UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

|

Filed

by the Registrant /x/

|

|

Filed

by a Party other than the Registrant / /

|

|

Check

the appropriate box:

|

|

/ /

|

|

Preliminary

Proxy Statement

|

|

/ /

|

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

/x/

|

|

Definitive

Proxy Statement

|

|

/ /

|

|

Definitive

Additional Materials

|

|

/ /

|

|

Soliciting

Material Pursuant to §Section 240.14a-11(c) or Section §240.14a-12

|

|

|

|

|

SOCKET

MOBILE, INC.

|

(Name

of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

Payment

of Filing Fee (Check the appropriate box):

|

|

/x/

|

|

No

fee required.

|

|

/ /

|

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

1)

|

|

Title

of each class of securities to which transaction applies:

N/A

|

|

|

|

2)

|

|

Aggregate

number of securities to which transaction applies:

N/A

|

|

|

|

3)

|

|

Per unit

price or other underlying value of transaction computed pursuant to Exchange

Act Rule 0-11 (set forth the amount on which the filing fee is calculated

and state how it was determined):

N/A

|

|

|

|

4)

|

|

Proposed

maximum aggregate value of transaction:

N/A

|

|

|

|

5)

|

|

Total

fee paid:

N/A

|

|

/ /

|

|

Fee

paid previously with preliminary materials.

|

|

/ /

|

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form

or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

|

1)

|

|

Amount

Previously Paid:

N/A

|

|

|

|

2)

|

|

Form,

Schedule or Registration Statement No.:

N/A

|

|

|

|

3)

|

|

Filing

Party:

N/A

|

|

|

|

4)

|

|

Date Filed:

N/A

|

SOCKET

MOBILE, INC.

NOTICE

OF 2019 ANNUAL MEETING OF STOCKHOLDERS

To

Be Held May 22, 2019

Dear

Stockholders:

You

are cordially invited to attend the Annual Meeting of Stockholders of Socket Mobile, Inc., a Delaware corporation (the "Company"),

to be held Wednesday, May 22, 2019 at 10:30 a.m., local time, at the Company's headquarters at 39700 Eureka Drive, Newark, California

94560 for the following purposes:

(1) To

elect seven directors to serve until their respective successors are elected;

(2) Advisory

vote on executive compensation policies and practices as described in the annual meeting proxy (“Say on Pay”).

(3) Advisory

vote on frequency of future votes on executive compensation policies and practices (“Say When on Pay”).

(4)

To approve an amendment to the 2004 Equity Incentive Plan to provide for a one-time stock option exchange program.

(5)

To ratify the appointment of Sadler, Gibb & Associates, LLC as independent registered public accountants of the Company for

the fiscal year ending December 31, 2019.

(6) To

transact such other business as may properly come before the meeting or any adjournment thereof.

The

foregoing items of business are more fully described in the Proxy Statement accompanying this notice. Only stockholders of record

at the close of business on March 25, 2019 are entitled to notice of and to vote at the meeting. All stockholders are cordially

invited to attend the meeting in person. However, to ensure your representation at the meeting, you are urged to mark, sign, date,

and return the enclosed Proxy as promptly as possible following the instructions on your proxy ballot. Any stockholder attending

the meeting may vote in person even if he or she has returned a Proxy.

|

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

|

Newark,

California

|

|

Kevin

J. Mills

|

|

March 28, 2019

|

|

President

and Chief Executive Officer

|

YOUR

VOTE IS IMPORTANT.

IN

ORDER TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING,

YOU ARE REQUESTED TO COMPLETE, SIGN AND DATE THE ENCLOSED PROXY

AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE, OR VOTE BY PHONE OR BY INTERNET

WHERE AVAILABLE.

SOCKET

MOBILE, INC.

PROXY

STATEMENT FOR

2019

ANNUAL MEETING OF STOCKHOLDERS

INFORMATION

CONCERNING SOLICITATION AND VOTING

GENERAL

The

enclosed proxy is solicited on behalf of the Board of Directors of Socket Mobile, Inc. (the "Company"), for use at the

2019 Annual Meeting of Stockholders to be held Wednesday May 22, 2019 at 10:30 a.m., local time, or at any adjournment thereof,

for the purposes set forth herein and in the accompanying Notice of 2019 Annual Meeting of Stockholders. The 2019 Annual Meeting

will be held at the Company's headquarters at 39700 Eureka Drive, Newark, California 94560. The Company's telephone number at

that location is (510) 933-3000.

Notice

of the availability of these proxy solicitation materials and our Annual Report on Form 10-K for the year ended December 31, 2018,

including financial statements, will be first mailed on or about April 5, 2019 to all stockholders entitled to vote at the 2019

Annual Meeting.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

The

proxy materials are available at http://www.socketmobile.com/about-us/investor-relations/stockholder-meeting-information

.

Stockholders may access the Notice of Annual Meeting and Proxy Statement, Annual Report on Form 10-K and Proxy Card at this site

to read, download the documents, and/or request a printed copy. Printed copies may also be requested by telephone at

800-856-9390

.

Printed copies will be mailed within 3 business days of receipt of the request.

RECORD

DATE AND PRINCIPAL SHARE OWNERSHIP

Holders

of record of our Common Stock at the close of business on March 25, 2019 (the "Record Date") are entitled to notice

of and to vote at the 2019 Annual Meeting. At the Record Date, 5,999,159 shares of Common Stock were issued and outstanding. Each

share of Common Stock is entitled to one vote. The Company has no other class of voting securities outstanding and entitled to

be voted at the meeting.

The

only persons known by the Company to beneficially own more than five percent of the Company's Common Stock as of the Record Date

were Charlie Bass, the Chairman of the Company’s Board of Directors and Manatuck Hill Partners, LLC. Please see "Security

Ownership of Certain Beneficial Owners and Management" for more information on these holdings.

REVOCABILITY

OF PROXIES

Any

proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the

Secretary of the Company a written notice of revocation or a duly executed proxy bearing a later date or by attending the 2019

Annual Meeting and voting in person. If voting in person, confirmation of revocation or non-submission of your proxy should be

obtained prior to the meeting from the organization where the proxy was originally filed.

VOTING

AND SOLICITATION

Generally

each stockholder is entitled to one vote for each share of Common Stock held on all matters to be voted on by the stockholders.

If, however, any stockholder at the 2019 Annual Meeting gives notice of his or her intention to cumulate votes with respect to

the election of directors (Proposal One), then each stockholder may cumulate such stockholder's votes for the election of directors

and give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of shares of

Common Stock that such stockholder is entitled to vote, or may distribute such stockholder's votes on the same principle among

as many candidates as the stockholder may select, provided that votes cannot be cast for more than seven candidates. However,

no stockholder shall be entitled to cumulate votes for a candidate unless the candidate's name has been placed in nomination prior

to the voting and the stockholder, or any other stockholder, has given notice at the meeting, prior to the voting, of the intention

to cumulate votes. On all other matters, stockholders may not cumulate votes.

This

solicitation of proxies is made by the Company, and all related costs will be borne by the Company. In addition, the Company may

reimburse brokerage firms and other persons representing beneficial owners of stock for their expenses in forwarding solicitation

material to such beneficial owners. Proxies may also be solicited by the Company's directors, officers and regular employees,

without additional compensation, personally or by telephone, email or facsimile.

