UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant

☒

|

|

|

|

|

Filed by a Party other than the Registrant

☐

|

|

|

|

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

ShotSpotter, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

Dear Fellow Shareholders:

I send this year's annual shareholder letter with a deep sense of gratitude. All of us at ShotSpotter are proud to have developed and established a critical technology solution that is transforming how law enforcement agencies address gun crime in our most vulnerable communities. ShotSpotter’s technology prevents, reduces and de-normalizes gun crime, while simultaneously improving positive law enforcement interventions and community engagement.

This is the heart of our corporate commitment to “doing well by doing good” and we are pleased that as we contribute to positive social impact, we have also delivered positive operating results. Since our public company debut in June 2017 we have made steady progress on our strategic growth objectives. Not only are we delivering strong revenue growth, but we are doing it with a high degree of visibility and a high retention rate.

Let me take a minute to review these dimensions of our financial performance:

Revenue Growth: Our 2018 revenues grew 46% to $34.8 million. We ended the year with approximately 670 miles under contract covering almost 100 cities. The majority of revenues in 2018 were associated with our Flex service offering. Beginning in 2019 we anticipate revenues will be slightly more diversified, with increased contribution from our new Missions offering, more deployments of SecureCampus, and new international customers. Our goal is to drive to $100M in revenue in the next few years and we are investing smartly to be able to reach that goal.

Visibility: Almost 100% of our revenues are delivered on a Software as a Service or SaaS-based platform. Most of our subscriptions are annual contracts, with approximately 40% of our revenue covered by multi-year agreements. We have historically begun each year with approximately 50% of the year’s revenue captured in short-term deferred revenue. We also enjoy a high degree of visibility from contracted projects slated for deployment in the next twelve months.

Retention: In 2018 our overall revenue retention rate was a very strong 139% (even excluding our large Chicago expansion the revenue retention rate was 118%). Revenue retention reflects total customer revenues in a given year divided by customer revenues in the prior year. ShotSpotter’s high revenue retention rate is the result of a company-wide obsession with developing strong customer partnerships and nurturing deep customer satisfaction – and the primary source of this positive customer experience has been the extraordinary team in our Incident Review Center.

Employees Hard at Work in our Incident Review Center

These high-quality professionals work 24x7x365 to resolve level one customer service requests, as well as perform the critical second factor human review and classification of published gunfire events. The IRC team is backed by an experienced customer support organization, a forensic analysis team led by a former District Attorney, and a world-class customer onboarding/success team. They design and implement best practices to help ensure our clients achieve their objectives and demonstrate how communities can benefit from ShotSpotter technology and services.

The success of all these efforts is evident in our 2018 Net Promoter Score of +50%. Net Promoter Score is a measure of customer satisfaction, loyalty and positive word-of-mouth. A higher NPS reflects the higher likelihood a current customer will renew and/or expand coverage, as well as an inclination to provide strong references to prospective customers. As a company we design our processes – including customer on-boarding activities and annual in-person account reviews – to continually improve our Net Promoter Score.

Profitability: Our core Flex offering provides strong unit economics. Each new mile we deploy costs less than the annual subscription fee associated with that mile, on a direct variable cash basis, meaning that we are profitable on a deployment in the first year of operation. Those deployment costs include the cost of the sensors (we install approximately 20+/per mile), associated packaging, shipping, and installation costs. Subsequent years are highly profitable, as direct cash variable costs generally consist only of sensor machine-to-machine network cost and field maintenance. These costs, combined, are typically less than 15% per year per mile. This provides a very strong unit cash and gross profit contribution to support the business and fund our operations.

As a unique and specialized solution with little direct competition, ShotSpotter is the defacto leading provider of outdoor gunshot detection and alerting services. Our pricing discipline, coupled with highly efficient customer discovery, acquisition, and service creates significant operating leverage. In 2018, for example, the company only spent $0.30 on sales and marketing to generate a $1.00 of new annualized contract value. This is actually less than

the prior year, even as we grow the bus

iness. In contrast, many SaaS-based businesses spend well north of $1.00 to capture similar annualized subscription revenue.

These attractive economics allowed us to meet our goal of profitability by the end of 2018, as we reported net income of over $300,000 or $0.03 per share for the fourth quarter. Needless to say, we are proud to have done so on less than $10 million in revenue for the quarter; most SaaS businesses require significantly higher revenues to achieve profitability.

