- 2018 Revenue rises 129% from the prior

year to $30.0 million

- 2018 Net income rises 455% from the

prior year to $12.0 million

- 2018 Basic and diluted earnings per

share (EPS) rises 340% from the prior year to $0.44 per share

Siebert Financial Corp. (NASDAQ:SIEB) (“Siebert”), a provider of

financial services, filed its 10K and reported results for its

fiscal year ending December 31, 2018.

“I am extremely proud of our financial results for 2018 and how

far we have come as a company. This year we made several

acquisitions to expand our product offerings, reach new clients,

and bolster our strategic position; KCA Technologies, LLC to

develop our Robo-Advisor, Park Wilshire Companies Inc. to offer

insurance products; and in January 2019, we acquired approximately

15% of StockCross Financial Services, Inc. (“StockCross”) in light

of the successful integration of their retail assets we purchased

at the end of 2017,” said Gloria E. Gebbia, controlling shareholder

and board member of Siebert. “While the bulk of our revenue

currently comes from our retail brokerage business through Muriel

Siebert & Co. Inc., these new acquisitions have already made a

positive impact on our financial results and strategically position

us for sustained success and continued growth in the future. We

look forward to what the future holds for our incredible

company.”

Siebert Turnaround Story

Andrew H. Reich, Siebert CFO, said, “Our 2018 results are a

remarkable milestone in the story of Siebert’s turnaround. Not only

did we have an outstanding year, but looking at the financial

results over the recent history of the company, the drastic shift

from sustained losses to profitability over the past two years is

quite remarkable.

"Our financial performance is a result of our strong management

team and outstanding employees. During 2018, the retail assets

acquired from StockCross contributed significantly to our revenue

and net income and Park Wilshire Companies Inc. added close to $1

million in revenue in less than a year of operation. We also

believe that StockCross will continue to be a valuable partner for

the long term.

“We are also very excited about how the market has responded to

our results. Over the past two years, our stock price has increased

almost 400%, rising from approximately $3.00 in the beginning of

2017 to approximately $14.50 at the end of 2018. In addition, in

June 2018, we were selected to join the Russell 3000 Index, further

solidifying our visibility in the capital markets.”

Selected Financial Highlights

The following table summarizes the year end results for 2018 and

2017 (in thousands, except per share amounts):

Year Ended December 31, 2018

2017 Change Revenue $ 30,036 $ 13,110 129 %

Income before income taxes $ 7,360 $ 2,310 219 % Net income $

11,962 $ 2,157 455 % Basic and diluted EPS $ 0.44 $ 0.10 340 %

Assets $ 18,177 $ 6,025 202 % Stockholders’ equity $ 17,174 $ 5,212

230 %

SIEBERT FINANCIAL CORP. &

SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME

Year Ended December 31, 2018

2017 Revenue: Margin interest, marketing and

distribution fees $ 10,928,000 $ 6,600,000 Commissions and fees

9,504,000 4,801,000 Principal transactions 9,020,000 1,639,000

Advisory fees 478,000 51,000 Interest 106,000

19,000 Total revenue 30,036,000 13,110,000 Expenses:

Employee compensation and benefits 13,817,000 5,075,000 Clearing

fees, including execution costs 2,852,000 1,031,000 Professional

fees 1,963,000 2,135,000 Other general and administrative 1,859,000

1,510,000 Technology and communications 1,008,000 410,000 Rent and

occupancy 988,000 437,000 Depreciation and amortization 144,000

115,000 Advertising and promotion 45,000

87,000 Total expenses 22,676,000 10,800,000 Income

before (benefit) for (from) income taxes 7,360,000 2,310,000

(Benefit) provision (from) for income taxes (4,602,000 )

