UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

|

|

|

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

for the year ended December 31, 2018

or

|

|

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File No. 000‑14719

SKYWEST, INC. EMPLOYEES’ RETIREMENT PLAN

(Full title of the plan and address of the plan, if different from that of the issuer named below)

SKYWEST, INC.

444 South River Road

St. George, Utah 84790

(Name of issuer of the securities held pursuant to the

Plan and the address of its principal executive office)

REQUIRED INFORMATION

Item 1.

Not applicable.

Item 2.

Not applicable.

Item 3.

Not applicable.

Item 4.

The SkyWest, Inc. Employees’ Retirement Plan (the “Plan”) is subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). Attached hereto are the audited financial statements and related schedule of the Plan for the fiscal year ended December 31, 2018, which have been prepared in accordance with the financial reporting requirements of ERISA.

Exhibits.

SKYWEST, INC. EMPLOYEES’ RETIREMENT PLAN

Index to Financial Statements and Supplemental Schedule

* Other supplemental schedules required by section 2520.103‑10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Plan Administrators and participants of the

SkyWest, Inc. Employees’ Retirement Plan

Opinion on the Financial Statements

We have audited the accompanying statements of assets available for benefits of the SkyWest, Inc. Employees’ Retirement Plan (the Plan) as of December 31, 2018 and 2017, and the related statement of changes in assets available for benefits for the year ended December 31, 2018, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the assets available for benefits of the Plan as of December 31, 2018 and 2017, and the changes in assets available for benefits for the year ended December 31, 2018, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental schedule of assets (held at end of year) as of December 31, 2018, referred to as supplemental information, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Tanner LLC

We have served as the Plan’s auditor since 2007.

Salt Lake City, Utah

June 24, 2019

SKYWEST, INC. EMPLOYEES’ RETIREMENT PLAN

Statements of Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

As of December 31,

|

|

|

|

2018

|

|

2017

|

|

Assets

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments, at fair value

|

|

$

|

668,135,765

|

|

$

|

674,958,518

|

|

|

|

|

|

|

|

|

|

Notes receivable from participants

|

|

|

16,062,945

|

|

|

15,407,743

|

|

|

|

|

|

|

|

|

|

Assets available for benefits

|

|

$

|

684,198,710

|

|

$

|

690,366,261

|

See accompanying notes to financial statements.

SKYWEST, INC. EMPLOYEES’ RETIREMENT PLAN

Statement of Changes in Assets Available for Benefits

For the Year Ended December 31, 2018

|

|

|

|

|

|

Additions:

|

|

|

|

|

Contributions:

|

|

|

|

|

Participants

|

|

$

|

46,697,807

|

|

Employer

|

|

|

33,696,117

|

|

|

|

|

|

|

Total contributions

|

|

|

80,393,924

|

|

|

|

|

|

|

Interest income on notes receivable from participants

|

|

|

776,584

|

|

|

|

|

|

|

Net investment loss:

|

|

|

|

|

Interest and dividends

|

|

|

6,685,508

|

|

Net depreciation in fair value of investments

|

|

|

(45,386,971)

|

|

|

|

|

|

|

Total net investment loss

|

|

|

(38,701,463)

|

|

|

|

|

|

|

Total additions

|

|

|

42,469,045

|

|

|

|

|

|

|

Deductions:

|

|

|

|

|

Distributions to participants

|

|

|

48,216,475

|

|

Administrative expenses

|

|

|

420,121

|

|

|

|

|

|

|

Total deductions

|

|

|

48,636,596

|

|

|

|

|

|

|

Net decrease in assets available for benefits

|

|

|

(6,167,551)

|

|

|

|

|

|

|

Assets available for benefits:

|

|

|

|

|

Beginning of the year

|

|

|

690,366,261

|

|

|

|

|

|

|

End of the year

|

|

$

|

684,198,710

|

See accompanying notes to financial statements.

SKYWEST, INC. EMPLOYEES’ RETIREMENT PLAN

Notes to Financial Statements

(1) Description of the Plan

The following description of the SkyWest, Inc. Employees’ Retirement Plan (the “Plan”) is provided for general information purposes only. Participants should refer to the Plan document and summary plan description for a more complete description of the Plan’s provisions.

(a) General

SkyWest, Inc. (the “Company”, “Plan Sponsor” or “Employer”) adopted the Plan, effective April 1, 1977. The Plan is a defined contribution plan and is intended to be a qualified retirement plan under Section 401(a) of the Internal Revenue Code (“IRC”) of 1986, as amended. It is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The Plan was most recently restated on January 1, 2018.

