Smart Sand, Inc. (NASDAQ: SND) (the “Company” or “Smart Sand”), a

fully integrated frac and industrial sand supply and services

company, a low-cost producer of high quality Northern White frac

sand and a provider of industrial product solutions and proppant

logistics solutions through both its in-basin transloading

terminals and SmartSystems™ products and services, today

announced results for the third quarter 2022.

“Smart Sand delivered solid operating and financial results in

the third quarter,” stated Charles Young, Smart Sand’s Chief

Executive Officer. “Activity levels continued to be strong at our

Oakdale and Utica facilities and we increased the utilization of

our SmartSystems last mile fleets during the quarter. Additionally,

Smart Sand generated positive Free Cash Flow in the quarter as we

continue to execute our plan to increase margins while efficiently

managing our costs and capital expenditures. The outlook for

completions activity in North America continues to be positive and

we expect demand for our products and services to continue to be

strong.”

Third Quarter

2022 Results

Tons sold were approximately 1,110,000 in the third quarter of

2022, compared to approximately 1,196,000 tons in the second

quarter of 2022 and 790,000 tons in the third quarter of 2021, a

decrease of 7% sequentially and an increase of 41% over the

comparable period in the prior year.

Revenues were $71.6 million in the third quarter of 2022,

compared to $68.7 million in the second quarter of 2022 and $34.5

million in the third quarter of 2021. Revenues increased in the

third quarter, compared to the second quarter of 2022, primarily

due to a higher average sales price of our sand, increased

utilization of our SmartSystems™ fleet and contractual

shortfall revenue. Revenues increased in the third quarter of 2022,

compared to the third quarter of 2021, due primarily to higher sand

sales volumes and a higher average sales price for our sand. Sand

volumes and sales prices have increased since the third quarter of

2021 due to improvement in the supply and demand fundamentals for

frac sand. We believe that this improvement has been driven by

increased prices in oil and natural gas, which has led to stronger

oil and natural gas drilling and completions activity in 2022.

Gross profit was $11.4 million in the third quarter of 2022,

compared to $9.0 million in the second quarter of 2022 and $(2.0)

million in the third quarter of 2021. Gross profit improved in the

third quarter of 2022 compared to the second quarter of 2022

primarily due to higher shortfall revenue and the increase compared

to the third quarter of 2021 was primarily due to higher sales

volumes and higher average sales prices for our sand relative to

the cost to produce and deliver products to our customers.

For the third quarter of 2022, the Company had net income of

$2.7 million, or $0.06 per basic and diluted share, compared to a

net loss of $0.1 million, or $0.00 per basic and diluted share, for

the second quarter of 2022 and a net loss of $7.3 million, or

$(0.17) per basic and diluted share, for the third quarter of 2021.

The increase in net income in the third quarter of 2022 compared to

the second quarter of 2022 was primarily due to higher average

sales prices for our sand, higher utilization of our SmartSystems

fleet and increased shortfall revenue. The increase in net income

year-over-year was primarily due to improved gross profit from

higher sales volumes and higher pricing in the current quarter

compared to the same period a year ago.

Contribution margin was $17.8 million, or $16.01 per ton sold,

for the third quarter of 2022 compared to $15.3 million, or $12.75

per ton sold for the second quarter of 2022, and $4.1 million, or

$5.19 per ton sold, for the third quarter of 2021. The increase in

contribution margin and contribution margin per ton in the third

quarter of 2022 compared to the second quarter of 2022 was

primarily due to higher shortfall revenue and compared to the third

quarter of 2021 was primarily due to higher sales volumes and

higher average sales prices for our sand relative to the cost to

produce and deliver our products to our customers.

Adjusted EBITDA was $11.3 million for the third quarter of 2022,

compared to $9.2 million for the second quarter of 2022 and $(1.0)

million for the third quarter of 2021. The improvement in Adjusted

EBITDA in the third quarter of 2022 compared to the prior quarter

was primarily due to higher shortfall revenue. The improvement in

Adjusted EBITDA in the third quarter of 2022 compared to the same

period in 2021 was primarily due to higher sales volumes and higher

average sales prices for our sand.

