Semtech Corporation (Nasdaq: SMTC), a leading supplier of high

performance analog and mixed-signal semiconductors and advanced

algorithms, today reported unaudited financial results for its

first quarter of fiscal year 2020, which ended April 28, 2019.

Highlights for the First Fiscal Quarter 2020

- Q1 FY2020 net sales of $131.4 million,

and GAAP EPS of $0.20 and non-GAAP EPS of $0.34

- Bookings grew 18% sequentially

resulting in a Book to Bill greater than 1

- Announced first LoRa Cloud™ Services

platform for geolocation

- Record quarterly number of design

wins

Results on a GAAP basis for the First Fiscal Quarter

2020

- GAAP Net sales were $131.4 million

- GAAP Gross margin was 61.9%

- GAAP SG&A expense was $38.4

million

- GAAP R&D expense was $27.1

million

- GAAP Operating margin was 9.8%

- GAAP Net income was $13.3 million or

$0.20 per diluted share

To facilitate a complete understanding of comparable financial

performance between periods, the Company also presents performance

results that exclude certain non-cash items and items that are not

considered reflective of the Company’s core results over time.

These non-GAAP financial measures exclude certain items and are

described below under “Non-GAAP Financial Measures.”

Results on a Non-GAAP basis for the First Fiscal Quarter

2020 (see the list of non-GAAP items and the reconciliation of

these to the most relevant GAAP items set forth in the tables

below):

- Non-GAAP Gross margin was 62.2%

- Non-GAAP SG&A expense was $28.7

million

- Non-GAAP R&D expense was $24.4

million

- Non-GAAP Operating margin was

21.8%

- Non-GAAP Net income was $23.0 million

or $0.34 per diluted share

Mohan Maheswaran, Semtech’s President and Chief Executive

Officer, stated, “We delivered first fiscal quarter 2020 results

that were in-line with our expectations. Our bookings grew nicely

over the prior quarter, as we saw early signs of improving customer

demand in several of our end-markets. Despite near-term

uncertainties, our main growth drivers have strong design win

momentum and should contribute to revenue growth in the second half

of fiscal year 2020.”

Second Fiscal Quarter 2020 Outlook

Both the GAAP and non-GAAP second fiscal quarter 2020 outlook

below take into account the anticipated impact to the Company,

based on its current estimates, of the recently announced export

restrictions pertaining to Huawei and certain of its affiliates,

imposed by the U.S. Department of Commerce. The Company is

continuing to review and assess the impact of the export

restrictions on its products and services, and is unable to predict

the full impact such restrictions may have on its results of

operations.

GAAP Second Fiscal Quarter 2020 Outlook

- Net sales are expected to be in the

range of $128.0 million to $142.0 million

- GAAP Gross margin is expected to be in

the range of 61.6% to 62.2%

- GAAP SG&A expense is expected to be

in the range of $37.4 million to $38.4 million

- GAAP R&D expense is expected to be

in the range of $26.7 million to $27.7 million

- GAAP Intangible amortization expense is

expected to be approximately $3.9 million

- GAAP Interest and other expense is

expected to be approximately $1.6 million

- GAAP Effective tax rate is expected to

be in the range of 16% to 18%

- GAAP Earnings per diluted share are

expected to be in the range of $0.11 to $0.20

- Fully-diluted share count is expected

to be approximately 68.0 million shares

- Share-based compensation is expected to

be approximately $11.3 million, categorized as follows: $0.4

million cost of sales, $8.4 million SG&A, and $2.5 million

R&D

- Capital expenditures are expected to be

approximately $7.0 million

- Depreciation expense is expected to be

approximately $5.9 million

Non-GAAP Second Fiscal Quarter 2020 Outlook (see the list

of non-GAAP items and the reconciliation of these to the most

comparable GAAP items set forth in the tables below)

- Non-GAAP Gross margin is expected to be

in the range of 61.9% to 62.5%

- Non-GAAP SG&A expense is expected

to be in the range of $28.0 million to $29.0 million

- Non-GAAP R&D expense is expected to

be in the range of $24.0 million to $25.0 million

- Non-GAAP Interest and other expense is

expected to be approximately $1.6 million

- Non-GAAP Effective tax rate is expected

to be in the range of 15% to 17%

- Non-GAAP Earnings per diluted share are

expected to be in the range of $0.32 to $0.40

Webcast and Conference Call

Semtech will be hosting a conference call today to discuss its

first fiscal quarter 2020 results at 2:00 p.m. Pacific time. An

audio webcast will be available on Semtech’s website at

www.semtech.com in the “Investor Relations” section under “Investor

News.” A replay of the call will be available through June 29, 2019

at the same website or by calling (855) 859-2056 and entering

conference ID 7237419.