QUORUM;

VOTE REQUIRED; ABSTENTIONS; BROKER NON-VOTES

The

presence at the 2019 Annual Meeting, either in person or by proxy, of the holders of a majority of votes entitled to be cast with

respect to the outstanding shares of Common Stock shall constitute a quorum for the transaction of business. Shares that are voted

"FOR," "AGAINST," "WITHHOLD or “ABSTAIN” on a subject matter are treated as being present

at the meeting for purpose of establishing a quorum entitled to vote on the matter. Broker non-votes will also be counted for

the purpose of determining the presence or absence of a quorum for the transaction of business.

Proposal One.

Election

of Directors.

Directors are elected by a plurality of the votes of the shares present in person or represented by proxy at

the meeting and entitled to vote on the election of directors. You may vote “FOR” or “WITHHOLD” on each

of the nominees for election as a director. If a quorum is present at the meeting, the seven nominees receiving the highest number

of votes will be elected to the Board of Directors. As a result, any shares not voted “for” a particular nominee (whether

as a result of “withhold” votes or broker non-votes) will not be counted in such nominee’s favor and will have

no effect on the outcome of the election. Votes withheld from any nominee and broker non-votes are, however, counted for purposes

of determining the presence or absence of a quorum.

Proposal

Two

.

Executive Compensation Policies and Practices (“Say on Pay”)

. Approval of the executive compensation

policies and practices of the Company as described in this Proxy Statement requires the affirmative vote of a majority of the

shares present in person or by proxy at the meeting and entitled to vote thereon. The vote is a non-binding advisory vote to be

considered by management and the Board of Directors. You may vote “for,” “against” or “abstain”

on this proposal. Abstentions represent shares present and entitled to vote and thus, will have the same effect as votes “against”

this proposal.

Proposal

Three. Advisory vote to determine the frequency of future votes on executive compensation policies and practices (“Say When

on Pay”).

Approval of the frequency of future votes on executive compensation policies and practices of the Company

as described in this Proxy Statement requires the affirmative vote of a majority of the shares present in person or by proxy at

the meeting and entitled to vote thereon. The vote is a non-binding advisory vote to be considered by management and the Board

of Directors. You may vote “for,” “against” or “abstain” on this proposal. Abstentions represent

shares present and entitled to vote and thus, will have the same effect as votes “against” this proposal.

Proposal

Four. 2004 Equity Incentive Plan Amendment.

Approval of an amendment to the 2004 Equity Incentive Plan to provide for a one-time

stock option exchange program requires the affirmative vote of a majority of the Votes Cast on the matter at the 2019 Annual Meeting.

You may vote “for,” “against” or “abstain” on this proposal. Abstentions represent shares

present and entitled to vote and thus, will have the same effect as votes “against” this proposal.

Proposal

Five. Auditor Ratification

. Approval of the ratification of the appointment of Sadler, Gibb & Associates, LLC, as the

Company's independent registered public accountants for the fiscal year ending December 31, 2019, requires the affirmative vote

of a majority of the shares present in person or by proxy at the meeting and entitled to vote thereon. You may vote “for,”

“against” or “abstain” on this proposal. Abstentions represent shares present and entitled to vote and

thus, will have the same effect as votes “against” this proposal.

DEADLINE

FOR RECEIPT OF STOCKHOLDER PROPOSALS TO BE INCLUDED IN THE COMPANY'S PROXY MATERIALS

The

Company currently intends to hold its 2020 Annual Meeting of Stockholders in May 2020 and to mail proxy statements relating to

such meeting in April 2020. Proposals of stockholders of the Company that are intended to be presented by such stockholders at

the 2020 Annual Meeting must be received by the Company no later than November 15, 2019, and must otherwise be in compliance with

applicable laws and regulations, in order to be considered for inclusion in the Company's proxy statement and proxy card relating

to that meeting. In addition, stockholders must comply with the procedural requirements in the Company's bylaws. Under the Company's

bylaws, notice of any stockholder nomination to the board or proposal of business must be delivered to or mailed and received

by the Secretary of the Company not less than ninety (90) days prior to the meeting; provided, however, that in the event that

less than one-hundred (100) days notice or prior public disclosure of the date of the meeting is given or made to stockholders,

notice by the stockholder to be timely must be so received not later than the close of business on the tenth day following the

day on which such notice of the date of the meeting is mailed or such public disclosure is made. To be in proper form, a stockholder's

notice to the Secretary shall set forth: (i) the name and address of the stockholder who intends to make the nominations or propose

the business and, as the case may be, of the person or persons to be nominated or of the business to be proposed; (ii) representations

that the stockholder is a holder of record of stock of the Company entitled to vote at such meeting and, as applicable, that such

stockholder intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice or

propose such business; (iii) if applicable, a description of all arrangements or understandings between the stockholder and each

nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to

be made by the stockholder; (iv) such other information regarding each nominee or each matter of business to be proposed by such

stockholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange

Commission had the nominee been nominated, or intended to be nominated, or the matter been proposed, or intended to be proposed

by the Board of Directors; and (v) if applicable, the consent of each nominee to serve as director of the Company if so elected.

The chairman of the meeting shall refuse to acknowledge the nomination of any person or the proposal of any business not made

in compliance with the foregoing procedure. Stockholders can obtain a copy of the Company's bylaws from the Company upon request.

The Company's bylaws are also on file with the Securities and Exchange Commission.

If

a stockholder intends to submit a proposal at the 2020 Annual Meeting but does not wish to have it included in the proxy statement

and proxy for that meeting, the stockholder must do so no later than January 24, 2020, or else the proxy holders will be allowed

to use their discretionary authority to vote against the proposal when it is raised at the 2020 Annual Meeting.

The

attached proxy card grants the persons named as proxies discretionary authority to vote on any matter raised at the 2019 Annual

Meeting that is not included in this Proxy Statement. The Company has not been notified by any stockholder of his or her intent

to present a stockholder proposal at the 2019 Annual Meeting.

PROPOSAL

ONE

ELECTION

OF DIRECTORS

The

proxy holders will vote to elect as directors the seven nominees named below, unless a proxy card is marked otherwise. The nominees

consist of six current directors and one new director. If a person other than a management nominee is nominated at the 2019 Annual

Meeting, the holders of the proxies may choose to cumulate their votes and allocate them among such nominees of management as

the proxy holders shall determine in their discretion to elect as many nominees of management as possible. The seven candidates

receiving the highest number of votes will be elected. In the event any nominee is unavailable for election, which is not currently

anticipated, the proxy holders may vote in accordance with their judgment for the election of substitute nominees designated by

the Board of Directors.

