Record EBITDA (1)

Record Backlog of $1.2 billion and Backlog

Gross Margin of 12.7%

Sterling Construction Company, Inc. (NasdaqGS: STRL) (“Sterling”

or “the Company”) today announced financial results for the three

months ended March 31, 2020.

Consolidated First Quarter 2020 Financial Results Compared to

First Quarter 2019:

- Revenues were $296.7 million compared to $223.9 million;

- Gross margin was 11.9% of revenues compared to 8.7%;

- Plateau acquisition related costs totaled $0.5 million or $0.02

per diluted share;

- Net income attributable to Sterling common stockholders was

$3.1 million or $3.5 million on an adjusted basis(1) compared to

$1.8 million or $2.0 million on an adjusted basis(1);

- Net income per diluted share attributable to Sterling common

stockholders was $0.11 or $0.12 on an adjusted basis(1) compared to

$0.07;

- Cash flows from operations was $10.8 million, an improvement of

$30.0 million; and,

- Adjusted EBITDA(1) was $20.8 million compared to $9.0

million.

Consolidated Financial Position and Liquidity at March 31,

2020:

- Cash and Cash Equivalents were $73.9 million;

- Debt, net of cash totaled $385.1 million; and,

- Remaining availability of $25 million under our $75 million

Revolving Credit Facility.

Heavy Civil and Specialty Services Backlog Highlights

- Combined Backlog at March 31, 2020 was $1.43 billion, up from

$1.34 billion at December 31, 2019. Combined Backlog consists of

$1.19 billion of Backlog and $241 million of Unsigned Low-bid

Awards as of March 31, 2020 compared to $1.07 billion and $273

million at December 31, 2019, respectively. No residential

contracts are included in Backlog.

- Total margin in Backlog has increased approximately 120 basis

points, from 11.5% at December 31, 2019 to 12.7% at March 31, 2020.

Combined Backlog gross margin improved from 11.0% at December 31,

2019 to 12.1% at March 31, 2020.

Due to the uncertain future COVID-19 financial impacts over the

balance of the year, we have withdrawn our previously articulated

guidance until we have greater visibility.

CEO Remarks and Outlook

Sterling’s Chief Executive Officer, Joe Cutillo, stated, “I’m

very proud of our 3,000 employees and their ability to take care of

our customers, protect themselves and their families and adapt to a

rapidly changing environment associated with the COVID-19 pandemic.

Their hard work, ingenuity and quick actions enabled us to deliver

record first quarter results that were consistent with our

expectations heading into the quarter. Additionally, our first

quarter results were aligned with our strategic objectives to

continue to grow our bottom line profits faster than top line

revenue. Our recently acquired Plateau business, which is the

largest component of the Specialty Services segment, exceeded our

expectations in financial performance and booked over $100 million

of new business in the quarter. Our Residential operating income

was slightly lower than the prior year quarter due to heavy March

rains, but was up sequentially over the fourth quarter of 2019 as

we continue to expand into the Houston market. The Heavy Civil

segment saw the largest unfavorable productivity impact in the

first quarter related to the pandemic as customers and back offices

began to work virtually and new procedures and protocol were

developed and implemented into field operations. Despite the

COVID-19 pandemic headwinds, the Heavy Civil segment managed to

approach achieving our first quarter financial expectations.”

“As we look forward, all our segments have been deemed to be a

component of “Essential Critical Infrastructure” per the National

Cybersecurity and Infrastructure Agency. We have record backlogs in

both the Heavy Civil and Specialty Services segments and remain in

an enviable position versus many other businesses. However, we

expect to begin to see more significant impacts related to the

COVID-19 pandemic in the second and third quarters as our home

builder customers expect demand to slow, and new commercial

projects related to multifamily and offices may be delayed.”