Net cash provided by operating activities was $10.8 million in

the third quarter of 2022, compared to net cash used in operating

activities of $(8.7) million in the second quarter of 2022 and net

cash provided by operating activities of $37.5 million in the third

quarter of 2021. The increase in net cash provided by operating

activities in the third quarter of 2022 compared to the second

quarter of 2022 was primarily due to increased cash collections on

sales of consistently high volumes of sand sold at higher average

sales prices. Net cash provided by operating activities was higher

in the third quarter of 2021 as compared to the third quarter of

2022 due primarily to the Company’s receipt of a of $35.0 million

cash payment from U.S. Well Services, LLC (“U.S. Well”) in

settlement of certain litigation with U.S. Well.

Free cash flow was $6.4 million for the third quarter of 2022.

Net cash provided by operating activities during this period was

$10.8 million, due primarily to cash collections on sales of

consistently high volumes of sand sold at higher average sales

prices. Capital expenditures were $4.4 million in the second

quarter of 2022.

Liquidity

Our primary sources of liquidity are cash on hand, cash flow

generated from operations and available borrowings under our ABL

Credit Facility. As of September 30, 2022, cash on hand was $10.4

million and we had $13.0 million in undrawn availability on our ABL

Credit Facility, with $6.0 million in borrowings outstanding. For

the nine months ended September 30, 2022, we had approximately

$15.1 million in capital expenditures, including approximately

$6.5 million related to the acquisition of the Blair facility.

We currently estimate that full year 2022 capital and acquisition

expenditures, including amounts relating to the acquisition of the

Blair facility, will be between $20.0 million and $25.0 million,

with capital expenditures for the remainder of 2022 primarily being

used to complete efficiency projects at our Oakdale and Utica

facilities.

Conference Call

Smart Sand will host a conference call and live webcast for

analysts and investors on November 9, 2022 at 10:00 a.m. Eastern

Time to discuss its third quarter 2022 financial results. Investors

are invited to listen to a live audio webcast of the conference

call, which will be accessible by visiting the “Investors” section

of the Company’s website at www.smartsand.com. To access the live

webcast, please log in 10 minutes prior to the start of the call to

register. Once registration is completed, participants will receive

a dial-in number along with a personalized PIN. An archived replay

of the call will also be available on our website following the

call.

Forward-looking Statements

All statements in this news release other than statements of

historical facts are forward-looking statements that contain our

Company’s current expectations about our future results, including

our Company’s expectations regarding future sales. We have

attempted to identify any forward-looking statements by using words

such as “expect,” “will,” “estimate,” “believe” and other

similar expressions. Although we believe that the expectations

reflected and the assumptions or bases underlying our

forward-looking statements are reasonable, we can give no assurance

that such expectations will prove to be correct. Such

statements are not guarantees of future performance or events and

are subject to known and unknown risks and uncertainties that could

cause our actual results, events or financial positions to differ

materially from those included within or implied by such

forward-looking statements.

Factors that could cause our actual results to differ materially

from the results contemplated by such forward-looking statements

include, but are not limited to, fluctuations in product demand,

regulatory changes, adverse weather conditions, increased fuel

prices, higher transportation costs, access to capital, increased

competition, continued effects of the global pandemic, changes in

economic or political conditions, and such other factors discussed

or referenced in the “Risk Factors” section of the Company’s Annual

Report on Form 10-K for the year ended December 31, 2021, filed by

the Company with the U.S. Securities and Exchange

Commission (“SEC”) on March 8, 2022, and in the Company’s

Quarterly Report on Form 10-Q for the quarter ended September 30,

2022, filed by the Company with the SEC on November 8,

2022.

You should not place undue reliance on our forward-looking

statements. Any forward-looking statement speaks only as of the

date on which such statement is made, and we undertake no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events,

changed circumstances or otherwise, unless required by law.

About Smart Sand

We are a fully integrated frac and industrial sand supply and

services company, offering complete mine to wellsite proppant and

logistic solutions to our frac sand customers, and a broad offering

of products for industrial sand customers. We produce low-cost,

high quality Northern White sand, which is a premium sand used as a

proppant to enhance hydrocarbon recovery rates in the hydraulic

fracturing of oil and natural gas wells. Our sand is also a

high-quality product used in a variety of industrial applications,

including glass, foundry, building products, filtration,

geothermal, renewables, ceramics, turf & landscaping, retail,

recreation and more. We also offer logistics solutions to our

customers through our in-basin transloading terminals and our

SmartSystems wellsite storage capabilities. We own and operate

premium sand mines and related processing facilities in Wisconsin

and Illinois, which have access to four Class I rail lines,

allowing us to deliver products substantially anywhere in the

United States and Canada. For more information, please visit

www.smartsand.com.

