As filed with the Securities and Exchange Commission

on October 12, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

STAGWELL INC.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

86-1390679

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification Number)

|

One World Trade Center, Floor 65

New York, NY 10007

(646) 429-1800

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Frank Lanuto

Chief Financial Officer

Stagwell Inc.

One World Trade Center, Floor 65

New York, NY 10007

(646) 412-6857

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Paul M. Tiger, Esq.

Andrea M. Basham, Esq.

Freshfields Bruckhaus Deringer US LLP

601 Lexington Avenue

New York, New York 10022

(212) 277-4000

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction

I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the

Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated filer

|

¨

|

Accelerated filer

|

x

|

|

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

|

|

|

|

|

Emerging growth company

|

¨

|

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of Securities Act.¨

CALCULATION OF REGISTRATION FEE

Title of each class of

securities to be registered

|

|

Amount

to be registered

|

|

|

Proposed

maximum

offering price

per unit

|

|

|

Proposed

maximum

aggregate

offering price

|

|

|

Amount of

registration fee

|

|

|

Class A Common Stock(1)

|

|

|

228,010,262

|

|

|

$

|

7.79

|

(2)

|

|

$

|

1,776,199,940.98

|

(2)

|

|

$

|

60,398.21

|

(3)

|

(1) Includes: (i) 27,091,465 shares of the registrant’s

Class A common stock, par value $0.001 per share (the “Class A common stock”), beneficially owned by the selling stockholders,

including 549,051 shares of unvested restricted stock, (ii) 179,970,051 shares of Class A common stock issuable in exchange for an equal

number of shares of the registrant’s Class C common stock, par value $0.00001 per share (the “Class C common stock”), together with such shares’ corresponding economic interest in a subsidiary of the registrant,

beneficially owned by the selling stockholders and (iii) 20,948,746 shares of Class A common stock issuable upon conversion of the 73,849

outstanding shares of the registrant’s Series 8 convertible preferred stock, par value $0.001 per share (the “Series 8 preferred

stock”). In addition, pursuant to Rule 416(a) under the Securities Act, the shares of Class A common stock being registered for

the selling stockholders hereunder include such indeterminate number of shares as may be issuable as a result of stock splits, stock dividends

or similar transactions.

(2) Estimated solely for the purpose of determining

the registration fee pursuant to Rule 457(c) under the Securities Act based upon the average of the high and low prices for the registrant’s

common stock as reported on the Nasdaq Global Select Market on October 4, 2021.

(3) The registrant previously paid a registration

fee of $124,500.00 in connection with the registrant’s Registration Statement on Form S-3 (File No. 333-222095) filed under the

Securities Act on December 15, 2017 (the “First Prior S-3 Registration Statement”). No securities were sold thereunder. $37,820.87

of the $124,500.00 was applied to offset the registration fee payable in connection with the registrant’s Registration Statement

on Form S-4/A filed under the Securities Act on April 30, 2021 (File No. 333-252829) pursuant to Rule 457(p) under the Securities Act.

Pursuant to Rule 457(p), $86,679.13 of the registration fee paid in connection with the First Prior S-3 Registration Statement remained

available for future setoff. In addition, the registrant previously paid a registration fee of $17,576.39 in connection with the registrant’s

Registration Statement on Form S-3 (File No. 333-222101) filed under the Securities Act on December 15, 2017 (the “Second Prior

S-3 Registration Statement”). No securities were sold thereunder. Pursuant to Rule 457(p), the registration fee due hereunder was

offset by $104,255.52, representing (i) the remaining $86,679.13 relating to the First Prior S-3 Registration Statement and (ii) the $17,576.39

relating to the Second Prior S-3 Registration Statement, resulting in a filing fee of $60,398.21 due hereunder.

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

OCTOBER 12, 2021

PROSPECTUS

Stagwell Inc.

228,010,262 Shares of Class A Common Stock

The selling stockholders named in this

prospectus may offer for resale under this prospectus, from time to time, up to 228,010,262 shares of our Class A common stock. The

Class A common stock offered hereunder includes (i) 27,091,465 shares of Class A common stock that are issued and outstanding, (ii)

179,970,051 shares of Class A common stock issuable in exchange for an equal number of shares of Class C common stock, together with

such shares’ corresponding economic interest in a subsidiary of the Company, and (iii) 20,948,746 shares of Class A common stock

issuable upon conversion of the Series 8 preferred stock.

The Class A common stock may be offered or sold

by the selling stockholders at fixed prices, at prevailing market prices at the time of sale or at prices negotiated with purchasers,

to or through underwriters, broker-dealers, agents, or through any other means described in this prospectus under “Plan of Distribution.”

We will bear all costs, expenses and fees in connection with the registration of the selling stockholders’ Class A common stock.

The selling stockholders will pay all commissions and discounts, if any, attributable to the sale or disposition of its shares of our

Class A common stock, or interests therein.

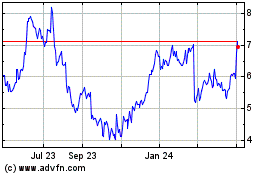

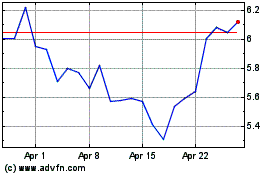

Our Class A common stock is listed on the Nasdaq

Global Select Market under the symbol “STGW.” As of October 8, 2021, the last reported sale price of our Class A common stock

was $8.39 per share.

This prospectus describes the general manner in

which Class A common stock may be offered and sold by the selling stockholders. We will provide supplements to this prospectus describing

the specific manner in which the selling stockholders’ Class A common stock may be offered and sold to the extent required by law.

We urge you to read carefully this prospectus, any accompanying prospectus supplement and any documents we incorporate by reference into

this prospectus and any accompanying prospectus supplement before you make your investment decision.

The selling stockholders may sell Class A common

stock to or through underwriters, dealers or agents. The names of any underwriters, dealers or agents involved in the sale of any common

stock and the specific manner in which it may be offered will be set forth in the prospectus supplement covering that sale to the extent

required by law. The selling stockholders may also use this prospectus to distribute shares of common stock to their shareholders, members

or partners pursuant to an in-kind distribution.

Investing in our Class A common stock involves

risks. You should carefully consider all of the information set forth in this prospectus, including the risk factors set forth under “Risk

Factors” in Exhibit 99.2 to our Current Report on Form 8-K filed with the Securities and Exchange Commission on August 10, 2021

(which section is specifically incorporated by reference herein), as well as the risk factors and other information in any accompanying

prospectus supplement and any documents we incorporate by reference into this prospectus and any accompanying prospectus supplement, before

deciding to invest in our Class A common stock. See “Incorporation By Reference.”