Mr. Cutillo concluded, “Due to the anticipated slowdown in

project activity for our residential, multi-family and commercial

markets, along with the high potential of other unforeseen impacts,

we have decided to withdraw our previously articulated guidance

until we have greater visibility into these markets. Despite the

near-term challenges created by the COVID-19 pandemic, the profit

and cash flow generated by of each of our businesses in the first

quarter exemplify the continued execution of our strategy.

Importantly, we generated positive free cash flow in our seasonally

weak first quarter, and our liquidity position remains strong,

providing us with the financial flexibility to continue to execute

on our record combined backlog even if business conditions worsen,

and leaving us well prepared to resume the growth trajectory of our

bottom line when the economic environment normalizes.”

Conference Call

Sterling’s management will hold a conference call to discuss

these results and recent corporate developments on Tuesday, May 5,

2020 at 9:00 a.m. ET/8:00 a.m. CT. Interested parties may

participate in the call by dialing (201) 493-6744 or (877)

445-9755. Please call in ten minutes before the conference call is

scheduled to begin and ask for the Sterling Construction call. To

coincide with the conference call, Sterling will post a slide

presentation at www.strlco.com on the Investor Presentations &

Webcast section of the Investor Relations tab. Following

management’s opening remarks, there will be a question and answer

session.

To listen to a simultaneous webcast of the call, please go to

the Company’s website at www.strlco.com at least fifteen minutes

early to download and install any necessary audio software. If you

are unable to listen live, the conference call webcast will be

archived on the Company’s website for thirty days.

About Sterling

Sterling Construction Company, Inc., (“Sterling” or “the

Company”), a Delaware corporation, is a construction company that

has been involved in the construction industry since its founding

in 1955. The Company operates through a variety of subsidiaries

within three operating groups specializing in heavy civil,

specialty services, and residential projects in the United States

(the “U.S.”), primarily across the southern U.S., the Rocky

Mountain states, California and Hawaii, as well as other areas with

strategic construction opportunities. Heavy civil includes

infrastructure and rehabilitation projects for highways, roads,

bridges, airfields, ports, light rail, water, wastewater and storm

drainage systems. Specialty services projects include construction

site excavation and drainage, drilling and blasting for excavation,

foundations for multi-family homes, parking structures and other

commercial concrete projects. Residential projects include concrete

foundations for single-family homes.

Important Information for Investors and Stockholders

Non-GAAP Measures

This press release contains “Non-GAAP” financial measures as

defined under Regulation G of the amended U.S. Securities Exchange

Act of 1934. The Company reports financial results in accordance

with U.S. generally accepted accounting principles (“GAAP”), but

the Company believes that certain Non-GAAP financial measures

provide useful supplemental information to investors regarding the

underlying business trends and performance of the Company’s ongoing

operations and are useful for period-over-period comparisons of

those operations.

Non-GAAP measures include adjusted net income, adjusted EPS and

adjusted EBITDA, in each case excluding the impacts of certain

identified items. The excluded items represent items that the

Company does not consider to be representative of its normal

operations. The Company believes that these measures are useful for

investors to review, because they provide a consistent measure of

the underlying financial results of the Company’s ongoing business

and, in the Company’s view, allow for a supplemental comparison

against historical results and expectations for future performance.

Furthermore, the Company uses each of these to measure the

performance of the Company’s operations for budgeting, forecasting,

as well as employee incentive compensation. However, Non-GAAP

measures should not be considered as substitutes for net income,

EPS, or other data prepared and reported in accordance with GAAP

and should be viewed in addition to the Company’s reported results

prepared in accordance with GAAP.