| |

|

SMART SAND, INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS |

| |

| |

Three Months Ended |

| |

September 30, 2022 |

|

June 30, 2022 |

|

September 30, 2021 |

| |

(unaudited) |

|

(unaudited) |

|

(unaudited) |

| |

|

| Revenues: |

|

|

|

|

|

|

Sand sales revenue |

$ |

66,663 |

|

|

$ |

67,111 |

|

|

$ |

31,343 |

|

|

Shortfall revenue |

|

2,681 |

|

|

|

— |

|

|

|

2,680 |

|

|

Logistics revenue |

|

2,248 |

|

|

|

1,603 |

|

|

|

456 |

|

|

Total revenue |

|

71,592 |

|

|

|

68,714 |

|

|

|

34,479 |

|

| Cost of goods sold |

|

60,163 |

|

|

|

59,743 |

|

|

|

36,526 |

|

|

Gross profit |

|

11,429 |

|

|

|

8,971 |

|

|

|

(2,047 |

) |

| Operating expenses: |

|

|

|

|

|

|

Salaries, benefits and payroll taxes |

|

3,554 |

|

|

|

3,225 |

|

|

|

2,490 |

|

|

Depreciation and amortization |

|

556 |

|

|

|

563 |

|

|

|

352 |

|

|

Selling, general and administrative |

|

3,542 |

|

|

|

3,795 |

|

|

|

3,867 |

|

|

Bad debt expense |

|

— |

|

|

|

1 |

|

|

|

— |

|

|

Total operating expenses |

|

7,652 |

|

|

|

7,584 |

|

|

|

6,709 |

|

| Operating Income (loss) |

|

3,777 |

|

|

|

1,387 |

|

|

|

(8,756 |

) |

|

Other income (expenses): |

|

|

|

|

|

|

Interest expense, net |

|

(411 |

) |

|

|

(406 |

) |

|

|

(467 |

) |

|

Other income |

|

148 |

|

|

|

56 |

|

|

|

1,792 |

|

|

Total other expenses, net |

|

(263 |

) |

|

|

(350 |

) |

|

|

1,325 |

|

| Income (loss) before income

tax expense (benefit) |

|

3,514 |

|

|

|

1,037 |

|

|

|

(7,431 |

) |

|

Income tax expense (benefit) |

|

831 |

|

|

|

1,127 |

|

|

|

(169 |

) |

| Net income (loss) |

$ |

2,683 |

|

|

$ |

(90 |

) |

|

$ |

(7,262 |

) |

| Net loss per common

share: |

|

|

|

|

|

|

Basic |

$ |

0.06 |

|

|

$ |

— |

|

|

$ |

(0.17 |

) |

|

Diluted |

$ |

0.06 |

|

|

$ |

— |

|

|

$ |

(0.17 |

) |

| Weighted-average number of

common shares: |

|

|

|

|

|

|

Basic |

|

42,522 |

|

|

|

42,181 |

|

|

|

41,850 |

|

|

Diluted |

|

42,524 |

|

|

|

42,181 |

|

|

|

41,850 |

|

| |

|

SMART SAND, INC.CONDENSED CONSOLIDATED

BALANCE SHEETS |

| |

| |

September 30, 2022 |

|

|

| |

(unaudited) |

|

December 31, 2021 |

| |

(in thousands) |

|

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

10,371 |

|

|

$ |

25,588 |

|

|

Accounts receivable |

|

32,902 |

|

|

|

17,481 |

|

|

Unbilled receivables |

|

1,292 |

|

|

|

1,884 |

|

|

Inventory |

|

20,618 |

|

|

|

15,024 |

|

|

Prepaid expenses and other current assets |

|

7,405 |

|

|

|

13,886 |

|

|

Total current assets |

|

72,588 |

|

|

|

73,863 |

|

|

Property, plant and equipment, net |

|

267,210 |

|

|

|

262,465 |

|

|

Operating lease right-of-use assets |

|

28,418 |

|

|

|

29,828 |

|

|

Intangible assets, net |

|

6,867 |

|

|

|

7,461 |

|

|

Other assets |

|

315 |

|

|

|

402 |

|

|

Total assets |

$ |

375,398 |

|

|

$ |

374,019 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

11,634 |

|

|

$ |

8,479 |

|

|

Accrued expenses and other liabilities |

|

16,267 |

|

|

|

14,073 |

|

|

Current portion of deferred revenue |

|

9,905 |

|

|

|

9,842 |

|

|

Current portion of long-term debt |

|

6,495 |

|

|

|

7,127 |

|

|

Current portion of operating lease liabilities |

|

10,560 |

|

|

|

9,029 |

|

|

Total current liabilities |

|

54,861 |

|

|

|

48,550 |

|

|

Long-term deferred revenue |

|

— |

|

|

|

6,428 |

|

|

Long-term debt |

|

16,289 |

|

|

|

15,353 |

|

|

Long-term operating lease liabilities |

|

19,989 |

|

|

|

23,690 |

|

|

Deferred tax liabilities, long-term, net |

|

19,650 |

|

|

|

22,434 |

|

|

Asset retirement obligation |

|

25,006 |

|

|

|

16,155 |

|

|

Other non-current liabilities |

|

42 |

|

|

|

249 |

|

|

Total liabilities |

|

135,837 |

|

|

|

132,859 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

Common stock |

|

42 |

|

|

|

42 |

|

|

Treasury stock |

|

(4,986 |

) |

|

|

(4,535 |

) |

|

Additional paid-in capital |

|

176,992 |

|

|

|

174,486 |

|

|

Retained earnings |

|

67,263 |

|

|

|

70,593 |

|

|

Accumulated other comprehensive income |

|

250 |

|

|

|

574 |

|

|

Total stockholders’ equity |

|

239,561 |

|

|

|

241,160 |

|

|

Total liabilities and stockholders’ equity |

$ |

375,398 |

|

|

$ |

374,019 |

|

| |

|

SMART SAND, INC.CONSOLIDATED STATEMENTS OF

CASH FLOWS |

| |

| |

Three Months Ended |

| |

September 30, 2022 |

|

June 30, 2022 |

|

September 30, 2021 |

| |

(unaudited) |

|

(unaudited) |

|

(unaudited) |

| |

(in thousands) |

| Operating activities: |

|

|

|

|

|

|

Net income (loss) |

$ |

2,683 |

|

|

$ |

(90 |

) |

|

$ |

(7,262 |

) |

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation, depletion and accretion of asset retirement

