased

15.8% driven by strong growth in Steve Madden handbags as well as

the addition of the BB Dakota apparel business. Gross margin

in the wholesale business decreased to 33.9% compared to 34.3% in

last year’s third quarter as an increase in the wholesale footwear

gross margin was more than offset by a decrease in the wholesale

accessories/apparel gross margin due primarily to the tariff on

goods imported from China.

Retail net sales in the third quarter rose 8.3%

to $75.7 million compared to $69.9 million in the third quarter of

the prior year. Same store sales increased 5.1% in the

quarter driven by strong performance in the Company’s e-commerce

business. Retail gross margin increased to 63.3% in the third

quarter of 2019 compared to 60.1% in the third quarter of the prior

year due primarily to reduced promotional activity.

The Company ended the quarter with 227

company-operated retail locations, including eight Internet stores,

as well as 32 company-operated concessions in international

markets.

The Company’s effective tax rate for the third

quarter of 2019 was 23.0% compared to 20.8% in the third quarter of

2018. On an Adjusted basis, the effective tax rate for the

third quarter of 2019 was 22.6%.

Balance Sheet and Cash Flow

During the third quarter of 2019, the Company

repurchased 784,757 shares of the Company’s common stock for

approximately $25.3 million, which includes shares acquired through

the net settlement of employee stock awards.

As of September 30, 2019, cash, cash

equivalents and current marketable securities totaled $194.9

million.

Increased Quarterly

Dividend

The Company’s Board of Directors approved a

quarterly cash dividend of $0.15 per share, reflecting a 7%

increase over the previous quarterly dividend. The dividend

will be paid on December 27, 2019, to stockholders of record at the

close of business on December 16, 2019.

Updated Fiscal Year 2019

Outlook

The Company is raising its fiscal year 2019 net

sales and diluted EPS guidance. For fiscal year 2019, the

Company now expects net sales will increase 7% to 7.5% over net

sales in 2018 compared to previous guidance of a 5% to 7% increase

over net sales in 2018. The Company now expects diluted EPS

for fiscal year 2019 will be in the range of $1.83 to $1.86

compared to the previous range of $1.74 to $1.82. The Company

now expects Adjusted diluted EPS for fiscal year 2019 will be in

the range of $1.92 to $1.95 compared to the previous range of $1.78

to $1.86.

Non-GAAP Adjustments

Amounts referred to as “Adjusted” exclude the

items below.

For the third quarter 2019:

- $3.1 million pre-tax ($2.3 million after-tax) expense in

connection with a provision for early lease termination charges and

impairment of lease right-of-use assets, included in operating

expenses.

- $1.1 million pre-tax ($0.8 million after-tax) expense in

connection with the acquisitions of GREATS and BB Dakota, included

in operating expenses.

- $0.4 million tax expense in connection with deferred tax

adjustments.

For the third quarter 2018:

- $0.4 million pre-tax ($0.3 million after-tax) expense in

connection with the integration of the Schwartz & Benjamin

acquisition and the related restructuring, included in operating

expenses.

For the fiscal year 2019 outlook:

- $5.4 million pre-tax ($4.1 million after-tax) expense in

connection with early lease termination charges and impairment of

lease right-of-use assets.

- $4.1 million pre-tax ($3.0 million after-tax) non-cash expense

associated with the impairment of the Brian Atwood trademark.

- $1.9 million pre-tax ($1.4 million after-tax) net benefit

associated with the change in a contingent liability and the

acceleration of amortization related to the termination of the Kate

Spade license agreement as of December 31, 2019.

- $1.1 million pre-tax ($1.0 million after-tax) expense in

connection with the acquisitions of GREATS and BB Dakota, included

in operating expenses.

- $0.7 million pre-tax ($0.5 million after-tax) expense in

connection with a divisional headquarters relocation.

- $0.3 million pre-tax ($0.3 million after-tax) recovery, net of

bad debt expense, associated with the Payless ShoeSource

bankruptcy.

- $0.5 million tax expense in connection with deferred tax

adjustments.

Reconciliations of amounts on a GAAP basis to

Adjusted amounts are presented in the Non-GAAP Reconciliation

tables at the end of this release and identify and quantify all

excluded items.

