Filed by Simmons First National Corporation

pursuant to Rule 425 under the

Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under

the

Securities Exchange Act of 1934, as amended

Subject Company: The Landrum Company

Commission File Number: 000-06253

Transcript of Simmons First National Corporation’s

July 31, 2019, Conference Call with Analysts and Investors

Operator

Good morning, everyone. My name is Kirby, and I

will be your conference operator today. At this time, I would like to welcome everyone to the Simmons First National Corporation

Analyst Call Webcast. [Operator Instructions] Also, this call is being recorded. [Operator Instructions] Steve Massanelli, you

may begin your conference.

Stephen Massanelli

Head of Investor Relations

Good morning, and thank you for joining our call

to review the announcement of Simmons First National Corporation's acquisition of The Landrum Company. My name is Steve Massanelli,

and I serve as Chief Administrative Officer and Investor Relations officer at Simmons. Joining me today are George Makris, Chairman

and Chief Executive Officer; Bob Fehlman, Chief Financial Officer; and Marty Casteel, Chairman and CEO of Simmons Bank, our wholly-owned

bank subsidiary.

We have invited institutional investors and

analysts from the equity firms that provide research on our company to participate in the call. All other guests are in listen-only

mode. A transcript of today's call will be posted on our website at simmonsbank.com under the Investor Relations tab.

During today's call, we'll make forward-looking

statements about our future plans, goals, expectations, estimates projections and outlook. I remind you that actual results could

differ materially from those projected in the forward- looking statements due to a variety of factors.

Additional information concerning some of these

factors is contained in our SEC filings, including without limitation the description of certain risk factors contained in our

most recent annual report on Form 10-K and the forward-looking statements section of our press release announcing the Landrum acquisition

that the company issued this morning.

The company assumes no obligation to update

or revise any forward-looking statements or other information. I'll now turn the call over to George Makris.

George Makris

Chief Executive Officer

Thanks, Steve, and good morning. It's my pleasure

to welcome you to this conference call introducing our newest partnership with the Simmons family. This morning, we announced the

execution of the merger agreement with The Landrum Company and its subsidiary Landmark Bank headquartered in Columbia, Missouri.

I'd like to welcome any of the Landmark associates listening this morning, and I look forward visiting Columbia, Sherman and West

Plains over the next couple of days.

The leadership of Simmons and Landrum recognized

very early in our discussions, potential benefits of the combination of our organizations for all of our respective stakeholders.

I would like to thank Dan Stubler, chairman of the Board of Landrum, all of the Landrum family and Kevin Gibbens, CEO, for their

support and cooperation throughout this process.

The Landrum family has operated Landmark Bank since

early 1900s and has built a franchise known for excellent customer service and exceptional associate experience. We will do our

best to build on that success together as we form this new alliance.

Certainly, we believe our corporate cultures are

very similar, which is paramount to a successful merger.

In our release this morning, we included a presentation

with a high level summary of the merger and expected results. I would like to mention just a few highlights.

First, consistent with our priority to build scale

and share in our current footprint, Landmark has significant operations in Columbia, Missouri; South Central Missouri; Southern

Oklahoma; and Northern Texas. The addition of over $3 billion in assets certainly helps Simmons establish a significant presence

in each of our regional community banking units. You can see the breakdown of loans and deposits in those regions on Page 12 in

the presentation.

The Landmark footprint is very

similar to Simmons in that there is a good mix of growth markets with more mature markets. Columbia, Missouri was recently named

1 of the 10 best places to live in the United States and the Sherman Dennison market has a great balance of fast-paced growth and

affordable living.

South Central Missouri connects the Southwest

Missouri and North Arkansas regions in the current footprint and provides a stable, well- integrated customer base.

The Landmark franchise has a strong base of

core deposits with a loan-to-deposit ratio which will give us room to grow. Landmark also has a much smaller concentration of CRE

loans, which will help lower the concentration risk in the current Simmons portfolio.