Another financial measure that highlights the strength of our business is the ‘Rule of 40.’ This widely followed benchmark for SaaS-based businesses combines two important metrics for a subscription company – Revenue growth rate plus EBITDA margin. For 2018, ShotSpotter’s Rule of 40 was 49%. To put this in context, in a 2018 summary prepared by KeyBank that analyzed 50 public SaaS companies, the average Rule of 40 score was only 33%.

Expansion Opportunities

While ShotSpotter is still in the early stages of penetrating the gunshot detection vertical within the Public Safety market, we already harbor broader ambitions. We continue to believe there are viable and attractive opportunities for our similar security solutions focused on college campuses and other high-traffic public spaces, including at-risk thoroughfares and stretches of freeway. While the spatial and geographic dynamics are slightly different, the underlying detection and response solution leverages the same technology platform of sensors, networks, cloud-based software, and IRC services. We already have more than 10 deployments and we expect to continue expanding in this market segment going forward.

Another area where we see growth potential is the use of artificial intelligence and machine learning to enhance public safety. After working with Chicago to integrate ShotSpotter gunshot detection into an AI-based analytics tool called HunchLab, it became clear to us that this kind of data-driven “predictive policing” might be able to transform how law enforcement agencies maximize their limited financial and personnel resources. It also became apparent that our fast and accurate incident data feed would be a distinct competitive advantage for a high-performance real-time analytics tool. After assessing other predictive solutions we recognized that HunchLab was proving itself to be the industry leader in this emerging market, and in the paraphrased words of Victor Kiam, “We liked the company so much we decided to buy it.”

Since acquiring HunchLab, we have rebranded the technology as ShotSpotter Missions and are investing in tightly integrating it with ShotSpotter gunfire data. We are now building a customer pipeline and are focused first on existing ShotSpotter Flex customers. We expect to generate modest revenues on Missions in the second half of 2019. This adjacent market extension is an important step toward our vision of becoming the technology and process platform that law enforcement agencies can lever to address their violent crime issues, before it happens (predictive), as it happens (real time gunfire alerts) and after it happens (post incident investigation/case management).

In addition to these expansions and extensions of our technology platform, we are also committed to establishing ShotSpotter solutions in international markets. We have enjoyed a very well publicized success in Cape Town, South Africa and seek to leverage that success by firmly focusing on other cities around the world. In mid-2018, we hired a VP of International Sales focused on Latin America and expect to see some modest revenue contribution from this market later in 2019. Early feedback we have received has been very positive from prospects in Colombia, Mexico, Brazil, and Argentina. We estimate the average revenue per captured city can range from $500,000-$1 million per year and offer similar unit contribution economics in each following year.

Purpose

As I have said on many occasions, ShotSpotter is a company aligned towards a social purpose that we believe augments our core commercial goals. Simply put that purpose is “Earn the trust of law enforcement to help them provide equal protection for all and strengthen the police-community relationship, ultimately reducing gun violence.”

This purpose resonates with all of

the various actors in our ecosystem - employees, management, customers, partners and investors. More alignment means less friction, providing more collective energy focused on driving impact which then leads to better company performance.

City of Chicago

Above you will see a picture of Eddie Johnson, the Superintendent of Police for the City of Chicago, our largest customer. Superintendent Johnson made a brief appearance at our executive leadership offsite in Chicago last summer to say a few words about what ShotSpotter means to him, his department, and his city. As he was leaving, he saw a draft of our Purpose statement on the wall and was so taken by it, he asked if he could take a picture. He told us that earning the trust of the police is very difficult, but he and his department trust ShotSpotter. We believe that trust is a critical contributor to all of our success to date and it will be at the heart of our future growth with new and existing customers.

Employee Engagement and Inclusion

Employee engagement is a priority for the executive leadership team as it not only reduces the cost of employee attrition and turnover, but also fuels our customer-facing initiatives involving Net Promoter Score (NPS). We believe our customers simply have a better impression of ShotSpotter if our employees have a positive attitude and are willing to go the extra mile on delivering a quality experience. It has been shown that companies with highly engaged workers grew revenues two and a half times as much as those with low engagement levels. (Source: Bain & Company, Chemistry of Engagement 2012 and Engaging and Enabling Employees for Company Success, WorkSpan, 2009). We also build camaraderie by conducting service projects for our community.

ShotSpotter employees making bicycles during our last “all-hands” meeting to donate to the Oakland Boys and Girls Club.

The Company instituted its first annual employee engagement survey and the scores qualified ShotSpotter as a Great Place to Work®. Details of our results can be found on our website.

