Sinclair Eyes More Regional Sports Networks as Disney Deal Closes

August 23 2019 - 2:31PM

Dow Jones News

By Joe Flint

Sinclair Broadcast Group Inc.'s appetite for regional sports

networks won't be satiated with its $9.6 billion purchase of Walt

Disney Co.'s 21 channels, which closed Friday after getting the

green light from the Justice Department.

In an interview, Sinclair Chief Executive Chris Ripley said the

company would be interested in acquiring more properties,

particularly the four regional sports outlets that AT&T Inc.

owns in Seattle, Colorado, Pittsburgh and the Southwest. AT&T

is looking to sell the channels, a person familiar with the matter

said.

"We of course would be very interested in looking at those and

filling out our regional sports network footprint," Mr. Ripley

said.

The 21 channels Sinclair acquired are the Fox Sports networks of

which Disney took control when it acquired the bulk of 21st Century

Fox's entertainment assets for $71.3 billion. Disney, which is the

parent company of sports-programming juggernaut ESPN, agreed to

spin off the regional channels in return for government approval of

the deal.

Sinclair separately partnered with the New York Yankees to

acquire the YES Network, another sports channel previously

controlled by Fox, for $3.47 billion. Other partners on the YES

purchase are Amazon.com Inc., private-equity firms RedBird Capital

Partners LLC and Blackstone Group Inc., and Abu Dhabi

sovereign-wealth fund Mubadala Investment Co.

The YES Network sale is also expected to receive Justice

Department approval and close before the end of the month, people

familiar with the matter said. Sinclair's role in the YES operation

will be to handle distribution for the network, a person close to

the Yankees said.

Mr. Ripley said the Disney deal is "the culmination of a

five-year push to get more exposure in sports." Besides the 21

networks and its YES stake, Sinclair is also launching a sports

channel in Chicago in partnership with the Cubs baseball team. It

also owns the Tennis Channel.

Sinclair, Mr. Ripley said, now derives 75% of its revenue from

local sports and news -- which he described as "the sweet spot of

where you want to be in the streaming wars."

A priority for Sinclair will be to try to negotiate a deal with

satellite broadcaster Dish Network Corp., which dropped the Fox

regional sports channels last month in a dispute over pricing.

Despite Sinclair's large local news operation, Mr. Ripley said

there are no plans to add any nonsports related content to its

newly acquired networks.

There has often been speculation that Sinclair might try to

launch its own national news service. Mr. Ripley said the company's

priority continues to be serving its local markets, but added he

never rules anything out.

"If there was the right opportunity we might do that," he

said.

Drew FitzGerald contributed to this article.

(END) Dow Jones Newswires

August 23, 2019 14:16 ET (18:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

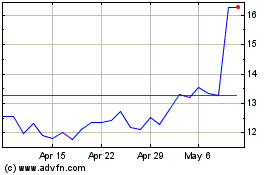

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

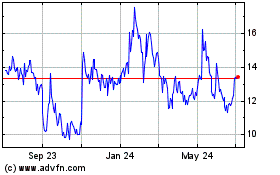

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Apr 2023 to Apr 2024