The Plan was established to provide employees with an opportunity to accumulate funds for retirement or disability and to provide death benefits for employees’ dependents and beneficiaries.

(b) Eligibility

All of the employees of the Company who have completed 60 days of service are eligible to participate in the Plan. An eligible employee, who has enrolled, shall become a participant on the first day of the month coinciding with or following the date that the employee meets the eligibility requirements. Employees must affirmatively elect to participate in the Plan.

(c) Participant Accounts

Individual accounts are maintained for each Plan participant. Each participant’s account is credited with the participant’s contributions, the Company’s matching contributions, and an allocation of investment earnings, and is charged with withdrawals and an allocation of investment losses and expenses. The allocations of investment earnings and losses, and expenses are based on participant earnings on account balances. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

(d) Contributions

Participants elect both the amount of salary reduction contributions and the allocation of the salary reduction contributions among the various investment alternatives within the Plan. Annual salary reduction contributions cannot exceed the lesser of 100% of the participant’s eligible compensation or the maximum amount allowable under the IRC, which was $18,500 during 2018 ($24,500 for participants age 50 and older).

Employees are eligible for the Company match when they have completed one year of service and have enrolled in the Plan. Employees must be making contributions to the Plan in order to receive the Company match. During 2018, the Company matched 100% of each eligible participant’s salary reduction contribution up to levels ranging from 2% to 12% of compensation, based on position and years of service. Additionally, each year the Company may make a discretionary contribution based on its earnings. An employee is eligible to participate in the discretionary contribution program if he or she has made salary reduction contributions. The Company made a discretionary contribution in 2018 of $4,157,436. Company discretionary contributions are allocated based on the participants’ contributions as a percentage of total participant contributions.

(e) Participant-Directed Options for Investments

Participants direct the investment of their contributions and the Company matching and discretionary contributions into various investments offered by the Plan. Investment options include mutual funds, pooled separate accounts, stable value funds, a common trust and SkyWest, Inc. common stock. Participants may change their elections or transfer investments between funds at any time.

Participants with SkyWest, Inc. common stock in their accounts may direct the sale of the stock and the investment of the resulting proceeds into other investments offered by the Plan.

(f) Vesting and Payment of Benefits

Participants are immediately vested 100% in their account balances. Benefits are normally paid at retirement, disability, death, or other termination. Benefits distributions may be made in a single lump sum payment, installments, or an annuity. Participants may withdraw funds from the Plan while actively employed subject to specific restrictions set forth in the Plan agreement.

(g) Notes Receivable from Participants

The Plan agreement provides for loans to be made to participants and beneficiaries. The loans must bear a reasonable rate of interest, have specific repayment terms and be adequately secured. Under no circumstances can the amount of the loan exceed the lesser of $50,000 or 50% of the participant’s vested account balance.

(h) Custodian and Record Keeper

Wells Fargo Institutional Trust Services (“Wells Fargo”) provides the recordkeeping and custodial services for the Plan. Wells Fargo is also a directed trustee of the Plan.

(i) Parties-in-Interest

The Company, participants and Wells Fargo are considered parties-in-interest to the Plan. The Company’s common stock is an investment option in the Plan.

(j) Termination of the Plan

Although it has not expressed any intent to do so, the Company may terminate the Plan at any time subject to the provisions of the Plan and ERISA. If the Plan is terminated, the participants have a non-forfeitable interest in their accounts.

(2) Summary of Significant Accounting Policies

(a) Basis of Accounting

The Plan’s financial statements are prepared on the accrual basis of accounting, in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

(b) Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates that affect the reported amounts of assets available for benefits and disclosure of contingent assets and liabilities at the date of the financial statements and the reported changes in assets available for benefits during the reporting period. Actual results could differ from these estimates.

(c) Risks and Uncertainties

The Plan provides for investments in securities that are exposed to various risks, such as interest rate, currency exchange rate, credit and overall market fluctuation. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of assets available for benefits.

(d) Investment Valuation and Income Recognition

Mutual funds are valued at quoted market prices, which represent the net asset values of units held by the Plan at year-end. Units of the Company’s common stock fund, pooled separate accounts, stable value funds and common trust are valued using net asset value, which approximates fair value, on the last business day of the Plan year. See Note 5 for more details regarding the valuation used for these investments. Unrealized appreciation or depreciation caused by fluctuations in the market value of investments is recognized in the statement of changes in assets available for benefits. Dividends and interest are reinvested as earned. Purchases and sales of investments are recorded on a trade-date basis.