Reconciliations of these Non-GAAP financial measures to the most

comparable GAAP measures are provided in the tables included in

this press release.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains statements that are considered

forward-looking statements within the meaning of the federal

securities laws. These forward-looking statements are subject to a

number of risks and uncertainties, many of which are beyond our

control, which may include statements about: the scope and duration

of the COVID-19 pandemic and its continuing impact on national and

global economic conditions; and our business strategy; financial

strategy; and plans, objectives, expectations, forecasts, outlook

and intentions. All of these types of statements, other than

statements of historical fact included in this press release, are

forward-looking statements. In some cases, forward-looking

statements can be identified by terminology such as “may,” “will,”

“could,” “should,” “expect,” “plan,” “project,” “intend,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,”

“pursue,” “target,” “continue,” the negative of such terms or other

comparable terminology. The forward-looking statements contained in

this press release are largely based on our expectations, which

reflect estimates and assumptions made by our management. These

estimates and assumptions reflect our best judgment based on

currently known market conditions and other factors. Although we

believe such estimates and assumptions to be reasonable, they are

inherently uncertain and involve a number of risks and

uncertainties that are beyond our control. In addition,

management’s assumptions about future events may prove to be

inaccurate. Management cautions all readers that the

forward-looking statements contained in this press release are not

guarantees of future performance, and we cannot assure any reader

that such statements will be realized or the forward-looking events

and circumstances will occur. Actual results may differ materially

from those anticipated or implied in the forward-looking statements

due to factors listed in the “Risk Factors” section in our filings

with the U.S. Securities and Exchange Commission (“SEC”) and

elsewhere in those filings. The forward-looking statements speak

only as of the date made, and other than as required by law, we do

not intend to publicly update or revise any forward-looking

statements as a result of new information, future events or

otherwise. These cautionary statements qualify all forward-looking

statements attributable to us or persons acting on our behalf.

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended March

31,

2020

2019

Revenues

$

296,688

$

223,949

Cost of revenues

(261,443

)

(204,446

)

Gross profit

35,245

19,503

General and administrative expense

(17,604

)

(11,889

)

Intangible asset amortization

(2,837

)

(600

)

Acquisition related costs

(473

)

—

Other operating expense, net

(2,228

)

(2,294

)

Operating income

12,103

4,720

Interest income

99

364

Interest expense

(7,803

)

(3,060

)

Income before income taxes

4,399

2,024

Income tax expense

(1,184

)

(163

)

Net income

3,215

1,861

Less: Net income attributable to

noncontrolling interests

(100

)

(46

)

Net income attributable to Sterling common

stockholders

$

3,115

$

1,815

Net income per share attributable to

Sterling common stockholders:

Basic

$

0.11

$

0.07

Diluted

$

0.11

$

0.07

Weighted average common shares

outstanding:

Basic

27,736

26,377

Diluted

27,992

26,723

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

SEGMENT INFORMATION

(In thousands)

(Unaudited)

Three Months Ended March

31,

2020

% of Revenue

2019

% of Revenue

Revenue

Heavy Civil

$

155,615

53%

$

150,505

67%

Specialty Services

104,723

35%

30,679

14%

Residential

36,350

12%

42,765

19%

Total Revenue

$

296,688

$

223,949

Operating Income (Loss)

Heavy Civil

$

(3,622

)

(2.3)%

$

(2,147

)

(1.4)%

Specialty Services

11,114

10.6%

1,048

3.4%

Residential

5,084

14.0%

5,819

13.6%

Subtotal

12,576

4.2%

4,720

2.1%

Acquisition related costs

(473

)

—

Total Operating Income

$

12,103

4.1%

$

4,720

2.1%

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except per

share data)

(Unaudited)

March 31, 2020

December 31, 2019

Assets

Current assets:

