Heavy Civil Construction Combined Backlog

Reaches an all-time high of $1.2 billion

Tealstone Residential Continues to Set

Record Numbers

Reaffirms 2019 Outlook for Significant

Bottom Line Growth

Sterling Construction Company, Inc. (NasdaqGS: STRL) (“Sterling”

or “the Company”) today announced financial results for the first

quarter of 2019.

Consolidated First Quarter 2019 Financial Results Compared to

First Quarter 2018:

- Revenues were $223.9 million compared

to $222.5 million;

- Gross margin was 8.7% of revenues

compared to 8.9%;

- Net income attributable to Sterling

common stockholders was $1.8 million compared to $2.5 million;

and,

- Net income per diluted share

attributable to Sterling common stockholders was $0.07 compared to

$0.09.

Consolidated Financial Position, Liquidity and Cash Flows at

March 31, 2019:

- Cash and Cash Equivalents were $56.8

million;

- Debt totaled $77.3 million reflecting

$5.6 million of debt repayments in the first quarter 2019;

and,

- During the quarter, Sterling

repurchased 250 thousand shares of common stock for $3.2 million.

To date under the stock repurchase plan, Sterling has repurchased

717 thousand shares of common stock for $7.9 million.

Business Overview

First quarter 2019 revenues increased $1.5 million compared to

the prior year quarter. The increase in revenues over the first

quarter of 2018 was driven by a $7.5 million increase in

residential construction, partially offset by a $6.1 million

decrease in heavy civil construction, primarily related to two

large construction joint venture projects that were substantially

complete by the end of 2018. Several significant new heavy civil

projects are expected to ramp-up during the remainder of 2019.

Gross profit was $19.5 million in the first quarter of 2019, a

decrease of $0.3 million from the prior year first quarter. Gross

margin declined 19 basis points to 8.7%, which was driven by a

decrease in heavy civil construction.

General and administrative expenses were $12.5 million in the

first quarter of 2019, or 5.6% of revenues compared to $12.3

million or 5.5% of revenues in the first quarter of 2018.

Heavy Civil Construction Backlog Highlights

- Combined backlog at March 31, 2019

was $1.2 billion, an increase of 5.8% from $1.1 billion at

December 31, 2018. Combined backlog consists of $808.7 million

of backlog and $401.5 million of unsigned contracts as of

March 31, 2019 compared to $850.7 million and $292.7 million

at December 31, 2018, respectively. No residential

construction contracts are included in backlog;

- Gross margin on projects in combined

backlog as of March 31, 2019 averaged 8.6%, a decrease from

8.9% at December 31, 2018; and,

- Non-heavy highway revenues accounted

for 48.3% of first quarter of 2019 heavy civil construction

revenues compared to 42.6% of revenues in the first quarter of

2018.

CEO Remarks and Outlook

“I'm pleased with the financial results we were able to achieve

in extremely adverse conditions. Our 2019 first quarter results

reflect the typical seasonality in our Heavy Civil business and

difficult weather delays and related costs across our geographies,”

stated Joe Cutillo, Sterling’s Chief Executive Officer. “We expect

our execution on Heavy Civil projects to ramp up significantly

throughout the remainder of the year, as evidenced by the $100

million increase sequentially in Combined Backlog. We’re

particularly pleased with our continued momentum in adjacent market

expansion as we recently announced new airport and water

infrastructure awards. While a potential federal infrastructure

bill continues to dominate the narrative in our business, funding

on the state level is more than sufficient to drive end-market

demand for the foreseeable future.”

Mr. Cutillo continued, “Our residential segment continues to

excel as Tealstone delivered monumental results with a record

quarter, increasing revenue 21.3% compared to the first quarter of

2018. New home starts in our key markets of Dallas-Fort Worth,

Houston, and the surrounding areas remain robust. Also noteworthy

is the progress we made on the capital allocation front. We remain

committed to enhancing shareholder value as we repurchased 250

thousand shares and repaid $5.6 million of debt during the

quarter.”