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2021.

TABLE OF CONTENTS

Prospectus

ABOUT

THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the Securities and Exchange Commission, which we refer to as the SEC, using the SEC’s “shelf” registration

rules. Pursuant to this prospectus, the selling stockholders named on page 7 may, from time to time, sell up to a total of 228,010,262

shares of Class A common stock described in this prospectus in one or more offerings.

In this prospectus, all references to the “Company,”

“Stagwell,” “we,” “us” and “our” refer to Stagwell Inc., a Delaware corporation, and its

consolidated subsidiaries.

When the selling stockholders sell Class A common

stock under this prospectus, we will, if necessary and required by law, provide a prospectus supplement that will contain specific information

about the terms of that offering. Any prospectus supplement may also add to, update, modify or replace information contained in this prospectus.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to

the actual documents for complete information. All of the summaries are qualified in their entirety by reference to the actual documents.

Copies of some of the documents referred to herein have been filed or will be filed or incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below in the section entitled

“Where You Can Find More Information.”

You should not assume that the information in

this prospectus, any accompanying prospectus supplement or any documents we incorporate by reference into this prospectus and any prospectus

supplement is accurate as of any date other than the date on the front of those documents. Our business, financial condition, results

of operations and prospects may have changed since those dates.

STAGWELL INC.

The combination of the Company’s preexisting

business with the business of the subsidiaries of Stagwell Media LP that own and operate a portfolio of marketing services companies is

intended to build a holding company positioned to transform marketing. The Company aims to deliver scaled creative performance for some

of the world’s most ambitious brands, connecting creativity with leading-edge technology to harmonize the art and science of marketing.

Led by entrepreneurs, the Company’s more than 10,000 specialists in over 30 countries strive to drive effectiveness and improve

business results for their clients.

Over the last 15 years, marketing was characterized

by television and brand advertising targeted to many through scale and reach. Since that time, a significant majority of overall growth

in the industry has come from the expansion of digital marketing with the creation and growth of digital/social media platforms, including

Facebook, Google, Twitter, Snapchat, LinkedIn and TikTok. Furthermore, the ability of consumers to purchase products through online channels

(e-commerce) either on digital platforms like Amazon or on retailers’ own websites has allowed marketers to create their own relationships

with customers.

With 21st century technical and digital know-how

across the Company, we believe we are positioned to take advantage of the continued disruption sweeping the marketing universe. The goal

in the current market is for marketers, based on the ability to leverage various types of customer data, to target the right ads and content

to the right people at the right time. With the creative assets and digital expertise at the combined Company, we believe we are positioned

to play a strong role in disrupting the legacy holding company model based on this new digital paradigm when the competition is still

very much reliant on the marketing model of the past.

Stagwell Inc. was originally formed as a Delaware

limited liability company on December 16, 2020 and was converted into a Delaware corporation on July 29, 2021. Our principal executive

office is located at One World Trade Center, Floor 65, New York, New York, 10007. Our telephone number is (646) 429-1800. Our website

address is http://www.stagwellglobal.com. Information contained on our website or on other external websites mentioned throughout

this prospectus is expressly not incorporated by reference into this prospectus.

RISK FACTORS

You should carefully consider the risk factors

set forth under “Risk Factors” in Exhibit 99.2 to our Current Report on Form 8-K filed with the Securities and Exchange Commission

on August 10, 2021 (which section is specifically incorporated by reference herein), as well as other risk factors described under the

caption “Risk Factors” in any accompanying prospectus supplement and any documents we incorporate by reference into this prospectus,

including all future filings we make with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), before deciding to invest in our Class A common stock. See “Incorporation By

Reference.”

DISCLOSURE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated

herein by reference contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Exchange Act and the United States Private Securities Litigation Reform Act of 1995, as amended. Statements

in this prospectus or that are incorporated by reference in this prospectus that are not historical facts, including statements about

the Company’s beliefs and expectations, recent business and economic trends, potential acquisitions and estimates of amounts for

redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. These statements are

based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in

this section. These forward-looking statements are subject to various risks and uncertainties, many

of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Forward-looking statements

speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information

or future events, if any.

Forward-looking statements involve inherent risks

and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking

statements. Such risk factors include, but are not limited to, the following:

|

|

·

|

risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients,

including as a result of the novel coronavirus pandemic (“COVID-19”);

|

|

|

·

|

the effects of the outbreak of COVID-19, including the measures to reduce its spread, and the impact on the economy and demand for

our services, which may precipitate or exacerbate other risks and uncertainties;

|

|

|

·

|

an inability to realize expected benefits of the redomiciliation of the Company from the federal jurisdiction of Canada to the State

of Delaware (the “Redomiciliation”) and the subsequent combination of the Company’s preexisting business with the business

of the subsidiaries of Stagwell Media LP that own and operate a portfolio of marketing services companies (the “Business Combination”

and, together with the Redomiciliation, the “Transactions”) or the occurrence of difficulties in connection with the Transactions;

|

|

|

·

|

adverse tax consequences in connection with the Transactions for the Company, its operations and its stockholders, that may differ

from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United

States and disagreements with the tax authorities on the Company’s determination of value and computations of its attributes may

result in increased tax costs;

|

|

|

·

|

the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Transactions;

|

|

|

·

|

the impact of uncertainty associated with the Transactions on the Company’s businesses;

|

|

|

·

|

direct or indirect costs associated with the Transactions, which could be greater than expected;

|

|

|

·

|

risks associated with severe effects of international, national and regional economic conditions;

|

|

|

·

|

the Company’s ability to attract new clients and retain existing clients;

|

|

|

·

|

reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

|

|

|

·

|

financial failure of the Company’s clients;

|

|

|

·

|

the Company’s ability to retain and attract key employees;

|

|

|

·

|

the Company’s ability to achieve the full amount of its stated cost saving initiatives;

|

|

|

·

|

the Company’s implementation of strategic initiatives;

|

|

|

·

|

the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent

payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred

acquisition consideration;

|

|

|

·

|

the successful completion and integration of acquisitions that complement and expand the Company’s business capabilities; and

|

|

|

·

|

foreign currency fluctuations.

|

Undue reliance should not be placed on our forward-looking

statements. Although forward-looking statements reflect our good faith beliefs, reliance should not be placed on forward-looking statements

because they involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements

to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements.