Non-GAAP Financial Measures

To supplement the Company's consolidated financial statements

prepared in accordance with GAAP, this release includes a

presentation of select non-GAAP metrics. The Company's measure of

free cash flow is calculated as cash flow from operations less net

capital expenditures. The Company’s non-GAAP measures of gross

margin, SG&A expenses, R&D expenses, operating margin,

effective tax rate, net income and earnings per diluted share

exclude the following items, if any:

- Share-based compensation

- Amortization of purchased intangibles

and impairments

- Restructuring, transaction and other

acquisition or disposition-related expenses and gains on

dispositions

- Litigation expenses or dispute

settlement charges or gains

- Environmental reserves

- Equity in net gains or losses of equity

method investments

To provide additional insight into the Company's second quarter

outlook, this release also includes a presentation of

forward-looking non-GAAP measures. Management believes that the

presentation of these non-GAAP financial measures provide useful

information to investors regarding the Company’s financial

condition and results of operations because these non-GAAP

financial measures are adjusted to exclude the items identified

above because such items are either operating expenses which would

not otherwise have been incurred by the Company in the normal

course of the Company’s business operations or are not reflective

of the Company’s core results over time. These excluded items may

include recurring as well as non-recurring items, and no inference

should be made that all of these adjustments, charges, costs or

expenses are unusual, infrequent or non-recurring. For example:

certain restructuring and integration-related expenses (which

consist of employee termination costs, facility closure or lease

termination costs, and contract termination costs) may be

considered recurring given the Company’s ongoing efforts to be more

cost effective and efficient; certain acquisition and

disposition-related adjustments or expenses may be deemed recurring

given the Company's regular evaluation of potential transactions

and investments; and certain litigation expenses or dispute

settlement charges or gains (which may include estimated losses for

which we may have established a reserve, as well as any actual

settlements, judgments, or other resolutions against, or in favor

of, the Company related to litigation, arbitration, disputes or

similar matters, and insurance recoveries received by the Company

related to such matters) may be viewed as recurring given that the

Company may from time to time be involved in, and may resolve,

litigation, arbitration, disputes, and similar matters.

Notwithstanding that certain adjustments, charges, costs or

expenses may be considered recurring, in order to provide

meaningful comparisons, the Company believes that it is appropriate

to exclude such items because they are not reflective of the

Company's core results and tend to vary based on timing, frequency

and magnitude.

As noted in its first quarter fiscal year 2019 earnings release,

the Company is no longer adjusting prior-period non-GAAP

performance metrics of net sales and gross margin to exclude the

cost of the Comcast Warrant as the Comcast Warrant was fully vested

in the first quarter of fiscal year 2019. Accordingly, the

Company’s non-GAAP performance previously reported for the first

quarter of fiscal year 2019 will not be comparable to the period

presented in the tables below. The Company in previous periods had

excluded the recognized cost of the Comcast Warrant from non-GAAP

net sales and non-GAAP gross margin because the cost related to a

non-routine, non-cash equity award that was provided to Comcast as

an incentive to deploy a network based on technology developed by

the Company and because the Comcast Warrant would not have had an

ongoing impact on revenues in future periods.

These non-GAAP financial measures are provided to enhance the

user's overall understanding of the Company's comparable financial

performance between periods. In addition, the Company’s management

generally excludes the items noted above when managing and

evaluating the performance of the business. The financial

statements provided with this release include reconciliations of

these non-GAAP measures to their most comparable GAAP measures for

the first and fourth quarters of fiscal year 2019 and first quarter

of fiscal year 2020, along with a reconciliation of forward-looking

non-GAAP measures (other than the non-GAAP effective tax rate) to

their most comparable GAAP measures for the second quarter of

fiscal year 2020. The Company is unable to include a reconciliation

of the forward-looking non-GAAP measure of the non-GAAP effective

tax rate to the corresponding GAAP measure as this is not available

without unreasonable efforts due to the high variability and low

visibility with respect to the charges that are excluded from this

non-GAAP measure. We expect the variability of the above charges to

have a potentially significant impact on our GAAP financial

results. These additional non-GAAP financial measures should not be

considered substitutes for any measures derived in accordance with

GAAP and may be inconsistent with similar measures presented by

other companies.