Mr. Cutillo concluded, “Based on our first quarter results, our

current backlog, market strength and the continued mix shift

towards higher margin projects, we reaffirm our expectations for

full year 2019 revenues of between $1.075 billion and $1.095

billion and net income attributable to Sterling common stockholders

of $29 million to $32 million. The midpoint of our guidance implies

greater than 20% year-over-year growth in net income compared to

2018. In addition, we continue to expect our main residential

end-markets in the Dallas-Fort Worth Metroplex and the Houston area

to grow at low double-digit percentages. Our outlook does not

assume any major positive changes in federal government investment

in infrastructure, which would likely enhance our growth

forecast.”

Conference Call

Sterling’s management will hold a conference call to discuss

these results and recent corporate developments on Tuesday,

May 7, 2019 at 9:00 a.m. ET/8:00 a.m. CT. Interested parties

may participate in the call by dialing (201) 493-6744 or (877)

445-9755. Please call in ten minutes before the conference call is

scheduled to begin and ask for the Sterling Construction call.

Following management’s opening remarks, there will be a question

and answer session. Questions may be asked during the live call, or

alternatively, you may e-mail questions in advance to

Brigette.Wilcox@strlco.com.

To listen to a simultaneous webcast of the call, please go to

the Company’s website at www.strlco.com at least fifteen minutes

early to download and install any necessary audio software. If you

are unable to listen live, the conference call webcast will be

archived on the Company’s website for thirty days.

About Sterling

Sterling is a construction company that specializes in heavy

civil infrastructure construction and infrastructure rehabilitation

as well as residential construction projects. The Company operates

primarily in Arizona, California, Colorado, Hawaii, Nevada, Texas

and Utah, as well as other states in which there are feasible

construction opportunities. Heavy civil construction projects

include highways, roads, bridges, airfields, ports, light rail,

water, wastewater and storm drainage systems, foundations for

multi-family homes, commercial concrete projects and parking

structures. Residential construction projects include concrete

foundations for single-family homes.

Important Information for Investors and Stockholders

Cautionary Statement Regarding Forward-Looking Statements

This press release includes certain statements that fall within

the definition of “forward-looking statements” under the Private

Securities Litigation Reform Act of 1995. Any such statements are

subject to risks and uncertainties, including overall economic and

market conditions, federal, state and local government funding,

competitors’ and customers’ actions, and weather conditions, which

could cause actual results to differ materially from those

anticipated, including those risks identified in the Company’s

filings with the Securities and Exchange Commission. Accordingly,

such statements should be considered in light of these risks. Any

prediction by the Company is only a statement of management’s

belief at the time the prediction is made. There can be no

assurance that any prediction once made will continue thereafter to

reflect management’s belief, and the Company does not undertake to

update publicly its predictions or to make voluntary additional

disclosures of nonpublic information, whether as a result of new

information, future events or otherwise.

STERLING CONSTRUCTION COMPANY, INC.

& SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per share

data)

(Unaudited)

Three Months EndedMarch 31, 2019

2018 Revenues $ 223,949 $ 222,492 Cost of revenues

(204,446 ) (202,658 ) Gross profit 19,503 19,834 General and

administrative expenses (12,489 ) (12,340 ) Other operating

expense, net (2,294 ) (815 ) Operating income 4,720 6,679 Interest

income 364 129 Interest expense (3,060 ) (3,087 ) Income before

income taxes 2,024 3,721 Income tax expense (163 ) (41 ) Net income

1,861 3,680 Less: Net income attributable to

noncontrolling interests (46 ) (1,191 ) Net income attributable to

Sterling common stockholders $ 1,815 $ 2,489

Net income per share attributable to Sterling common stockholders:

Basic $ 0.07 $ 0.09 Diluted $ 0.07 $ 0.09 Weighted average

number of common shares outstanding used in computing per share

amounts: Basic 26,377 26,854 Diluted 26,723 27,078

STERLING CONSTRUCTION COMPANY, INC.

& SUBSIDIARIES

SEGMENT INFORMATION

(In thousands)

(Unaudited)

Three Months Ended March 31,

2019 % of

Total

2018 % of

Total

Revenue Heavy Civil Construction $ 181,184 81 % $ 187,241 84

% Residential Construction 42,765 19 % 35,251

16 % Total Revenue $ 223,949 $ 222,492

Operating Income Heavy Civil Construction $ (847 ) (18 )% $

1,945 29 % Residential Construction 5,567 118 %

4,734 71 % Total Operating Income $ 4,720 $

6,679

STERLING CONSTRUCTION COMPANY, INC.

& SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except per share

data)

March 31,2019 December

31,2018 Assets (Unaudited) Current assets:

Cash and cash equivalents $ 56,764 $ 94,095 Receivables, including

retainage 147,001 145,026 Costs and estimated earnings in excess of

billings on uncompleted contracts 44,133 41,542 Inventories 2,699

3,159 Receivables from and equity in construction joint ventures

11,625 10,720 Other current assets 6,696 8,074

Total current assets

268,918 302,616 Property and equipment, net 52,011 51,999 Operating

lease right-of-use assets 15,290 — Goodwill 85,231 85,231

Intangibles, net 41,818 42,418 Other assets, net 246

309 Total assets $ 463,514 $ 482,573

Liabilities and Stockholders’ Equity Current liabilities:

Accounts payable $ 81,870 $ 99,426 Billings in excess of costs and

estimated earnings on uncompleted contracts 55,598 62,407 Current

maturities of long-term debt 393 2,899 Current portion of long-term

lease obligations 7,009 — Income taxes payable 340 318 Accrued

compensation 10,500 9,448 Other current liabilities 6,300

4,676 Total current liabilities 162,010

179,174 Long-term debt, net of current

maturities 76,923 79,117 Long-term lease obligations 8,466 —

Members’ interest subject to mandatory redemption and undistributed

earnings 47,132 49,343 Deferred taxes 1,591 1,450 Other long-term

liabilities 1,115 1,229 Total

liabilities 297,237 310,313

Stockholders’ equity: Preferred stock, par value $0.01 per share;

1,000 shares authorized, none issued — — Common stock, par value

$0.01 per share; 38,000 shares authorized, 27,056 and 27,064 shares

issued, 26,424 and 26,597 shares outstanding 271 271 Additional

paid in capital 233,502 233,795 Treasury Stock, at cost: 632 and

467 shares (7,182 ) (4,731 ) Retained deficit (63,119 )

(64,934 ) Total Sterling stockholders’ equity 163,472

164,401 Noncontrolling interests 2,805 7,859

Total stockholders’ equity 166,277

172,260 Total liabilities and stockholders’ equity $ 463,514

$ 482,573

STERLING CONSTRUCTION COMPANY, INC.

& SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

Three Months EndedMarch 31,

2019 2018 Cash flows from operating

activities: Net income 1,861 3,680 Adjustments to reconcile net

income to net cash used in operating activities: Depreciation and

amortization 4,389 4,124 Amortization of deferred loan costs 833

801 Gain on disposal of property and equipment (38 ) (250 )

Deferred tax expense 141 — Stock-based compensation expense 1,021

617 Changes in operating assets and liabilities (27,449 ) (31,464 )

Net cash used in operating activities (19,242 ) (22,492 ) Cash

flows from investing activities: Additions to property and

equipment (3,814 ) (1,897 ) Proceeds from sale of property and

equipment 137 886 Net cash used in investing

activities (3,677 ) (1,011 ) Cash flows from financing activities:

Repayments on long-term debt (5,610 ) (4,679 ) Distributions to

noncontrolling interest owners (5,100 ) — Purchase of treasury

stock (3,201 ) — Other (501 ) (309 ) Net cash used in financing

activities (14,412 ) (4,988 ) Net decrease in cash and cash

equivalents (37,331 ) (28,491 ) Cash and cash equivalents at

beginning of period 94,095 83,953 Cash and cash

equivalents at end of period $ 56,764 $ 55,462

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190506005695/en/

Sterling Construction Company, Inc.Ron Ballschmiede, Chief

Financial Officer281-214-0800Investor Relations Counsel:The

Equity Group Inc.Fred Buonocore, CFA 212-836-9607Kevin Towle

212-836-9620

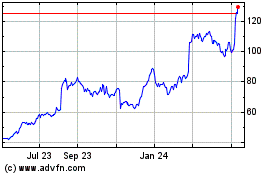

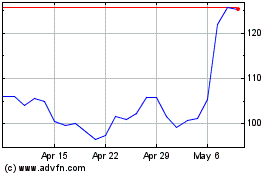

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Apr 2023 to Apr 2024