We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future

events, changed circumstances or otherwise, except to the extent law requires.

USE OF PROCEEDS

We will not receive any proceeds from the sale

of shares of our Class A common stock by the selling stockholders identified in this prospectus, their pledgees, donees, transferees or

other successors in interest. The selling stockholders will receive all of the net proceeds from the sale of their shares of our Class

A common stock. See “Selling Stockholders.”

SELLING STOCKHOLDERS

This registration statement of which this prospectus

forms a part has been filed pursuant to registration rights granted to the selling stockholders in order to permit the selling stockholders

to resell to the public shares of our Class A common stock, including shares of Class A common stock issuable upon the conversion of convertible

securities and vesting of unvested restricted shares beneficially owned by the selling stockholders, as well as any Class A common stock

that we may issue or may be issuable by reason of any stock split, stock dividend or similar transaction involving these shares. Under

the terms of the registration rights agreements between us and the selling stockholders named herein, we will pay all expenses of the

selling stockholders’ shares of our Class A common stock, including SEC filing fees, except that the selling stockholders will pay

all underwriting discounts and selling commissions, if any.

The table below provides, as of the date of this

prospectus, information regarding the beneficial ownership of our Class A common stock of each selling stockholder, the number of shares

of Class A common stock that may be sold by each selling stockholder under this prospectus and that each selling stockholder will beneficially

own after this offering. We have based percentage ownership on 91,084,186 shares of Class A common stock outstanding as of the date

of this prospectus.

Because each selling stockholder may dispose of

all, none or some portion of the shares of Class A common stock covered by this prospectus, no estimate can be given as to the number

of shares of Class A common stock that will be beneficially owned by a selling stockholder upon termination of this offering. For purposes

of the table below, however, we have assumed that after termination of this offering, none of the shares of Class A common stock covered

by this prospectus will be beneficially owned by the selling stockholders and further assumed that the selling stockholders will not acquire

beneficial ownership of any additional securities during the offering. In addition, the selling stockholders may have sold, transferred

or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, our securities in transactions

exempt from the registration requirements of the Securities Act after the date on which the information in the table is presented. When

we refer to the selling stockholders in this prospectus, we mean the individuals and entities listed in the table below, as well as their

pledgees, donees, assignees, transferees and successors in interest.

We may amend or supplement this prospectus from

time to time in the future to update or change this selling securityholders list and the securities that may be resold.

Please see the section titled “Plan of Distribution”

for further information regarding the selling stockholders’ method of distributing these shares.

|

|

|

Type of

|

|

Shares of Class A

Common Sock

Beneficially Owned

|

|

|

Number of

Shares

|

|

|

Shares of Class A

Common Stock

Beneficially Owned

After the Offering

|

|

|

Name

|

|

Shareholding

|

|

Prior to theOffering

|

|

|

Offered

|

|

|

Number

|

|

|

Percent

|

|

|

Mark J. Penn

|

|

Direct

|

|

|

589,051

|

(1)

|

|

|

589,051

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

Indirect

|

|

|

206,472,465

|

(2)

|

|

|

206,472,465

|

|

|

|

—

|

|

|

|

—

|

|

|

The Stagwell Group LLC(2)

|

|

|

|

|

206,472,465

|

(2)

|

|

|

206,472,465

|

|

|

|

—

|

|

|

|

—

|

|

|

Goldman Sachs(3)

|

|

|

|

|

20,961,554

|

(3)

|

|

|

20,948,746

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(1)

|

Includes 549,051 shares of unvested restricted stock that are not scheduled to vest until December 31, 2022 subject to achievement

of financial performance targets and continued employment.

|

|

|

(2)

|

Mr. Penn, our Chairman and CEO, is the controlling person of (i) The Stagwell Group LLC, the manager of Stagwell Agency Holdings

LLC and the general partner of Stagwell Media LP, and (ii) Stagwell Media LP, the manager of Stagwell Friends and Family LLC. The Stagwell

Group LLC directly holds 130,000 shares of Class A common stock. Stagwell Agency Holdings LLC directly holds 26,372,414 shares of Class

A common stock. Stagwell Media LP directly holds 160,909,058 shares of Class C common stock, which are convertible into 160,909,058 shares

of Class A common stock. Stagwell Friends and Family LLC directly holds 19,060,993 shares of Class C common stock, which are convertible

into 19,060,993 shares of Class A common stock. The address of each of Stagwell Agency Holdings LLC, Stagwell Friends and Family LLC,

Stagwell Media LP and The Stagwell Group LLC is 1808 I Street, NW, Sixth Floor, Washington, DC 20006.

|

|

|

(3)

|

The Goldman Sachs Group Inc. (“GS Group”) and Goldman Sachs & Co. LLC (“Goldman Sachs”) may each be

deemed to beneficially own 20,961,554 shares of Class A common stock, consisting of (i) based solely on information provided by Goldman Sachs, 12,808 shares of Class A Common Stock directly held by Goldman Sachs or another wholly-owned broker or dealer

subsidiary of GS Group in ordinary course trading activities; (ii) 61,411 shares of Series 8 preferred stock, which are convertible

into 17,420,458 shares of Class A common stock, directly held by Broad Street Principal Investments, L.L.C. (“BSPI”);

(iii) 9,183 shares of Series 8 preferred stock, which are convertible into 2,604,942 shares of Class A common stock, directly held

by StoneBridge 2017, L.P. (“SB Employee Fund”); and (iv) 3,255 shares of Series 8 preferred stock, which are convertible

into 923,346 shares of Class A common stock, directly held by StoneBridge 2017 Offshore, L.P. (“SB Employee Fund

Offshore,” and together with SB Employee Fund, the “Employee Funds”). Goldman Sachs is a subsidiary of GS Group.

Goldman Sachs is the manager of BSPI and Bridge Street Opportunity Advisors, L.L.C (“Bridge Street”) and the investment

manager of the Employee Funds. GS Group is the direct owner of Bridge Street. Bridge Street is the general partner of each Employee

Fund. The address of each of GS Group, Goldman Sachs, BSPI, the Employee Funds and Bridge Street is 200 West Street, New York, NY

10282.

|

DESCRIPTION OF OUR

CAPITAL STOCK

The following description of our capital stock

is a summary. This summary is qualified by the complete text of our certificate of incorporation (the “Certificate of Incorporation”)

and bylaws (the “Bylaws”), each of which is incorporated by reference as an exhibit to the registration statement of which

this prospectus forms a part.

