Recent Acquisition and Base Business

Performance Drive Record Results

Raises Full Year Revenues and Income

Outlook

Sterling Construction Company, Inc. (NasdaqGS: STRL) (“Sterling”

or “the Company”) today announced financial results for the second

quarter 2020.

Consolidated Second Quarter 2020 Financial Results Compared

to Second Quarter 2019:

- Revenues were $400.0 million compared to $264.1 million;

- Gross margin was 14.9% of revenues compared to 9.7%;

- Net Income was $18.3 million compared to $7.8 million;

- EPS was $0.65 compared to $0.29; and,

- EBITDA was $41.2 million compared to $15.3 million.

Consolidated Financial Position and Liquidity:

- Cash and Cash Equivalents were $70.6 million at June 30, 2020

compared to $45.7 million at December 31, 2019;

- Cash flows from operations were $52.3 million for the six

months ended June 30, 2020 compared to $(4.3) million for the

comparable prior year period;

- Payments of scheduled Term Loan Facility debt and the seller

notes totaled $22.5 million for the six months ended June 30,

2020;

- Debt, net of cash totaled $351.4 million at June 30, 2020

compared to $387.4 million at December 31, 2019; and,

- Our $75 million Revolving Credit Facility has $55 million of

availability, reflecting a $30 million repayment in the

quarter.

Heavy Civil and Specialty Services Backlog Highlights

- Combined Backlog at June 30, 2020 was $1.57 billion, up from

$1.34 billion at December 31, 2019. Combined Backlog consists of

$1.13 billion of Backlog and $437 million of unsigned contracts as

of June 30, 2020 compared to $1.07 billion and $273 million at

December 31, 2019, respectively. No residential construction

contracts are included in Backlog.

- Total margin in Backlog has increased approximately 140 basis

points, from 11.5% at December 31, 2019 to 12.9% at June 30, 2020.

Combined Backlog gross margin improved from 11.0% at December 31,

2019 to 11.7% at June 30, 2020.

Full Year Revenue and Income Guidance

- Revenue: $1.415 billion to $1.430 billion.

- Net Income: $41 million to $44 million, excluding acquisition

related costs of $1 million to $2 million.

CEO Remarks and Outlook

“I am extremely proud of what our employees were able to

accomplish in one of the most challenging times in our Company’s

history,” stated Joe Cutillo, Sterling’s Chief Executive Officer.

“Our bottom-line results were the best ever achieved by the

Company, which reflects the benefits of our strategy to transform

our business portfolio and our overall project mix towards higher

value add, lower risk, and more profitable work. Most importantly,

we delivered this performance while maintaining the health and

safety of our team across all of our operating geographies, which

is a testament to the attentiveness, discipline and professionalism

of our nearly 3,000 employees in the face of our nation’s ongoing

battle against the COVID-19 pandemic.”

“Our Specialty Services segment, which includes our recent

acquisition of Plateau, more than doubled its operating profit

relative to the first quarter of 2020. Plateau entered the quarter

with record backlog and executed flawlessly for its blue chip

customer base. Our Residential segment rebounded from the

pandemic-related headwinds of the first quarter, and also solidly

outperformed the prior year quarter driven by a faster than

anticipated recovery of the Texas housing market and our expansion

into the Houston market. Our Heavy Civil business has remained

stable as we executed on substantial heavy highway work during the

quarter while maintaining our backlog at near record levels. We are

yet to see significant project delays or cancellations in the

geographies in which we perform heavy civil work and have no reason

to anticipate that this will be the case for the foreseeable

future. Additionally, as yet, no states in the geographies in which

we operate have stopped or reduced project lettings due to funding

challenges. In fact, despite the uncertainty and general social and

economic disruption caused by the pandemic crisis, we remain

optimistic about the outlook for all of our businesses for the

balance of the year given our Combined Backlog, the pending new

awards we expect to realize in the coming months, and the sizeable

quantity of new project opportunities that we’ve identified.”