All

seven directors will be elected for one-year terms expiring at the 2020 Annual Meeting of Stockholders, subject to the election

and qualification of their successors or their earlier death, resignation or removal. The following table sets forth information

concerning the nominees for director. Information on committee assignments reflects current assignments to be reviewed at the

first meeting of the Board following election. Information on age is as of the record date of March 25, 2019.

|

Name

of Nominee (4)

|

Age

|

Position(s)

Currently Held With the Company

|

Director

Since

|

|

Charlie

Bass (1)(2)(3)

|

77

|

Chairman

of the Board

|

1992

|

|

Kevin

J. Mills

|

58

|

President,

Chief Executive Officer and Director

|

2000

|

|

David

W. Dunlap

|

76

|

VP

Finance & Administration, CFO, Secretary and Director

|

2014

|

|

Nelson

C. Chan (2)(3)

|

57

|

Director

|

2016

|

|

Brenton

Earl MacDonald (1)(2)

|

52

|

Director

|

2016

|

|

Bill

Parnell (1)(2)

|

63

|

Director

|

2017

|

|

Lynn

Zhao

|

50

|

VP

and Controller

|

New

|

____________________________

(1)

Member of the Audit Committee.

(2)

Member of the Nominating Committee.

(3)

Member of the Compensation Committee.

(4)

Committee assignments will be made at the first meeting of the Board following election.

Charlie

Bass

co-founded the Company in March 1992 and has been the Chairman of the Board of Directors from such time to the present.

Dr. Bass served as the Company's Chief Executive Officer from April 1997 to March 2000. Dr. Bass has served as the Trustee

of The Bass Trust since April 1988. Dr. Bass holds a Ph.D. in electrical engineering from the University of Hawaii.

Kevin

J. Mills

was appointed the Company's President and Chief Executive Officer and a director of the Company in March 2000. He

served as the Company's Chief Operating Officer from September 1998 to March 2000. Mr. Mills joined the Company in September

1993 as Vice President of Operations and has also served as our Vice President of Engineering. Prior to joining the Company, Mr. Mills

worked from September 1987 to August 1993 at Logitech, Inc., a computer peripherals company, serving most recently as its Director

of Operations. He holds a B.E. in Electronic Engineering with honors from the University of Limerick, Ireland.

David

W. Dunlap

has served as the Company's Vice President of Finance and Administration, Secretary and Chief Financial Officer

since February 1995 and as a director of the Company since May 2014. Mr. Dunlap previously served as Vice President of Finance

and Administration and Chief Financial Officer at several public and private companies. He is a certified public accountant (inactive)

and holds an M.B.A. and a B.A. in Business Administration from the University of California at Berkeley.

Nelson

C. Chan

has served as a director of the Company since October 2016. He served as the Chief Executive Officer of Magellan Corporation

from 2006 to 2008, a leader in the consumer, survey, GPS and OEM GPS navigation and positioning markets. From 1992 through 2006

he served in various senior management positions with SanDisk Corporation, a global leader in flash memory cards, the most recent

as Executive Vice President and General Manager, Consumer Business. From 1983 to 1992 Mr. Chan held marketing and engineering

positions at Chips and Technologies, Signetics, and Delco Electronics. Mr. Chan serves as an independent director on several public

companies, including Synaptics, a worldwide developer and supplier of custom-designed human interface solutions; Adesto Technologies,

a developer of innovative, low-power memory solutions; and Decker Brands, a global leader in designing, marketing and distributing

footwear, apparel and accessories. Mr. Chan also serves on the board of directors of several private companies. Within the past

five years, Mr. Chan previously served on the boards of Outerwall Inc. – a provider of automated retail solutions, and Affymetrix

– which developed, manufactured and sold products and services for genetic analysis to the life science research and clinical

healthcare markets. Mr. Chan holds a Bachelor of Science degree in Electrical and Computer Engineering from the University of

California, Santa Barbara and a Master’s degree in Business Administration from Santa Clara University, Santa Clara California.

Brent

MacDonald

has been a director of the Company since June 2016. In February 2018, he joined Rising Tide, a private equity fund,

as a partner. Mr. MacDonald served for over eleven years, through February 2018, with Hewlett Packard Enterprise and HP Inc. in

an array of strategic planning and business management positions that focused on business growth. His most recent assignment was

to lead the Internet of Things (IoT) marketing efforts for Hewlett Packard Enterprise (HPE) CMS division. Prior to Hewlett Packard,

Mr. MacDonald spent six years in private equity financing at Newbury Ventures where his focus was on early stage global communication

and IT companies throughout the world, and from 1997 to 2000 he worked for Alcatel-Lucent as a senior business analyst. Mr. MacDonald

is a graduate of the London School of Economics (MSc) and Carleton University (MA).

Bill

Parnell

has been a director of the Company since June 2017. Mr. Parnell was President and CEO of Datalogic ADC from January

2012 thru July 2015 and President and CEO of its predecessors: 1) Datalogic Scanning from March 2006 through December 2011 (initially

known as PSC, Inc. and later including the related operations of Datalogic) and 2) Datalogic Mobile from January 2011 thru December

2011. Datalogic is a supplier of Automatic Data Capture and Industrial Automation products for the retail, manufacturing, transportation

and logistics and healthcare industries. Mr. Parnell holds an MBA from the University of Washington and a Bachelor of Science

Degree in Physics from Utah State University.

Lynn

Zhao

is nominated to serve as a management director. She has served as the Company’s Controller since January 2015 and

was appointed Vice President and Controller in September 2017. Ms. Zhao previously served as general accounting manager from December

2000 through January 2015. Ms. Zhao holds an MBA degree from San Jose State University and a Bachelor of Science degree in chemistry

from Xiamen University in China.

BOARD

MEETINGS AND COMMITTEES

The

Board of Directors has determined that all of the nominees, except Mr. Mills, Mr. Dunlap and Ms. Zhao, satisfy the definition

of "independent director," as established by Nasdaq listing standards. The Board of Directors has an Audit Committee,

a Nominating Committee and a Compensation Committee. Each committee has adopted a written charter, all of which are available

on the Company's web site at http://www.socketmobile.com/about-us/investor-relations/corporate-governance. The Board of Directors

has also determined that each member of the Audit Committee, the Nominating Committee and the Compensation Committee satisfies

the definition of "independent director," as established by Nasdaq listing standards.

The

Board of Directors held a total of four regular meetings during fiscal 2018 and approved one action by unanimous written consent.

The independent directors met separately without management or the management directors after each of the four regular Board meetings

held during 2017. The Company strongly encourages members of the Board of Directors to attend all meetings, including meetings

of committees on which they serve. No director attended fewer than 75 percent of the meetings of the Board of Directors and the

Board committees on which he served.

The

Audit Committee consists of Messrs. Bass (Chairman), Parnell and MacDonald. The members of the Audit Committee each qualify as

"independent" under the standards established by the United States Securities and Exchange Commission for members of

audit committees. The Audit Committee also includes one member, Dr. Bass, who has been determined by the Board of Directors to

meet the qualifications of an "audit committee financial expert" in accordance with Securities and Exchange Commission

rules. Stockholders should understand that this designation is a disclosure required by the Securities and Exchange Commission

relating to Dr. Bass' experience and understanding with respect to certain accounting and auditing matters. This designation does

not impose upon Dr. Bass any duties, obligations or liabilities that are greater than are generally imposed on him as a member

of the Audit Committee, and his designation as an audit committee financial expert pursuant to this SEC requirement does not affect

the duties, obligations or liabilities of any other member of the Audit Committee or Board of Directors.