General

The Certificate of Incorporation authorizes 1,000,000,000

shares of Class A common stock, par value $0.001 per share, 5,000 shares of Class B common stock, par value $0.001 per share, 250,000,000

shares of Class C common stock, par value $0.00001 per share, and 200,000,000 shares of Preferred Stock, par value $0.001 per share.

Common Stock

Voting Rights

Each holder of (i) Class A common stock is entitled

to one vote, (ii) Class B common stock is entitled to twenty votes and (iii) Class C common stock is entitled to one vote for each share

on all matters submitted to a vote of the stockholders, including the election of directors. In any uncontested election of directors,

each person receiving a majority of the votes cast shall be elected. In any contested election of directors, the persons receiving a plurality

of the votes cast shall be elected. Accordingly, holders of a majority of the voting power are able to elect all of the directors of the

Company, subject to the rights, if any, of holders of any series of preferred stock to elect additional directors under specific circumstances.

Unless otherwise required by law, other actions by the stockholders will be authorized by the affirmative vote of holders of a majority

of the voting power of the capital shares present in person or by proxy at the meeting such action is taken.

Dividends

Subject to preferences that may be applicable

to any then outstanding shares of any series of preferred stock, holders of shares of Class A common stock and Class B common stock are

entitled to receive dividends, if any, as may be declared from time to time by the Company’s Board of Directors (the “Board”)

out of legally available funds. Holders of shares of Class C common stock are not entitled to receive dividends. Declaration and payment

of any dividend are subject to the discretion of the Board and may be paid in cash, in property or in shares of common stock. If the Board

declares a dividend on the Class A common stock, it shall declare a dividend on the Class B common stock in an amount equal to or, in

its discretion, lesser per share than on the Class A common stock, and if the Board declares a dividend on the Class B common stock, it

shall declare a dividend on the Class A common stock in an amount equal to or, in its discretion, greater per share than on the Class

B common stock.

Liquidation

In the event of or the Company’s liquidation,

dissolution or winding up, holders of common stock are entitled to share ratably in the net assets legally available for distribution

to stockholders after the payment of all of the Company’s debts and other liabilities and the satisfaction of any liquidation preference

or other similar rights granted to the holders of any then outstanding shares of any series of preferred stock.

Rights and Preferences

Holders of common stock have no preemptive, subscription

or other rights, and there are no redemption or sinking fund provisions applicable to shares of common stock. The rights, preferences

and privileges of the holders of common stock are subject to and may be adversely affected by the rights of the holders of shares of any

series of preferred stock that the Company may designate.

Conversion and Transfer

Holders of Class B common stock have the right,

at their election, to convert such shares into shares of Class A common stock on a one-to-one basis, and holders of Class A common stock

have the right to convert such shares to Class B common stock on a one-to-one basis in connection with the occurrence of certain events

related to an offer to purchase all shares of Class B common stock.

Holders of Class C common stock have the right,

at their election, to convert such shares of Class C common stock, together with such shares’ corresponding economic interest in

a subsidiary of the Company, into shares of Class A common stock on a one-to-one basis. Shares of Class C common stock are

not transferable except together with such corresponding economic interest.

Fully Paid and Nonassessable

The Company’s shares of capital stock are

fully paid and non-assessable.

Preferred Stock

There is one issued and outstanding series of

preferred stock of the Company, the Series 8 preferred stock. On September 23, 2021, the Company issued a notice of conversion (the “conversion

notice”) with respect to the outstanding shares of Series 8 preferred stock. Pursuant to the conversion notice and the terms of

the certificate of designation of the Series 8 preferred stock, shares of Series 8 preferred stock will not accrue interest and are convertible

(i) into shares of Class A common stock, as described elsewhere in this prospectus, or (ii) in certain limited circumstances set forth

in the certificate of designation, into shares of the Company’s Series 9 Convertible Preferred Stock, par value $0.001 per share

(the “Series 9 preferred stock”). No shares of Series 9 preferred stock are currently outstanding. If issued, shares of Series

9 preferred stock would not accrue interest and would be convertible on a one-for-one basis into shares of Class A common stock.

Except as required by law, holders of a series

of preferred stock will not be entitled to receive notice of or to attend any meeting of the stockholders of the Company or to vote at

any such meeting but would be entitled to receive notice of meetings of stockholders of the Company called for the purpose of authorizing

the dissolution of the Company or the sale of its undertaking or a substantial part thereof.

The Certificate of Incorporation authorizes the

Board from time to time to create one or more additional series of preferred stock by resolution and, with respect to each such series,

to fix the number of shares constituting such series and the designations, powers, preferences, rights, qualifications, limitations and

restrictions in respect of the shares of such series, without vote or action by the Company’s stockholders.

The Company has no current plan to issue any additional

shares of preferred stock.

Annual Stockholder Meetings

The Bylaws provide that annual stockholder meetings

will be held at a date, place (if any) and time as exclusively selected by the Board. To the extent permitted under applicable law, the

Company may, but is not obligated to, conduct annual stockholder meetings by remote communications, including by webcast.

Anti-Takeover Effects of Provisions of the Certificate of Incorporation

and Bylaws and Delaware Law

Some provisions of Delaware law and the Certificate

of Incorporation and Bylaws could make the following transactions difficult: acquisition of the Company by means of a tender offer, merger

or otherwise; or removal of incumbent officers and directors of the Company by means of a proxy contest or otherwise. It is possible that

these provisions could make it more difficult to accomplish or could deter transactions that stockholders may otherwise consider to be

in their best interest or in the best interests of the Company, including transactions that might result in a premium over the market

price for the Class A common stock.

These provisions, summarized below, are expected

to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking

to acquire control of the Company to first negotiate with the Board. We believe that the benefits of the Company’s potential ability

to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure the Company outweigh the disadvantages

of discouraging these proposals because negotiation of these proposals could result in an improvement of their terms.

Undesignated Preferred Stock

The ability to authorize undesignated preferred

stock makes it possible for the Board to issue shares of preferred stock with voting or other rights or preferences that could impede

the success of any attempt to change control of the Company. Such provision may have the effect of deterring hostile takeovers or delaying

changes in control or management of the Company.

Special Stockholder Meetings

The Certificate of Incorporation and the Bylaws

provide that a special meeting of stockholders may be called only by the Chairman of the Board or the majority of the whole Board. This

may limit the ability of stockholders to take action between annual meetings without the prior approval of the Board.

