STABILIS SOLUTIONS, INC.

(Name of the Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

1.

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

2.

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

3.

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

4.

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

5.

|

|

Total fee paid:

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

1.

|

|

Amount Previously Paid:

|

|

|

|

2.

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

3.

|

|

Filing Party:

|

|

|

|

4.

|

|

Date Filed:

|

Dear Fellow Shareholders:

The Board of Directors of Stabilis Solutions, Inc. has changed its slate of nominees for election to the Board of Directors at our Annual Meeting of Stockholders to be held on September 14, 2021. Westervelt T. Ballard, Jr. who was recently appointed as our President, CEO and a director has been added as a nominee in substitution for James C. Reddinger who has left the Company and will not be running for re-election.

The Board of Directors has also changed one provision of the Amended and Restated 2021 Long Term Incentive Plan (the “Plan”) to allow for an increased number of shares to be granted to an eligible participant.

Because these changes affect the matters to be voted on at the Annual Meeting, we are providing additional information in the enclosed Supplement to Proxy Statement, and an Amended Proxy Card, to enable stockholders to vote on the election of Mr. Ballard to our Board of Directors at the 2021 Annual Meeting and on the approval of the Amended and Restated 2019 Long Term Incentive Plan. For technical reasons the election of Mr. Ballard to our Board of Directors is set forth as a separate Proposal 5. Please read the proxy statement that was previously made available to stockholders and the enclosed Supplement to Proxy Statement in their entirety, as together they contain information that is important to your decisions in voting at the Annual Meeting.

If you have already voted and would like to change your vote to vote for Mr. Ballard or on any of the other Proposals set forth in the Proxy Statement or you have not yet voted please follow the Revised Voting Instructions in the Supplement to Proxy Statement and the Amended Proxy Card.

On behalf of the directors, officers and employees of Stabilis Solutions, Inc., I thank you for your continued support.

Sincerely,

J. Casey Crenshaw

Chairman

August 31, 2021

SUPPLEMENT TO PROXY STATEMENT FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS

STABILIS SOLUTIONS, INC.

11750 Katy Freeway, Suite 900

Houston, Texas 77079

This Supplement to Proxy Statement (“Supplement”) supplements and amends the Proxy Statement dated August 2, 2021 (the “Proxy Statement”) of Stabilis Solutions, Inc. (the “Company”), previously made available to our stockholders in connection with the solicitation of proxies on behalf of the Board of Directors of the Company for use at the Annual Meeting of Stockholders to be held on September 14, 2021 (the “Annual Meeting”), or any adjournment thereof. This Supplement, which should be read in conjunction with the Proxy Statement, is being made available to shareholders on or about August 31, 2021. Except as specifically supplemented or amended by the information contained in this Supplement, all information set forth in the Proxy Statement continues to apply and should be considered in voting your shares.

THE PROXY STATEMENT CONTAINS IMPORTANT INFORMATION AND THIS SUPPLEMENT SHOULD BE READ IN CONJUNCTION WITH THE PROXY STATEMENT.

The Annual Meeting will be held Tuesday, September 14, 2021 at 11:00 a.m., Central Daylight Time, at 11750 Katy Freeway, Suite 900, Houston, Texas. Stockholders of record of the Company’s common stock at the close of business on July 16, 2021 are entitled to notice of and to vote at the Annual Meeting.

CHANGE IN CANDIDATES NOMINATED BY THE BOARD OF DIRECTORS

On August 2, 2021, the Company filed its Proxy Statement with the Securities and Exchange Commission and began mailing the Proxy Statement to the shareholders of record. Subsequent to that date, the Board of Directors (the “Board”) authorized a revised slate of nominees for election to the Board of Directors at the Annual Meeting. As discussed further below, the revised list of candidates nominated by the Board consists of all of the nominees identified in the Proxy Statement other than James C. Reddinger. Mr. Reddinger resigned as President, CEO and director of the Company as of August 22, 2021 and advised us that he will not be a nominee for election as a director at the Annual Meeting. Westervelt T. Ballard, Jr. was appointed President, CEO and a director on August 23, 2021 and has been selected by the Board of Directors as a nominee for election as a director at the Annual Meeting in substitution for Mr. Reddinger. We are providing an Amended Proxy Card to enable stockholders to vote on the revised nominees for election as directors, including Mr. Ballard as a substitute nominee for Mr. Reddinger. For technical reasons the vote for Mr. Ballard as additional director is set forth in the Amended Proxy Card as Proposal 5.