Forward-Looking and Cautionary Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, as amended, based on the

Company’s current expectations, estimates and projections about its

operations, industry, financial condition, performance, results of

operations, and liquidity. Forward-looking statements are

statements other than historical information or statements of

current condition and relate to matters such as future financial

performance including the second quarter of fiscal year 2020

outlook, the Company’s expectations concerning the negative impact

on the Company’s results of operations from its inability to ship

certain products and provide certain support services due to the

export restrictions related to Huawei, future operational

performance, the anticipated impact of specific items on future

earnings, and the Company’s plans, objectives and expectations.

Statements containing words such as “may,” “believes,”

“anticipates,” “expects,” “intends,” “plans,” “projects,”

“estimates,” “should,” “will,” “designed to,” “projections,” or

“business outlook,” or other similar expressions constitute

forward-looking statements.

Forward-looking statements involve known and unknown risks and

uncertainties that could cause actual results and events to differ

materially from those projected. Potential factors that could cause

actual results to differ materially from those in the

forward-looking statements include, but are not limited to: the

Company's ability to manage expenses to achieve anticipated shifts

in demand among target customers, and other comparable changes or

protracted weakness in projected or anticipated markets;

competitive changes in the marketplace including, but not limited

to, the pace of growth or adoption rates of applicable products or

technologies; export restrictions and laws affecting the Company's

trade and investments including the adoption and expansion of trade

restrictions including with respect to Huawei, and tariffs or the

occurrence of trade wars; changes in the legal requirements related

to the sale of our products, including developments regarding the

restrictions on future shipments with respect to Huawei; shifts in

focus among target customers, and other comparable changes in

projected or anticipated end-user markets; the Company’s ability to

forecast its effective tax rates due to changing income in higher

or lower tax jurisdictions and other factors that contribute to the

volatility of the Company’s effective tax rates and impact

anticipated tax benefits; the Company’s ability to integrate its

acquisitions and realize expected synergies and benefits from its

acquisitions and dispositions; the continuation and/or pace of key

trends considered to be main contributors to the Company's growth,

such as demand for increased network bandwidth and connectivity,

demand for increasing energy efficiency in the Company's products

or end-use applications of the products, and demand for increasing

miniaturization of electronic components; adequate supply of

components and materials from the Company’s suppliers, to include

disruptions due to natural causes or disasters, weather, or other

extraordinary events; the Company's ability to forecast and achieve

anticipated net sales and earnings estimates in light of periodic

economic uncertainty, to include impacts arising from European,

Asian and global economic dynamics; and the amount and timing of

expenditures for capital equipment. Additionally, forward-looking

statements should be considered in conjunction with the cautionary

statements contained in the risk factors disclosed in the Company's

Annual Report on Form 10-K for the fiscal year ended January 27,

2019, subsequent Quarterly Reports on Form 10-Q, and other filings

with the Securities and Exchange Commission, and in material

incorporated therein, including, without limitation, information

under the captions “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and “Risk Factors.”

In light of the significant risks and uncertainties inherent in the

forward-looking information included herein that may cause actual

performance and results to differ materially from those predicted,

any such forward-looking information should not be regarded as

representations or guarantees by the Company of future performance

or results, or that its objectives or plans will be achieved or

that any of its operating expectations or financial forecasts will

be realized. Reported results should not be considered an

indication of future performance. Investors are cautioned not to

place undue reliance on any forward-looking information contained

herein, which reflect management’s analysis only as of the date

hereof. Except as required by law, the Company assumes no

obligation to publicly release the results of any update or

revision to any forward-looking statements that may be made to

reflect new information, events or circumstances after the date

hereof or to reflect the occurrence of unanticipated or future

events, or otherwise.

About Semtech

Semtech Corporation is a leading supplier of high performance

analog, mixed-signal semiconductors and advanced algorithms for

high-end consumer, enterprise computing, communications and

industrial equipment. Products are designed to benefit the

engineering community as well as the global community. The Company

is dedicated to reducing the impact it, and its products, have on

the environment. Internal green programs seek to reduce waste

through material and manufacturing control, use of green technology

and designing for resource reduction. Publicly traded since 1967,

Semtech is listed on the NASDAQ Global Select Market under the

symbol SMTC. For more information, visit

http://www.semtech.com.

Semtech, the Semtech logo and LoRa are registered trademarks or

service marks of Semtech Corporation or its subsidiaries.

