Shockwave Medical, Inc. (Nasdaq: SWAV), a pioneer in the

development and commercialization of Intravascular Lithotripsy

(IVL) to treat complex calcified cardiovascular disease, today

reported financial results for the three months ended March 31,

2020.

Recent Highlights

- Recognized revenue of $15.2 million for the first quarter of

2020, representing an increase of 109% over the first quarter of

2019

- Completed enrollment in CAD III study of IVL for coronary use

in the U.S.

- Completed enrollment in CAD IV pivotal study of IVL for

coronary use in Japan

- Extended geographic reach and now commercial in 46

countries

- Expanded US field team from 61 to 78 members

“We are very pleased with our first

quarter results, particularly given the COVID-19 pandemic that is

so profoundly impacting the world. Our results reflect the

continued growth and penetration of our IVL products and the hard

work and dedication of our teams across the globe as we work to

continue to help our customers and patients in any way we can,”

said Doug Godshall, President and Chief Executive Officer of

Shockwave Medical. “The foundation of Shockwave remains strong and

I want to thank each employee and business partner for the

resiliency and dedication they have shown during this unprecedented

time. Our hearts go out to those who have lost their lives to the

COVID-19 pandemic and I want to express our gratitude to the

healthcare workers – many of whom are friends and customers of

Shockwave - who are on the front line fighting this pandemic.”

First Quarter 2020 Financial Results

Revenue for the first quarter of 2020 was $15.2 million, an

increase of $7.9 million, or 109%, compared to the first quarter of

2019. The growth was primarily driven by continued sales force

expansion in the U.S. and increased penetration in both U.S. and

international markets.

Gross profit for the first quarter of 2020 was $9.5 million

compared to $4.2 million for the first quarter of 2019. The gross

margin percentage for the first quarter of 2020 increased to 63%

compared to 58% in the first quarter of 2019, driven primarily by

continued improvements in production processes to drive

efficiencies and greater absorption of fixed costs from increased

production.

Operating expenses were $28.5 million for the first quarter of

2020 compared to $16.4 million in the corresponding prior year

period, an increase of 74%, primarily driven by sales force

expansion and clinical costs from the CAD III and CAD IV

studies.

Net loss was $18.8 million in the first quarter of 2020, as

compared to $12.8 million in the corresponding period of the prior

year. Net loss per share was $0.59 in the first quarter of

2020.

Cash, cash equivalents and short-term investments totaled $170.4

million as of March 31, 2020.

2020 Financial GuidanceShockwave Medical

withdrew its previously announced annual guidance for 2020 on April

6, 2020. The COVID-19 pandemic reduced IVL catheter sales toward

the end of the first quarter of 2020 and is continuing to adversely

impact sales in the second quarter of 2020. The pandemic could also

significantly impact the financial health of our customers which

could pressure hospital spending and impact pricing. As a result of

these factors as well as the uncertain scope and duration of the

COVID-19 pandemic, and uncertain timing of global recovery, we

cannot, at this time, reliably estimate the future impact on IVL

catheter sales, and in turn, our operations and financial

results.

Conference CallShockwave Medical will host a

teleconference at 1:30 p.m. Pacific Time / 4:30 p.m. Eastern Time

on Tuesday, May 12, 2020 to discuss its first quarter. The

teleconference will be webcasted live and available in listen-only

mode on the company’s investor relations website at

https://ir.shockwavemedical.com/. An archived webcast of the event

will be available following the teleconference.

About Shockwave Medical, Inc. Shockwave Medical

is focused on developing and commercializing products intended to

transform the way calcified cardiovascular disease is treated. The

company aims to establish a new standard of care for medical device

treatment of atherosclerotic cardiovascular disease through their

differentiated and proprietary local delivery of sonic pressure

waves for the treatment of calcified plaque, which they refer to as

Intravascular Lithotripsy (IVL). IVL is a minimally invasive,

easy-to-use and safe way to significantly improve patient outcomes.