Stockholder Action by Written Consent

Until the first date on which Stagwell Media LP

and certain permitted transferees, directly or indirectly, cease to beneficially own, in the aggregate, shares of common stock representing

at least thirty percent (30%) of the Company’s voting power, the Certificate of Incorporation permits stockholders to take action

by written consent.

Requirements for Advance Notification of Stockholder Nominations

and Proposals and Proxy Access

The Bylaws establish advance notice procedures

with respect to stockholder proposals and the nomination of candidates for election as directors, other than nominations made by or at

the direction of the Board or a committee of the Board.

Composition of the Board; Election and Removal of Directors

Directors are elected until their respective successors

are duly elected and qualified or until their earlier death, resignation or removal. At each annual meeting of the Company, directors

are elected to one-year terms.

Subject to the rights, if any, of holders of any

series of preferred stock with respect to removal without cause of directors elected by such holders, directors may be removed with or

without cause at any time by the holders of a majority of the shares of capital stock entitled to vote at a meeting of stockholders.

Directors are elected by the vote of the majority

of the votes cast with respect to the director at any meeting for the election of directors at which a quorum is present, except if, as

of the date that is 14 days before the Company files its definitive proxy statement (regardless of whether or not thereafter revised or

supplemented) with the SEC, the number of director nominees exceeds the number of directors to be elected, in which case directors on

the Board are elected by the vote of a plurality of the votes cast. Unless plurality voting shall have applied to the election, any director

who receives a greater number of “against” votes than votes “for” election, the Board decides whether to accept

or reject the resignation that was submitted upon his or her election, or whether other action should be taken. The Board acts on such

recommendation within 90 days following certification of the election results.

Exclusive Forum

The Certificate of Incorporation provides that,

unless the Company consents in writing to the selection of an alternative forum, and subject to applicable jurisdictional requirements,

the Court of Chancery of the State of Delaware is the exclusive forum (or if the Court of Chancery of the State of Delaware lacks jurisdiction,

then another court of the State of Delaware or, if no court of the State of Delaware has jurisdiction, then the United States District

Court for the District of Delaware) for: (a) any derivative action or proceeding brought on behalf of the Company; (b) any action or proceeding

asserting a claim of breach of a fiduciary duty owed by any current or former director, officer or other employee or stockholder of the

Company to the Company or the Company’s stockholders; (c) any action or proceeding asserting a claim arising pursuant to any provision

of the General Corporation Law of the State of Delaware (the “DGCL”) (or any successor provision thereto) or as to which the

DGCL (or any successor provision thereto) confers jurisdiction on the Court of Chancery of the State of Delaware; (d) any action or proceeding

asserting a claim against the Company or any current or former director, officer or other employee of the Company arising pursuant to

any provision of the DGCL, the Certificate of Incorporation or the Bylaws (as each may be amended form time to time); (e) any action asserting

a claim governed by the internal affairs doctrine; or (f) any other action asserting an “internal corporate claim” as that

term is defined in Section 115 of the DGCL. The exclusive forum provision does not apply to suits brought to enforce a duty or liability

created by the Exchange Act, or any rules or regulations promulgated thereunder, or any other claim for which the United States federal

courts have exclusive jurisdiction.

The Certificate of Incorporation further provides

that the federal district courts of the United States of America are the exclusive forum for resolving any complaint asserting a cause

of action arising under the Securities Act.

These choice of forum provisions may limit a stockholder’s

ability to bring a claim in a judicial forum that it finds favorable for disputes with the Company or its directors, officers or other

matters pertaining to the Company’s internal affairs, and may discourage lawsuits with respect to such claims. Alternatively, if

a court were to find these provisions of the Certificate of Incorporation inapplicable to, or unenforceable in respect of, one or more

of the specified types of actions or proceedings, the Company may incur additional costs associated with resolving such matters in other

jurisdictions, which could adversely affect its business, results of operations or financial condition.

Business Combinations Involving Interested Stockholders

In general, Section 203 of the DGCL (“Section 203”)

prohibits a publicly held Delaware corporation from engaging in a business combination with an interested stockholder for a period of

three years following the date that such person became an interested stockholder, unless (i) the board of directors of the corporation

has approved, prior to the time the person became an interested stockholder, either the business combination or the transaction that resulted

in the person becoming an interested stockholder, (ii) upon consummation of the transaction that resulted in the person becoming

an interested stockholder, the person owns at least 85% of the corporation’s voting stock (excluding shares owned by directors who

are also officers and shares owned by employee stock plans in which participants do not have the right to determine confidentially whether

shares subject to the plan will be tendered in a tender or exchange offer) or (iii) after the person or entity becomes an interested

stockholder, the business combination is approved by the board of directors and authorized at a meeting of stockholders by the affirmative

vote of at least 66-2/3% of the outstanding voting stock not owned by the interested stockholder. Generally, a “business combination”

is defined to include a merger, consolidation, a sale of assets and other transactions resulting in a financial benefit to the interested

stockholder. Generally, an “interested stockholder” is a person that owns (or is an affiliate or associate of the corporation

and within the prior three years did own) 15% or more of a corporation’s voting stock and the affiliates and associates of

any such person.

Section 203 provides that these restrictions

do not apply if, among other things, the corporation’s certificate of incorporation contains a provision expressly electing not

to be governed by Section 203. The Certificate of Incorporation opts out of Section 203 until the first date on which Stagwell

Media LP and its permitted transferees, directly or indirectly, cease to beneficially own, in the aggregate, shares of common stock representing

at least five percent (5%) of the Company’s voting power. From and after such date, the Company shall be governed by Section 203

so long as Section 203 by its terms would apply to the Company.

Corporate Opportunities Waiver

Directors (the “Exempted Persons”)

have no duty to refrain from (i) engaging directly or indirectly in the same or similar business activities or lines of business

that the Company does, (ii) doing business with any potential or actual customer or supplier of the Company or (iii) employing

or otherwise engaging any officer or employee of the Company. In the event that any Exempted Person acquires knowledge of a potential

transaction or matter that may be a corporate opportunity for him or herself or another person and us, the Company will not have any expectancy

in the corporate opportunity, and no Exempted Person will have any duty to communicate or offer the corporate opportunity to us and may

pursue or acquire such corporate opportunity for him or herself or direct such opportunity to another person. In addition, Exempted Persons

will be expressly permitted to act in their own best interest and will be under no obligation to take any action in their capacity as

a director that prefers the interest of the Company over their own self-interest. Exempted Persons will further be expressly permitted

to use information they acquired as a director that enhanced their knowledge and understanding of the industries in which the Company

operates in making investment or voting decisions relating to non-Company entities or securities.