obligation |

|

6,698 |

|

|

|

6,638 |

|

|

|

6,333 |

|

|

Amortization of intangible assets |

|

198 |

|

|

|

199 |

|

|

|

198 |

|

|

(Gain) loss on disposal of assets |

|

(466 |

) |

|

|

(16 |

) |

|

|

283 |

|

|

Provision for bad debt |

|

— |

|

|

|

1 |

|

|

|

— |

|

|

Amortization of deferred financing cost |

|

26 |

|

|

|

27 |

|

|

|

26 |

|

|

Accretion of debt discount |

|

47 |

|

|

|

46 |

|

|

|

47 |

|

|

Deferred income taxes |

|

480 |

|

|

|

911 |

|

|

|

(1,704 |

) |

|

Stock-based compensation |

|

808 |

|

|

|

802 |

|

|

|

879 |

|

|

Employee stock purchase plan compensation |

|

7 |

|

|

|

6 |

|

|

|

10 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

(3,264 |

) |

|

|

(5,563 |

) |

|

|

(4,965 |

) |

|

Unbilled receivables |

|

6,042 |

|

|

|

(3,236 |

) |

|

|

(19 |

) |

|

Inventories |

|

(3,744 |

) |

|

|

(3,291 |

) |

|

|

556 |

|

|

Prepaid expenses and other assets |

|

1,218 |

|

|

|

(1,981 |

) |

|

|

505 |

|

|

Deferred revenue |

|

(1,823 |

) |

|

|

(3,369 |

) |

|

|

4,877 |

|

|

Accounts payable |

|

(445 |

) |

|

|

3,422 |

|

|

|

(134 |

) |

|

Accrued and other expenses |

|

2,315 |

|

|

|

3,207 |

|

|

|

1,434 |

|

| Net cash (used in) provided by

operating activities |

|

10,780 |

|

|

|

(2,287 |

) |

|

|

1,064 |

|

| Investing activities: |

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

(4,398 |

) |

|

|

(1,369 |

) |

|

|

(1,933 |

) |

|

Proceeds from disposal of assets |

|

995 |

|

|

|

— |

|

|

|

76 |

|

| Net cash used in investing

activities |

|

(3,403 |

) |

|

|

(1,369 |

) |

|

|

(1,857 |

) |

| Financing activities: |

|

|

|

|

|

|

Repayments of notes payable |

|

(1,893 |

) |

|

|

(1,805 |

) |

|

|

(1,798 |

) |

|

Payments under equipment financing obligations |

|

(28 |

) |

|

|

(25 |

) |

|

|

(27 |

) |

|

Proceeds from revolving credit facility |

|

3,000 |

|

|

|

3,000 |

|

|

|

— |

|

|

Proceeds from equity issuance |

|

27 |

|

|

|

— |

|

|

|

25 |

|

|

Purchase of treasury stock |

|

(210 |

) |

|

|

(114 |

) |

|

|

(6 |

) |

| Net cash provided by (used in)

financing activities |

|

896 |

|

|

|

1,056 |

|

|

|

(1,806 |

) |

| Net increase in cash and cash

equivalents |

|

8,273 |

|

|

|

(2,600 |

) |

|

|

(2,599 |

) |

|

Cash and cash equivalents at beginning of period |

|

2,098 |

|

|

|

4,698 |

|

|

|

39,278 |

|

|

Cash and cash equivalents at end of period |

$ |

10,371 |

|

|

$ |

2,098 |

|

|

$ |

36,679 |

|

|

|

Non-GAAP Financial Measures

Contribution Margin

We also use contribution margin, which we define as total

revenues less costs of goods sold excluding depreciation, depletion

and accretion of asset retirement obligations, to measure its

financial and operating performance. Contribution margin excludes

other operating expenses and income, including costs not directly

associated with the operations of the Company’s business such as

accounting, human resources, information technology, legal, sales