To view an animation of the IVL procedure and for more information,

visit www.shockwavemedical.com.

Forward-Looking Statements This press release

contains statements relating to Shockwave’s expectations,

projections, beliefs, and prospects (including statements regarding

Shockwave’s product development outlook), which are

“forward-looking statements” within the meaning of the federal

securities laws and by their nature are uncertain. Words such as

“believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “plans,” and similar expressions are intended

to identify forward-looking statements. Such forward-looking

statements are not guarantees of future performance, and you are

cautioned not to place undue reliance on these forward-looking

statements.

Forward-looking statements include, but are not limited to

statements about: the impact of the COVID-19 pandemic on our

operations, financial results, and liquidity and capital resources,

including on our sales, expenses, supply chain, manufacturing,

research and development activities, clinical trials and employees;

our ability to design, develop, manufacture and market innovative

products to treat patients with challenging medical conditions,

particularly in peripheral artery disease, coronary artery disease

and aortic stenosis; our expected future growth, including growth

in international sales; the size and growth potential of the

markets for our products, and our ability to serve those markets;

the rate and degree of market acceptance of our products; coverage

and reimbursement for procedures performed using our products; the

performance of third parties in connection with the development of

our products, including third-party suppliers; regulatory

developments in the United States and foreign countries; our

ability to obtain and maintain regulatory approval or clearance of

our products on expected timelines; our plans to research, develop

and commercialize our products and any other approved or cleared

product; our ability to scale our organizational culture of

cooperative product development and commercial execution; the

development, regulatory approval, efficacy and commercialization of

competing products; the loss of key scientific or management

personnel; our expectations regarding the period during which we

qualify as an emerging growth company under the JOBS Act; our

ability to develop and maintain our corporate infrastructure,

including our internal controls; our financial performance and

capital requirements; and our expectations regarding our ability to

obtain and maintain intellectual property protection for our

products, as well as our ability to operate our business without

infringing the intellectual property rights of others.

These forward-looking statements are only predictions based on

our current expectations and projections about future events. There

are important factors that could cause our actual results, level of

activity, performance or achievements to differ materially from the

results, level of activity, performance or achievements expressed

or implied by the forward-looking statements. These factors, as

well as others, are discussed in greater detail in our filings with

the Securities and Exchange Commission (SEC), including in Part I,

Item IA - Risk Factors in our most recent Annual Report on Form

10-K filed with the SEC, and in our other periodic and other

reports filed with the SEC. There may be additional risks of which

we are not presently aware or that we currently believe are

immaterial which could have an adverse impact on our business. Any

forward-looking statements are based on our current expectations,

estimates and assumptions regarding future events and are

applicable only as of the dates of such statements. We make no

commitment to revise or update any forward-looking statements in

order to reflect events or circumstances that may change.