Limitations of Liability and Indemnification Matters

The Certificate of Incorporation contains provisions

that limit the liability of directors for monetary damages for breach of fiduciary duty as a director to the fullest extent permitted

by Delaware law. Consequently, directors will not be personally liable to the Company or its stockholders for monetary damages for any

breach of fiduciary duties as directors, except liability for:

|

|

·

|

any breach of the director’s duty of loyalty to the Company or its stockholders;

|

|

|

·

|

any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

|

|

|

·

|

willful or negligent declaration and payment of unlawful dividends, or unlawful share purchases or redemptions; or

|

|

|

·

|

any transaction from which the director derived an improper personal benefit.

|

The Bylaws provide that the Company is

required to indemnify its directors and officers, in each case to the fullest extent permitted by Delaware law. The Bylaws also

obligate the Company to advance expenses incurred by a director or officer in advance of the final disposition of any action or

proceeding. In addition, the Company enters into agreements with Company directors and officers to indemnify such directors and

officers. With specified exceptions, these agreements provide for indemnification against all liability and loss suffered and

expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement by any of these individuals in any

action, suit or proceeding, to the fullest extent permitted by applicable law. We believe that these provisions and indemnification

agreements are necessary to attract and retain qualified persons as directors and officers. Also, the Company maintains

directors’ and officers’ liability insurance.

The limitation of liability and indemnification

provisions in the Certificate of Incorporation and Bylaws may discourage stockholders from bringing a lawsuit against Company directors

and officers for breach of their fiduciary duty. They may also reduce the likelihood of derivative litigation against Company directors

and officers, even though an action, if successful, might benefit the Company and its stockholders. Furthermore, a stockholder’s

investment may be adversely affected to the extent that the Company pays the costs of settlement or damages.

Uncertificated Shares

The shares of common stock are uncertificated,

and holders of common stock do not have the right to require the Company to issue certificates for their shares.

Transfer Agent and Registrar

The transfer agent and registrar for our capital

stock is American Stock Transfer & Trust Company, LLC. The transfer agent and registrar’s address is 6201 15th Avenue, Brooklyn,

New York 11219. AST US and its Canadian office, at AST Trust Company (Canada), P.O. Box 700, Station B, Montreal, QC H3B 3K3, will act

as co-transfer agent.

Listing

Our Class A common stock is listed on the Nasdaq

Global Select Market under the symbol “STGW”.

PLAN OF DISTRIBUTION

General

The selling stockholders may sell the shares of

our Class A common stock covered by this prospectus using one or more of the following methods:

|

|

·

|

underwriters in a public offering;

|

|

|

·

|

“at the market” to or through market makers or into an existing market for the securities;

|

|

|

·

|

ordinary brokerage transactions or transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the

block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

short sales (including short sales “against the box”);

|

|

|

·

|

through the writing or settlement of standardized or over-the-counter options or other hedging or derivative transactions, whether

through an options exchange or otherwise;

|

|

|

·

|

by pledge to secure debts and other obligations;

|

|

|

·

|

in other ways not involving market makers or established trading markets, including direct sales to purchasers or sales effected through

agents;

|

|

|

·

|

a combination of any such methods of sale; and

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

To the extent required by law, this prospectus

this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution. Any prospectus supplement

relating to a particular offering of our Class A common stock by the selling stockholders may include the following information to the

extent required by law:

|

|

·

|

the terms of the offering;

|

|

|

·

|

the names of any underwriters or agents;

|

|

|

·

|

the purchase price of the securities;

|

|

|

·

|

any delayed delivery arrangements;

|

|

|

·

|

any underwriting discounts and other items constituting underwriters’ compensation;

|

|

|

·

|

any initial public offering price; and

|

|

|

·

|

any discounts or concessions allowed or reallowed or paid to dealers.

|

The selling stockholders may offer our Class A

common stock to the public through underwriting syndicates represented by managing underwriters or through underwriters without an underwriting

syndicate. If underwriters are used for the sale of our Class A common stock, the securities will be acquired by the underwriters for

their own account. The underwriters may resell the Class A common stock in one or more transactions, including in negotiated transactions

at a fixed public offering price or at varying prices determined at the time of sale. In connection with any such underwritten sale of

Class A common stock, underwriters may receive compensation from the selling stockholders, for whom they may act as agents, in the form

of discounts, concessions or commissions. Underwriters may sell Class A common stock to or through dealers, and the dealers may receive

compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the purchasers for whom

they may act as agents. Such compensation may be in excess of customary discounts, concessions or commissions.

If the selling stockholders use an

underwriter or underwriters to effectuate the sale of Class A common stock, we and/or they will execute an underwriting agreement

with those underwriters at the time of sale of those securities. To the extent required by law, the names of the underwriters will

be set forth in the prospectus supplement used by the underwriters to sell those securities. Unless otherwise indicated in the

prospectus supplement relating to a particular offering of Class A common stock, the obligations of the underwriters to purchase the

securities will be subject to customary conditions precedent and the underwriters will be obligated to purchase all of the

securities offered if any of the securities are purchased.

In effecting sales, brokers or dealers engaged

by the selling stockholders may arrange for other brokers or dealers to participate. Broker-dealers may receive discounts, concessions

or commissions from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser)

in amounts to be negotiated. Such compensation may be in excess of customary discounts, concessions or commissions. If dealers are utilized

in the sale of securities, the names of the dealers and the terms of the transaction will be set forth in a prospectus supplement, if

required.

The selling stockholders may also sell shares

of our Class A common stock from time to time through agents. We will name any agent involved in the offer or sale of such shares and

will list commissions payable to these agents in a prospectus supplement, if required. These agents will be acting on a best efforts basis

to solicit purchases for the period of their appointment, unless we state otherwise in any required prospectus supplement.

The selling stockholders may sell shares of our

Class A common stock directly to purchasers. In this case, they may not engage underwriters or agents in the offer and sale of such shares.

The selling stockholders and any underwriters,

broker-dealers or agents that participate in the sale of the selling stockholders’ shares of Class A common stock or interests therein

may be “underwriters” within the meaning of the Securities Act. Any discounts, commissions, concessions or profit they earn

on any resale of the shares may be underwriting discounts and commissions under the Securities Act. Selling stockholders who are “underwriters”

within the meaning of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act. We will make copies

of this prospectus available to the selling stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities

Act, if applicable. If any entity is deemed an underwriter or any amounts deemed underwriting discounts and commissions, the prospectus

supplement will identify the underwriter or agent and describe the compensation received from the selling stockholders.