And as one would expect the asset quality of Landmark

represents the same level of excellent asset quality as we have currently at Simmons.

Our experienced M&A team did a thorough review

of the Landmark operations. Some of the results such as the estimated loan credit and interest rate marks are included in the presentation.

And while we model no revenue synergy, we're optimistic that a larger balance sheet and additional products and services will provide

future revenue gains.

We also believe the Landmark customers and associates

will benefit from our next-generation banking initiatives, which will be substantially available before we convert systems and

merge the banks.

The financial metrics of the transaction are consistent

with Simmons’ standards. The transaction is estimated to be accretive to EPS. Tangible book value dilution is expected to

be earned back in approximately 3 years. The estimated internal rate of return meets our corporate standard and all pro forma capital

ratios are well within our internal guidelines.

We expect to file the holding company regulatory

application in a few days and expect to close the transaction in the fourth quarter of this year.

We anticipate the bank-to-bank merger and systems conversion

to occur in the first half of 2020.

Once again, we're really excited about this opportunity.

We're honored that the Landrum family has chosen to partner with Simmons, and we'll do our best to maintain the highest standards

of customer and associate satisfaction.

At this time, I'd like to ask the operator to open the

line for questions from our analysts.

Q&A Operator

[Operator Instructions] And our first question comes

from the line of Brett Rabatin from Piper Jaffray.

Brett Rabatin

Piper Jaffray Companies, Research Division

Hey, Guys. Good morning. It’s Brett. Congrats

on the deal. I guess my first question is just thinking about the addition of this bank, your deposit pro forma composition and

what they bring to table is similar to yours but lower, it does lower your loan-to-deposit ratio, how should we think about this

deal? Does this allow you to be less aggressive with CDs and deposit pricing? Or does this kind of reload you for continued stronger

growth? How do you think about what this bank does for your balance sheet?

George Makris

Chief Executive Officer

Well, Brett, I will tell you, we look it at as additional

inventory. So we look at the lower loan-to-deposit ratio as an opportunity to continue our growth. I think you can see their costs

of deposits are very reasonable, very similar to ours. So we really don't have a strategy to reduce any of the deposit base in

the current Simmons portfolio or in the Landrum portfolio. We're very pleased with the combination of our deposit bases.

Brett Rabatin

Piper Jaffray Companies, Research Division

Okay. And then the other question wanted to ask

was just around CECL and 2020 PC averages and all that noise. How are you guys factoring that into this deal? And how should we

think about discount accretion for this transaction?

George Makris

Chief Executive Officer

Well, we're still working on the final numbers.

We expect to have a first pass maybe in 30 days or so for us to take a look at. Obviously, CECL had an impact on the timing of

this transaction. Just for your information, if this deal closed after January 1, we would have a net income impact of the approximate

loan credit mark. We're going to be able to avoid that by a onetime balance sheet adjustment at the end of this year. So from a

CECL standpoint, we've modeled the capital pro formas. They will all be in great shape using the assumptions that we have today.

And now I’m out over my skies so I will turn that question over to Bob Fehlman and let him bail me out.

Robert Fehlman

Chief Financial Officer

Well, Brett, I'd tell you on the PCD the majority

of this is going to be non PCD accretion. There will be some PCD related to the impaired portfolio, but I would say there would

be a smaller piece of that maybe in the 15% to 20% range of the total accretion. So the majority of this would be non-PCD, So the

accretion will continue into next year, and it will be part of our CECL adjustment in the first quarter. Other than that is, as

George said, our goal is we said several times to close this deal by the end of this year if at all possible, to avoid that first

year provision hit. It will come later on down the road with banks that do acquisitions, but we just didn’t want to be the

first one out with that.

Brett Rabatin

Piper Jaffray Companies, Research Division

Okay. And then maybe just one last one. You've reviewed

47% of the loan portfolio. Presumably, you didn't have to spend too much time on the [inaudible] book. Can you talk about their

construction portfolio, what you reviewed? And what they do in construction?