The

Audit Committee met with management and the independent accountants four times by telephone during the year ended December 31,

2018 to review quarterly and annual financial information and to discuss the results of quarterly review and annual audit procedures

performed by the independent accountants before quarterly and annual financial reports were issued. The Audit Committee is responsible

for appointing, compensating and overseeing actions taken by the Company's independent accountants, and reviews the Company's

internal financial controls and financial statements. The Audit Committee also oversees management’s assessment and management

of risks. Management and the independent accountants participated in all meetings of the Audit Committee. Portions of each Audit

Committee meeting were held between the Audit Committee members and the independent accountants without the presence of management.

The Committee reviewed the financial statements and the annual audit results, including the independent accountants’ assessment

of the Company’s internal controls and procedures, and discussed with the independent accountants the matters denoted as

required communications by Auditing Standard AS1301, Communications with Audit Committees. The meetings also included a discussion

and review of auditor independence, the pre-approval of the independent accountants’ fees for 2018, and a recommendation

to the Board of Directors to approve the issuance of the financial statements for the year ended December 31, 2018. The report

of the Audit Committee for the year ended December 31, 2018 is included in this Proxy Statement. The Audit Committee Charter

is available at http://www.socketmobile.com/about-us/investor-relations/corporate-governance on the Company’s website.

The

Nominating Committee Chairman is Dr. Bass who works with the other independent directors as a committee of the whole to consider

and recommend nominations for the Board of Directors and facilitate the self-assessment of Board performance by the independent

directors. The independent directors discussed nominations at the first regular board meeting of the year and Dr. Bass followed

up with each candidate. The role of the Nominating Committee is to determine that all nominated directors are willing and able

to serve as a director for the ensuing year and recommend their nomination. In addition, the independent directors met four times

during 2018 and once in January 2019 to date following their regular board meetings to consider matters relating to board governance,

oversight and effectiveness. For 2018, the Nominating Committee will consider nominees recommended by security holders. Such nominations

should be made in writing to the Company, attention Corporate Secretary, no later than November 15, 2019 in order to be considered

for inclusion in next year’s proxy statement. The Nominating Committee Charter is available on the Corporate Governance

section of the Company’s website at http://www.socketmobile.com/about-us/investor-relations/corporate-governance.

The

Compensation Committee chairman is Mr. Chan assisted by Dr. Bass. The Committee held three meetings during fiscal year 2018. The

Compensation Committee is responsible for determining salaries, incentives and other forms of compensation for directors and officers

of the Company, approving stock option and other incentive award grants, approving the Company's incentive compensation and benefit

plans, and providing oversight of all matters affecting compensation including overseeing management’s assessment and management

of compensation-related risks. The report of the Compensation Committee for fiscal year 2018 is included in this Proxy Statement.

The Compensation Committee Charter is available on the Corporate Governance section of the Company's website at

http://www.socketmobile.com/about-us/investor-relations/corporate-governance.

COMPENSATION

OF DIRECTORS

Regular

meetings of the Board of Directors are scheduled once per quarter. Directors who are not employees of the Company receive $6,000

per regular meeting of the Board of Directors that they attend. Outside directors are also entitled to participate in the Company's

2004 Equity Incentive Plan. Grants of options to directors are made annually as compensation for Board service, committee service

and committee and Board leadership positions, generally at the time of annual election of the Board of Directors. Additional grants

may be awarded in recognition of services beyond normal board duties. See “Director Compensation” for information

regarding stock option grants awarded in 2018.

VOTE

REQUIRED AND RECOMMENDATION OF THE BOARD

If

a quorum is present at the Annual Meeting, the seven nominees receiving the highest number of votes will be elected to the Board

of Directors.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" ALL OF THE COMPANY'S NOMINEES FOR DIRECTORS.

PROPOSAL

TWO

APPROVAL

OF EXECUTIVE COMPENSATION POLICIES AND PRACTICES

(“SAY-ON-PAY”)

Each

year our stockholders have the opportunity to vote to approve, on a nonbinding advisory basis, the compensation of our named executive

officers as disclosed in this proxy statement. As described in “Compensation Discussion and Analysis” and elsewhere

in this proxy statement, we seek to closely align the interests of our executive officers with the interests of our stockholders

and to attract, motivate and retain our named executive officers who are critical to our success. Our Compensation Committee regularly

reviews named executive officer compensation to ensure such compensation is consistent with our goals.

The

base salaries paid to our named executive officers are compared to other similar smaller technology public companies set forth

in a regional compensation survey. Base salaries for executives are generally targeted between the median and 75

th

percentile of compensation levels for equivalent positions in smaller public technology companies operating in the Company’s

geographic region but may be set to higher or lower levels to recognize a particular executive’s role, responsibilities,

skills, experience and performance.

Variable

performance-based incentive awards for our named executive officers are intended to motivate and reward executives to meet or

exceed financial performance goals of revenue attainment and operating profitability measured both quarterly and annually based

on actual financial results for revenue and Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), a common

measure of operating performance, compared to financial targets set at the beginning of each year.

Long

term incentive awards for our named executive officers consist of stock option grants that are granted at the fair market value

on the date of grant and vest over a period of time, typically 4 years, through the stockholder-approved 2004 Equity Incentive

Plan. The goal is to align the financial interests of the named executive officers with those of stockholders by providing significant

incentives to manage the Company from the perspective of an owner with an equity stake in the business. The Compensation Committee

determines the size of each award based on the individual’s level of responsibility, recent performance, his or her potential

for future responsibility and promotion, the number of unvested options held by the individual at the time of the new grant, and

the size of the available stock award pool.

The

advisory vote on executive compensation solicited by this proposal is not intended to address any specific item of compensation,

but rather the overall compensation of our Chief Executive Officer, our Chief Financial Officer and our three other most highly-compensated

executive officers, who are collectively referred to as our “named executive officers,” which is disclosed elsewhere

in this proxy statement. The vote is advisory, which means that it is not binding on the Board of Directors, the Compensation

Committee or the Company in any way. However, the Compensation Committee will review the outcome of the vote and take it into

consideration when considering future executive compensation policies and decisions.

We

ask our stockholders to vote “FOR” the following resolution at the 2019 Annual Meeting:

RESOLVED, that the stockholders

of Socket Mobile, Inc. approve, on an advisory basis, the compensation of the Company’s named executive officers for the

fiscal year ended December 31, 2018, as disclosed pursuant to Item 402 of Regulation S-K in the Company’s definitive proxy

statement for the 2019 Annual Meeting of Stockholders.

VOTE

REQUIRED AND RECOMMENDATION OF THE BOARD

Approval

of the executive compensation policies and practices of the Company as described in this Proxy Statement requires the affirmative

vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote thereon.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" APPROVAL OF THE FOREGOING RESOLUTION.

PROPOSAL

THREE

ADVISORY

VOTE ON THE FREQUENCY OF FUTURE SAY-ON-PAY VOTES

(“SAY-WHEN-ON-PAY”)

Stockholders

may indicate whether they would prefer that we conduct future say-on-pay votes once every one, two, or three years. Stockholders

may also abstain from casting a vote on this proposal.

The

Board of Directors has determined that an annual advisory vote on executive compensation will permit our stockholders to provide

direct input on the Company’s executive compensation philosophy, policies and practices as disclosed in the Company’s

proxy statement, which is consistent with our efforts to engage in an ongoing dialogue with our stockholders on executive compensation

and corporate governance matters.