(e) Distributions to Participants

Distributions to participants are recorded when paid.

(f) Notes Receivable from Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2018 or 2017. If a participant ceases to make loan repayments and the Plan Administrators deem the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

(g) Administrative Expenses

The Plan pays substantially all administrative expenses of the Plan, other than some legal and accounting fees, which are paid by the Plan Sponsor.

(h) Interest and Dividend Income

Interest income is recorded as earned on the accrual basis. Dividend income is recorded on the ex-dividend date.

(i) Reclassification

Certain amounts in the 2017 financial statements have been reclassified to conform with the current year presentation. These reclassifications had no effect on the change in assets available for benefits.

(j) Subsequent Events

The Plan Administrators have evaluated events occurring subsequent to December 31, 2018 through the date of issuance of these financial statements.

(3) Party-in-Interest Transactions

Transactions in shares of the Company’s common stock qualify as exempt party-in-interest transactions under the provisions of ERISA. The Plan held 368,875 and 362,733 shares of SkyWest, Inc. common stock in the SkyWest, Inc. Common Stock Fund with a fair value of $16,403,871 and $19,261,122 as of December 31, 2018 and 2017, respectively. The SkyWest, Inc. Common Stock Fund also held cash equivalents of $602,955 and $678,503 as of December 31, 2018 and 2017.

Notes receivable from participants totaling $16,062,945 and $15,407,743 as of December 31, 2018 and 2017, respectively, are also considered exempt party-in-interest transactions.

(4) Tax Status

The Plan has received a determination letter from the Internal Revenue Service (“IRS”) dated October 10, 2017, stating that the Plan is designed in accordance with applicable sections of the IRC and, therefore, the related trust is exempt from taxation. As of December 31, 2018, the Plan was required to make certain corrective distributions in order to remain qualified under IRC 401(a). Subsequent to December 31, 2018, the Plan made the corrective distributions in accordance with IRS regulations.

(5) Fair Value Measurements

U.S. GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the measurement date. U.S. GAAP establishes a fair value hierarchy that requires an entity to maximize the use of observable inputs when measuring fair value, with the following three levels of inputs:

Level 1 — Valuation is based upon quoted prices in active markets for identical securities.

Level 2 — Valuation is based upon other significant observable inputs that reflect the assumptions market participants would use in pricing the asset developed on market data obtained from sources independent of the Plan.

Level 3 — Valuation is based upon unobservable inputs that reflect the assumptions that Plan management believes market participants would use in pricing the asset, based on the best information available.

As of December 31, 2018 and 2017, the Plan held certain assets that are required to be measured at fair value on a recurring basis. Assets measured at fair value on a recurring basis are summarized below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements as of December 31, 2018

|

|

|

|

(in 000’s)

|

|

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Mutual funds

|

|

$

|

318,929

|

|

$

|

318,929

|

|

$

|

—

|

|

$

|

—

|

|

Pooled separate accounts*

|

|

|

207,925

|

|

|

—

|

|

|

—

|

|

|

—

|

|

Stable value funds*

|

|

|

58,270

|

|

|

—

|

|

|

—

|

|

|

—

|

|

Common trust*

|

|

|

53,626

|

|

|

—

|

|

|

—

|

|

|

—

|

|

Common stock fund*

|

|

|

17,007

|

|

|

—

|

|

|

—

|

|

|

—

|

|

Participant-directed brokerage accounts

|

|

|

12,379

|

|

|

12,379

|

|

|

—

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

668,136

|

|

$

|

331,308

|

|

$

|

—

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements as of December 31, 2017

|

|

|

|

(in 000’s)

|

|

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Mutual funds (a)

|

|

$

|

547,712

|

|

$

|

547,712

|

|

$

|

—

|

|

$

|

—

|

|

Common trust* (a)

|

|

|

49,223

|

|

|

—

|

|

|

—

|

|

|

—

|

|

Stable value funds*

|

|

|

49,028

|

|

|

—

|

|

|

—

|

|

|

—

|

|

Common stock fund*

|

|

|

19,940

|

|

|

—

|

|

|

—

|

|

|

—

|

|

Participant-directed brokerage accounts

|

|

|

9,056

|

|

|

9,056

|

|

|

—

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

674,959

|

|

$

|

556,768

|

|

$

|

—

|

|

$

|

—

|

* The fair values for the stable value funds, pooled separate accounts, common stock fund and common trust are provided above to permit the reconciliation of the fair value hierarchy to the amounts presented in the statements of assets available for benefits. The pooled separate accounts, stable value fund, common trust and the common stock fund are measured using the net asset value per unit as a practical expedient and therefore are not classified in the fair value hierarchy.

