By Jaewon Kang | Photographs by Theo Stroomer/Redux for The Wall Street Journal

Gourmet grocers are losing their edge as natural foods become

mainstream.

Supermarket chains and discounters are selling more fresh,

natural and organic foods at lower prices, drawing shoppers who

used to seek out those products at specialty grocers. Kroger Co.

has said it is now one of the nation's largest sellers of organic

produce, meat and other goods, while discounters Aldi and Lidl are

adding more fresh food and opening more U.S. stores.

Meanwhile, Whole Foods Market has cut prices on hundreds of

items including organic produce since Amazon.com Inc. acquired the

company three years ago.

As a result, specialty grocers are having a hard time convincing

customers to pay a premium to shop in their stores. And without the

revenue and reach of bigger chains, they have also been hesitant to

match price cuts or to invest in new services like delivery.

Regional chains Earth Fare, Lucky's Market and Fairway Market

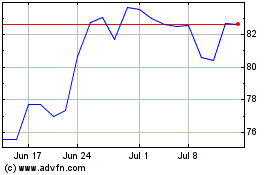

have filed for bankruptcy in recent weeks. Shares in Sprouts

Farmers Market Inc. and Natural Grocers by Vitamin Cottage Inc. are

down respectively about 30% and nearly 50% over the past year.

"Differentiation can be ephemeral. Retail is an open book of

copycats," said Scott Moses, managing director at investment bank

PJ Solomon who is advising Lucky's and Fairway.

Fairway saw same-store sales slip 5% and lost $69 million over

the past year, according to court filings. The chain of 14

supermarkets in the New York area said competitors selling more

natural, organic and hard-to-find foods hurt demand for its gourmet

fare.

Lucky's recorded a same-store sales decline of 10% and a net

loss of $100 million over the past year, according to bankruptcy

filings. The Niwot, Colo.-based operator of 39 stores said rising

competition hurt its profitability, particularly in Florida, where

it was seeking to expand.

Earth Fare said in court documents that competition and spending

on store improvements had strained its business.

Mike Brewer, a 44-year-old business consultant who has shopped

at an Earth Fare store in Huntersville, N.C., since it opened in

2011, said he appreciated its relatively affordable selection of

natural products including veggie-pop snacks and grass-fed

beef.

"For a store closing, I'm pretty upset," he said.

He said he would turn to a Kroger-owned Harris Teeter

supermarket in his neighborhood when Earth Fare closes at the end

of February.

"What was special 10 years ago isn't special anymore," said Don

Fitzgerald, who teaches marketing at DePaul University and until

last year was a merchandising executive at Kroger's Mariano's

chain. Kroger owns more than 40 Mariano's stores in Illinois.

Some natural chains continue to add stores and enter markets to

find new customers. Lakewood, Colo.-based Natural Grocers by

Vitamin Cottage has added or relocated 11 stores in each of the

past two years, bringing its total to more than 150. But sales

growth has slowed to 1.9% during the latest quarter, down from 4.7%

in that period two years earlier, in part due to pressure from

bigger chains, Chief Executive Kemper Isely said.

"It's not growing as fast as it used to," he said in an

interview.

New Seasons Market, based in Portland, Ore., is trying to stand

out from the competition with hyperlocal products, Chief Operating

Officer Mark Law said. The chain of more than 20 stores in the

Pacific Northwest works with local chefs to prepare oven-ready

meals and buys dairy products from nearby farmers. Same-store sales

growth rate nearly doubled last year.

"Organic has been commoditized," Mr. Law, a former Whole Foods

executive, said. "You can't differentiate with your product mix

alone."

Other specialty grocers also are emphasizing services to stand

out. But offering better services can push up costs, executives

said.

"You not only have your cost of goods but you're trying to

provide a higher level of customer service to differentiate

yourself," Steven Mortensen, an adviser to private-equity firm

Yucaipa Cos., an investor in grocery chains. Yucaipa bought up West

Coast chains Ralphs, Quality Food Centers and Smith's under the

Fred Meyer banner, which it sold to Kroger in the 1990s. More

recent investments haven't fared as well. Yucaipa invested in Fresh

& Easy and Great Atlantic and Pacific Tea, chains that filed

for bankruptcy in 2015.

Some executives said Whole Foods became a tougher rival after

the chain started offering rapid delivery via Amazon. Green Aisle

Grocery closed its two Philadelphia stores in January after sales

decreased 30% over the past two years, co-owner Andrew Erace

said.

"I can't compete with that. I don't have the technology to

implement for our small shops," Mr. Erace said.

Write to Jaewon Kang at jaewon.kang@wsj.com

(END) Dow Jones Newswires

March 01, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

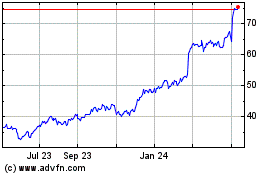

Sprouts Farmers Market (NASDAQ:SFM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sprouts Farmers Market (NASDAQ:SFM)

Historical Stock Chart

From Apr 2023 to Apr 2024