VOTE

REQUIRED AND RECOMMENDATION OF THE BOARD

The

proxy card provides stockholders with the opportunity to choose among four options: holding the vote every one; two; or three

years; or abstain from voting. Therefore, the shareholders will not be voting to approve or disapprove the recommendation of the

Board of Directors.

The

vote is advisory, which means that the vote on executive compensation is not binding on the Company, our Board of Directors, or

the Compensation Committee of the Board of Directors. The Board of Directors and the Compensation Committee will take into account

the outcome of the vote; however, when considering the frequency of future say-on-pay votes, the Board of Directors may decide

that it is in the best interests of our stockholders and the Company to hold future say-on-pay vote more or less frequently than

the frequency receiving the most votes cast by our stockholders.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE OPTION OF AN ANNUAL VOTE AS THE PREFERRED

FREQUENCY FOR FUTURE SAY-ON-PAY VOTES.

PROPOSAL

FOUR

APPROVAL

OF AN AMENDMENT TO THE 2004 EQUITY INCENTIVE PLAN TO ALLOW STOCK OPTION EXCHANGE PROGRAM

Introduction

On

March 20, 2019 our Board of Directors determined that it is in the best interests of the Company and its stockholders to obtain

authority from our stockholders to undertake a one-time stock option exchange program so that we can continue to achieve the Company’s

equity compensation goals. Options eligible for the exchange program consist of outstanding options granted under our 2004 Equity

Incentive Plan (the “2004 Incentive Plan”) on (x) April 29, 2010, (y) June 1, 2010 or (z) July 1, 2010 (collectively,

the “eligible options”). Such an exchange program will necessitate an amendment to the 2004 Incentive Plan.

EXCHANGE

PROGRAM

If

this proposal is approved by the stockholders, we intend to offer the exchange program to all employees, executive officers, directors

and consultants of the Company based in U.S. locations who are employed by, or providing services to, us throughout the duration

of the exchange program (the employees, executive officers, directors and consultants eligible for the exchange are referred to

herein as “eligible participants” or “service providers”) and who hold eligible options.

Our

Board of Directors may commence the exchange program within 120 days of the date this proposal is approved by the stockholders.

Within this timeframe, the actual start date will be determined at the discretion of the Board. Even if stockholders approve the

proposal, however, the Board may later determine not to implement the exchange program. If the exchange program does not commence

within 120 days of stockholder approval, the Company will consider any exchange program commenced thereafter to be a new one,

requiring new stockholder approval under the 2004 Incentive Plan.

CHANGES

BEING MADE TO THE 2004 INCENTIVE PLAN

The

amendment to the 2004 Incentive Plan permits the Company to commence a one-time stock option exchange to allow our eligible employees,

executive officers, directors and consultants to surrender certain outstanding stock options that are approaching the expiration

of their maximum 10-year term and which also currently are “underwater” (meaning the exercise prices of such options

are greater than our current stock price) in exchange for new options to purchase the same number of shares of our Common Stock

granted under the 2004 Incentive Plan, but with a new 10-year term, a new, 4-year vesting schedule, a per share exercise price

equal to the fair market value of our Common Stock on the new date of grant and which, once vested, would remain exercisable for

the full term of the option unless terminated earlier under the dissolution, liquidation or change in control provisions of the

2004 Incentive Plan. Our Board of Directors believes that this program will be beneficial to stockholders by minimizing the risk

of unnatural fluctuations in our stock price from the high volume trading that could result if these eligible option holders rush

to exercise before the option expiration dates and then sell some or all of the purchased shares in the market in a short window.

In addition, our Board of Directors believes that this program will enhance long term stockholder value by restoring meaningful

retention and incentive benefits associated with these awards.

Reasons

for implementing an exchange program

Equity

awards have been, and continue to be, a key part of our incentive compensation and retention programs and are designed to motivate

and reward our service providers’ efforts. We believe that to develop and market competitive products, we need to maintain

competitive compensation and incentive programs.

The

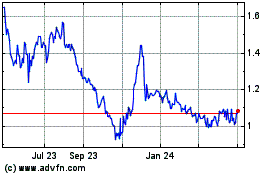

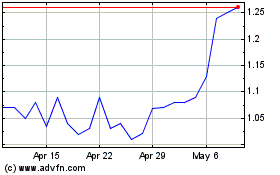

eligible options, which are held by long-term, valued employees, are nearing the end of their term As of March 25, 2019, these

options currently are “underwater.” The closing price of a share of our common stock on March 25, 2019 was $1.96.

The per share exercise prices of the eligible options range from $2.74 to $3.16.

Importantly,

if optionees otherwise want to exercise before the options expire, whether because options do have value before they expire (that

is, they come back “in-the-money”) or otherwise, it raises a significant concern that the exercise of these options

and subsequent sale of even a relatively small portion of the purchased shares could cause unnatural fluctuations in our stock

price, due to the high volume of shares that likely would be sold into the market as a result.

Offering

to exchange the eligible options for new options with a new 10-year term, a new, 4-year vesting schedule and the ability to exercise

vested options through the expiration of the new term will relieve the pressure to exercise the eligible options before they expire.

In fact, due to the new, 4-year vesting schedule, the exercise of new options granted in exchange would necessarily be spread

out over at least 4 years. This would remove the pressure that a flood of exercises before a 2020 expiration could cause on our

stock price and float.

In

addition, whether the eligible options are exercised or expire by their terms, they will no longer provide the strong retention

and incentive benefits we need from our equity compensation program. Additionally, the eligible options are currently “underwater,”

which adds to our concerns regarding their impact on retention and incentives. As a result, to the extent that the eligible options

expire before benefits can be realized, or that unusually high trading activity depresses returns on the exercise of these options

and/or the sale of the shares purchased under the options, we believe there is high risk that the objectives of equity program

to retain and motivate service providers and aligning their interests with those of our stockholders will not be achieved. The

Company needs to retain and motivate its employees, and reinvigorating the retention and incentive value of these options through

this exchange program is a key step toward that.

We

believe that the proposed exchange program is in the best interests of our stockholders and our employees. We believe the exchange

program is an important component in our strategy to align the interests of our service providers and stockholders because it

will permit us to:

•

Minimizes Risk of Destabilization of Our Stock Price As a Result of High Volume Option-Related Sales.

If the eligible options

become “in-the-money” (meaning our stock price is greater than the exercise price of the options) before they expire

in 2020, then the eligible option holders likely would be put in the position of having to exercise their eligible options in

order to avoid allowing those options to expire without any benefit to them. The Company’s trading volume has historically

tended to be fairly low. The average daily trading volume in our stock over the last thirty trading days ending on March 25, 2019

was 11,731 shares. There are a total of 384,064 shares subject to outstanding and unexercised eligible options as of that same

date. As a result, if even a small portion of these options were exercised and the shares sold, it could introduce unusually high

trading volume in our stock, causing destabilization and unnatural fluctuations in our stock price. Providing new options that

are subject to a 4-year vesting schedule, a new 10-year term and the ability to exercise vested options through the expiration

of the new term effectively spreads out the exercise period for the options, ameliorating these risks. In fact, due to the new,

4-year vesting schedule, the exercise of new options granted in exchange would necessarily be spread out over at least 4 years.