153,000 Net income $ 11,962,000 $

2,157,000 Net income per share of common stock Basic and

diluted $ 0.44 $ 0.10 Weighted average shares

outstanding Basic and diluted 27,157,188

22,507,798

SIEBERT FINANCIAL

CORP. & SUBSIDIARIES CONSOLIDATED STATEMENTS OF

FINANCIAL CONDITION December 31, 2018

December 31, 2017 ASSETS Cash and cash equivalents $

7,229,000 $ 3,765,000 Receivables from clearing and other brokers

2,030,000 1,396,000 Receivable from related party 1,000,000 283,000

Receivable from lessors 171,000 — Other receivables 96,000 —

Prepaid expenses and other assets 470,000 234,000 Furniture,

equipment and leasehold improvements, net 468,000 263,000 Software,

net 1,137,000 84,000 Deferred tax assets 5,576,000

— $ 18,177,000 $ 6,025,000

LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities

Accounts payable and accrued liabilities $ 699,000 $ 561,000 Lease

incentive obligation 171,000 — Due to clearing brokers and related

parties 133,000 127,000 Income taxes payable —

125,000 1,003,000 813,000 Commitments and

Contingencies Stockholders’ equity Common stock, $.01 par

value; 49,000,000 shares authorized, 27,157,188shares issued and

outstanding as of December 31, 2018 and December 31, 2017 271,000

271,000 Additional paid-in capital 7,641,000 7,641,000 Retained

earnings/(Accumulated deficit) 9,262,000

(2,700,000 ) 17,174,000 5,212,000

$ 18,177,000 $ 6,025,000

Notice to Investors

This communication is provided for informational purposes only

and is neither an offer to sell nor a solicitation of an offer to

buy any securities in the United States or elsewhere.

About Siebert Financial Corp.

Siebert Financial Corp. is a holding company that conducts its

retail discount brokerage business through its wholly-owned

subsidiary, Muriel Siebert & Co., Inc., which became a member

of the NYSE in 1967 when Ms. Siebert became the first woman to own

a seat on the Exchange and the first to head one of its member

firms. The company conducts its investment advisory business

through its wholly-owned subsidiary, Siebert AdvisorNXT, Inc., a

registered investment advisor, its insurance business through its

wholly-owned subsidiary, Park Wilshire Companies Inc., a licensed

insurance agency, and KCA Technologies, LLC, its wholly-owned

subsidiary and developer of robo-advisory technology. Siebert is

headquartered in New York City with 12 retail branches throughout

the continental United States. Siebert is under common control with

StockCross. More information is available at

www.siebertnet.com.

Cautionary Note Regarding Forward-Looking Statements

Statements in this press release that are not statements of

historical or current fact constitute “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such “forward-looking statements” involve risks and

uncertainties and known and unknown factors that could cause the

actual results of Siebert Financial Corp. (the “Company”) to be

materially different from historical results or from any future

results expressed or implied by such “forward-looking statements”,

including without limitation: changes in general economic and

market conditions; changes and prospects for change in interest

rates; fluctuations in volume and price of securities; changes in

demand for brokerage services; competition within and without the

brokerage business, including the offer of broader services;

competition from electronic discount brokerage firms offering

greater discounts on commissions than the Company; the prevalence

of a flat fee environment; limited trading opportunities; the

method of placing trades by the Company’s customers; computer and

telephone system failures; the level of spending by the Company on

advertising and promotion; trading errors and the possibility of

losses from customer non-payment amounts due; other increases in

expenses and changes in net capital or other regulatory

requirements. As a result of these and other factors, the Company

may experience material fluctuations in its operating results on a

quarterly or annual basis, which could materially and adversely

affect its business, financial condition, operating results, and

stock price, as well as other risks detailed in the Company’s

filings with the Securities and Exchange Commission (“SEC”).

Accordingly, investors are cautioned not to place undue reliance on

any such “forward-looking statements.” The Company undertakes no

obligation to update the information contained herein or to

publicly announce the result of any revisions to such

“forward-looking statements” to reflect future events or

developments. An investment in the Company involves various risks,

including those mentioned above and those which are detailed from

time to time in the Company’s SEC filings, copies of which may be

obtained from the Company or through the SEC’s website.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190329005398/en/

Siebert Financial Corp.120 Wall StreetNew York, NY 10005

Investor Relations:Yesenia Berdugo, 212-644-2435Office of the

Administratorir@siebertnet.com

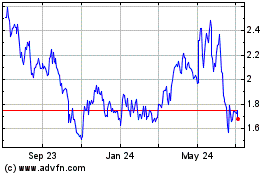

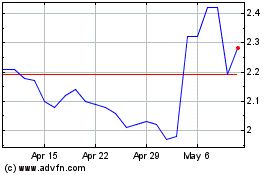

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Apr 2023 to Apr 2024