We are not aware of any plans, arrangements or

understandings between the selling stockholders and any underwriter, broker-dealer or agent regarding the sale of the shares of our Class

A common stock by the selling stockholders. We cannot assure you that the selling stockholders will sell any or all of the shares of our

Class A common stock offered by them pursuant to this prospectus. In addition, we cannot assure you that the selling stockholders will

not transfer, devise or gift the shares of our Class A common stock by other means not described in this prospectus. Moreover, shares

of Class A common stock covered by this prospectus that qualify for sale pursuant to Rule 144 under the Securities Act may be sold

under Rule 144 rather than pursuant to this prospectus.

From time to time, the selling stockholders may

pledge, hypothecate or grant a security interest in some or all of the shares owned by them. The pledgees, secured parties or persons

to whom the shares have been hypothecated will, upon foreclosure, be deemed to be selling stockholders. The number of a selling stockholder’s

shares offered under this prospectus will decrease as and when it takes such actions. The plan of distribution for that selling stockholder’s

shares will otherwise remain unchanged. In addition, a selling stockholder may, from time to time, sell the shares short, and, in those

instances, this prospectus may be delivered in connection with the short sales and the shares offered under this prospectus may be used

to cover short sales.

The selling stockholders may enter into hedging

transactions with broker-dealers, and the broker-dealers may engage in short sales of the shares in the course of hedging the positions

they assume with the selling stockholders, including, without limitation, in connection with distributions of the shares by those broker-dealers.

The selling stockholders may enter into option or other transactions with broker-dealers that involve the delivery of the shares offered

hereby to the broker-dealers, who may then resell or otherwise transfer those securities.

A selling stockholder that is an entity may

elect to make a pro rata in-kind distribution of the shares of Class A common stock to its members, partners or shareholders. Such

members, partners or shareholders would thereby receive freely tradeable shares of Class A common stock pursuant to the distribution

through a registration statement. To the extent a distributee is an affiliate of ours (or to the extent otherwise required by law),

we may file a prospectus supplement in order to permit the distributees to use the prospectus to resell the Class A common stock

acquired in the distribution. A selling stockholder that is an individual may make gifts of shares of Class A common stock covered

hereby. Such donees may use the prospectus to resell the shares, or if required by law, we may file a prospectus supplement naming

such donees.

Indemnification

We and the selling stockholders may enter agreements

under which underwriters, dealers and agents who participate in the distribution of our Class A common stock may be entitled to indemnification

by us and/or the selling stockholders against various liabilities, including liabilities under the Securities Act, and to contribution

with respect to payments that the underwriters, dealers or agents may be required to make.

Price Stabilization and Short Positions

If underwriters or dealers are used in the sale,

until the distribution of the securities is completed, rules of the SEC may limit the ability of any underwriters to bid for and purchase

the securities. As an exception to these rules, representatives of any underwriters are permitted to engage in transactions that stabilize

the price of the securities. These transactions may consist of bids or purchases for the purpose of pegging, fixing or maintaining the

price of the securities. If the underwriters create a short position in the securities in connection with the offering (that is, if they

sell more securities than are set forth on the cover page of the prospectus supplement), the representatives of the underwriters may reduce

that short position by purchasing securities in the open market.

We make no representation or prediction as to

the direction or magnitude of any effect that the transactions described above may have on the price of our Class A common stock. In addition,

we make no representation that the representatives of any underwriters will engage in these transactions or that these transactions, once

commenced, will not be discontinued without notice.

LEGAL MATTERS

Unless otherwise specified in a prospectus supplement

accompanying this prospectus, the validity of the Class A common stock offered by this prospectus will be passed upon by Freshfields Bruckhaus

Deringer US LLP. Any underwriters will be advised about legal matters by their own counsel, which will be named in a prospectus supplement

to the extent required by law.

EXPERTS

The consolidated financial statements and schedules

of MDC Partners Inc. as of December 31, 2020 and 2019 and for each of the three years in the period ended December 31, 2020, and management’s

assessment of the effectiveness of internal control over financial reporting as of December 31, 2020, incorporated by reference in this

prospectus and in the Registration Statement have been so incorporated in reliance on the reports of BDO USA, LLP, an independent registered

public accounting firm, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

The financial statements of Stagwell

Marketing Group LLC as of and for the year ended December 31, 2020 incorporated in this prospectus by reference from Stagwell

Inc.’s Current Report on Form 8-K/A dated October 12, 2021 have been audited by Deloitte & Touche LLP, independent

auditors, as stated in their report, which is incorporated by reference herein. Such financial statements are incorporated by reference in

reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

The audited historical financial statements of

Stagwell Marketing Group LLC as of December 31, 2019 and December 31, 2018 and for the years then ended included in Stagwell Inc.’s

Current Report on Form 8-K/A dated October 12, 2021 have been so incorporated in reliance

on the report of PricewaterhouseCoopers LLP, independent accountants, given on the authority of said firm as experts in auditing and accounting.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference”

information into this document. This means that we can disclose important information to you by referring you to another document filed

separately with the SEC. The information incorporated by reference is considered to be part of this prospectus, and information that we

file later with the SEC will automatically update and supersede the previously filed information. We incorporate by reference the documents

listed below and any future filings made by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (other

than any portions of the respective filings that are furnished, pursuant to Item 2.02 or Item 7.01 of Current Reports on Form

8-K (including exhibits related thereto) or other applicable SEC rules, rather than filed) prior to the termination of the offering under

this prospectus:

|

|

·

|

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2021 and June 30, 2021 filed with the SEC on May 5, 2021 and August 5, 2021, respectively (File No. 001-13718);

|

|

|

·

|

our Current Reports on Form 8-K and Form 8-K/A, as applicable, filed with the SEC on January

13, 2021, January

21, 2021, February

5, 2021, February

9, 2021, April

23, 2021, June

7, 2021, June

23, 2021, July

9, 2021, July

13, 2021, July

19, 2021, July

27, 2021 (two

filings), July

30, 2021, August

2, 2021 (as amended on by the Current Reports on Form 8-K/A filed September

16, 2021 and October 12, 2021), August

4, 2021, August

5, 2021, August

9, 2021, August

10, 2021 (including the section entitled “Risk Factors” in Exhibit

99.2 thereto, which is specifically incorporated by reference herein), August

13, 2021, August

20, 2021, August

25, 2021 (two

filings), August

30, 2021, September

8, 2021 and September

23, 2021 (other than information furnished pursuant to Item 2.02 and Item 7.01 and any related exhibits of such Current Reports

on Form 8-K, unless expressly stated otherwise therein) (File No. 001-13718); and

|

|

|

·

|

the description of our capital stock contained in Exhibit 99.1 to our Current Report on Form 8-K12B, filed with the SEC on July 30, 2021 (File No. 001-13718), including any amendments or reports that we may file in the future for the purpose of updating the description of our capital stock.

|

You may request a copy of any or all of the information

incorporated by reference into this prospectus (other than an exhibit to the filings unless we have specifically incorporated that exhibit

by reference into the filing), at no cost, by writing or telephoning us at the following address:

Stagwell Inc.