The Amended Proxy Card enclosed with this Supplement differs from the proxy card previously made available to you with the Proxy Statement, in that the enclosed Amended Proxy Card includes the name of Westervelt T. Ballard, Jr. as an additional director nominee in Proposal 5 and as a stockholder proxy and excludes the name of James C. Reddinger as a director nominee in Proposal 1 and as a stockholder proxy. If you have voted already, we encourage you to resubmit your vote on all five proposals by submitting the Amended Proxy Card enclosed with this Supplement or by voting online or by telephone by following the procedures on your Amended Proxy Card. However, if you return, or have returned, an original proxy card, or voted online or by telephone, and do not vote again by the Amended Proxy Card or online or telephone, your vote will still remain valid for Proposals 2, 3 and 4 and the director nominees set forth in Proposal 1 except for Mr. Reddinger because he withdrew as a candidate and Mr. Ballard because he is not listed as a nominee on the original proxy card. PLEASE NOTE THAT IF YOU SUBMIT AN AMENDED PROXY CARD, IT WILL REVOKE ALL PRIOR PROXY CARDS, SO IT IS IMPORTANT TO INDICATE YOUR VOTE ON EACH OF THE FIVE PROPOSALS ON THE AMENDED PROXY CARD.

|

|

|

|

|

|

|

|

PROPOSAL 5: ELECTION OF ADDITIONAL DIRECTOR

|

|

The Proxy Statement with respect to the 2021 Annual Meeting is supplemented and amended to provide that the Board has nominated Westervelt T. Ballard, Jr., a current director, to hold office until the 2022 annual meeting and until his successor is elected and qualified, in substitution for James C. Reddinger who has declined to run for re-election. For technical reasons the election of Mr. Ballard will be considered under Proposal 5. The other nominees of the Board of Directors, in addition to Mr. Ballard, are: J. Casey Crenshaw, Stacey B. Crenshaw, Mushahid “Mush” Khan, Edward L. Kuntz, Peter C. Mitchell, Ben J. Broussard and James G. Aivalis and their election will be considered under Proposal 1. Biographical information with respect to all nominees other than Mr. Ballard is set forth in the Proxy Statement under the caption “Proposal 1 - Election of Directors – Nominees of the Board of Directors”. Mr. Ballard’s biographical information is set forth below. As of August 23, 2021 Mr. Ballard beneficially owned 193,358 shares of Company common stock issued in connection with his employment.

Required Vote and Recommendation

The eight nominees who receive the highest number of affirmative votes of the shares present in person or represented by proxy and entitled to vote, a quorum being present, shall be elected as directors. Only votes cast “FOR” a nominee will be counted, except that the accompanying proxy will be voted “FOR” all nominees in the absence of instructions to the contrary. Broker non-votes and proxies marked “withheld”, “against” or “abstain” as to any nominees will have no effect on the election since only votes “FOR” a nominee are counted in order to determine the eight nominees with the highest number of votes.

The individuals named as proxies on the enclosed Amended Proxy Card will vote your shares “FOR” the election of these eight nominees as set forth in Proposal 1 and Proposal 5 unless you instruct otherwise or you withhold authority to vote for any one or more of them.

The Board recommends that you vote “FOR” the election of Mr. Ballard and the other nominees named above.

Westervelt T. Ballard, Jr., age 49, was appointed as our President, Chief Executive Officer and a director on August 23, 2021. Mr. Ballard served as executive vice president, chief financial officer and treasurer of Superior Energy Services, Inc., a highly diversified provider of rental equipment, manufactured products, and engineered and specialized services to the global energy industry from 2018 to 2021. At Superior, Mr. Ballard served in a variety of progressive roles during his 13-year career, including as an operations executive vice president from 2012 to 2018 with full responsibility over strategic and commercial direction, capital allocation, operations, safety, financial and administrative functions for a diversified portfolio of business lines operating in over 30 countries. Additionally, he served as vice president of corporate development where he was responsible for sourcing, evaluating and executing acquisitions and strategic investments globally. Superior entered into Chapter 11 bankruptcy to consummate a prepackaged reorganization in December 2020 and emerged in February 2021. Mr. Ballard served in the United States Marine Corps, earning the rank of captain. He is a graduate of the University of Georgia and is a director of the Marine Corps-Law Enforcement Foundation.