Mr. Cutillo continued, “In addition to record earnings, we

further enhanced our liquidity position in the second quarter. We

are comfortable with our capital structure which provides us with

the financial flexibility to continue to generate profitable

growth. For the first six months of 2020 we generated $52.3 million

of operating cash flow, an increase of $56.6 million compared to

last year. In addition, we reduced our net debt by $36.0 million

during the year. We expect to continue paying down debt over the

remainder of 2020, putting us in an increasingly strong financial

position going into 2021.”

Mr. Cutillo concluded, “Based on our year-to-date performance,

the anticipated contribution from Plateau and our record high

Combined Backlog and associated margin, along with our view on

market strength and diversification of our business, we are

providing updated guidance for 2020. We now expect to generate full

year 2020 revenues of between $1.415 billion and $1.430 billion.

Our expectation for 2020 net income attributable to Sterling common

stockholders is between $41 million to $44 million, excluding

acquisition related costs of $1 million to $2 million, representing

a 73% increase from adjusted net income in 2019. We expect our full

year 2020 diluted average common shares outstanding to be

approximately 28.0 million. This guidance assumes no significant

increase in COVID-19 pandemic impacts on our operations during the

remainder of the year. However, with the continuing volatility of

the COVID-19 pandemic, significant incremental pandemic impacts

could keep us from achieving our 2020 guidance.”

Conference Call

Sterling’s management will hold a conference call to discuss

these results and recent corporate developments on Tuesday, August

4, 2020 at 9:00 a.m. ET/8:00 a.m. CT. Interested parties may

participate in the call by dialing (201) 493-6744 or (877)

445-9755. Please call in ten minutes before the conference call is

scheduled to begin and ask for the Sterling Construction call. To

coincide with the conference call, Sterling will post a slide

presentation at www.strlco.com on the Investor Presentations &

Webcast section of the Investor Relations tab, which includes

additional 2020 financial modeling considerations. Following

management’s opening remarks, there will be a question and answer

session.

To listen to a simultaneous webcast of the call, please go to

the Company’s website at www.strlco.com at least fifteen minutes

early to download and install any necessary audio software. If you

are unable to listen live, the conference call webcast will be

archived on the Company’s website for thirty days.

About Sterling

Sterling Construction Company, Inc., (“Sterling” or “the

Company”), a Delaware corporation, is a construction company that

has been involved in the construction industry since its founding

in 1955. The Company operates through a variety of subsidiaries

within three operating groups specializing in heavy civil,

specialty services, and residential projects in the United States

(the “U.S.”), primarily across the southern U.S., the Rocky

Mountain States, California and Hawaii, as well as other areas with

strategic construction opportunities. Heavy civil includes

infrastructure and rehabilitation projects for highways, roads,

bridges, airfields, ports, light rail, water, wastewater and storm

drainage systems. Specialty services projects include construction

site excavation and drainage, drilling and blasting for excavation,

foundations for multi-family homes, parking structures and other

commercial concrete projects. Residential projects include concrete

foundations for single-family homes.

Important Information for Investors and Stockholders

Non-GAAP Measures

This press release contains “Non-GAAP” financial measures as

defined under Regulation G of the amended U.S. Securities Exchange

Act of 1934. The Company reports financial results in accordance

with U.S. generally accepted accounting principles (“GAAP”), but

the Company believes that certain Non-GAAP financial measures

provide useful supplemental information to investors regarding the

underlying business trends and performance of the Company’s ongoing

operations and are useful for period-over-period comparisons of

those operations.

Non-GAAP measures include adjusted net income, adjusted EPS, and

adjusted EBITDA, in each case excluding the impacts of certain

identified items. The excluded items represent items that the

Company does not consider to be representative of its normal

operations. The Company believes that these measures are useful for

investors to review, because they provide a consistent measure of

the underlying financial results of the Company’s ongoing business

and, in the Company’s view, allow for a supplemental comparison

against historical results and expectations for future performance.