and other administrative activities.

Historically, we have reported production costs and production

cost per ton as non-GAAP financial measures. As we expand our

logistics activities and continue to sell sand closer to the

wellhead, our sand production costs will only be a portion of our

overall cost structure.

Gross profit is the GAAP measure most directly comparable to

contribution margin. Contribution margin should not be considered

an alternative to gross profit presented in accordance with GAAP.

Because contribution margin may be defined differently by other

companies in the industry, our definition of contribution margin

may not be comparable to similarly titled measures of other

companies, thereby diminishing its utility. The following table

presents a reconciliation of contribution margin to gross

profit.

| |

Three Months Ended |

| |

September 30, 2022 |

|

June 30, 2022 |

|

September 30, 2021 |

| |

(in thousands, except per ton amounts) |

|

Revenue |

$ |

71,592 |

|

$ |

68,714 |

|

$ |

34,479 |

|

| Cost of goods sold |

|

60,163 |

|

|

59,743 |

|

|

36,526 |

|

| Gross profit |

|

11,429 |

|

|

8,971 |

|

|

(2,047 |

) |

|

Depreciation, depletion, and accretion of asset retirement

obligations included in cost of goods sold |

|

6,340 |

|

|

6,283 |

|

|

6,145 |

|

| Contribution margin |

$ |

17,769 |

|

$ |

15,254 |

|

$ |

4,098 |

|

| Contribution margin per

ton |

$ |

16.01 |

|

$ |

12.75 |

|

$ |

5.19 |

|

| Total tons sold |

|

1,110 |

|

|

1,196 |

|

|

790 |

|

| |

|

|

|

|

|

|

|

|

|

EBITDA and Adjusted EBITDA

We define EBITDA as net income, plus: (i) depreciation,

depletion and amortization expense; (ii) income tax expense

(benefit); (iii) interest expense; and (iv) franchise taxes. We

define Adjusted EBITDA as EBITDA, plus: (i) gain or loss on sale of

fixed assets or discontinued operations; (ii) integration and

transition costs associated with specified transactions; (iii)

equity compensation; (iv) acquisition and development costs; (v)

non-recurring cash charges related to restructuring, retention and

other similar actions; (vi) earn-out, contingent consideration

obligations and other acquisition and development costs; and (vii)

non-cash charges and unusual or non-recurring charges. Adjusted

EBITDA is used as a supplemental financial measure by management

and by external users of our financial statements, such as

investors and commercial banks, to assess:

- the financial performance of our

assets without regard to the impact of financing methods, capital

structure or historical cost basis of our assets;

- the viability of capital expenditure

projects and the overall rates of return on alternative investment

opportunities;

- our ability to incur and service

debt and fund capital expenditures;

- our operating performance as

compared to those of other companies in our industry without regard

to the impact of financing methods or capital structure; and

- our debt covenant compliance, as

Adjusted EBITDA is a key component of critical covenants to the ABL

Credit Facility.