George Makris

Chief Executive Officer

Talk a little bit about construction.

Marty Casteel

Simmons Bank CEO

C&D?

George Makris

Chief Executive Officer

Yes, what’s in their portfolio.

Marty Casteel

Simmons Bank CEO

Mortgage and in some, they have some, I'd call it,

college housing. Not what we're calling, really it would be more related to fraternity and sorority type financing. They have some

of that on their books in their C&D portfolio.

Matt Reddin

President of Banking Enterprise

They have, that North Dallas group has done -- has

been successful. Not a large commercial, but proven developers across product types, repeat business that they've done in Texas,

you know, year-over-year is where they've really grown construction over the last few years.

Brett Rabatin

Piper Jaffray Companies, Research Division

Ok. Great. Thanks for all the color.

Operator

And your next question comes from the line of David Feaster

from Raymond James. David, your line is now open.

David Feaster

Raymond James & Associates, Inc., Research

Division

Hey, good morning, guys, and congrats on the deal.

Just wanted to get your thoughts on the pro forma asset sensitivity and expectations for the core NIM, inclusive of Landmark. And

does the guidance that you gave assume just the July rate cut and maybe expectations for a 25 basis point cut pro forma?

Robert Fehlman

Chief Financial Officer

Yes, David, I will start off on that. As you can

see, their NIM was a little lower at 3 16 while a lot of that is driven from their lower loan to deposit ratio. If you go back

over the last couple of years, they have, their NIM was pretty good at 3 80 almost 4%. So they got hit last year pretty hard on

their deposit increase. And having a much higher security portfolio.

So there was some squeeze there. So we believe

in stable increase -- decreasing environment, this bank will have some room for margin improvement. We would say right now, you

know, if you model this, it would probably be 6, 7 basis point decline on our margin on a pro forma basis. That assumes we don't

do anything in management of the balance sheet. So our strategy on this would be able to continue the margin at our current levels

of the 3 66 and growing and to manage the balance sheet. And again, part of this, as we said earlier, is we needed a low loan-to-deposit

ratio bank, so that it helps our balance sheet in there. So our existing portfolio potential growth and so forth. So we do think

we'll be able to maintain our current -- our guidance is still in that 3 66 range, if and increasing.

David Feaster

Raymond James & Associates, Inc., Research

Division

Okay, okay. That's helpful.

Robert Fehlman

Chief Financial Officer

On the rate increase, we – you know, I think everybody's

pretty confident there will be a rate increase today.

George Makris

Chief Executive Officer

Decrease.

Robert Fehlman

Chief Financial Officer

I'm sorry, decrease. After that, we don't have

anything modeled right now until we hear further guidance, and it's kind of up in the air, I think.

David Feaster

Raymond James & Associates, Inc., Research

Division

Okay. Thank you. That's helpful. And I know you

are not including any revenue synergies in the model. And you've talked in the past about how difficult it is in acquisitions to

get cross-selling, but it looks like Landmark has actually got a pretty good fee income contribution and some complementary businesses

to y’all, how do you think about your opportunity to get your noninterest income products over there? And do you think there

could be more success with Landmark going forward?

George Makris

Chief Executive Officer

Yes, David, and quite honestly, this is one of those

situations where their expertise is going to help our legacy organization because some of the markets where they do have excellent

cross-sell, we don't. So we're going to get more scale in Southern Oklahoma, North Texas, where they do a really good job, that's

new to those markets in the current Simmons organization. So to have that expertise, that close in those regions should help our

existing footprint do more cross-selling and diversify our revenue stream. So it's not necessarily that we expect a lot of revenue

pickup in the Landrum organization, it's bringing their expertise into the Simmons organization and trying to help us accomplish

what we want to from previous acquisitions.