Furthermore, the Company uses each of these to measure the

performance of the Company’s operations for budgeting, forecasting,

as well as employee incentive compensation. However, Non-GAAP

measures should not be considered as substitutes for net income,

EPS, or other data prepared and reported in accordance with GAAP

and should be viewed in addition to the Company’s reported results

prepared in accordance with GAAP.

Reconciliations of these Non-GAAP financial measures to the most

comparable GAAP measures are provided in the tables included in

this press release.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains statements that are considered

forward-looking statements within the meaning of the federal

securities laws. These forward-looking statements are subject to a

number of risks and uncertainties, many of which are beyond our

control, which may include statements about: the scope and duration

of the COVID-19 pandemic and its continuing impact on national and

global economic conditions; and our business strategy; financial

strategy; and plans, objectives, expectations, forecasts, outlook

and intentions. All of these types of statements, other than

statements of historical fact included in this press release, are

forward-looking statements. In some cases, forward-looking

statements can be identified by terminology such as “may,” “will,”

“could,” “should,” “expect,” “plan,” “project,” “intend,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,”

“pursue,” “target,” “continue,” the negative of such terms or other

comparable terminology. The forward-looking statements contained in

this press release are largely based on our expectations, which

reflect estimates and assumptions made by our management. These

estimates and assumptions reflect our best judgment based on

currently known market conditions and other factors. Although we

believe such estimates and assumptions to be reasonable, they are

inherently uncertain and involve a number of risks and

uncertainties that are beyond our control. In addition,

management’s assumptions about future events may prove to be

inaccurate. Management cautions all readers that the

forward-looking statements contained in this press release are not

guarantees of future performance, and we cannot assure any reader

that such statements will be realized or the forward-looking events

and circumstances will occur. Actual results may differ materially

from those anticipated or implied in the forward-looking statements

due to factors listed in the “Risk Factors” section in our filings

with the U.S. Securities and Exchange Commission (“SEC”) and

elsewhere in those filings. The forward-looking statements speak

only as of the date made, and other than as required by law, we do

not intend to publicly update or revise any forward-looking

statements as a result of new information, future events or

otherwise. These cautionary statements qualify all forward-looking

statements attributable to us or persons acting on our behalf.

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2020

2019

2020

2019

Revenues

$

400,038

$

264,086

$

696,726

$

488,035

Cost of revenues

(340,439

)

(238,590

)

(601,882

)

(443,036

)

Gross profit

59,599

25,496

94,844

44,999

General and administrative expense

(18,451

)

(10,174

)

(36,055

)

(22,063

)

Intangible asset amortization

(2,866

)

(600

)

(5,703

)

(1,200

)

Acquisition related costs

(139

)

(262

)

(612

)

(262

)

Other operating expense, net

(5,097

)

(3,276

)

(7,325

)

(5,570

)

Operating income

33,046

11,184

45,149

15,904

Interest income

24

291

123

655

Interest expense

(7,557

)

(2,904

)

(15,360

)

(5,964

)

Income before income taxes

25,513

8,571

29,912

10,595

Income tax expense

(7,248

)

(706

)

(8,432

)

(869

)

Net income

18,265

7,865

21,480

9,726

Less: Net income attributable to

noncontrolling interests

(55

)

(37

)

(155

)

(83

)

Net income attributable to Sterling common

stockholders

$

18,210

$

7,828

$

21,325

$

9,643

Net income per share attributable to

Sterling common stockholders:

Basic

$

0.65

$

0.30

$

0.77

$

0.37

Diluted

$

0.65

$

0.29

$

0.76

$

0.36

Weighted average common shares

outstanding:

Basic

27,941

26,338

27,794

26,357

Diluted

27,957

26,623

27,887

26,657

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

SEGMENT INFORMATION

(In thousands)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2020

% of Revenue

2019

% of Revenue

2020

% of Revenue

2019

% of Revenue

Revenue

Heavy Civil

$

220,448

55

%

$

200,236

75

%

$

376,063

53

%

$

350,741

72

%

Specialty Services

135,703

34

%

27,894

11

%

240,426

35

%

58,573

12

%

Residential

43,887

11

%

35,956

14

%

80,237

12

%

78,721

16

%

Total Revenue

$

400,038

$

264,086

$

696,726

$

488,035

Operating Income

Heavy Civil

$

3,896

1.8

%

$

5,747

2.9

%

$

274

0.1

%

$

3,600

1.0

%

Specialty Services

23,246

17.1

%

865

3.1

%

34,360

14.3

%

1,913

3.3

%

Residential

6,043

13.8

%

4,834

13.4

%

11,127

13.9

%

10,653

13.5

%

Subtotal

33,185

8.3

%

11,446

4.3

%

45,761

6.6

%

16,166

3.3

%

Acquisition related costs

(139

)

(262

)

(612

)

(262

)

Total Operating Income

$

33,046

8.3

%

$

11,184

4.2

%

$

45,149

6.5

%

$

15,904

3.3

%

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except per

share data)

(Unaudited)

June 30, 2020

December 31,

2019

Assets

Current assets:

Cash and cash equivalents

$

70,612

$

45,733

Accounts receivable, including

retainage

269,406

248,247

Costs and estimated earnings in excess of

billings

52,068

42,555

Receivables from and equity in

construction joint ventures

12,396

9,196

Other current assets

11,965

11,790

Total current assets

416,447

357,521

Property and equipment, net

119,596

116,030

Operating lease right-of-use assets

17,076

13,979

Goodwill

192,014

191,892

Other intangibles, net

250,620

256,323

Deferred tax asset, net

21,604

26,012

Other non-current assets, net

153

183

Total assets

$

1,017,510

$

961,940

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

131,098

$

137,593

Billings in excess of costs and estimated

earnings

110,934

85,011

Current maturities of long-term debt

54,979

42,473

Current portion of long-term lease

obligations

7,423

7,095

Income taxes payable

3,594

1,212

Accrued compensation

19,075

13,727

Other current liabilities

10,589

6,393

Total current liabilities

337,692

293,504

Long-term debt

367,028

390,627

Long-term lease obligations

9,733

6,976

Members’ interest subject to mandatory

redemption and undistributed earnings

53,751

49,003

Other long-term liabilities

8,221

619

Total liabilities

776,425

740,729

Stockholders’ equity:

Common stock, par value $0.01 per share;

38,000 shares authorized, 28,280 and 28,290 shares issued, 28,034

and 27,772 shares outstanding

283

283

Additional paid in capital

253,820

251,019

Treasury Stock, at cost: 246 and 518

shares

(3,435

)

(6,142

)

Retained deficit

(3,708

)

(25,033

)

Accumulated other comprehensive loss

(7,323

)

(209

)

Total Sterling stockholders’ equity

239,637

219,918

Noncontrolling interests

1,448

1,293

Total stockholders’ equity

241,085

221,211

Total liabilities and stockholders’

equity

$

1,017,510

$

961,940

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Six Months Ended June

30,

2020

2019

Cash flows from operating

activities:

Net income

$

21,480

$

9,726

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation and amortization

16,541

8,473

Amortization of debt issuance costs and

non-cash interest

1,762

1,602

Gain on disposal of property and

equipment

(598

)

(441

)

Deferred taxes

6,223

761

Stock-based compensation expense

6,196

1,670

Loss on interest rate hedge

272

—

Changes in operating assets and

liabilities

385

(26,116

)

Net cash provided by (used in) operating

activities

52,261

(4,325

)

Cash flows from investing

activities:

Capital expenditures

(14,574

)

(4,854

)

Proceeds from sale of property and

equipment

769

802

Net cash used in investing activities

(13,805

)