Conference Call Information

Interested stockholders are invited to listen to

the third quarter earnings conference call scheduled for today,

October 29, 2019, at 8:30 a.m. Eastern Time. The call will be

broadcast live over the Internet and can be accessed by logging

onto http://stevemadden.gcs-web.com. An online archive of the

broadcast will be available within one hour of the conclusion of

the call and will be accessible for a period of 30 days following

the call.

About Steve Madden

Steve Madden designs, sources and markets

fashion-forward footwear, accessories and apparel for women, men

and children. In addition to marketing products under its own

brands including Steve Madden®, Dolce Vita®, Betsey Johnson®,

Blondo®, Report®, Brian Atwood®, Cejon®, GREATS®, BB Dakota®, Mad

Love® and Big Buddha®, Steve Madden is a licensee of various

brands, including Anne Klein®, Kate Spade®, Superga® and

DKNY®. Steve Madden also designs and sources products under

private label brand names for various retailers. Steve

Madden’s wholesale distribution includes department stores,

specialty stores, luxury retailers, national chains and mass

merchants. Steve Madden also operates 227 retail stores

(including eight Internet stores). Steve Madden licenses

certain of its brands to third parties for the marketing and sale

of certain products, including ready-to-wear, outerwear, eyewear,

hosiery, jewelry, fragrance, luggage and bedding and bath

products. For local store information and the latest Steve

Madden booties, pumps, men’s and women’s boots, fashion sneakers,

dress shoes, sandals and more, visit

http://www.stevemadden.com.

Safe Harbor

This press release and oral statements made from

time to time by representatives of the Company contain certain

“forward looking statements” as that term is defined in the federal

securities laws. The events described in forward looking statements

may not occur. Generally, these statements relate to business plans

or strategies, projected or anticipated benefits or other

consequences of the Company’s plans or strategies, projected or

anticipated benefits from acquisitions to be made by the Company,

or projections involving anticipated revenues, earnings or other

aspects of the Company’s operating results. The words “may,”

“will,” “expect,” “believe,” “anticipate,” “project,” “plan,”

“intend,” “estimate,” and “continue,” and their opposites and

similar expressions are intended to identify forward looking

statements. The Company cautions you that these statements concern

current expectations about the Company’s future results and

condition and are not guarantees of future performance or events

and are subject to a number of uncertainties, risks and other

influences, many of which are beyond the Company’s control, that

may influence the accuracy of the statements and the projections

upon which the statements are based. Factors which may affect the

Company’s results include, but are not limited to, the risks and

uncertainties discussed in the Company’s Annual Report on Form

10-K, Quarterly Reports on Form 10-Q and Current Reports on Form

8-K filed with the Securities and Exchange Commission. Any one or

more of these uncertainties, risks and other influences could

materially affect the Company’s results of operations and financial

condition and whether forward looking statements made by the

Company ultimately prove to be accurate and, as such, the Company’s

actual results, performance and achievements could differ

materially from those expressed or implied in these forward looking

statements. The Company undertakes no obligation to publicly update

or revise any forward looking statements, whether as a result of

new information, future events or otherwise.

STEVEN MADDEN, LTD. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS DATA

(In thousands, except per share amounts)

(Unaudited)