We believe Mr. Ballard is well qualified to serve as a director due to his extensive experience in executive management, finance, and corporate development for a large energy service company.

Employment Arrangements for Mr. Ballard

The Company has entered into an Employment Agreement with Mr. Ballard effective as of August 23, 2021 (the “Employment Agreement”) pursuant to which it agreed for a term of three years (unless terminated earlier pursuant to the terms of the Employment Agreement), subject to successive one-year extensions, to employ Mr. Ballard as its President and Chief Executive Officer. The Company agreed to cause Mr. Ballard to be elected to the Board and thereafter to cause him to be nominated as a director and recommend his election to stockholders on an annual basis during the term of his employment.

In consideration of his services, the Company has agreed to pay Mr. Ballard an annualized base salary of not less than $500,000. Mr. Ballard will be entitled to participate in the Company’s Annual Bonus Plan, with a target bonus based on performance to be determined by the Compensation Committee of the Board of Directors and to initially range from 50% of Mr. Ballard’s base salary for “threshold” performance, to 100% of his base salary for “Target” performance, and 150% of his base salary for “Maximum” performance. Notwithstanding the foregoing, Mr. Ballard’s bonus target for calendar year 2021 shall be prorated in the amount of $125,000. Additionally, the Company granted Mr. Ballard 500,000 restricted stock units (“RSUs”) under the Company’s 2019 Long Term Incentive Plan (“LTIP”), subject to Board approval, which will vest (i) 250,000 RSUs on August 23, 2021, (ii) 125,000 RSUs on August 23, 2022, and (iii) 125,000 RSUs on August 23, 2023, conditioned on Mr. Ballard remaining continuously employed through each vesting date. The Company also agreed to grant Mr. Ballard 1,300,000 options to purchase the Company’s common stock under the LTIP, subject to Board approval with a strike price equal to $10.00 per share,

which will vest (i) 442,000 options on August 23, 2022, (ii) 429,000 options on August 23, 2023, and (iii) 429,000 options on August 23, 2024, conditioned on Mr. Ballard remaining continuously employed through each vesting date. Mr. Ballard shall not be permitted to exercise any of the options while he is employed by the Company on or before the expiration of his term of employment, unless (Y) in connection with a sale of an equal number of more of shares of stock by the Company’s Chairman of the Board, or (Z) the Company’s stock has traded at $20.00 or more per share for at least 120 consecutive days. Mr. Ballard will also be eligible to participate in all of the Company’s discretionary short-term and long-term incentive compensation plans and programs and other employee benefit plans which are generally made available to other similarly situated senior executives of the Company.

Upon a termination of the Employment Agreement by the Company without Cause (as defined in the Employment Agreement) or by Mr. Ballard resigning his employment for Good Reason (as defined in the Employment Agreement), the Company will cause the RSUs and options described above to become fully vested and will pay Mr. Ballard an amount equal to the base salary and target bonus (at “Target” performance) that he would have received during the period between the date the Employment Agreement is terminated and its expiration or renewal date, as applicable, or for 12 months following the date of termination of the Employment Agreement, whichever is greater. Additionally, the Company will pay a pro rata portion of the target bonus that would have been payable to Mr. Ballard for the year of termination, if his employment had not terminated, and will reimburse him for up to 18 months of certain COBRA payments if he timely elects to continue coverage under COBRA. If the Employment Agreement is terminated by the Company for Cause or by Mr. Ballard without Good Reason on or before 24 months from the effective date of the Employment Agreement, Mr. Ballard will forfeit or repay, as applicable, the shares of common stock he received with respect to the 250,000 RSUs that vested on the effective date of the Employment Agreement, with such forfeiture or repayment, as applicable, being net of any withholding obligations. He will also forfeit any unvested part of the RSUs and options described if the Employment Agreement is terminated by the Company for Cause or by Mr. Ballard without Good Reason.

Upon a Change-in-Control (as defined in the Employment Agreement) of the Company, the RSUs and options described above would become fully vested, subject to Mr. Ballard’s continued employment through the effective date of the Change-in-Control.

PROPOSAL 4: TO APPROVE THE AMENDED AND RESTATED 2019 LONG TERM INCENTIVE PLAN

In connection with Mr. Ballard’s agreement to join us as President and Chief Executive Officer we agreed to issue him the equity awards under the 2019 Long Term Incentive Plan of 500,000 Restricted Stock Units and 1,300,000 Stock Options with an exercise price of $10.00 per share.