David Feaster

Raymond James & Associates, Inc., Research

Division

Okay. That's extremely

helpful. And last one from me. Pro forma for this deal looks like your capital levels are going to be towards the lower end of

ranges that we talked about on the 2Q call. Does that probably imply that you're out of the M&A arena for the time being? Or

would you consider other potential opportunities?

George Makris

Chief Executive Officer

Well, we're going to continue to have what I consider

to be very productive discussions with other potential partners. We expect our capital position to be improved quite quickly actually.

And I don't think that current capital level that we're showing in the pro forma will deter our M&A strategy at all.

David Feaster

Raymond James & Associates, Inc., Research

Division

Okay.

Robert Fehlman

Chief Financial Officer

And David, just looking back to last year, we were

hitting below 8% and quickly grew that back up over 9%. As George said, we believe that earning stream is there to build up capital

pretty quickly.

David Feaster

Raymond James & Associates, Inc., Research

Division

Okay. Thanks, guys, and congrats on the deal.

George Makris

Chief Executive Officer

Thanks, David.

Operator

And your next question comes from the line of Matt Olney,

Stephens.

Matthew Olney

Stephens Inc., Research Division

Hey, great. Thanks, and first off, I want to say

it's nice to see the characteristics of Landrum to be very similar to what George laid out last week on the earnings call. So well

done on that front.

George Makris

Chief Executive Officer

Well, if I had missed it last week, that would have been

bad.

Matthew Olney

Stephens Inc., Research Division

That's true. I want to dig in on the EPS accretion

range that was laid out there in the slide deck, 6% to 8%. Bob, can you just clarify is there accretible yield that is assumed

in that forecast? And if so, how much? And secondly, what type of balance sheet growth are you assuming from the target?

Robert Fehlman

Chief Financial Officer

So, yes, the accretible yield is in the

numbers. I would say on the credit portion of the accretible yield is mostly offset by the projected provision increases

based on how the accounting rules are today. So the credit portion is basically in and out on both sides. The interest mark

is in those numbers, and we do believe just like we did with Reliance it’s more like purchasing a bond –

we’ll have some loans rolling off that even in the down rate environment will be accretive to what they're currently on

the books for. So we think the accretible portion of the interest mark piece is more of a permanent. The credit,

there’s a very little piece in there that is hitting bottom line because of the provision buildup that we have as those

loans are projected to migrate. The years that we have on both of those is on an average of about 3.5 to 4 years. That will

extend longer, but the bulk -- the majority of it would be about 3.5 to 4 years. And it is not straight line over that period

of time, but our scheduling would be relatively close over the first several years.

On the growth level, you know, generally speaking,

we put about 7% for both companies. We didn’t put one company growing 10% to 12%, and that's really just our - a standard

number we use when we're modeling.

Matthew Olney

Stephens Inc., Research Division

Okay. And I guess, going back to Brett's question,

I'm trying to appreciate, does the EPS accretion guidance there at 6-8%, did -- does that assume any kind of balance sheet remix

using the strong liquidity from Landrum for loan growth at Simmons? or you just simply smashing the balance sheets together?

Robert Fehlman

Chief Financial Officer

Yes, simply pushing the balance

sheet together. We don't have any rebalancing built into their pro formas right now. We do expect that, just like we do on revenue

enhancements, but that's not what we model when we're putting these deals together.

Matthew Olney

Stephens Inc., Research Division

Okay. And then within Landrum,

I'm trying to understand, how much of a liquidity event this could be for their shareholders? What else can you us about their

shareholder base? Are they locked up following the closing? If so, how long? I'm just trying to understand there could be some

selling pressure on the stock once this deal has closed.

George Makris

Chief Executive Officer

Well, Matt. This is George.

So in our negotiations, we talked about cash, stock. You can see where we ended up – all stock. So I would, and I hate to

speak for their shareholders, but my impression is they believe that taking Simmons stock is a good long-term investment. Now their

ownership is basically made up of Landrum family members and entities that own about 50% of the bank. They have an ESOP plan that

owns about 7%. And then there are individual investors that make up the balance, none of which owns more than, say, 6.5% of the

bank.