Spreading out the exercise period for these options, along with reinvigorating the retention and incentive value of the options

to our employees, is the primary purpose of the exchange program.

•

Provide effective incentives for the service providers who participate in the exchange program.

By issuing eligible participants

new stock options which may have lower exercise prices and that are subject to a new vesting period, it encourages them to remain

with us and to work to increase stockholder value. Providing effective incentives to our service providers is a key purpose of

the exchange program, and we believe the exchange program will enable us to enhance long-term stockholder value by aligning the

interests of our service providers more fully with the interests of our stockholders.

•

Reduce the pressure to grant additional or alternative equity awards to achieve the goals that our equity incentive program

is intended to accomplish.

If we are unable to conduct a program in which the expiring eligible options with low incentive

values may be exchanged for new higher incentive value options, we may be compelled to grant alternative equity awards such as

additional options or restricted stock awards to our service providers at current market prices in order to provide them with

renewed incentive value. Any such additional grants would increase our overhang as well as our compensation expense. The exchange

program as proposed, on the other hand, is a one-for-one exchange that accomplishes the retention and alignment goals of our equity

incentive program without increasing the number of stock option grants outstanding.

AlternativeS

considered

In

considering how best to continue to motivate, retain and reward our service providers who have options that are underwater, we

evaluated several alternatives, including the following:

•

Allowing the Options to Expire if Not Exercised and Granting New Equity Awards at That Time

. We considered doing nothing

at this time, which would allow the eligible options to simply continue under their current terms. After the expiration of those

options, we would consider granting new stock options or other equity awards. However, this approach would leave the Company more

vulnerable to the risks enumerated above. That is, if the eligible options came back “in-the-money” before expiration,

some or all likely would be exercised, causing the potential impact on our trading volume and stock price noted above.

•

Granting Additional Equity Awards

. We also considered granting service providers additional or alternative equity awards

at current market prices. We determined, however, that granting additional stock options was not feasible. Most of the shares

that had been available for issuance under our 2004 Incentive Plan have been used for equity award grants to our employees, and

the remainder needs to be better reserved and ultimately used for retention and incentive purposes unrelated to expiring awards.

In order to comfortably obtain sufficient shares under the 2004 Incentive Plan to grant new awards while leaving the eligible

options outstanding, we would have to seek stockholder approval of a significant increase to the 2004 Incentive Plan share reserve

or implement a new equity plan. We determined that doing so at this time and for this purpose was not in the best interests of

our stockholders, as this would substantially increase our total equity award overhang, and the potential dilution to our stockholders.

Instead, under the proposed exchange offer, the eligible options are cancelled and return to the 2004 Incentive Plan to be used

for the new options granted in replacement, thus keeping our total equity award overhang and potential dilution neutral.

After

considering the relative merits of these and other alternatives, we determined that a program under which service providers could

exchange eligible options for new options to purchase the same number of shares of Common Stock was most attractive for the reasons

described above under the section titled “Reasons for Implementing an Exchange Program.”

Implementation

and mechanics of the exchange program

On

March 20, 2019, our Board of Directors determined that it is in the best interests of the Company and its stockholders to obtain

authority from our stockholders to permit the one-time stock option exchange program for outstanding options granted under the

2004 Incentive Plan on (x) April 29, 2010, (y) June 1, 2010 or (z) July 1, 2010 (collectively, the “eligible options”).

The Company has not implemented the exchange program and will not do so unless our stockholders approve this proposal. If approved

by stockholders, the exchange program must begin within 120 days of the date of stockholder approval. Within this timeframe, the

actual start date will be determined at the discretion of our Board of Directors. However, even if stockholders approve the proposal,

the Company may later determine not to implement the exchange program. If the exchange program does not commence within 120 days

of stockholder approval, the Company will consider any exchange program implemented thereafter to be a new one, requiring new

stockholder approval, with respect to options granted under the 2004 Incentive Plan.

If

our stockholders do not approve the exchange program, eligible options will remain outstanding and in effect in accordance with

their existing terms.

Upon

the commencement of the exchange program, eligible participants holding eligible options will receive a written offer that will

set forth the precise terms and timing of the exchange program. Eligible participants will be given at least 20 business days

to elect to surrender their eligible options in exchange for new option awards. Promptly following the completion of this election

period, the surrendered eligible options will be cancelled and new options will be granted in exchange (with the date of grant

of the new options referred to as the “Exchange Date”).

At

the start of the exchange program, we will file the documents setting forth the exchange offer with the SEC as part of a tender

offer statement on Schedule TO. Eligible participants, as well as stockholders and members of the public, will be able to obtain

a copy of the exchange offer and other documents filed by us with the SEC free of charge from the SEC’s website at

www.sec.gov

.

Eligible

options

Eligible

options will include all of our outstanding options granted under the 2004 Incentive Plan on (x) April 29, 2010, (y) June 1, 2010

or (z) July 1, 2010. As of March 25, 2019, options to purchase 384,064 shares of our Common Stock would be eligible

for exchange under the exchange program.

Eligible

participants

The

exchange program will be open to all employees, executive officers, directors and consultants of the Company in our U.S. locations

who are employed by, or providing services, to us at the commencement of the exchange program and who remain service providers

with us through the date the new options are granted under the exchange program, if they hold eligible options. Any service provider

holding eligible options who elects to participate in the exchange program but whose service with us terminates for any reason

prior to the grant of the new options will retain his or her eligible options subject to their existing terms but will be excluded

from participation in the exchange program.

Interests

of officers and directors in the exchange program

The

Company’s Chief Executive Officer, Chief Financial Officer, three other most highly compensated executive officers and directors,

to the extent they elect to participate in the exchange program, will receive new options to purchase the same number of shares

that would have been issued upon the full exercise of their exchanged eligible options. As of March 28, 2019, each such

executive officer and director was entitled to exchange options for the following number of shares of Common Stock:

|

Executive Officers/Directors

|

|

Shares Subject to Options

|

|

Kevin J. Mills, President, CEO & Director

|

|

|

98,700

|

|

|

David W. Dunlap, CFO

|

|

|

62,000

|

|

|

Leonard L. Ott, EVP Engineering and Chief Technical Officer

|

|

|

43,450

|

|

|

Lee A. Baillif, VP of Operations

|

|

|

41,200

|

|

|

Lynn Zhao, VP & Controller

|

|

|

14,660

|

|

|

Charlie Bass, Director and Chairman

|

|

|

50,250

|

|

Exchange

ratios

The

exchange program is a one-for-one exchange. Eligible participants who participate in the exchange program will receive new options

to purchase the same number of shares that would have been issued upon the full exercise of their exchanged eligible options.