Technology Innovation

We are very proud of the technology innovation we have brought to the marketplace with our acoustic gunshot detection solution. We have continually improved and perfected our solution with over two decades of experience and over 100 customer deployments. Our unique technical prowess has resulted in 33 issued patents and other key intellectual property assets which affords us a strong IP position. In addition, our huge date repository of hundreds of thousands of acoustic gunfire signatures give us a unique foundation to exploit recent developments in machine learning and cognitive platforms and further improve our machine classification capabilities and detection accuracy.

We also continue to refine the sensor and related sensor firmware at the heart of our acoustic detection technology, including firmware technology that suppresses ambient noise and amplifies impulsive sounds to enable a higher

detection rates with the same infrastructure. This pro

prietary combination of cutting-edge hardware and software allow SST to do something utterly unique and – for public safety professionals – utterly valuable: detect and discern incidents of gunfire within 30 to 60 seconds with the location accuracy of 25 m

eters or less and with false positive or false negatives less than 10% of the time. What’s more, ShotSpotter systems have been scaled from anywhere from 1 to over 100 miles in all manner of difficult and harsh acoustic environments characterized by conti

nuous ambient noise, building density, hills, wind tunnels and inclement weather.

We are also actively looking to the long-term opportunity for our technology through the creation of ShotSpotter Labs. This internal “think tank” at the company has been tasked to take on tough new acoustic (and soon to be sonar) detection problems, initially by addressing the unique environmental and ecological challenges of large, wild game preserves of South Africa where we are working with local authorities to help mitigate rhino poaching in the Kruger National Forest. Our Labs team is also developing solutions to address blast fishing in Southeast Asia. Besides keeping our engineering team challenged and engaged, ShotSpotter Labs has already produced some key learnings and innovations vis a vis solar/battery/power management that can be used in other commercial applications, such as freeway deployments. Longer term, we believe ShotSpotter Labs provides us with a potential additional revenue stream.

Connecting with Investors

We have had the pleasure of meeting many of you over the last year as Alan Stewart, our CFO, and I conducted over 200 calls and meetings with both current and prospective investors. We enjoy sharing the ShotSpotter story, discussing the strength of our business model and explaining our vision for the future as well as the positive impact that we can make in the communities where our solutions are deployed. We hope to meet many more of you in the coming year. We find these interactions to be very valuable. In fact, the inspiration for this expanded shareholder letter came from a prospective investor that suggested (gently) that I could do better than the one-page inaugural investor letter sent out last year.

As many of you know, we ended 2018 with a strong accounts receivable position and approximately $10 million in cash on our balance sheet. Subsequently, in March of this year, we conducted a small follow-on offering, which shored up our balance sheet with approximately $11 million in additional cash, permitting us to not only continue our organic growth but also allowing us additional flexibility to pursue selected acquisition targets that would further expand our platform of software and services.

Lastly, I wanted to share a short note that we received from one of the original investors in our IPO. As background, following our IPO we sent a brief letter to every investor we met with – whether they invested or not - to thank them for taking an interest in a small, relatively unknown, company that had a big vision for the future. Apparently, this made such an impact on one of our investors that he mentions it often during our periodic update meetings. Our investor indicated that the outreach we made was so unique that he has the letter pinned on the wall by his desk to remind him of how ShotSpotter values its investors.

Summary

We are very excited about our future prospects and we believe we are well positioned to exploit the growth opportunities in front of us. We view our growth journey as a marathon and not a sprint and we’re are in the very early part of the race. Our obsession around the customer experience and relationship helps us build an enduring franchise that thrives due to our unique role in addressing gun violence. Our Purpose statement - printed on the back of our business cards and painted on our mural in the lobby of our office - focuses in part on building trusted relationships with our law enforcement customers. But this applies equally to employees, partners and investors. Thank you again for your support and sharing this journey with us. I am always open to constructive dialogue so please do not hesitate to contact me directly with any feedback.

Looking forward to continuing to work together over the course of 2019 and beyond.

Sincerely,

Ralph A. Clark

President & CEO

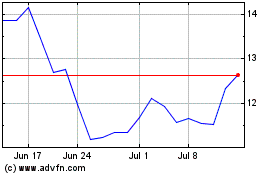

SoundThinking (NASDAQ:SSTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

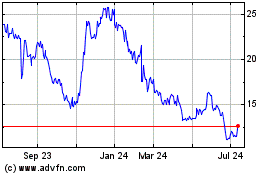

SoundThinking (NASDAQ:SSTI)

Historical Stock Chart

From Apr 2023 to Apr 2024