Additional Proxy Soliciting Materials (definitive) (defa14a)

May 03 2019 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant

☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

|

|

SPAR Group, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

N/A

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

Schedule 14A - Additional Definitive Documents

Mistake in 2019

Proxy Card.

SPAR Group, Inc. ("SGRP", the "Corporation" or the "Registrant"), on April 29, 2019, filed its definitive Proxy Statement on Schedule 14A (the "2019 Proxy Statement") with the Securities and Exchange Commission ("SEC"), and began mailing the 2019 Proxy Statement to its stockholders and soliciting their proxies for the 2019 annual meeting of SGRP's stockholders (the "2019 Annual Meeting"). The 2019 Proxy Statement is hereby incorporated herein by reference.

The 2019 Proxy Statement included a Proxy Card (the "2019 Proxy Card") that contains an unintentional omission: it fails to provide a check box for a vote "AGAINST" a director.

However, the 2019 Proxy Statement correctly described the votes "for" and "AGAINST" (or "NO") for a candidate for director:

An affirmative majority of votes cast at the 2019 Annual Meeting in person or by proxy is required for the election of each nominee to serve as a director. Accordingly, any Director receiving a majority of "no" votes is denied reelection and has agreed to immediately retire (see below). Stockholders are not entitled to cumulate votes. In a field of more than seven nominees, the seven nominees receiving the most votes would be elected as directors. Votes withheld, abstentions and broker non-votes are not counted as votes "FOR" or "AGAINST" a director nominee and will have no effect on the outcome of the election.

This result is mandated by SGRP's 2019 Amended and Restated By-Laws (the "Restated By- Laws) respecting stockholder voting.

The 2019 Proxy Card should have had provision for voting "no" or "against" a candidate for director. To be elected, a candidate must receive more "FOR" votes cast than "AGAINST" votes cast, i.e, the decision is made by a majority of the votes cast. Votes cast do not include abstentions (including "withheld"), non-votes or inconclusive votes (i.e., no box clearly checked, multiple boxes checked, and the like) respecting any candidate or matter.

I

nstructions

For Voting

"AGAINST" a Director

.

As described in the 2019 Proxy Statement, the Board recommended a vote in favor of all candidates. SGRP has worked with its transfer agent also to correct this error for those voting via the internet, telephone or mail. Accordingly, you can vote "AGAINST" a director.

However, you can vote "AGAINST" any candidate for director any of four different ways:

|

1.

|

You can vote over the internet, which will permit you to vote "AGAINST" any candidate for director.

|

|

|

Go to www.envisionreports.com/SGRP.

|

|

|

Or scan the QR code with your smartphone.

|

|

|

Follow the steps outlined on the secure website.

|

|

2.

|

You can vote by telephone, which will permit you to vote "AGAINST" any candidate for director.

|

|

|

Call toll free 1-800-652-VOTE (8683) within the USA, US territories &Canada on a touch tone telephone

|

|

|

Follow the instructions provided by the recorded message

|

|

3.

|

You can vote "AGAINST" any candidate for director on your 2019 Proxy Card IF YOU WRITE "AGAINST" immediately after such director's name on your 2019 Proxy Card and return it in the envelope included with the 2019 Proxy Statement. Be careful not to check "for" or "withheld" if you are voting "AGAINST". More than one choice for the same director will invalidate your vote.

|

|

4.

|

You can vote "AGAINST" any candidate for director by attending the 2019 Annual Meeting in person on Wednesday, May 15, 2019, at 9:00 AM, Eastern Time, at Tampa Airport Marriott, 4200 George J. Bean Parkway, Tampa, FL 33607.

|

Consequences of a Majority Vote "AGAINST" a Director

.

As described in the 2019 Proxy Statement:

If more votes are cast "against" a candidate for director than "for" him or her, that candidate will not be elected. As provided in the Restated By- Laws pursuant to the Settlement, each Director has signed and delivered to the Corporation a written irrevocable letter of resignation and retirement (which shall constitute an irrevocable resignation for purposes of DGCL Section 141(b)), pursuant to which the departing Director shall be deemed to have retired for all purposes (including all plans and other benefits, but excluding indemnification and severance rights) which letter shall be effective as and when, and effective upon, such person failing to be re-elected by the required majority affirmative vote of the voting stockholders at which such person is subject to re-election. Accordingly, that retirement could be triggered if a majority of the votes are "no" (or "against"), and the Majority Stockholders have the power to together vote "no" and effectively remove any Director.

For a description of the Majority Stockholders, the Restated By- Laws and the Settlement, Please see Note 9 to the Company's Consolidated Financial Statements –

Commitments and Contingencies -- Legal Matters -

Delaware Litigation Settlement

, in the Corporation's 2018 Annual Report on Form 10-K/A for the year ended December 31, 2018, as filed with the SEC on April 24, 2019 (the "2018 Annual Report").

The removal of any independent director would result in an immediate violation of Nasdaq Listing Rule 5605(b)(1), which requires a majority of the board of directors of a listed company to be comprised of independent directors as defined in Rule 5605(b)(1) (the "Nasdaq Board Independence Rule"). See

Risks of a Nasdaq Delisting and Penny Stock Trading

in Item 1A – Risk Factors in the 2018 Annual Report.

Any vacancy created by a majority vote "AGAINST" any director must be filled within 90 days by the Governance Committee and Board or else the stockholders may act. As part of the Settlement, the parties agreed in the Restated By- Laws to provisions that (among other things) preserve the current roles of the Governance Committee and Board in the location, evaluation, and selection of candidates for candidates to fill Board vacancies (other than those under a stockholder written consent making a removal and appointment, which is unchanged).

A current copy of the Restated By-Laws is posted and available to stockholders and the public on the Corporation's web site (

www.sparinc.com

). The foregoing descriptions are qualified in their entirety by reference to the Restated By-Laws, which are incorporated herein by reference.

Revised Proxy Card

s

.

The Corporation has revised the forms of its 2019 Proxy Cards (each a "Revised 2019 Proxy Card ") to permit a vote "AGAINST" any candidate for director and to correct several typographical errors. Copies of the Revised 2019 Proxy Cards for stockholders and for brokers are attached hereto and filed herewith as Exhibit 99.1 and 99.2, respectively, and are incorporated herein by reference. The Revised 2019 Proxy Cards also are being filed with the SEC as Exhibits to SGRP's Current Report on Form 8-K Definitive Additional Materials under Schedule 14A.

However, you should still use one of the four ways listed above to vote "AGAINST" any candidate for director.

Exhibits

.

|

|

99.1

|

Revised 2019 Proxy Card of SPAR Group, Inc. – Common (as filed herewith).

|

|

|

99.2

|

Revised 2019 Proxy Card of SPAR Group, Inc. – Broker (as filed herewith).

|

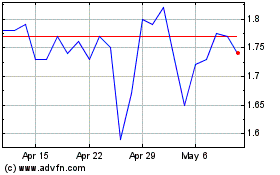

Spar (NASDAQ:SGRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

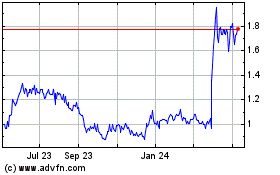

Spar (NASDAQ:SGRP)

Historical Stock Chart

From Apr 2023 to Apr 2024