The

following table summarizes information regarding the eligible options (as of March 25, 2019) that may be surrendered and the new

options that would be granted in exchange:

|

Date

of Grant

|

|

Exercise Price Per

Share of Eligible Options

|

|

Number of Shares Underlying

Eligible Options

|

|

Expiration Date of Eligible Options

|

|

Maximum

Number

of Shares Under New Options That May Be Granted

|

|

April

29, 2010

|

|

|

$

|

3.16

|

|

|

|

10,000

|

|

|

April 29, 2020

|

|

|

10,000

|

|

|

June

1, 2010

|

|

|

$

|

2.74

|

|

|

|

40,500

|

|

|

June 1, 2020

|

|

|

40,500

|

|

|

July

1, 2010

|

|

|

$

|

3.04

|

|

|

|

333,564

|

|

|

July 1, 2020

|

|

|

333,564

|

|

|

|

|

|

|

Total

|

|

|

|

384,064

|

|

|

|

|

|

384,064

|

|

The

exchange program is a one-for-one exchange. Under the proposed exchange offer, eligible options cancelled in the exchange program

return to the 2004 Incentive Plan, and will match the number of shares to be granted as new options granted in replacement, thus

leaving the total number of shares available for future (non-exchange program-related) issuance under the 2004 Incentive Plan

the same. As of March 25, 2019, there are options to purchase 2,459,934 shares of Common Stock and 116,050 shares of restricted

stock outstanding under the 2004 Incentive Plan, and there are 150,167 shares remaining available for future grants under the

2004 Incentive Plan. Options exchanged would have a new term of 10 years, a new 4-year vesting period from the Exchange Date(1/48

th

of the shares subject to each new option would be scheduled to vest monthly, subject to continued service with us), an exercise

price equal to the closing market price of the Company’s Common Stock on the Exchange Date and which, once vested, would

remain exercisable for the full term of the option unless terminated earlier under the dissolution, liquidation or change in control

provisions of the 2004 Incentive Plan.

Participation

in the exchange program

Eligible

participants will not be required to participate in the exchange program. Participation in the exchange program is voluntary.

Eligible participants will have an election period of at least 20 business days from the start of the exchange program during

which to determine whether they wish to participate.

Eligible

participants may decide whether to participate in the exchange program on a grant-by-grant basis. This means that participants

may elect to tender any or all of their eligible option grants. Eligible participants will not, however, be permitted to tender

only a portion of an option.

Since

the decision whether to participate in the exchange program is voluntary, we are not able to predict which or how many service

providers will elect to participate, how many eligible options will be surrendered for exchange, and therefore how many new options

may be issued. As of March 25, 2019, 20 employees, executive officers, directors and consultants were eligible to participate

in the exchange program.

Vesting

of new options

The

new options granted in the exchange program will be unvested as of their grant date and will have a new vesting schedule. Unless

our Board of Directors adopts another vesting schedule prior to the date eligible options are exchanged for new options, the each

new option grant would be scheduled to vest as to 1/48

th

of the total number of shares subject to the option each month

following the date of grant, so that the option is fully vested 4 years from the date of grant, subject to the eligible participant’s

continued service with us through each relevant vesting date. This is the vesting schedule the Company typically applies to its

annual refresh stock option grants.

Terms

and conditions of the new options

New

options issued in the exchange program will be granted under our 2004 Incentive Plan and will be subject to an option agreement

between the Company and the option recipient. The per share exercise price of the new options will be equal to the closing sales

price of our Common Stock as quoted on the Nasdaq Capital Market on the date of grant; this price may be higher, lower or the

same as the per share exercise price of the eligible options they replace. Each option represents the right to purchase shares

of our Common Stock during a prescribed period of time and as the option vests. Stock options granted pursuant to the exchange

program for employees will be granted as incentive stock options for tax purposes to the maximum extent permitted by law. Stock

options granted pursuant to the exchange program for directors and consultants will be granted as nonstatutory stock options for

tax purposes. All new options issued in exchange will have a term of 10 years from the date of grant. Once vested, the new options

will remain exercisable for the full 10-year term of the option unless terminated earlier under the dissolution, liquidation or

change in control provisions of the 2004 Incentive Plan, which is consistent with the typical provisions of Company stock options

held by employees who have remained with the Company for at least 10 years. Other than the exercise price, vesting schedule and

ability to exercise vested options for the full option term, the other terms and conditions of the new options issued in the exchange

program will be substantially the same as those that applied previously to the eligible options that are exchanged in the program

(the “exchanged options”).

Surrendered

stock options

The

shares subject to exchanged options granted under the 2004 Incentive Plan will return to the 2004 Incentive Plan pool, where they

would be eligible for future awards under the 2004 Incentive Plan.

Eligible

options that are not surrendered will not be affected and will remain outstanding according to their original terms.

Potential

modifications to the terms of the exchange program

While

the terms of the exchange program are expected to be materially similar to the terms described in this proposal, we may find it

necessary or appropriate to change its terms to take into account, among other things, our administrative needs, legal requirements,

accounting rules, and Company policy decisions that make it appropriate to change the exchange program. It is also possible that

certain terms of the exchange program may need to be modified for tax, accounting or administrative reasons.

Additionally,

we may decide not to implement the exchange program even if stockholder approval is obtained or we may amend or terminate the

exchange program once it is in progress. Although we do not anticipate that the staff of the SEC will require us to materially

modify the terms of the exchange program, it is also possible that we may need to alter the terms of the exchange program to comply

with comments from the staff. The final terms of the exchange program will be described in an exchange offer document that will

be filed with the SEC.

U.S.

Federal income tax consequences

The

following is a summary of the anticipated material U.S. federal income tax consequences of participating in the exchange program.

A more detailed summary of the applicable tax considerations to participants will be provided in the exchange program documents.

The law and regulations themselves are subject to change, and the Internal Revenue Service is not precluded from adopting a contrary

position. The exchange of eligible options for new options should be treated as a non-taxable exchange, and neither we nor any

of our service providers should recognize any income for U.S. federal income tax purposes upon the surrender of eligible options

and the grant of new options. The foregoing is only a summary of the tax effect of U.S. federal income taxation upon participants

of the exchange program and the Company with respect to the surrender of eligible options and grant of new options under the exchange

program. It does not purport to be complete, and does not discuss the tax consequences of a service provider’s death or

the provisions of the income tax laws of any municipality or state in which the service provider may reside.

Accounting

treatment of new equity awards

On

January 1, 2006, we adopted the provisions of Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC)

Topic 718, Stock Compensation (formerly FASB Statement 123R), on accounting for share-based payments. Under ASC Topic 718, we

expect to recognize incremental compensation expense resulting from the new options granted in the exchange program. The incremental

compensation expenses will be measured as the excess, if any, of the fair value of the new options granted to participants in

exchange for surrendered eligible options, measured as of the date the new options are granted, over the fair value of the options

surrendered in exchange for the new awards, measured immediately prior to the exchange.

In

the event that any of the new options are forfeited prior to their vesting due to termination of employment or service, the compensation

expense for the forfeited options will not be recognized. With respect to participants who terminate after satisfying the new

vesting schedule of their new options, the compensation expense that the Company will recognize for their forfeited options is

limited to the incremental expense (if any) associated with the new option and not the expense of the option surrendered in the

exchange program.

Effect

on the Company’s stockholders

We

are unable to predict the precise impact of the exchange program on our stockholders because we are unable to predict how many

or which eligible participants will exchange their eligible options. Nonetheless, the exchange program is generally intended to

ameliorate the potential effect on our the trading volume and share price of our stock that could result from the high volume

of shares that could be sold into the market in connection with the exercise of eligible options before their expiration in 2020.

The exchange program also is intended to restore competitive and appropriate equity incentives for our service providers and recapture

value for compensation expense already being incurred.