SMTC-F

SEMTECH CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF

INCOME (Amounts in thousands - except per share amount)

Three Months Ended April 28, January

27 April 29 2019

2019 2018 Q120

Q419 Q119 Net sales $

131,354 $ 160,006 $ 130,429 Cost

of sales 50,079 61,139 58,960

Gross profit 81,275 98,867

71,469 Operating costs and expenses: Selling, general and

administrative 38,377 36,875 41,406 Product development and

engineering 27,099 28,493 26,199 Intangible amortization 5,143

6,728 6,961 Changes in the fair value of contingent earn-out

obligations (2,161 ) - - Total

operating costs and expenses 68,458 72,096

74,566

Operating income (loss)

12,817 26,771 (3,097 ) Interest

expense, net (2,467 ) (2,457 ) (2,190 ) Non-operating income, net

1,043 1,909 190

Income

(loss) before taxes and equity in net losses of equity method

investments 11,393 26,223 (5,097 )

(Benefit) provision for taxes (2,312 ) 12,798

(17,510 )

Net income before equity in net losses of

equity method investments 13,705 13,425

12,413 Equity in net losses of equity method investments

(411 ) (85 ) (31 )

Net income $

13,294 $ 13,340 $

12,382 Earnings per share: Basic $ 0.20 $ 0.20

$ 0.19 Diluted $ 0.20 $ 0.20 $ 0.18 Weighted average number

of shares used in computing earnings per share: Basic 66,105 65,525

66,324 Diluted 67,976 68,165 68,195

SEMTECH

CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

April 28, January

27, 2019 2019 (Unaudited) ASSETS

Current assets: Cash and cash equivalents $ 287,302 $ 312,120

Accounts receivable, net 66,459 79,223 Inventories 73,480 63,679

Prepaid taxes 11,186 8,406 Other current assets 18,620

21,876 Total current assets 457,047 485,304

Non-current assets: Property, plant and equipment, net 126,169

118,488 Deferred tax assets 14,365 14,362 Goodwill 351,141 351,141

Other intangible assets, net 31,415 36,558 Other assets

73,273 57,028

Total assets $ 1,053,410

$ 1,062,881 LIABILITIES AND STOCKHOLDERS'

EQUITY Current liabilities: Accounts payable $ 40,713 $ 43,183

Accrued liabilities 39,394 65,023 Deferred revenue 4,942 3,439

Current portion, long term debt 18,281 18,269 Total

current liabilities 103,330 129,914 Non-current liabilities:

Deferred tax liabilities 3,646 3,363 Long term debt, less current

portion 188,270 192,845 Other long-term liabilities 62,938 54,078

Stockholders’ equity 695,226 682,681

Total

liabilities & stockholders' equity $

1,053,410 $ 1,062,881 SEMTECH

CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

AND SUPPLEMENTAL INFORMATION (Amounts in thousands)

Three Months Ended April 28,

April 29 2019 2018

(Unaudited) Net income $ 13,294

$ 12,382 Net cash provided by operating

activities

6,741

35,029 Net cash used in investing activities (15,770 ) (8,797 ) Net

cash used in financing activities

(15,789

) (30,806 )

Net decrease in cash and cash equivalents

(24,818 ) (4,574 ) Cash and cash

equivalents at beginning of period 312,120

307,923

Cash and cash equivalents at end of period

$ 287,302 $ 303,349

Three Months Ended April 28, January

27 April 29 2019 2019

2018 Q120 Q419

Q119 (Unaudited) (Unaudited) Free Cash

Flow: Cash Flow from Operations $

6,741

$ 47,198 $ 35,029 Net Capital Expenditures (15,258 )

(4,124 ) (4,935 )

Free Cash Flow: $

(8,517

) $ 43,074 $ 30,094

SEMTECH CORPORATION SUPPLEMENTAL

INFORMATION: RECONCILIATION OF GAAP TO NON-GAAP RESULTS

(Amounts in thousands - except per share amounts)

Three Months Ended April 28, January 27

April 29 2019 2019

2018 Q120 Q419

Q119 Gross Margin- GAAP 61.9 %

61.8 % 54.8 % Share-based compensation

0.3 % 0.3 % 0.3 %

Adjusted Gross Margin

(Non-GAAP) 62.2 % 62.1

% 55.1 % Three Months

Ended April 28, January 27 April 29

2019 2019 2018

Q120 Q419 Q119 Selling, general and

administrative- GAAP $ 38,377 $

36,875 $ 41,406 Share-based compensation

(8,344 ) (10,264 ) (11,462 ) Transaction and integration related

(1,249 ) (41 ) (233 ) Environmental and other reserves and charges

(140 ) (252 ) (346 ) Litigation cost net of recoveries 74

575 (559 )

Adjusted selling, general

and administrative (Non-GAAP) $ 28,718

$ 26,893 $ 28,806

Three Months Ended April 28, January 27

April 29 2019 2019

2018 Q120 Q419 Q119

Product development and engineering- GAAP $

27,099 $ 28,493 $ 26,199

Share-based compensation (2,557 ) (2,121 ) (2,225 ) Transaction and

integration related (186 ) (186 ) (294 )