So it's well-established ownership base. One

of the attractive things for these shareholders is that their dividend income will almost double as a result of owning Simmons

stock. And when you consider the sizable ownership that they will have, that's a big number. So I'd tell you that while we don't

have anyone locked up, we believe that this is viewed as a good long-term investment by their shareholders.

Matthew Olney

Stephens Inc., Research Division

Got it. Okay. That's great color, George. And then,

I guess, circling back on the other question on M&A from here. It sounds like you want to remain acquisitive. And the slide

deck has a good illustration that you're a proven acquiror with 10 successful integrations since 2013. You'll be $21 billion of

assets with this deal, is there a certain asset size you're targeting, or a certain level you want to be at? I'm trying to understand

at what point do you tap the brakes and more fully integrate your previous deals after tripling the asset size over the last few

years.

George Makris

Chief Executive Officer

Matt, we believe there's still really good opportunities

to grow our franchise through M&A. We will continue down that path. We don't view this as an either/or situation. We can either

do M&A or we can stop and grow organically. We think we can do both at the same time. And our NGB initiative is a great example

of that. We're working on efficiency through technology and offering better products and services to our customers. At the same

time, we're growing organically, we're going through M&A. We think we can manage all of that concurrently. And you know, when

we look back, since 2013, since that period of time, we've acquired approximately $11 billion of assets through our acquisitions,

but we've also grown organically some $3.5 billion during that period of time. So, you know, once again, we don't have a target

asset size. We believe what we're putting in place from a risk management perspective, from an NGB's perspective is scalable.

What I will tell you is this. That as we get bigger

and more sophisticated in our back office and operations and processes, we're really widening the gap between what is expected

in the current Simmons organization and what may be prevalent in smaller community banks. It is just a wide difference between

what they do and what will be expected at Simmons. So I would say smaller asset size banks would have to have a very special purpose

in the Simmons organization for us to consider those kind of acquisitions going forward.

And once again, we've mentioned predominantly agricultural

lending banks as a potential small bank that has a niche that would fit in well in the Simmons organization. So I would say that

we're widening the gap between what's possible with a small asset-based community bank.

Matthew Olney

Stephens Inc., Research Division

Okay. Great color. Thank you, George.

George Makris

Chief Executive Officer

Thank you, Matt.

Operator

And your next question comes from the

line of Stephen Scouten from Sandler O'Neill.

Stephen Scouten

Sandler O'Neill + Partners, L.P., Research Division

Hey, guys. Good morning. So

I just wanted to get some color, maybe digging back into Matt’s questions on the EPS accretion, what is the starting point

for how you're thinking about that 6 and 8% on 2020 and 2021? Is that -- are you starting off the 2 48 consensus number for 2020

and then what about 2021?

Robert Fehlman

Chief Financial Officer

Yeah, we used consensus for both years.

We figure that’s the best number for the public.

Stephen Scouten

Sandler O'Neill + Partners, L.P., Research Division

Okay. And just to confirm your question -- your

answer to Matt, there's no theoretical adjustments to the balance sheet. You're not assuming any sort of deployment of the excess

liquidity at Landmark or moving any of the excess loan-to- deposit ratio there into loans within that accretion, that's right?

Robert Fehlman

Chief Financial Officer

That's correct.

Stephen Scouten

Sandler O'Neill + Partners, L.P., Research

Division

Okay. Great. And then if you think about the loan

book, obviously, with the last couple of deals, the Texas deals, there ended up being maybe more runoff kind of in these last couple

of years that's constrained growth as you guys kind of thought about the risk profile of your entire loan portfolio. So with that

in mind, did you see any segments of the loan book here that you think you might see a similar outflows on? Or do you think you

can really just grow this from day 1 as it is?