(4,052

)

Cash flows from financing

activities:

Repayments of debt

(22,644

)

(5,763

)

Distributions to noncontrolling interest

owners

—

(5,100

)

Purchase of treasury stock

—

(3,201

)

Other

9,067

76

Net cash used in financing activities

(13,577

)

(13,988

)

Net change in cash and cash

equivalents

24,879

(22,365

)

Cash and cash equivalents at beginning of

period

45,733

94,095

Cash and cash equivalents at end of

period

$

70,612

$

71,730

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Reconciliation of Non-GAAP

Supplemental Adjusted Financial Data (1)

(In thousands, except per

share data)

(Unaudited)

The Company reports its financial results

in accordance with GAAP. This press release also includes several

Non-GAAP financial measures as defined under the SEC’s Regulation

G. The following tables reconcile certain Non-GAAP financial

measures used in this press release to comparable GAAP financial

measures.

Three Months Ended June 30,

2020

As Reported (GAAP)

Adjustment

Adjusted

(Non-GAAP)

Revenues

$

400,038

$

—

$

400,038

Cost of revenues

(340,439

)

—

(340,439

)

Gross profit

59,599

—

59,599

General and administrative expense

(18,451

)

—

(18,451

)

Intangible asset amortization

(2,866

)

(2,866

)

Acquisition related costs

(139

)

139

—

Other operating expense, net

(5,097

)

—

(5,097

)

Operating income

33,046

139

33,185

Interest income

24

—

24

Interest expense

(7,557

)

—

(7,557

)

Income before income taxes

25,513

139

25,652

Income tax expense (2)

(7,248

)

(39

)

(7,287

)

Net income

18,265

100

18,365

Less: Net income attributable to

noncontrolling interests

(55

)

—

(55

)

Net income attributable to Sterling common

stockholders

$

18,210

$

100

$

18,310

Net income per share attributable to

Sterling common stockholders:

Basic

$

0.65

$

0.01

$

0.66

Diluted

$

0.65

$

—

$

0.65

Weighted average common shares

outstanding:

Basic

27,941

27,941

Diluted

27,957

27,957

(1)

The summary unaudited adjusted financial

data is presented excluding the costs of acquiring Plateau, net of

tax. This presentation is considered a non-GAAP financial measure,

which the Company believes provides a better indication of our

operating results prior to the excluded items.

(2)

Adjusted Non-GAAP income tax expense of

$7,287 includes non-cash federal income tax expense of $5,349.

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Reconciliation of Non-GAAP

Supplemental Adjusted Financial Data (1)

(In thousands, except per

share data)

(Unaudited)

The Company reports its financial results

in accordance with GAAP. This press release also includes several

Non-GAAP financial measures as defined under the SEC’s Regulation

G. The following tables reconcile certain Non-GAAP financial

measures used in this press release to comparable GAAP financial

measures.

Three Months Ended June 30,

2019

As Reported (GAAP)

Adjustment

Adjusted

(Non-GAAP)

Revenues

$

264,086

$

—

$

264,086

Cost of revenues

(238,590

)

—

(238,590

)

Gross profit

25,496

—

25,496

General and administrative expense

(10,174

)

—

(10,174

)

Intangible asset amortization

(600

)

(600

)

Acquisition related costs

(262

)

262

—

Other operating expense, net

(3,276

)

—

(3,276

)

Operating income

11,184

262

11,446

Interest income

291

—

291

Interest expense

(2,904

)

—

(2,904

)

Income before income taxes

8,571

262

8,833

Income tax expense

(706

)

—

(706

)

Net income

7,865

262

8,127

Less: Net income attributable to

noncontrolling interests

(37

)

—

(37

)

Net income attributable to Sterling common

stockholders

$

7,828

$

262

$

8,090

Net income per share attributable to

Sterling common stockholders:

Basic

$

0.30

$

0.01

$

0.31

Diluted

$

0.29

$

0.01

$

0.30

Weighted average common shares

outstanding:

Basic

26,338

26,338

Diluted

26,623

26,623

(1)

The summary unaudited adjusted financial

data is presented excluding the costs of acquiring Plateau, net of

tax. This presentation is considered a non-GAAP financial measure,

which the Company believes provides a better indication of our

operating results prior to the excluded items.

