Sinclair Gets Disney Regional Sports Units -- WSJ

May 03 2019 - 3:02AM

Dow Jones News

Acquisition of 21 networks for more than $10 billion is part of

deal with Fox

By Joe Flint

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 3, 2019).

TV-station giant Sinclair Broadcast Group Inc. has struck a deal

valued at more than $10 billion to acquire 21 regional sports

networks from Walt Disney Co., according to people familiar with

the matter.

The agreement is expected to be announced as early as Friday,

the people said.

For Sinclair, which already is the nation's biggest owner of

local television stations, the acquisition would instantly make it

a force in cable programming. Among the properties it is acquiring

are sports channels in Los Angeles and Detroit.

Disney acquired the sports networks as part of its purchase of

entertainment assets of 21st Century Fox and agreed to sell them to

pave the way for government approval of the deal.

"Sinclair got a great deal and should be able to cut costs and

leverage the RSN's and their stations together effectively" with

distributors and advertisers, said Patrick Crakes, a sports media

consultant.

Sinclair Broadcast has separately partnered with the New York

Yankees to acquire the YES Network, another of the networks once

controlled by Fox, in a deal valued at $3.45 billion, people close

to that deal said. That sale, which hasn't been finalized, also

includes Amazon.com Inc. as a partner.

The price tag for the regional sports networks is less than some

industry observers initially anticipated.

When Disney began preparing to sell the networks, the price tag

likely bidders and industry analysts forecast was between $16

billion and $20 billion.

Regional sports networks carry popular local sports, primarily

basketball and baseball. They typically are among the most

expensive channels for distributors and customers. As more pay-TV

customers have cut the cord, regional sports networks have suffered

the same audience erosion as the rest of the television business.

Younger viewers, in particular, now seek out sports content online,

where highlights are ubiquitous.

Pay-TV distributors also have become more willing to drop

regional sports networks rather than pay high prices to carry

them.

In Los Angeles, AT&T Inc. has never carried the Los Angeles

Dodgers baseball network that was launched several years ago.

Comcast Corp. didn't carry the YES Network for all of the 2016

season because of a fight over rates.

Still, Sinclair sees value in local sports programming as it

seeks to increase its content holdings.

The company already owns the Tennis Channel and is launching its

own regional sports channel in Chicago in partnership with the

Chicago Cubs.

For Sinclair, the deal represents a big win after its efforts to

buy Tribune Media Co. last year were thwarted by the Federal

Communications Commission.

Fox Business reported last month that Sinclair and Disney had a

"handshake agreement" for the networks that had yet to be

finalized.

Other suitors for the regional sports networks included Liberty

Media Corp. and Big 3 Basketball LLC, whose management includes

entertainment executive Jeff Kwatinetz and rapper and actor Ice

Cube.

Write to Joe Flint at joe.flint@wsj.com

(END) Dow Jones Newswires

May 03, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

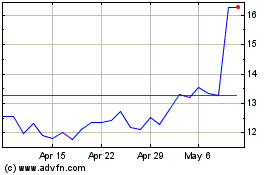

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

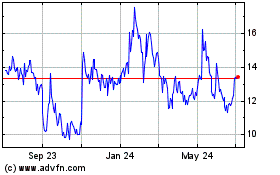

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Apr 2023 to Apr 2024