Adjusted product development and engineering (Non-GAAP)

$ 24,356 $ 26,186

$ 23,680 Three Months

Ended April 28, January 27 April 29

2019 2019 2018

Q120 Q419 Q119 Operating Margin-

GAAP 9.8 % 16.7 % -2.4

% Share-based compensation 8.6 % 8.1 % 10.7 % Intangible

amortization 3.9 % 4.2 % 5.3 % Transaction and integration related

1.1 % 0.1 % 0.5 % Environmental and other reserves and charges 0.1

% 0.2 % 0.3 % Litigation cost net of recoveries -0.1 % -0.4 % 0.4 %

Changes in the fair value of contingent earn-out obligations

-1.6 % 0.0 % 0.0 %

Adjusted Operating Margin

(Non-GAAP) 21.8 % 28.9

% 14.8 % Three Months

Ended April 28, January 27 April 29

2019 2019 2018

Q120 Q419 Q119 GAAP net income

$ 13,294 $ 13,340 $

12,382 Adjustments to GAAP net income: Share-based

compensation 11,328 12,913 14,015 Intangible amortization 5,143

6,728 6,961 Transaction and integration related 1,435 226 527

Environmental and other reserves and charges 140 252 346 Litigation

cost net of recoveries (74 ) (575 ) 559 Changes in the fair value

of contingent earn-out obligations (2,161 ) - - Investment gain

- (1,288 ) -

Total Non-GAAP

adjustments before taxes 15,811 18,256

22,408 Associated tax effect (6,504 ) 5,867 (20,654 ) Equity

in net losses of equity method investments 411

85 31 Total of supplemental information net of

taxes 9,718 24,208 1,785

Non-GAAP net income $ 23,012 $

37,548 $ 14,167

Diluted GAAP earnings per share $ 0.20

$ 0.20 $ 0.18 Adjustments per above

0.14 0.35

0.03 Diluted non-GAAP earnings per share

$ 0.34 $ 0.55 $

0.21 Three Months Ended April

28, January 27 April 29 2019

2019 2018 Q120

Q419 Q119 Comcast Warrant* Impact on Net Sales

$ - $ - $ (21,501 ) Associated tax effect - - 3,678 Impact on EPS $

- $ - $ (0.26 )

*In consideration of discussions held with

the Securities and Exchange Commission we will no longer adjust net

sales for the impact of the Warrant for any comparable historical

periods presented. The Company will instead provide GAAP net sales

for historical periods presented and will separately disclose the

impact of the Warrant on the financial statement line items

impacted by the Warrant.

SEMTECH CORPORATION RECONCILIATION OF GAAP TO

NON-GAAP OUTLOOK Second Quarter of Fiscal Year 2020

Outlook (Amounts in thousands - except per share amounts)

Q2 FY20 Outlook July 28, 2019

Low

High

Gross Margin- GAAP 61.6 % 62.2 % Share-based compensation

0.3 % 0.3 %

Adjusted Gross Margin (Non-GAAP)

61.9 % 62.5 %

Low

High

Selling, general and administrative- GAAP $

37.4 $ 38.4 Share-based compensation (8.4 )

(8.4 ) Transaction and integration related (1.0 )

(1.0 )

Adjusted selling, general and administrative

(Non-GAAP) $ 28.0 $ 29.0

Low

High

Product development and engineering- GAAP $

26.7 $ 27.7 Share-based compensation (2.5 )

(2.5 ) Transaction and integration related (0.2 )

(0.2 )

Adjusted product development and engineering

(Non-GAAP) $ 24.0 $ 25.0

Low

High

Diluted GAAP earnings per share $ 0.11

$ 0.20 Share-based compensation 0.17 0.17

Transaction, restructuring, and acquisition related expenses 0.02

0.02 Amortization of acquired intangibles 0.06 0.06 Associated Tax

Effect (0.04 ) (0.05 )

Diluted adjusted earnings

per share (Non-GAAP) $ 0.32 $

0.40

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190529005880/en/

Sandy HarrisonSemtech Corporation(805)

480-2004webir@semtech.com

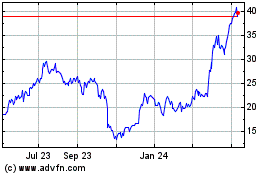

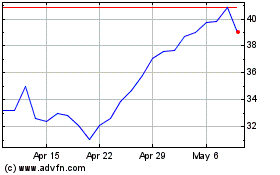

Semtech (NASDAQ:SMTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Semtech (NASDAQ:SMTC)

Historical Stock Chart

From Apr 2023 to Apr 2024