Summary

of the 2004 Equity Incentive Plan

The

following is a summary of the principal features of the 2004 Incentive Plan and its operation. The summary is qualified in its

entirety by reference to the 2004 Incentive Plan, a copy of which is set forth in Appendix A. The 2004 Incentive Plan also is

available in its entirety in the proxy materials located at the Stockholder Meeting Info page on the Company’s website at

htt

p://www.socketmobile.com/2019-proxy-materials

.

The

2004 Incentive Plan provides for the grant of the following types of incentive awards: (i) stock options, (ii) restricted

stock, (iii) stock appreciation rights and (iv) performance units and performance shares. Each of these is referred to individually

as an “Award.” As of March 15, 2019, approximately 58 of our employees, executive officers, directors and consultants

are eligible to participate in the 2004 Incentive Plan, plus 11 former service providers with outstanding awards that may be exercised

in accordance with their terms, but who are not eligible for future awards under the 2004 Incentive Plan at this time.

Number

of Shares of Common Stock Available Under the 2004 Incentive Plan

. The maximum aggregate number of shares that may be awarded

and sold under the 2004 Incentive Plan is equal to the sum of (i) the 599,774 that became available under the 2004 Incentive Plan

from (x) shares which were reserved but not issued under the Company’s 1995 Stock Plan, as amended and restated (the “1995

Plan”) as of the date of stockholder approval of the 2004 Incentive Plan, and (y) shares that returned to the 1995 Plan

as a result of termination of options or repurchase of shares issued under the 1995 Plan after the approval of the 2004 Incentive

Plan, and (ii) an annual increase to be added on the first day of the Company’s fiscal year beginning in 2005, equal to

the

least

of (A) 400,000 shares, (B) 4% of the outstanding shares on such date or (C) a lesser amount determined

by the Board of Directors. As of March 25, 2019, 2,575,984 shares have been granted as options plus 116,050 shares granted as

restricted stock grants for a total of 2,692,034 shares outstanding under the 2004 Incentive Plan and 150,167 shares that remain

available for future Award grants under the 2004 Incentive Plan.

If

an Award expires or becomes unexercisable without having been exercised in full (including, for the avoidance of doubt, any shares

that are surrendered pursuant to the contemplated exchange program or any other exchange program), the unpurchased shares which

were subject thereto will become available for future grant or sale under the 2004 Incentive Plan (unless the 2004 Incentive Plan

itself has terminated); provided, however, that shares that have actually been issued under the 2004 Incentive Plan, whether or

not upon exercise of an Award, will not be returned to the 2004 Incentive Plan and will not become available for future distribution

under the 2004 Incentive Plan, except that if unvested shares are forfeited or repurchased by the Company, such shares will become

available for future grant under the 2004 Incentive Plan.

In

the event of any dividend or other distribution (whether in the form of cash, shares, other securities, or other property), recapitalization,

stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange

of shares or other securities of the Company, or other change in the corporate structure affecting the Company’s Common

Stock occurs, the Administrator (as defined below), in order to prevent diminution or enlargement of the benefits or potential

benefits intended to be made available under the 2004 Incentive Plan, will adjust the number and class of shares that may be delivered

under the Plan, and/or the number, class and price of shares of stock subject to outstanding awards, and the specified per-person

limits on Awards described below.

Option

Exchanges.

The 2004 Incentive Plan prohibits the implementation of a stock option exchange program without stockholder approval.

If this proposal is approved by stockholders, the 2004 Incentive Plan will be amended to permit a one-time stock option exchange

program that will allow eligible participants to surrender certain outstanding underwater stock options in exchange for new options

for the same number of shares granted under the 2004 Incentive Plan, as described above. The exchange program must begin within

120 days of the date this amendment to the 2004 Incentive Plan is approved by stockholders. Within this timeframe, the actual

start date will be determined at the discretion of our Board of Directors. If the exchange program does not commence within 120

days of stockholder approval, the Company will consider any exchange program implemented thereafter to be a new one, requiring

new stockholder approval.

Administration

of the 2004 Incen

tive Plan

. The Compensation Committee of our Board of Directors, or the Board of Directors itself (referred

to as the “Administrator”), administers the 2004 Incentive Plan. In the case of transactions, including grants to

certain officers and key employees of the Company, intended to qualify, as exempt under Rule 16b-3 of the Securities Exchange

Act of 1934, the members of the committee must qualify as “non-employee directors” under Rule 16b-3 of the Securities

Exchange Act of 1934. .

Subject

to the terms of the 2004 Incentive Plan, the Administrator has the sole discretion to select the employees, consultants, and directors

who receive Awards, to determine the terms and conditions of Awards, to modify or amend each Award (subject to the restrictions

of the 2004 Incentive Plan), and to interpret the provisions of the 2004 Incentive Plan and outstanding Awards.

Options

.

The Administrator is able to grant nonstatutory stock options and incentive stock options under the 2004 Incentive Plan. Only

employees may receive incentive stock options. The Administrator determines the number of shares subject to each option, although

the 2004 Incentive Plan provides that a participant may not receive options and/or stock appreciation rights for more than 750,000

shares in any fiscal year, except in connection with his or her initial employment with the Company, in which case he or she may

be granted an option and/or stock appreciation right covering up to an additional 1,250,000 shares.

The

Administrator determines the exercise price of options granted under the 2004 Incentive Plan, provided the exercise price must

be at least equal to the fair market value of our Common Stock on the date of grant. In addition, the exercise price of an incentive

stock option granted to any participant who owns more than 10% of the total voting power of all classes of our outstanding stock

must be at least 110% of the fair market value of the common stock on the grant date.

The

term of each option will be stated in the Award agreement. The term of an incentive stock option may not exceed ten years, except

that, with respect to any participant who owns 10% of the voting power of all classes of the Company’s outstanding capital

stock, the term of an incentive stock option may not exceed five years.

After

a termination of service with the Company, a participant will be able to exercise the vested portion of his or her option for

the period of time stated in the Award agreement. If no such period of time is stated in the participant’s Award agreement,

the participant will generally be able to exercise his or her option for (i) three months following his or her termination for

reasons other than death or disability, and (ii) twelve months following his or her termination due to death or disability.

Restricted

Stock

. Awards of restricted stock are rights to acquire or purchase shares of our Common Stock, which vest in accordance with

the terms and conditions established by the Administrator in its sole discretion. For example, the Administrator may set restrictions

based on the achievement of specific performance goals. The Administrator, in its discretion, may accelerate the time at which

any restrictions will lapse or be removed. The Award agreement generally will grant the Company a right to repurchase or reacquire

the shares upon the termination of the participant’s service with the Company for any reason (including death or disability).

The Administrator will determine the number of shares granted pursuant to an Award of restricted stock, but no participant will

be granted a right to purchase or acquire more than 250,000 shares of restricted stock during any fiscal year, except that a participant

may be granted up to an additional 500,000 shares of restricted stock in connection with his or her initial employment with the

Company. No restricted stock awards have been made.

Stock

Appreciation Rights

. The Administrator is able to grant stock appreciation rights, which are rights to receive the appreciation

in fair market value of Common Stock between the exercise date and the date of grant. The Company can pay the appreciation in