Cash and cash equivalents

$

73,905

$

45,733

Accounts receivable, including

retainage

221,268

248,247

Costs and estimated earnings in excess of

billings

54,791

42,555

Receivables from and equity in

construction joint ventures

10,789

9,196

Other current assets

10,335

11,790

Total current assets

371,088

357,521

Property and equipment, net

117,818

116,030

Operating lease right-of-use assets

14,790

13,979

Goodwill

191,892

191,892

Other intangibles, net

253,486

256,323

Deferred tax asset, net

27,149

26,012

Other non-current assets, net

172

183

Total assets

$

976,395

$

961,940

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

123,172

$

137,593

Billings in excess of costs and estimated

earnings

79,293

85,011

Current maturities of long-term debt

50,211

42,473

Current portion of long-term lease

obligations

7,410

7,095

Income taxes payable

1,656

1,212

Accrued compensation

14,187

13,727

Other current liabilities

10,403

6,393

Total current liabilities

286,332

293,504

Long-term debt

408,828

390,627

Long-term lease obligations

7,465

6,976

Members’ interest subject to mandatory

redemption and undistributed earnings

49,186

49,003

Other long-term liabilities

5,654

619

Total liabilities

757,465

740,729

Stockholders’ equity:

Common stock, par value $0.01 per share;

38,000 shares authorized, 28,282 and 28,290 shares issued, 27,966

and 27,772 shares outstanding

283

283

Additional paid in capital

250,689

251,019

Treasury Stock, at cost: 316 and 518

shares

(4,247

)

(6,142

)

Retained deficit

(21,918

)

(25,033

)

Accumulated other comprehensive loss

(7,270

)

(209

)

Total Sterling stockholders’ equity

217,537

219,918

Noncontrolling interests

1,393

1,293

Total stockholders’ equity

218,930

221,211

Total liabilities and stockholders’

equity

$

976,395

$

961,940

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Three Months Ended March

31,

2020

2019

Cash flows from operating

activities:

Net income

$

3,215

$

1,861

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation and amortization

8,285

4,302

Amortization of debt issuance costs

1,022

833

Gain on disposal of property and

equipment

(393

)

(38

)

Deferred taxes

913

141

Stock-based compensation expense

2,234

1,021

Loss on interest rate hedge

171

—

Changes in operating assets and

liabilities

(4,676

)

(27,362

)

Net cash provided by (used in) operating

activities

10,771

(19,242

)

Cash flows from investing

activities:

Capital expenditures

(7,354

)

(3,814

)

Proceeds from sale of property and

equipment

512

137

Net cash used in investing activities

(6,842

)

(3,677

)

Cash flows from financing

activities:

Borrowings on revolving credit

facility

30,000

—

Repayments of long-term debt

(5,082

)

(5,610

)

Distributions to noncontrolling interest

owners

—

(5,100

)

Purchase of treasury stock

—

(3,201

)

Other

(675

)

(501

)

Net cash provided by (used in) financing

activities

24,243

(14,412

)

Net change in cash and cash

equivalents

28,172

(37,331

)

Cash and cash equivalents at beginning of

period

45,733

94,095

Cash and cash equivalents at end of

period

$

73,905

$

56,764

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Reconciliation of Non-GAAP

Supplemental Adjusted Financial Data (1)

(In thousands, except per

share data)

(Unaudited)

The Company reports its financial results in accordance with GAAP.

This press release also includes several Non-GAAP financial

measures as defined under the SEC’s Regulation G. The following

tables reconcile certain Non-GAAP financial measures used in this

press release to comparable GAAP financial measures.

Three Months Ended March 31,

2020

As Reported (GAAP)

Adjustment

Adjusted (Non-GAAP)

Revenues

$

296,688

$

—

$

296,688

Cost of revenues

(261,443

)

—

(261,443

)

Gross profit

35,245

—

35,245

General and administrative expense

(17,604

)

—

(17,604

)

Intangible asset amortization

(2,837

)

—

(2,837

)

Acquisition related costs

(473

)

473

—

Other operating expense, net

(2,228

)

—

(2,228

)

Operating income

12,103

473

12,576

Interest income

99

—

99

Interest expense

(7,803

)

—

(7,803

)

Income before income taxes

4,399

473

4,872

Income tax expense (2)

(1,184

)

(99

)

(1,283

)

Net income

3,215

374

3,589

Less: Net income attributable to noncontrolling interests

(100

)

—

(100

)

Net income attributable to Sterling common stockholders

$

3,115

$

374

$

3,489

Net income per share attributable to Sterling common stockholders:

Basic

$

0.11

$

0.02

$

0.13

Diluted

$

0.11

$

0.01

$

0.12

Weighted average common shares outstanding:

Basic

27,736

—

27,736

Diluted

27,992

—

27,992

(1)

The summary unaudited adjusted financial

data is presented excluding the costs of acquiring Plateau, net of

tax. This presentation is considered a non-GAAP financial measure,

which the Company believes provides a better indication of our

operating results prior to the excluded items.