Marty Casteel

Simmons Bank CEO

I don't think we have any plans to try to change

the mix of the loan book at all. We like the composition, we like the diversity. Good solid community banking portfolio. So we

have no plans to reposition the portfolio.

Stephen Scouten

Sandler O'Neill + Partners, L.P., Research

Division

Okay. Great. And then, I guess, here -- obviously,

you guys have been clear you want to close this deal this year. Are there any provisions to adjust pricing here otherwise? Or would

that be needed if it did happen to get pushed into early 2020 for some reason? George, you mentioned kind of the differential on

the mark related to CECL and so forth. Is that accounted for somewhere in the agreement?

George Makris

Chief Executive Officer

There is no provision for a 2020 closing if

it gets pushed into there. We still think this is a good long-term opportunity for us. We just felt like we needed to try to take

advantage of the onetime CECL adjustment, if we could. We're fairly confident that we're going to be able to get this closed this

year, but it would not affect our interest at all if it moved into 2020.

Robert Fehlman

Chief Financial Officer

I'll make one comment on that also is on the accounting

side, once both adjustments are made, whether you do it before or after, the net effect on the capital is about the same. There

is very little difference. It's just we preferred to get to close this year. While, as George said, while we have that opportunity

instead of being the first one out and having to explain it in the first quarter. If it is, we’ll just explain it in the

new accounting rule.

Stephen Scouten

Sandler O'Neill + Partners, L.P., Research

Division

Got it. And that makes complete sense. And then

just lastly, what's the impact on the Landmark revenues from Durbin? Do you have that number of how much their revenues will be

hit as they become subject to Durbin under Simmons?

Robert Fehlman

Chief Financial Officer

Yes. Our ballpark is about $1 million

to $1.5 million range is our estimate right now.

Stephen Scouten

Sandler O'Neill + Partners, L.P., Research

Division

That's an annual number?

Robert Fehlman

Chief Financial Officer

Yes.

Stephen Scouten

Sandler O'Neill + Partners, L.P., Research

Division

Great. Well, thanks, guys. Appreciate the time, and congrats

on getting across the finish line. I know that's never easy.

Operator

And your next question comes from the line of Garrett

Holland of Baird.

Garrett Holland

Baird

Thanks for taking the questions. The projected financial

returns look very good here. I was just curious if you expect any investment spending required in personnel or systems? Or is that

reflected in the net cost savings figure?

George Makris

Chief Executive Officer

That's reflected in the net cost savings. We believe

our next-generation banking initiative, which is fairly expensive on its face, is going to be a real enhancement, not only to Simmons,

but to the Landmark Bank associates as well. We will have almost all of that complete before we merge Landmark Bank into Simmons

Bank. So it'll just be a single conversion for Landmark associates and the Landmark customers. We don't think there is any additional

investment that’s going to be required from a technology standpoint associated with this transaction.

Garrett Holland

Baird

That's helpful. And Landrum's credit performance

looks good historically. I was just interested in your thoughts on how the due diligence process or credit risk appetite changes

with M&A as we advance in the cycle?

George Makris

Chief Executive Officer

Well, we have our own internal loan review team

that does the diligence on every acquisition. So over a period of time, they have a historical perspective of all the banks that

we've acquired. I have every bit of confidence in their ability to identify potential risk in the portfolio. And while Landrum's

credit history is excellent, you'll notice that their loan mark is a little higher than their current allowance, which I think

is consistent with what you've experienced in all of our acquisitions. And we call that the Fehlman Factor because we understand

very clearly that we, in a short period of time, can't understand all the credits inside and out. So we want to make sure that

we have appropriately provided for any unknown risk in that portfolio. But I'll say this, our loan review team came back very pleased,

not only with the quality of the credit in the portfolio, but the process that Landrum uses, which is very similar from a conservative

standpoint to what Simmons has. So we don't expect there to be much of a change for the Landrum loan officers as we transition

into the Simmons credit policy.