The 2019 Long Term Incentive Plan as currently in effect and as originally proposed to be amended and restated as the Amended and Restated 2019 Long Term Incentive Plan has a provision limiting the maximum grants of share-based awards to any participant to 500,000 shares in any calendar year. In order to

be able to issue the awards covering 1,800,000 shares to Mr. Ballard the Board of Directors has revised the Amended and Restated 2019 Long Term Incentive Plan being voted on at the Annual Meeting to increase the maximum number of shares that can be covered by a grant to a participant to 2,000,000 shares in any calendar year. There are no other changes in the Amended and Restated 2019 Long Term Incentive Plan as described in the Proxy Statement.

Vote Required and Recommendation

The affirmative vote of a majority of the shares of voting stock present at the Annual Meeting and voting on the proposal is required to approve the Amended and Restated 2019 Long Term Incentive Plan. Abstentions and broker non-votes have no effect since only shares voting on the proposal will be counted.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF PROPOSAL NO. 4, TO APPROVE THE AMENDED AND RESTATED 2019 LONG TERM INCENTIVE PLAN.

Revised Voting Instructions

In view of the revision of the Board’s nominees for election at the Annual Meeting and revision in the Amended and Restated 2019 Long Term Incentive Plan described herein, this Supplement sets forth revised voting instructions as follows.

If you have already voted and would like to change your vote or have not yet voted you may vote online, by phone or by Amended Proxy Card enclosed with this Supplement.

The Amended Proxy Card differs from the original proxy card previously made available to you in that the enclosed proxy card includes the name of Westervelt T. Ballard, Jr. as a director nominee in Proposal 5 and as a stockholder proxy and removes James C. Reddinger as a director nominee in Proposal 1 and as a stockholder proxy. If you have already returned your original proxy card or voted online or by phone, you do not need to submit the Amended Proxy Card unless you would like to vote on the revised slate of director nominees, including Mr. Ballard. If you return, or have returned, an original proxy card, your proxy will remain valid for all of the other proposals and director nominees except Mr. Ballard because he is not listed as a nominee on the original proxy card and Mr. Reddinger because he has declined to run for re-election, and will be voted at the Annual Meeting unless revoked.

The Amended Proxy Card does not make any change in Proposal 4 - TO APPROVE THE AMENDED AND RESTATED 2019 LONG TERM INCENTIVE PLAN. If you have already voted on Proposal 4 your vote will be counted as originally cast. If you want to change your vote on Proposal 4 you should vote online or by telephone or return the Amended Proxy Card. PLEASE NOTE THAT IF YOU SUBMIT AN AMENDED PROXY CARD, IT WILL REVOKE ALL PRIOR PROXY CARDS, SO IT IS IMPORTANT TO INDICATE YOUR VOTE ON EACH PROPOSAL ON THE AMENDED PROXY CARD.

The original proxy and the amended proxy are solicited on behalf of the Board of Directors and revocable at any time before they have been exercised at the Annual Meeting by:

|

|

|

|

|

|

|

|

•

|

timely mailing in a revised proxy dated later than the prior submitted proxy;

|

|

|

|

|

•

|

timely notifying the Corporate Secretary in writing that you are revoking your proxy;

|

|

|

|

|

•

|

timely casting a new vote by telephone or online; or

|

|

|

|

|

•

|

appearing in person and voting by ballot at the Annual Meeting.

|

OTHER MATTERS

Other than as set forth above, no items presented in the Proxy Statement are affected by this Supplement, and you should carefully review the Proxy Statement prior to voting your shares.

The Company knows of no other matters to be submitted to the shareholders at the Annual Meeting. If any other matters properly come before the shareholders at the Annual Meeting, it is the intention of the persons named on the enclosed proxy card to vote the shares represented thereby on such matters in accordance with their best judgment.

By Order of the Board of Directors

August 31, 2021

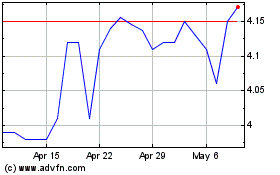

Stabilis Solutions (NASDAQ:SLNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

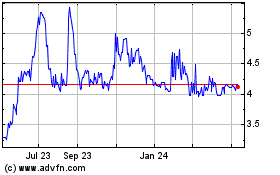

Stabilis Solutions (NASDAQ:SLNG)

Historical Stock Chart

From Apr 2023 to Apr 2024