One World Trade Center, Floor

65

New York, New York 10007

Attention: Investor Relations

Telephone: (646) 429-1800

You should rely only on the information contained

or incorporated by reference into this prospectus. We have not authorized anyone to provide you with different information. If anyone

provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell, or soliciting

an offer to buy, securities in any jurisdiction where the offer and sale is not permitted.

WHERE YOU CAN FIND

MORE INFORMATION

We have filed with the SEC a registration statement

on Form S-3 under the Securities Act with respect to the shares of Class A common stock offered hereby. This prospectus is part of a registration

statement we have filed with the SEC. As permitted by SEC rules, this prospectus does not contain all of the information we have included

in the registration statement and the accompanying exhibits. You may refer to the registration statement and the exhibits for more information

about us and our securities. The registration statement and the exhibits are available at the SEC’s website at http://www.sec.gov.

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. Our Class A common stock is listed on the Nasdaq Global Select Market under the

symbol “STGW.” Our reports and other information filed with the SEC can also be inspected at the offices of the Nasdaq Global

Select Market. General information about us, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports

on Form 8-K and amendments to those reports, is available free of charge on our website at www.stagwellglobal.com as soon as reasonably

practicable after we electronically file them with, or furnish them to, the SEC. Information on our website is not incorporated into

this prospectus or our other securities filings and is not a part of these filings.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the costs and expenses,

other than selling or underwriting discounts and commissions, to be incurred by us in connection with the distribution of the Class A

common stock being registered hereby. With the exception of the SEC registration fee and Financial Industry Regulatory Authority (“FINRA”)

filing fee, all fees and expenses set forth below are estimates.

|

SEC registration fee

|

|

$

|

60,398.21

|

|

|

FINRA filing fee

|

|

|

225,500.00

|

|

|

Legal fees and expenses

|

|

|

*

|

|

|

Accounting fees and expenses

|

|

|

*

|

|

|

Printing expenses

|

|

|

*

|

|

|

Transfer agent fees and expenses

|

|

|

*

|

|

|

Miscellaneous expenses

|

|

|

*

|

|

|

Total

|

|

$

|

*

|

|

* These fees are not presently known and cannot be estimated at this

time, as they will be based upon, among other things, the amount of the securities being offered as well as the number of offerings.

Item 15. Indemnification of Directors and Officers.

Under Section 145 of the DGCL, a corporation

may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit

or proceeding (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director,

officer, employee or agent of the corporation (or is or was serving at the request of the corporation as a director, officer, employee

or agent of another corporation, partnership, joint venture, trust or other enterprise) against expenses (including attorneys’ fees),

judgments, fines and amounts paid in settlement actually and reasonably incurred by the person if he or she acted in good faith and in

a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal

action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. In the case of an action brought by or in the

right of a corporation, the corporation may indemnify any person who was or is a party or is threatened to be made a party to any such

threatened, pending or completed action by reason of the fact that the person is or was a director, officer, employee or agent of the

corporation (or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation,

partnership, joint venture, trust or other enterprise) only against expenses (including attorneys’ fees) actually and reasonably

incurred by him or her in connection with the defense or settlement of such action if he or she acted in good faith and in a manner he

or she reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification may be made

in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only

to the extent the appropriate court finds that, in view of all the circumstances of the case, such person is fairly and reasonably entitled

to indemnity for such expenses as the court shall deem proper.

The DGCL further provides that a corporation may

purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is

or was serving at the request of the corporation as director, officer, employee or agent of another entity or enterprise, against any

liability asserted against such person and incurred by such person in any such capacity, whether or not the corporation would have the

power to indemnify such person against such liability.

The Bylaws provide that directors and officers

will be indemnified by the Company to the fullest extent authorized by Delaware law as it now exists or may in the future be amended,

against all expenses, liabilities and loss incurred in connection with their service as a director or officer on behalf of the Company.

The Bylaws provide that, to the fullest

extent not prohibited by applicable law, the Company shall pay the expenses (including attorneys’ fees) incurred by a director

or officer and may pay the expenses incurred by any employee or agent of the Company, in defending any action, suit or proceeding in

advance of its final disposition; provided, that if required by law, such payment of expenses in advance of the final disposition of

the action, suit or proceeding shall be made only upon receipt of an undertaking by or on behalf of the person to repay all amounts

advanced if it is ultimately determined that such person is not entitled to be indemnified by the Company.

The Company expects to enter into separate indemnification

agreements with the Company’s directors and officers. These agreements, among other things, will require the Company to indemnify

its directors and officers for certain expenses, including attorneys’ fees, judgments, fines and settlement amounts incurred by

a director or officer in any action or proceeding arising out of their services as one of the Company’s directors or officers or

any other company or enterprise to which the person provides services at the Company’s request.

The Company maintains a directors’ and officers’

insurance policy pursuant to which the Company’s directors and officers are insured against liability for actions taken in their

capacities as directors and officers.

The registration rights agreements between the

Company and certain investors provides for cross-indemnification in connection with registration of the Class A common stock on behalf

of such investors.

In connection with an offering of the Class A

common stock registered hereunder, the Company may enter into an underwriting agreement, which may provide that the underwriters are obligated,

under certain circumstances, to indemnify directors, officers and controlling persons of the Company against certain liabilities, including

liabilities under the Securities Act.

Item 16. Exhibits

The exhibits to this registration statement are

listed on the Exhibit Index page hereof, which is incorporated by reference into this Item 16.

Item 17. Undertakings

The undersigned registrant hereby undertakes:

|

|

(1)

|