We believe that our presentation of EBITDA and Adjusted EBITDA

will provide useful information to investors in assessing our

financial condition and results of operations. Net income is the

GAAP measure most directly comparable to EBITDA and Adjusted

EBITDA. EBITDA and Adjusted EBITDA should not be considered

alternatives to net income presented in accordance with GAAP.

Because EBITDA and Adjusted EBITDA may be defined differently by

other companies in our industry, our definitions of EBITDA and

Adjusted EBITDA may not be comparable to similarly titled measures

of other companies, thereby diminishing their utility. The

following table presents a reconciliation of EBITDA and Adjusted

EBITDA to net income for each of the periods indicated.

The following table presents a reconciliation of EBITDA and

Adjusted EBITDA to net income for each of the periods

indicated:

| |

Three Months Ended |

| |

September 30, 2022 |

|

June 30, 2022 |

|

September 30, 2021 |

| |

(in thousands) |

|

Net income (loss) |

$ |

2,683 |

|

|

$ |

(90 |

) |

|

$ |

(7,262 |

) |

| Depreciation, depletion and

amortization |

|

6,705 |

|

|

|

6,658 |

|

|

|

6,165 |

|

| Income tax expense/(benefit) |

|

831 |

|

|

|

1,127 |

|

|

|

(169 |

) |

| Interest expense |

|

431 |

|

|

|

417 |

|

|

|

484 |

|

| Franchise taxes |

|

77 |

|

|

|

131 |

|

|

|

42 |

|

| EBITDA |

$ |

10,727 |

|

|

$ |

8,243 |

|

|

$ |

(740 |

) |

| (Gain) loss on sale of fixed

assets |

|

(466 |

) |

|

|

(16 |

) |

|

|

281 |

|

| Equity compensation |

|

713 |

|

|

|

636 |

|

|

|

784 |

|

| Employee retention credit |

|

— |

|

|

|

— |

|

|

|

(1,674 |

) |

| Acquisition and development

costs |

|

97 |

|

|

|

— |

|

|

|

— |

|

| Cash charges related to

restructuring and retention |

|

31 |

|

|

|

106 |

|

|

|

8 |

|

| Accretion of asset retirement

obligations |

|

189 |

|

|

|

190 |

|

|

|

332 |

|

| Adjusted EBITDA |

$ |

11,291 |

|

|

$ |

9,159 |

|

|

$ |

(1,009 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

Free Cash Flow

Free cash flow, which we define as net cash provided by

operating activities less purchases of property, plant and

equipment, is used as a supplemental financial measure by our

management and by external users of our financial statements, such

as investors and commercial banks, to measure the liquidity of our

business.

Net cash provided by operating activities is the GAAP measure

most directly comparable to free cash flow. Free cash flow should

not be considered an alternative to net cash provided by operating

activities presented in accordance with GAAP. Because free cash

flows may be defined differently by other companies in our

industry, our definition of free cash flow may not be comparable to

similarly titled measures of other companies, thereby diminishing

its utility. The following table presents a reconciliation of free

cash flow to net cash provided by operating activities.

| |

Three Months Ended |

| |

September 30, 2022 |

|

June 30, 2022 |

|

September 30, 2021 |

| |

(in thousands) |

|

Net cash provided by (used in) operating activities |

$ |

10,780 |

|

|

$ |

(2,287 |

) |

|

$ |

37,544 |

|

| Purchases of property, plant

and equipment |

|

(4,398 |

) |

|

|

(1,369 |

) |

|

|

(6,976 |

) |

| Free cash flow |

$ |

6,382 |

|

|

$ |

(3,656 |

) |

|

$ |

30,568 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Investor Contacts:

Lee Beckelman

Chief Financial Officer

(281) 231-2660

lbeckelman@smartsand.com

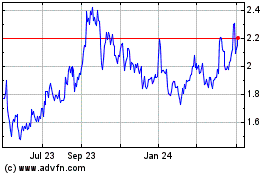

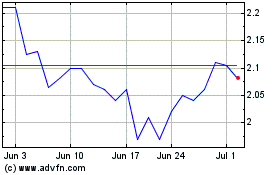

Smart Sand (NASDAQ:SND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Smart Sand (NASDAQ:SND)

Historical Stock Chart

From Apr 2023 to Apr 2024