(2)

Adjusted Non-GAAP income tax expense of

$1,283 includes non-cash federal income tax expense of $1,012.

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Reconciliation of Non-GAAP

Supplemental Adjusted Financial Data (1)

(In thousands, except per

share data)

(Unaudited)

The Company reports its financial results

in accordance with GAAP. This press release also includes several

Non-GAAP financial measures as defined under the SEC’s Regulation

G. The following tables reconcile certain Non-GAAP financial

measures used in this press release to comparable GAAP financial

measures.

Three Months Ended March 31,

2019

As Reported (GAAP)

Adjustment

Adjusted (Non-GAAP)

Revenues

$

223,949

$

—

$

223,949

Cost of revenues

(204,446

)

—

(204,446

)

Gross profit

19,503

—

19,503

General and administrative expense

(11,889

)

—

(11,889

)

Intangible asset amortization

(600

)

—

(600

)

Other operating expense, net

(2,294

)

—

(2,294

)

Operating income

4,720

—

4,720

Interest income

364

—

364

Interest expense

(3,060

)

—

(3,060

)

Income before income taxes

2,024

—

2,024

Income tax (expense) benefit

(163

)

141

(22

)

Net income

1,861

141

2,002

Less: Net income attributable to

noncontrolling interests

(46

)

—

(46

)

Net income attributable to Sterling common

stockholders

$

1,815

$

141

$

1,956

Net income per share attributable to

Sterling common stockholders:

Basic

$

0.07

$

—

$

0.07

Diluted

$

0.07

$

—

$

0.07

Weighted average common shares

outstanding:

Basic

26,377

—

26,377

Diluted

26,723

—

26,723

(1)

The summary unaudited adjusted financial

data is presented excluding the non-cash taxes. This presentation

is considered a non-GAAP financial measure, which the Company

believes provides a better indication of our operating results

prior to the excluded items.

STERLING CONSTRUCTION COMPANY,

INC. & SUBSIDIARIES

EBITDA Reconciliation

(In thousands)

(Unaudited)

Three Months Ended March

31,

2020

2019

Net income attributable to Sterling common

stockholders

$

3,115

$

1,815

Depreciation

5,448

3,702

Amortization

2,837

600

Interest expense, net of interest

income

7,704

2,696

Income tax (benefit) expense

1,184

163

EBITDA (1)

20,288

8,976

Acquisition related costs

473

—

Adjusted EBITDA (2)

$

20,761

$

8,976

(1)

The Company defines EBITDA as GAAP net

income (loss) attributable to Sterling common stockholders,

adjusted for depreciation and amortization, net interest expense,

taxes, and loss on extinguishment of debt.

(2)

Adjusted EBITDA excludes the impact of

acquisition related costs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200504005750/en/

Sterling Construction Company, Inc. Ron Ballschmiede, Chief

Financial Officer 281-214-0800

Investor Relations Counsel: The Equity Group Inc. Fred

Buonocore, CFA 212-836-9607

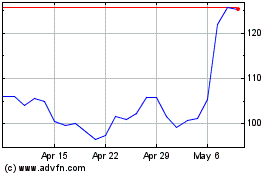

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

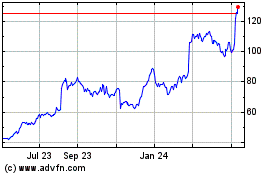

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Apr 2023 to Apr 2024