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, 2019 |

|

September 30, 2018 |

|

September 30, 2019 |

|

September 30, 2018 |

| |

|

|

|

|

|

|

|

|

Net sales |

$ |

497,308 |

|

|

$ |

458,482 |

|

|

$ |

1,353,222 |

|

|

$ |

1,243,249 |

|

|

Cost of sales |

306,277 |

|

|

283,265 |

|

|

|

839,849 |

|

|

|

779,525 |

|

|

Gross profit |

191,031 |

|

|

175,217 |

|

|

|

513,373 |

|

|

|

463,724 |

|

|

Commission and licensing fee income, net |

2,157 |

|

|

4,994 |

|

|

|

6,531 |

|

|

|

10,897 |

|

|

Operating expenses |

125,147 |

|

|

110,007 |

|

|

|

358,520 |

|

|

|

326,276 |

|

|

Impairment charges |

— |

|

|

— |

|

|

|

4,050 |

|

|

|

— |

|

|

Income from operations |

68,041 |

|

|

70,204 |

|

|

|

157,334 |

|

|

|

148,345 |

|

|

Interest and other income, net |

961 |

|

|

872 |

|

|

|

3,415 |

|

|

|

2,502 |

|

|

Income before provision for income taxes |

69,002 |

|

|

71,076 |

|

|

|

160,749 |

|

|

|

150,847 |

|

|

Provision for income taxes |

15,886 |

|

|

14,757 |

|

|

|

36,257 |

|

|

|

32,885 |

|

|

Net income |

53,116 |

|

|

56,319 |

|

|

|

124,492 |

|

|

|

117,962 |

|

| Less: net income attributable

to noncontrolling interest |

653 |

|

|

756 |

|

|

|

932 |

|

|

|

1,316 |

|

|

Net income attributable to Steven Madden, Ltd. |

$ |

52,463 |

|

|

$ |

55,563 |

|

|

$ |

123,560 |

|

|

$ |

116,646 |

|

| |

|

|

|

|

|

|

|

|

Basic income per share |

$ |

0.66 |

|

|

$ |

0.68 |

|

|

$ |

1.55 |

|

|

$ |

1.43 |

|

| |

|

|

|

|

|

|

|

|

Diluted income per share |

$ |

0.63 |

|

|

$ |

0.64 |

|

|

$ |

1.48 |

|

|

$ |

1.35 |

|

| |

|

|

|

|

|

|

|

| Basic weighted average common

shares outstanding |

79,092 |

|

|

81,727 |

|

|

|

79,854 |

|

|

|

81,832 |

|

| |

|

|

|

|

|

|

|

| Diluted weighted average

common shares outstanding |

83,106 |

|

|

86,574 |

|

|

|

83,740 |

|

|

|

86,273 |

|

| |

|

|

|

|

|

|

|

| Cash dividends declared per

common share |

$ |

0.14 |

|

|

$ |

0.13 |

|

|

$ |

0.42 |

|

|

$ |

0.39 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

STEVEN MADDEN, LTD. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET

DATA

(In thousands)

| |

|

|

As of |

|

|

| |

September 30, 2019 |

|

December 31, 2018 |

|

September 30, 2018 |

| |

(Unaudited) |

|

|

|

(Unaudited) |

| |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

167,492 |

|

|

$ |

200,031 |

|

|

$ |

172,537 |

|

| Marketable securities |

27,452 |

|

|

66,968 |

|

|

57,896 |

|

| Accounts receivable, net |

335,503 |

|

|

266,452 |

|

|

332,049 |

|

| Inventories |

148,053 |

|

|

137,247 |

|

|

147,491 |

|

| Other current assets |

28,586 |

|

|

32,427 |

|

|

43,966 |

|

| Property and equipment,

net |

60,662 |

|

|

64,807 |

|

|

65,472 |

|

| Operating lease right-of-use

assets |

162,385 |

|

|

— |

|

|

— |

|

| Goodwill and intangibles,

net |

334,341 |

|

|

291,423 |

|

|

295,269 |

|

| Other assets |

17,991 |

|

|

13,215 |

|

|

10,379 |

|

| Total assets |

$ |

1,282,465 |

|

|

$ |

1,072,570 |

|

|

$ |

1,125,059 |

|

| |

|

|

|

|

|

| Accounts payable |

$ |

90,278 |

|

|

$ |

79,802 |

|

|

$ |

94,636 |

|

| Operating leases (current

& non-current) |

177,772 |

|

|

— |

|

|

— |

|

| Other current liabilities |

124,356 |

|

|

141,887 |

|

|

121,894 |

|

| Contingent payment

liability |

9,770 |

|

|

3,000 |

|

|

3,000 |

|

| Other long-term

liabilities |

30,053 |

|

|

33,199 |

|

|

38,332 |

|

| Total Steven Madden, Ltd.

stockholders’ equity |

838,738 |

|

|

805,814 |

|

|

859,770 |

|

| Noncontrolling interest |

11,498 |

|

|

8,868 |

|

|

7,427 |

|

| Total liabilities and

stockholders’ equity |

$ |

1,282,465 |

|

|

$ |

1,072,570 |

|

|

$ |

1,125,059 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

STEVEN MADDEN, LTD. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED CASH FLOW

DATA

(In thousands)

