Current Report Filing (8-k)

August 27 2020 - 7:01AM

Edgar (US Regulatory)

0000354963

false

0000354963

2020-08-26

2020-08-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934

Date of Report (Date of earliest event reported): August 26, 2020

Shenandoah Telecommunications Company

(Exact name of registrant as specified

in its charter)

|

Virginia

|

|

0-9881

|

|

54-1162807

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

500 Shentel Way

P.O.

Box 459

Edinburg, VA 22824

(Address of principal executive offices)(Zip Code)

(540) 984-4141

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock (No Par Value)

|

SHEN

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not

to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 13(a) of the Exchange Act. ☐

On August 26, 2020, Sprint Corporation

(“Sprint”), an indirect subsidiary of T-Mobile US, Inc., on behalf of and as the direct or indirect owner

of Sprint PCS, delivered to the Company notice exercising its option to purchase the assets of our

Wireless operations for 90% of the “Entire Business Value” (as defined under our affiliate agreement with Sprint PCS

and determined pursuant to the appraisal process set forth therein). The affiliate agreement contains various provisions governing

the process and timeline with respect to the appraisal of the assets of our Wireless operations and the consummation of the sale

thereof.

Prior to Sprint exercising the purchase option described above,

the Company and T-Mobile had been in discussions regarding the appraisal framework through which the purchase price for the

assets of our Wireless operations would be determined if Sprint were to exercise its option. The parties were not able to

agree on certain terms for an effective appraisal of such assets. On August 24, 2020, the Company delivered to T-Mobile a “Notice

of Dispute” relating to such appraisal framework and other contractual terms related to Sprint’s acquisition of the

assets of the Company’s Wireless operations. Issuance of the Notice of Dispute by the Company triggered the dispute

resolution process set out in the affiliate agreement and may lead the parties to extend or otherwise adjust the timeline for the

appraisal process and purchase of the assets of our Wireless operations under the terms of

the affiliate agreement. Should the parties fail to resolve this dispute within 60 days following delivery of the Notice of Dispute,

either party may pursue other remedies, including arbitration of any remaining disputed appraisal framework items, as permitted

by the affiliate agreement. The appraisal process could be subject to various other legal challenges that may also extend or affect

the timeline set forth in the affiliate agreement.

This Form

8-K contains forward-looking statements, including, but not limited to, statements regarding the appraisal process for determining

Entire Business Value and the related process and our discussions with T-Mobile with respect to the sale of our Wireless operations

to Sprint, that are subject to various risks and uncertainties. The Company's actual results could differ materially from those

anticipated in these forward-looking statements as a result of unforeseen factors. A discussion of factors that may cause actual

results to differ from management's projections, forecasts, estimates and expectations, is available in the Company’s filings

with the SEC. Those factors may include the business combination between T-Mobile and Sprint, changes in general economic conditions,

increases in costs, changes in regulation and other factors, including public health crises, such as pandemics and outbreaks of

a contagious disease like the novel coronavirus, either nationally or in the local markets in which we operate.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SHENANDOAH TELECOMMUNICATIONS COMPANY

|

|

|

|

|

|

Dated: August 27, 2020

|

/s/ Raymond B. Ostroski

|

|

|

|

Raymond B. Ostroski

|

|

|

Vice President – Legal and General Counsel

|

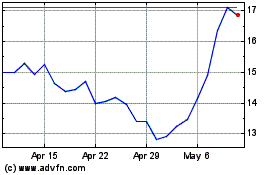

Shenandoah Telecommunica... (NASDAQ:SHEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shenandoah Telecommunica... (NASDAQ:SHEN)

Historical Stock Chart

From Apr 2023 to Apr 2024