|

|

(a)

|

|

The December 31, 2017 common trust amount has been reclassified out of Level 2 mutual funds to conform to the current year presentation. There was no impact to the previously reported asset values for 2017 as a result of this reclassification.

|

The SkyWest, Inc. Common Stock Fund (the “Common Stock Fund”), T. Rowe Price Stable Value (the “Stable Value Fund”), T. Rowe Price Blue Chip Growth Trust (“Common Trust”), and T. Rowe Price Retirement Trust funds (“Pooled Separate Accounts”) are valued at the net asset value (NAV) of units of the respective funds. The NAV, as provided by the respective fund trustees, is used as a practical expedient to estimate fair value. The NAV is based on the fair value of the underlying investments held by the fund less its liabilities. This practical expedient is not used when it is determined to be probable that the fund will sell the investment for an amount different than the reported NAV.

The Stable Value Fund is designed to provide safety of principal with consistency of returns with minimal volatility by employing a strategy of investing in investment contracts and security-backed contracts while employing broad diversification among contract issuers and underlying securities. The Plan Sponsor is able to redeem the investment in the Stable Value Fund by providing a 12‑month notice. Although the notice requirement is 12 months, T. Rowe Price has indicated the ability to redeem the investment sooner. Redemption frequency for the Stable Value Fund is immediate, and the Stable Value Fund contains no unfunded commitments. There are no other significant restrictions on the ability to redeem the investment.

The Common Stock Fund includes investments in SkyWest, Inc. common stock. Redemption frequency for the Common Stock Fund is immediate, the Common Stock Fund contains no unfunded commitments, and has no redemption restrictions.

The Common Trust is designed to provide long-term capital growth by investing in the common stocks of large and medium sized blue chip companies that have the potential for above-average earnings growth and are well established in their respective industries. Redemption frequency for the Common Trust is immediate, the Common Trust contains no unfunded commitments, and has no redemption restrictions.

The Pooled Separate Accounts are designed to provide the highest total return over time consistent with an emphasis on both capital growth and income by pursuing an asset allocation strategy that promotes asset accumulation prior to retirement, but it is intended to also serve as a post-retirement investment vehicle with allocations designed to support an income stream made up of regular withdrawals throughout retirement along with some portfolio growth that exceeds inflation. Redemption frequency for the Pooled Separate Accounts is immediate, the Pooled Separate Accounts contain no unfunded commitments, and have no redemption restrictions.

(6) Plan Amendments

Effective January 1, 2018, the Plan was restated, incorporating all previous amendments, under the IRS pre-approved Wells Fargo Bank, N.A. Defined Contribution Volume Submitter Plan and Trust.

Supplemental Schedule

SKYWEST, INC. EMPLOYEES’ RETIREMENT PLAN

EIN 87‑0292166, Plan 001

Form 5500, Schedule H, Part IV, Line 4i — Schedule of Assets (Held at End of Year)

As of December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b) Identity of issue, borrower,

lessor, or similar party

|

|

(c) Description of investment including

maturity date, rate of interest,

collateral, par, or maturity value

|

|

(e) Current value

|

|

Number

of units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Vanguard Group

|

|

Vanguard Institutional Index

|

|

$

|

61,164,690

|

|

268,797

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Stable Value N

|

|

|

58,270,161

|

|

58,270,161

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Blue Chip Growth Trust

|

|

|

53,625,619

|

|

1,444,267

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2030

|

|

|

37,466,233

|

|

2,066,532

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS

|

|

MFS Value

|

|

|

37,137,969

|

|

1,055,656

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goldman Sachs

|

|

Goldman Sachs Small Cap Value

|

|

|

34,011,687

|

|

731,277

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Mid-Cap Growth

|

|

|

33,949,773

|

|

444,485

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price New Horizons

|

|

|

33,778,471

|

|

700,798

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2040

|

|

|

33,417,580

|

|

1,763,461

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2035

|

|

|

31,612,268

|

|

1,697,759

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metropolitan West Asset Mgmt.