(Unaudited)

| |

Nine Months Ended |

| |

September 30, 2019 |

|

September 30, 2018 |

| |

|

|

|

|

Net cash provided by operating activities |

$ |

83,158 |

|

|

$ |

46,466 |

|

| |

|

|

|

| Investing Activities |

|

|

|

| Purchases of property and

equipment |

(9,211 |

) |

|

(8,164 |

) |

| Sales of marketable

securities, net |

40,331 |

|

|

33,842 |

|

| Acquisitions, net of cash

acquired |

(36,753 |

) |

|

— |

|

| Net cash (used in) / provided

by investing activities |

(5,633 |

) |

|

25,678 |

|

| |

|

|

|

| Financing Activities |

|

|

|

| Common stock share repurchases

for treasury |

(76,505 |

) |

|

(50,880 |

) |

| Investment of noncontrolling

interest |

1,283 |

|

|

— |

|

| Distribution of noncontrolling

interest earnings |

(1,113 |

) |

|

— |

|

| Payment of contingent

liability |

— |

|

|

(7,000 |

) |

| Proceeds from exercise of

stock options |

2,606 |

|

|

12,801 |

|

| Cash dividends paid |

(35,805 |

) |

|

(35,147 |

) |

| Net cash used in financing

activities |

(109,534 |

) |

|

(80,226 |

) |

| |

|

|

|

| Effect of exchange rate

changes on cash and cash equivalents |

(530 |

) |

|

(595 |

) |

| |

|

|

|

| Net decrease in cash and cash

equivalents |

(32,539 |

) |

|

(8,677 |

) |

| |

|

|

|

| Cash and cash equivalents -

beginning of period |

200,031 |

|

|

181,214 |

|

| |

|

|

|

| Cash and cash equivalents -

end of period |

$ |

167,492 |

|

|

$ |

172,537 |

|

| |

|

|

|

|

|

|

|

STEVEN MADDEN, LTD. AND

SUBSIDIARIES

NON-GAAP RECONCILIATION

(In thousands, except per share amounts)

(Unaudited)

The Company uses non-GAAP financial information

to evaluate its operating performance and in order to represent the

manner in which the Company conducts and views its business.

Additionally, the Company believes the information assists

investors in comparing the Company’s performance across reporting

periods on a consistent basis by excluding items that are not

indicative of its core business. The non-GAAP financial information

is provided in addition to, and not as an alternative to, the

Company’s reported results prepared in accordance with GAAP.