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Reconciliation of Non-GAAP

Supplemental Adjusted Financial Data (1)

(In thousands, except per

share data)

(Unaudited)

The Company reports its financial results

in accordance with GAAP. This press release also includes several

Non-GAAP financial measures as defined under the SEC’s Regulation

G. The following tables reconcile certain Non-GAAP financial

measures used in this press release to comparable GAAP financial

measures.

Six Months Ended June 30,

2020

As Reported (GAAP)

Adjustment

Adjusted

(Non-GAAP)

Revenues

$

696,726

$

—

$

696,726

Cost of revenues

(601,882

)

—

(601,882

)

Gross profit

94,844

—

94,844

General and administrative expense

(36,055

)

—

(36,055

)

Intangible asset amortization

(5,703

)

(5,703

)

Acquisition related costs

(612

)

612

—

Other operating expense, net

(7,325

)

—

(7,325

)

Operating income

45,149

612

45,761

Interest income

123

—

123

Interest expense

(15,360

)

—

(15,360

)

Income before income taxes

29,912

612

30,524

Income tax expense (2)

(8,432

)

(173

)

(8,605

)

Net income

21,480

439

21,919

Less: Net income attributable to

noncontrolling interests

(155

)

—

(155

)

Net income attributable to Sterling common

stockholders

$

21,325

$

439

$

21,764

Net income per share attributable to

Sterling common stockholders:

Basic

$

0.77

$

0.01

$

0.78

Diluted

$

0.76

$

0.02

$

0.78

Weighted average common shares

outstanding:

Basic

27,794

27,794

Diluted

27,887

27,887

(1)

The summary unaudited adjusted financial

data is presented excluding the costs of acquiring Plateau, net of

tax. This presentation is considered a non-GAAP financial measure,

which the Company believes provides a better indication of our

operating results prior to the excluded items.

(2)

Adjusted Non-GAAP income tax expense of

$8,605 includes non-cash federal income tax expense of $6,396.

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Reconciliation of Non-GAAP

Supplemental Adjusted Financial Data (1)

(In thousands, except per

share data)

(Unaudited)

The Company reports its financial results

in accordance with GAAP. This press release also includes several

Non-GAAP financial measures as defined under the SEC’s Regulation

G. The following tables reconcile certain Non-GAAP financial

measures used in this press release to comparable GAAP financial

measures.

Six Months Ended June 30,

2019

As Reported (GAAP)

Adjustment

Adjusted

(Non-GAAP)

Revenues

$

488,035

$

—

$

488,035

Cost of revenues

(443,036

)

—

(443,036

)

Gross profit

44,999

—

44,999

General and administrative expense

(22,063

)

—

(22,063

)

Intangible asset amortization

(1,200

)

(1,200

)

Acquisition related costs

(262

)

262

—

Other operating expense, net

(5,570

)

—

(5,570

)

Operating income

15,904

262

16,166

Interest income

655

—

655

Interest expense

(5,964

)

—

(5,964

)

Income before income taxes

10,595

262

10,857

Income tax expense

(869

)

—

(869

)

Net income

9,726

262

9,988

Less: Net income attributable to

noncontrolling interests

(83

)

—

(83

)

Net income attributable to Sterling common

stockholders

$

9,643

$

262

$

9,905

Net income per share attributable to

Sterling common stockholders:

Basic

$

0.37

$

0.01

$

0.38

Diluted

$

0.36

$

0.01

$

0.37

Weighted average common shares

outstanding:

Basic

26,357

26,357

Diluted

26,657

26,657

(1)

The summary unaudited adjusted financial

data is presented excluding the costs of acquiring Plateau, net of

tax. This presentation is considered a non-GAAP financial measure,

which the Company believes provides a better indication of our

operating results prior to the excluded items.