|

|

Metropolitan West Total Return Bond

|

|

|

29,655,346

|

|

2,854,220

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2045

|

|

|

28,654,657

|

|

1,510,525

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Funds

|

|

American Funds EuroPacific Growth R6

|

|

|

28,342,425

|

|

634,059

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2025

|

|

|

24,983,980

|

|

1,433,390

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

SkyWest, Inc.

|

|

SkyWest, Inc. Common Stock Fund

|

|

|

17,006,826

|

|

368,875

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2050

|

|

|

16,783,972

|

|

885,231

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS

|

|

MFS International Value R3

|

|

|

16,376,413

|

|

438,928

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Vanguard Group

|

|

Vanguard Extended Market Index Inst

|

|

|

16,024,199

|

|

211,708

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2020

|

|

|

15,738,224

|

|

944,671

|

* Indicates a party-in-interest to the Plan.

Column (d), cost information, is not applicable for participant-directed investments.

S

KYWEST, INC. EMPLOYEES’ RETIREMENT PLAN

EIN 87‑0292166, Plan 001

Form 5500, Schedule H, Part IV, Line 4i — Schedule of Assets (Held at End of Year)

As of December 31, 2018 (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b) Identity of issue, borrower,

lessor, or similar party

|

|

(c) Description of investment including

maturity date, rate of interest,

collateral, par, or maturity value

|

|

(e) Current Value

|

|

Number

of Units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JPMorgan

|

|

JPMorgan Mid Cap Value L

|

|

$

|

9,198,288

|

|

278,905

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self Directed Brokerage Invested Account

|

|

|

9,047,787

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2055

|

|

|

8,878,623

|

|

468,282

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Vanguard Group

|

|

Vanguard Total Bond Market Index Admiral

|

|

|

6,014,046

|

|

575,507

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Vanguard Group

|

|

Vanguard Total Intl Stock Index Admiral

|

|

|

3,796,650

|

|

149,651

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2015

|

|

|

3,363,022

|

|

212,715

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self Directed Brokerage Liquid Account

|

|

|

3,331,718

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2010

|

|

|

3,266,416

|

|

219,076

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price International Discovery

|

|

|

2,563,584

|

|

46,207

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JPMorgan

|

|

JPMorgan Strategic Income Opps R5

|

|

|

2,396,723

|

|

210,979

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2005

|

|

|

1,951,257

|

|

136,071

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

T. Rowe Price Retirement 2060

|

|

|

1,808,979

|

|

148,643

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fidelity

|

|

Fidelity Low Priced Stock

|

|

|

1,661,572

|

|

38,294

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Vanguard Group

|

|

Vanguard Emerging Mkts Stock Idx Adm

|

|

|

1,554,107

|

|

48,933

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Vanguard Group

|

|

Vanguard Real Estate Idx Admiral Shares

|

|

|

1,302,500

|

|

12,320

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Plan participants

|

|

Notes receivable from participants at 4.25% - 10.00% interest, with maturity dates from 2019 through 2031, collateralized by the respective participants’ account balances

|

|

|

16,062,945

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

684,198,710

|

|

|

* Indicates a party-in-interest to the Plan.

Column (d), cost information, is not applicable for participant-directed investments.

See accompanying Report of Independent Registered Public Accounting Firm.

SIGNATURES

The Plan.

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Date: June 24, 2019

|

SKYWEST, INC. EMPLOYEES’ RETIREMENT PLAN

|

|

|

|

|

|

By:

|

SkyWest, Inc., Plan Sponsor

|

|

|

|

|

|

|

/s/ Eric J. Woodward

|

|

|

|

Eric J. Woodward

|

|

|

|

Chief Accounting Officer

|

|

|

|

of SkyWest, Inc.

|

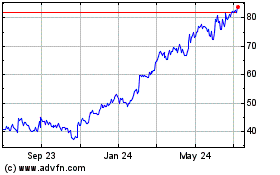

SkyWest (NASDAQ:SKYW)

Historical Stock Chart

From Mar 2024 to Apr 2024

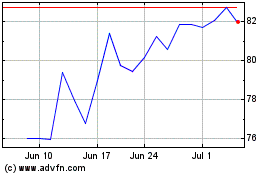

SkyWest (NASDAQ:SKYW)

Historical Stock Chart

From Apr 2023 to Apr 2024