|

Table 1 - Reconciliation of GAAP commission and licensing fee

income, net to Adjusted commission and licensing fee income,

net |

|

|

Nine Months Ended |

|

|

September 30, 2019 |

|

|

|

|

GAAP commission and licensing fee income, net |

$ |

6,531 |

|

|

|

|

| Bad debt

expense, net of recovery, associated with the Payless ShoeSource

bankruptcy |

1,409 |

|

|

|

|

|

Adjusted commission and licensing fee income, net |

$ |

7,940 |

|

| |

|

|

|

| |

|

|

|

|

|

Table 2 - Reconciliation of GAAP operating expenses to Adjusted

operating expenses |

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, 2019 |

|

September 30, 2018 |

|

September 30, 2019 |

|

September 30, 2018 |

|

|

|

|

|

|

|

|

|

|

GAAP operating expenses |

$ |

125,147 |

|

|

$ |

110,007 |

|

|

$ |

358,520 |

|

|

$ |

326,276 |

|

|

|

|

|

|

|

|

|

|

| Expense

in connection with provision for early lease termination charges

and impairment of lease right-of-use assets |

(3,131 |

) |

|

— |

|

|

(5,424 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

| Net

benefit in connection with the change in a contingent liability and

the acceleration of amortization related to the termination of the

Kate Spade license agreement |

— |

|

|

— |

|

|

1,868 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Recovery

associated with the Payless ShoeSource bankruptcy |

— |

|

|

— |

|

|

1,668 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Expense

in connection with the acquisitions of GREATS and BB Dakota |

(1,078 |

) |

|

— |

|

|

(1,078 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

| Expense

in connection with a divisional headquarters relocation |

— |

|

|

— |

|

|

(669 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

| Expense

in connection with provision for legal charges |

— |

|

|

— |

|

|

— |

|

|

(2,837 |

) |

|

|

|

|

|

|

|

|

|

| Expense

in connection with the integration of the Schwartz & Benjamin

acquisition and the related restructuring |

— |

|

|

(406 |

) |

|

— |

|

|

(1,787 |

) |

|

|

|

|

|

|

|

|

|

| Expense

in connection with a warehouse consolidation |

— |

|

|

— |

|

|

— |

|

|

(1,241 |

) |

|

|

|

|

|

|

|

|

|

|

Adjusted operating expenses |

$ |

120,938 |

|

|

$ |

109,601 |

|

|

$ |

354,885 |

|

|

$ |

320,411 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 3 - Reconciliation of GAAP income from operations to Adjusted

income from operations |

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, 2019 |

|

September 30, 2018 |

|

September 30, 2019 |

|

September 30, 2018 |

|

|

|

|

|

|

|

|

|

|

GAAP income from operations |

$ |

68,041 |

|

|

$ |

70,204 |

|

|

$ |

157,334 |

|

|

$ |

148,345 |

|

|

|

|

|

|

|

|

|

|

| Expense

in connection with provision for early lease termination charges

and impairment of lease right-of-use assets |

3,131 |

|

|

— |

|

|

5,424 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

Impairment of the Brian Atwood trademark |

— |

|

|

— |

|

|

4,050 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Expense

in connection with the acquisitions of GREATS and BB Dakota |

1,078 |

|

|

— |

|

|

1,078 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Expense

in connection with a divisional headquarters relocation |

— |

|

|

— |

|

|

669 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net

benefit in connection with the change in a contingent liability and

the acceleration of amortization related to the termination of the

Kate Spade license agreement |

— |

|

|

— |

|

|

(1,868 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

| Recovery,

net of bad debt expense, associated with the Payless ShoeSource

bankruptcy |

— |

|

|

— |

|

|

(259 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

| Expense

in connection with provision for legal charges |

— |

|

|

— |

|

|

— |

|

|

2,837 |

|

|

|

|

|

|

|

|

|

|

| Expense

in connection with the integration of the Schwartz & Benjamin

acquisition and the related restructuring |

— |

|

|

406 |

|

|

— |

|

|

1,787 |

|

|

|

|

|

|

|

|

|

|

| Expense

in connection with a warehouse consolidation |

— |

|

|

— |

|

|

— |

|

|

1,241 |

|

|

|

|

|

|

|

|

|

|

|

Adjusted income from operations |

$ |

72,250 |

|

|

$ |

70,610 |

|

|

$ |

166,428 |

|

|

$ |

154,210 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 4 - Reconciliation of GAAP provision for income taxes to