Media Contact: Scott Shadiow

+1.317.432.9210sshadiow@shockwavemedical.com

Investor Contact:Debbie Kaster, Gilmartin

Groupinvestors@shockwavemedical.com

|

SHOCKWAVE MEDICAL, INC. |

|

Balance Sheet Data |

|

(in thousands) |

| |

|

March 31, 2020 |

|

December 31, 2019 |

| |

|

|

|

|

| ASSETS |

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

123,111 |

|

|

$ |

139,045 |

|

|

Short-term investments |

|

|

47,278 |

|

|

|

56,304 |

|

|

Accounts receivable, net |

|

|

7,811 |

|

|

|

7,377 |

|

|

Inventory |

|

|

15,921 |

|

|

|

12,074 |

|

|

Prepaid expenses and other current assets |

|

|

3,485 |

|

|

|

1,897 |

|

|

Total current assets |

|

|

197,606 |

|

|

|

216,697 |

|

| Operating lease right-of-use

assets |

|

|

8,495 |

|

|

|

8,825 |

|

| Property and equipment, net |

|

|

13,084 |

|

|

|

4,910 |

|

| Other assets |

|

|

1,553 |

|

|

|

1,506 |

|

| TOTAL ASSETS |

|

$ |

220,738 |

|

|

$ |

231,938 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

Accounts payable |

|

$ |

2,150 |

|

|

$ |

2,790 |

|

|

Term notes, current portion |

|

|

— |

|

|

|

6,667 |

|

|

Accrued liabilities |

|

|

15,826 |

|

|

|

13,777 |

|

|

Lease liability, current portion |

|

|

787 |

|

|

|

774 |

|

|

Total current liabilities |

|

|

18,763 |

|

|

|

24,008 |

|

| Lease liability, noncurrent |

|

|

8,077 |

|

|

|

8,125 |

|

| Term notes, noncurrent

portion |

|

|

16,126 |

|

|

|

7,152 |

|

| TOTAL LIABILITIES |

|

|

42,966 |

|

|

|

39,285 |

|

| STOCKHOLDERS’ EQUITY: |

|

|

|

|

| Preferred stock |

|

|

— |

|

|

|

— |

|

| Common stock |

|

|

32 |

|

|

|

31 |

|

| Additional paid-in capital |

|

|

374,386 |

|

|

|

370,561 |

|

| Accumulated other comprehensive

loss |

|

|

103 |

|

|

|

35 |

|

| Accumulated deficit |

|

|

(196,749 |

) |

|

|

(177,974 |

) |

| TOTAL STOCKHOLDERS’ EQUITY |

|

|

177,772 |

|

|

|

192,653 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

$ |

220,738 |

|

|

$ |

231,938 |

|

|

|

|

SHOCKWAVE MEDICAL, INC. |

|

Statement of Operations Data |

|

(Unaudited) |

|

(in thousands, except share and per share

data) |

| |

|

Three Months Ended March 31, |

|

|

|

|

2020 |

|

|

|

2019 |

|

| Revenue: |

|

|

|

|

|

Product revenue |

|

$ |

15,197 |

|

|

$ |

7,269 |

|

| Cost of revenue: |

|

|

|

|

|

Cost of product revenue |

|

|

5,651 |

|

|

|

3,072 |

|

|

Gross profit |

|

|

9,546 |

|

|

|

4,197 |

|

| Operating expenses: |

|

|

|

|

|

Research and development |

|

|

11,890 |

|

|

|

7,484 |

|

|

Sales and marketing |

|

|

10,411 |

|

|

|

5,871 |

|

|

General and administrative |

|

|

6,224 |

|

|

|

3,001 |

|

|

Total operating expenses |

|

|

28,525 |

|

|

|

16,356 |

|

| Loss from operations |

|

|

(18,979 |

) |

|

|

(12,159 |

) |

| Interest expense |

|

|

(277 |

) |

|

|

(245 |

) |

| Change in fair value of warrant

liability |

|

|

— |

|

|

|

(609 |

) |

| Other income, net |

|

|

504 |

|

|

|

221 |

|

| Net loss before taxes |

|

|

(18,752 |

) |

|

|

(12,792 |

) |

| Income tax provision |

|

|

23 |

|

|

|

7 |

|

|

Net loss |

|

$ |

(18,775 |

) |

|

$ |

(12,799 |

) |

| Net loss per share, basic and

diluted |

|

$ |

(0.59 |

) |

|

$ |

(1.37 |

) |

| Shares used in computing net loss

per share, basic and diluted |

|

|

31,644,041 |

|

|

|

9,364,755 |

|

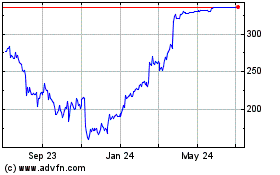

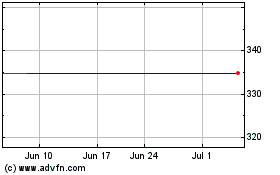

Shockwave Medical (NASDAQ:SWAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shockwave Medical (NASDAQ:SWAV)

Historical Stock Chart

From Apr 2023 to Apr 2024