Garrett Holland

Baird

That’s great.

Thanks, George. Congrats on the deal.

George Makris

Chief Executive Officer

Thanks very much, Garrett.

Operator

And your next question comes from the line of Gary Tenner

of Davidson.

Gary Tenner

D.A. Davidson & Co., Research Division

Good morning. I just wanted -- hey, I was curious

about the cost save outlook, 35%, but it doesn't like there's any plans to close branches on this and not any real geographical

overlap or not meaningful, at least. So I'm just wondering if you could give - sort of go into where you see the cost saves coming

from?

Robert Fehlman

Chief Financial Officer

Say -- well, first off, as George said, we've got

the NGB program coming out. So some of our projections are on the technology side and automation side. So we do believe in that

area. You also look at when you're putting 2 big companies together, there's just going to be cost savings overall, but we think

this is a good opportunity for us. And you can see our track record of our cost saves. We think that range is a pretty good range

that we can achieve.

Gary Tenner

D.A. Davidson & Co., Research Division

Okay. And then regarding the Series D, I don't

know if you mentioned this at the outset, but do you know what the coupon would be on that?

Unknown Individual

The Series D preferred.

Robert Fehlman

Chief Financial Officer

It's only $700,000, I think I couldn't [inaudible].

George Makris

Chief Executive Officer

I didn't hear the question.

Robert Fehlman

Chief Financial Officer

The coupon on the preferred.

George Makris

Chief Executive Officer

Oh, it’s 6 75, I think.

Gary Tenner

D.A. Davidson & Co., Research Division

Okay.

Robert Fehlman

Chief Financial Officer

About $767,000.

Gary Tenner

D.A. Davidson & Co., Research Division

Yes, small number. Okay. Thank you.

Operator

And we have a follow-up question from Brett Rabatin of

Piper Jaffray.

George Makris

Chief Executive Officer

Hey, Brett.

Brett Rabatin

Piper Jaffray Companies, Research Division

Hey, my follow-up has been answered. Thank you.

George Makris

Chief Executive Officer

Okay.

Robert Fehlman

Chief Financial Officer

Thanks, Brett.

George Makris

Chief Executive Officer

Good deal.

Operator

[Operator Instructions] And we have a

follow-up question from Stephen Scouten of Sandler O'Neill.

Stephen Scouten

Sandler O'Neill + Partners, L.P., Research Division

Hey, guys. Sorry. I just wanted to clarify that

$1.5 million related to the Durbin, is that all already wrapped into the 6% and 8% accretion as well?

Robert Fehlman

Chief Financial Officer

Yes, it is.

Stephen Scouten

Sandler O'Neill + Partners, L.P., Research Division

Perfect. Thank you. Sorry about that.

George Makris

Chief Executive Officer

No problem.

Operator

And there are no further questions at this time. I will

turn the call back to Mr. George Makris.

George Makris

Chief Executive Officer

Okay. Thank you very much for joining us this morning.

I can't tell you how excited we are about this merger opportunity. We're all hitting the road. I hope that we get to meet most

of the Landrum associates over the next couple of days. Welcome them to the family as well. Now have a great day, and we'll talk

to you later.

Operator

Thank you so much, everyone, for your participation.

And this concludes today's conference call. You all have a lovely day, and you may now disconnect.

Forward Looking Statements

Statements in this communication may not be

based on historical facts and are “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements may be identified by reference to a future period(s) or by the use of forward-looking

terminology, such as “anticipate,” “estimate,” “expect,” “foresee,” “may,”

“might,” “will,” “would,” “could” or “intend,” future or conditional

verb tenses, and variations or negatives of such terms. These forward-looking statements include, without limitation, statements

relating to the expected impact of the proposed transaction between Simmons First National Corporation (“Company”)

and The Landrum Company (“Landrum”) (the “Proposed Transaction”) on the combined entities operations, financial

condition, and financial results, and the expectations regarding the ability of the Company and Landrum to successfully integrate

the combined businesses and the amount of cost savings and other benefits that are expected to be realized as a result of the Proposed

Transaction. Readers are cautioned not to place undue reliance on the forward-looking statements contained in this communication

in that actual results could differ materially from those indicated in such forward-looking statements, due to a variety of factors.