Adjusted provision for income taxes |

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, 2019 |

|

September 30, 2018 |

|

September 30, 2019 |

|

September 30, 2018 |

|

|

|

|

|

|

|

|

|

|

GAAP provision for income taxes |

$ |

15,886 |

|

|

$ |

14,757 |

|

|

$ |

36,257 |

|

|

$ |

32,885 |

|

|

|

|

|

|

|

|

|

|

| Tax

effect of expense in connection with provision for early lease

termination charges and impairment of lease right-of-use

assets |

786 |

|

|

— |

|

|

1,361 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Tax

effect in connection with the impairment of the Brian Atwood

trademark |

— |

|

|

— |

|

|

1,017 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Tax

effect of expense in connection with the acquisitions of GREATS and

BB Dakota |

271 |

|

|

— |

|

|

271 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Tax

effect of expense in connection with a divisional headquarters

relocation |

— |

|

|

— |

|

|

168 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Tax

effect of the net benefit in connection with the change in a

contingent liability and the acceleration of amortization related

to the termination of the Kate Spade license agreement |

— |

|

|

— |

|

|

(469 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

| Tax

effect of recovery, net of bad debt expense, associated with the

Payless ShoeSource bankruptcy |

— |

|

|

— |

|

|

85 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Tax

effect of expense in connection with provision for legal

charges |

— |

|

|

— |

|

|

— |

|

|

702 |

|

|

|

|

|

|

|

|

|

|

| Tax

effect of expense in connection with the integration of the

Schwartz & Benjamin acquisition and the related

restructuring |

— |

|

|

102 |

|

|

— |

|

|

462 |

|

|

|

|

|

|

|

|

|

|

| Tax

effect of expense in connection with a warehouse consolidation |

— |

|

|

— |

|

|

— |

|

|

327 |

|

|

|

|

|

|

|

|

|

|

| Tax

expense in connection with deferred tax adjustments |

(383 |

) |

|

— |

|

|

(383 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

| Tax

expense in connection with the impairment of the preferred interest

investment in Brian Atwood Italia Holding, LLC recorded in fourth

quarter 2017 |

— |

|

|

— |

|

|

— |

|

|

(1,028 |

) |

|

|

|

|

|

|

|

|

|

|

Adjusted provision for income taxes |

$ |

16,560 |

|

|

$ |

14,859 |

|

|

38,307 |

|

|

$ |

33,348 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 5 - Reconciliation of GAAP net income to Adjusted net

income |

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, 2019 |

|

September 30, 2018 |

|

September 30, 2019 |

|

September 30, 2018 |

|

|

|

|

|

|

|

|

|

|

GAAP net income attributable to Steven Madden, Ltd. |

$ |

52,463 |

|

|

$ |

55,563 |

|

|

$ |

123,560 |

|

|

$ |

116,646 |

|

|

|

|

|

|

|

|

|

|

| After-tax

impact of expense in connection with early lease termination

charges and impairment of lease right-of-use assets |

2,345 |

|

|

— |

|

|

4,062 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| After-tax

impact associated with the impairment related to the Brian Atwood

trademark |

— |

|

|

— |

|

|

3,033 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| After-tax

impact of expense in connection with the acquisitions of GREATS and

BB Dakota |

808 |

|

|

— |

|

|

808 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| After-tax

impact of expense in connection with a divisional headquarters

relocation |

— |

|

|

— |

|

|

501 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| After-tax

impact of the net benefit in connection with the change in a

contingent liability and the acceleration of amortization related

to the termination of the Kate Spade license agreement |

— |

|

|

— |

|

|

(1,399 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

| After-tax

impact of a recovery, net of bad debt expense, associated with the

Payless ShoeSource bankruptcy |

— |

|

|

— |

|

|

(344 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

| After-tax

impact of expense in connection with provision for legal

charges |

— |

|

|

— |

|

|

— |

|

|

2,135 |

|

|

|

|

|

|

|

|

|

|

| After-tax

impact of expense in connection with the integration of the

Schwartz & Benjamin acquisition and the related

restructuring |

— |

|

|

304 |

|

|

— |

|

|

1,325 |

|

|

|

|

|

|

|

|

|

|

| After-tax

impact of expense in connection with a warehouse consolidation |

— |

|

|

— |

|

|

— |

|

|

914 |

|

|

|

|

|

|

|

|

|

|

| Tax

expense in connection with the impairment of the preferred interest

investment in Brian Atwood Italia Holding, LLC recorded in fourth

quarter 2017 |

— |

|

|

— |

|

|

— |

|

|

1,028 |

|

|

|

|

|

|

|

|

|

|

| Tax

expense in connection with deferred tax adjustments |

383 |

|

|

— |

|

|

383 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Adjusted

net income attributable to Steven Madden, Ltd. |

$ |

55,999 |

|

|

$ |

55,867 |

|

|

$ |

130,604 |

|

|

$ |

122,048 |

|

|

|

|

|

|

|

|

|

|

| GAAP

diluted income per share |

$ |

0.63 |

|

|

$ |

0.64 |

|

|

$ |

1.48 |

|

|

$ |

1.35 |

|

|

|

|

|

|

|

|

|

|

|

Adjusted diluted income per share |

$ |

0.67 |

|

|

$ |

0.65 |

|

|

$ |

1.56 |

|

|

$ |

1.41 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact

Steven Madden, Ltd.Director of Corporate Development &

Investor RelationsDanielle

McCoy718-308-2611InvestorRelations@stevemadden.com

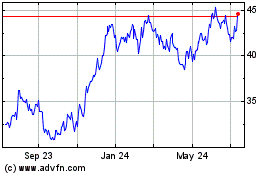

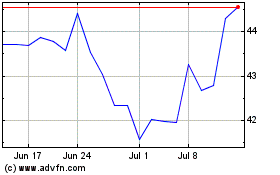

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Apr 2023 to Apr 2024