Current Report Filing (8-k)

September 14 2020 - 9:40AM

Edgar (US Regulatory)

false

0000877422

0000877422

2020-09-14

2020-09-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 14, 2020

SpartanNash Company

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Michigan

|

|

000-31127

|

|

38-0593940

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification no.)

|

|

|

|

|

|

850 76th Street, S.W.

P.O. Box 8700

Grand Rapids, Michigan

|

|

49518-8700

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (616) 878-2000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

|

SPTN

|

|

NASDAQ Global Select Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 14, 2020, SpartanNash Company (the “Company”) announced the appointment of Tony B. Sarsam as President and Chief Executive Officer and a member of the Company’s Board of Directors, effective on September 21, 2020 (the “Effective Date”).

Mr. Sarsam, age 58, most recently served as Chief Executive Officer of Borden Dairy Co., a privately-held American dairy processor and distributor (“Borden”), from February 2018 until July 2020. From 2013 until 2018, Mr. Sarsam served as CEO of HIG Bayside-backed Ready Pac, a manufacturer of fresh products nationally distributed to grocery/mass/club and food service channels. Mr. Sarsam has a master’s degree in management from Stanford University and a bachelor’s degree in Chemical Engineering from Arizona State University.

Mr. Sarsam will receive an annual base salary of $850,000 and be eligible to receive a cash bonus for 2020 of up to 125% of his base salary under the SpartanNash Annual Incentive Plan (the “AIP”). His bonus will be based upon his eligible earnings during fiscal year 2020. He will also be eligible to participate in the SpartanNash Long Term Incentive Plan (“LTIP”) at a target level equal to $3,200,000, pro-rated for the period from September 21, 2020 through the end of fiscal year 2020. Under the current terms of the SpartanNash LTIP program, one-half of the LTIP award consists of a grant of restricted stock units, vesting in equal annual installments on each of the four years after the date of grant. The other half of the LTIP award is a performance cash award, subject to the achievement of certain targets over a three-year performance period. He will receive relocation assistance and reimbursement of legal fees related to the preparation and negotiation of his employment agreement described below and be eligible to participate in the Company’s 401(k) plan, health insurance plan, supplemental savings plan and other benefit programs offered to its employees.

The terms of Mr. Sarsam’s compensation are set forth in an Employment Agreement by and between the Company and Mr. Sarsam, effective as of the Effective Date (the “Employment Agreement”). Upon termination of employment other than by the Company without “Cause” or by Mr. Sarsam for “Good Reason” (in each case, as defined in the Employment Agreement), Mr. Sarsam would only be entitled to receive accrued pay and other benefits. Upon termination of employment by the Company without “Cause” or by Mr. Sarsam for “Good Reason”, Mr. Sarsam would be eligible to receive 52 weeks of his base salary in a lump sum payment, a lump sum payment of his pro-rated annual bonus under the AIP or successor plan based upon the number of days employed during the applicable plan year and the performance achievement of the applicable bonus targets (determined as part of the Company’s Compensation Committee’s regular process of determining performance after the close of the applicable plan year), reimbursement of COBRA premiums for up to 52 weeks and outplacement assistance. Mr. Sarsam is also subject to certain confidentiality and non-competition obligations pursuant to the Employment Agreement.

2

The Company and Mr. Sarsam also entered into the Company’s standard form of Executive Severance Agreement, effective as of the Effective Date, providing for the payment of severance in connection with a change in control. The description of the Executive Severance Agreement set forth under “Executive Compensation--Potential Payments Upon Termination or Change in Control—Executive Severance Agreements” in the Company’s Definitive Proxy Statement on Schedule 14A for the Company’s 2020 Annual Meeting of Shareholders filed with the Securities and Exchange Commission on April 8, 2020 is incorporated by reference herein.

Since August 9, 2019, Dennis Eidson, a director of the Company who served as the Company’s Chief Executive Officer from October 2008 until his retirement in May 2017, has served as the Company’s Interim President and Chief Executive Officer and Chairman of the Board. Mr. Eidson will continue to serve as an employee of the Company for a 30-day transition period and will continue as Chairman of the Company’s Board of Directors.

ITEM 8.01Other Events.

On September 14, 2020, the Company announced the appointment of Mr. Sarsam. The press release is incorporated by reference herein.

ITEM 9.01Financial Statements and Exhibits.

(d)Exhibit

99.1Press release of SpartanNash Company dated September 14, 2020

104Cover Page Interactive Data File (embedded within the Inline XBRL document)

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

Date: September 14, 2020

|

SpartanNash Company

|

|

|

|

|

|

By:

|

/s/ Mark E. Shamber

|

|

|

|

Mark E. Shamber

Executive Vice President and Chief Financial Officer (Principal Financial Officer)

|

4

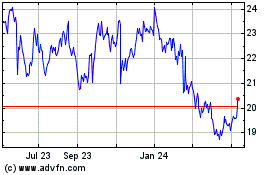

SpartanNash (NASDAQ:SPTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

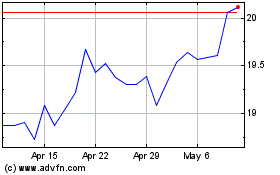

SpartanNash (NASDAQ:SPTN)

Historical Stock Chart

From Apr 2023 to Apr 2024