These factors, include, but are not limited to, the ability to obtain regulatory approvals and meet other closing conditions to

the Proposed Transaction, including approval by Landrum’s shareholders on the expected terms and schedule, delay in closing

the Proposed Transaction, difficulties and delays in integrating the Landrum business or fully realizing cost savings and other

benefits of the Proposed Transaction, business disruption following the Proposed Transaction, changes in interest rates and capital

markets, inflation, customer acceptance of the Company’s products and services, and other risk factors. Other relevant risk

factors may be detailed from time to time in the Company’s press releases and filings with the Securities and Exchange Commission

(the “SEC”). All forward-looking statements, expressed or implied, included in this communication are expressly qualified

in their entirety by the cautionary statements contained or referred to herein. Any forward-looking statement speaks only as of

the date of this communication, and the Company and Landrum undertake no obligation, and specifically decline any obligation, to

revise or update these forward-looking statements, whether as a result of new information, future developments or otherwise.

Additional Information and Where to Find

It

This communication does not constitute an offer

to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the Proposed

Transaction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act

of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

In connection with the Proposed Transaction,

the Company will file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include

a proxy statement of Landrum and a prospectus of the Company (the “Proxy Statement/Prospectus”), and the Company may

file with the SEC other relevant documents concerning the Proposed Transaction. The definitive Proxy Statement/Prospectus will

be mailed to shareholders of Landrum.

Shareholders are urged to read the Registration Statement

and the Proxy Statement/Prospectus regarding the Proposed Transaction carefully and in their entirety when it becomes available

and any other relevant documents filed with the SEC by the Company, as well as any amendments or supplements to those documents,

because they will contain important information about the Proposed Transaction.

Free copies of the Proxy Statement/Prospectus,

as well as other filings containing information about the Company, may be obtained at the SEC’s Internet site (http://www.sec.gov),

when they are filed by the Company. You will also be able to obtain these documents, when they are filed, free of charge, from

the Company at www.simmonsbank.com under the heading “Investor Relations.” Copies of the Proxy Statement/Prospectus

can also be obtained, when it becomes available, free of charge, by directing a request to Simmons First National Corporation,

501 Main Street, Pine Bluff, Arkansas 71601, Attention: Stephen C. Massanelli, Investor Relations Officer, Email: steve.massanelli@simmonsbank.com

or ir@simmonsbank.com, Telephone: (870) 541-1000 or to The Landrum Company, 801 East Broadway, Columbia, Missouri, 65201, Attention:

Kevin Gibbens, CEO, Telephone: (800) 618-5503.

Participants in the Solicitation

The Company, Landrum and certain of

its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from the shareholders

of Landrum in connection with the Proposed Transaction. Information about the Company’s directors and executive officers

is available in its proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC on March 12, 2019.

Information regarding all of the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation

and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement/Prospectus

regarding the Proposed Transaction and other relevant materials to be filed with the SEC when they become available. Free copies

of these documents may be obtained as described in the preceding paragraph.

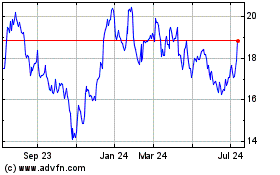

Simmons First National (NASDAQ:SFNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

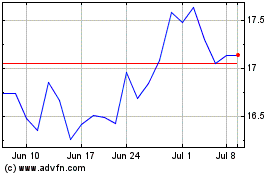

Simmons First National (NASDAQ:SFNC)

Historical Stock Chart

From Apr 2023 to Apr 2024