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Reconciliation of Non-GAAP

Supplemental Adjusted Financial Data (1)

(In thousands, except per

share data)

(Unaudited)

The Company reports its financial results

in accordance with GAAP. This press release also includes several

Non-GAAP financial measures as defined under the SEC’s Regulation

G. The following tables reconcile certain Non-GAAP financial

measures used in this press release to comparable GAAP financial

measures.

Year Ended December 31,

2019

As Reported (GAAP) (2)

Adjustment

Adjusted

(Non-GAAP)

Revenues

$

1,126,278

$

—

$

1,126,278

Cost of revenues

(1,018,484

)

—

(1,018,484

)

Gross profit

107,794

—

107,794

General and administrative expense

(49,200

)

—

(49,200

)

Intangible asset amortization

(4,695

)

(4,695

)

Acquisition related costs

(4,311

)

4,311

—

Other operating expense, net

(11,837

)

—

(11,837

)

Operating income

37,751

4,311

42,062

Interest income

1,142

—

1,142

Interest expense

(16,686

)

—

(16,686

)

Loss on extinguishment of debt

(7,728

)

7,728

—

Income before income taxes

14,479

12,039

26,518

Income tax expense

26,216

(27,398

)

(1,182

)

Net income

40,695

(15,359

)

25,336

Less: Net income attributable to

noncontrolling interests

(794

)

—

(794

)

Net income attributable to Sterling common

stockholders

$

39,901

$

(15,359

)

$

24,542

Net income per share attributable to

Sterling common stockholders:

Basic

$

1.50

$

(0.58

)

$

0.92

Diluted

$

1.47

$

(0.57

)

$

0.90

Weighted average common shares

outstanding:

Basic

26,671

26,671

Diluted

27,119

27,119

(1)

The summary unaudited adjusted financial

data is presented excluding the costs of acquiring Plateau

(including related refinancing) and non-cash taxes. This

presentation is considered a non-GAAP financial measure, which the

Company believes provides a better indication of our operating

results prior to the excluded items.

(2)

Includes a fourth quarter charge for a

legacy project of $10.2 million or $0.36 per diluted share based on

28,201 weighted average common shares outstanding in the

quarter.

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

EBITDA Reconciliation

(In thousands)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2020

2019

2020

2019

Net income attributable to Sterling common

stockholders

$

18,210

$

7,828

$

21,325

$

9,643

Depreciation and amortization

8,256

4,171

16,541

8,473

Interest expense, net of interest

income

7,533

2,613

15,237

5,309

Income tax (benefit) expense

7,248

706

8,432

869

EBITDA (1)

41,247

15,318

61,535

24,294

Acquisition related costs

139

262

612

262

Adjusted EBITDA (2)

$

41,386

$

15,580

$

62,147

$

24,556

(1)

The Company defines EBITDA as

GAAP net income (loss) attributable to Sterling common

stockholders, adjusted for depreciation and amortization, net

interest expense, taxes, and loss on extinguishment of debt.

(2)

Adjusted EBITDA excludes the impact of

acquisition related costs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200803005773/en/

Sterling Construction Company, Inc. Ron Ballschmiede, Chief

Financial Officer 281-214-0800

Investor Relations Counsel: The Equity Group Inc. Fred

Buonocore, CFA 212-836-9607

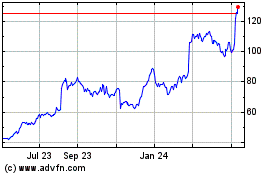

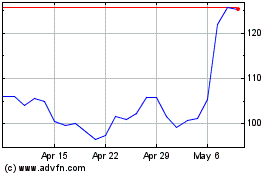

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Apr 2023 to Apr 2024