UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant

x

|

|

Filed by a Party other than the Registrant

¨

|

|

Check the appropriate box:

|

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

x

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material under §240.14a-12

|

SELLAS

LIFE SCIENCES GROUP, INC.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy Statement

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

¨

|

No fee required.

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction

applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

August 7, 2019

Dear Fellow Stockholders:

On

behalf of the Board of Directors (the "Board") of SELLAS Life Sciences Group, Inc. (the "Company"), you are

cordially invited to attend a Special Meeting of Stockholders to be held at 8:30 a.m., local time, on September 10, 2019,

at 15 West 38

th

Street, 4

th

Fl., New York, New York 10018.

At the Special Meeting, stockholders will

consider and vote on

|

|

(i)

|

a proposal to adopt and approve an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse

stock split of our common stock, par value $0.0001 per share (the “common stock”) at a ratio of not less than

1-for-20 and not greater than 1-for-60, with the exact ratio and effective time of the reverse stock split to be determined

by the Board (the “Reverse Stock Split”) at any time within one year of the date of the Special Meeting;

|

|

|

(ii)

|

the approval of the Company’s 2019 Equity Incentive Plan; and

|

|

|

(iii)

|

if necessary, the adjournment of the Special Meeting to solicit additional proxies in favor of the Reverse Stock Split proposal

and the 2019 Equity Plan proposal.

|

The proxy statement attached to this letter

provides you with information regarding the above three proposals. Please read the entire proxy statement carefully. You may obtain

additional information about the Company from documents we file with the Securities and Exchange Commission.

It is important that your shares be represented

and voted at the meeting. Please vote as soon as possible even if you plan to attend the Special Meeting. We appreciate your continued

ownership of the Company shares and your support regarding this matter.

|

|

Very truly yours,

|

|

|

|

|

|

|

|

|

Angelos M. Stergiou, M.D., Sc.D. h.c.

|

|

|

President and Chief Executive Officer

|

SELLAS LIFE SCIENCES GROUP, INC.

15 West 38

th

Street, 10

th

Floor

New York, New York 10018

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on September 10, 2019

|

DATE:

|

September 10, 2019 at 8:30 a.m., local time

|

|

PLACE:

|

15 West 38

th

Street, 4

th

Fl.

|

|

|

New York, NY 10018

|

|

PURPOSES:

|

At this Special Meeting, or any adjournment or postponement of the Special Meeting, we plan to consider and vote upon the following

proposals:

|

|

|

1.

|

To adopt and approve an amendment to our Amended and Restated Certificate of Incorporation that effects a Reverse Stock

Split at a ratio of not less than 1-for-20 and not greater than 1-for-60, with the exact ratio and effective time of the

Reverse Stock Split to be determined by the Board at any time within one year of the date of the Special Meeting.

|

|

|

2.

|

To approve the Company’s 2019 Equity Incentive Plan.

|

|

|

3.

|

To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies in favor of the Reverse Stock

Split proposal and the 2019 Equity Plan proposal.

|

WHO MAY VOTE:

The close of business on July 12, 2019 has been fixed as the

record date for determining those stockholders entitled to vote at the Special Meeting. Accordingly, only stockholders of record

at the close of business on that date will receive this notice of, and be eligible to vote at, the Special Meeting and any adjournment

or postponement of the Special Meeting. The above items of business for the Special Meeting are more fully described in the proxy

statement that accompanies this notice.

Your vote is important.

Please

read the proxy statement and the instructions on the enclosed proxy card and then, whether or not you plan to attend the Special

Meeting in person, and no matter how many shares you own, please submit your proxy promptly by telephone or via the Internet in

accordance with the instructions on the enclosed proxy card, or by completing, dating and returning your proxy card in the envelope

provided. This will not prevent you from voting in person at the Special Meeting. It will, however, help to assure a quorum and

to avoid added proxy solicitation costs.

You may revoke your proxy at any time before the vote is taken

by delivering to the Secretary of the Company a written revocation or a proxy with a later date (including a proxy by telephone

or via the Internet) or by voting your shares in person at the Special Meeting, in which case your prior proxy would be disregarded.

|

|

By order of the Board of Directors

|

|

|

|

|

|

|

|

|

|

|

|

Barbara A. Wood

|

|

|

General Counsel and Corporate Secretary

|

|

|

New York, New York

|

|

|

August 7, 2019

|

TABLE OF CONTENTS

SELLAS LIFE SCIENCES GROUP, INC.

15 West 38

th

Street,

10

th

Floor

New York, New York 10018

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON

Friday, September 10, 2019

Important Notice Regarding the Availability

of Proxy Materials for the Special Meeting to be Held on September 10, 2019:

The proxy statement is available at

www.envisionreports.com/SLS

This proxy statement is being furnished to you by the Board

of Directors (the "Board" or "Board of Directors") of SELLAS Life Sciences Group, Inc. (the "Company")

to solicit your proxy to vote your shares at our Special Meeting of Stockholders (the "Special Meeting"). The Special

Meeting will be held on September 10, 2019 at 8:30 a.m., local time, at 15 West 38

th

Street, 4

th

Floor,

New York, New York 10018.

This proxy statement, the foregoing notice and the accompanying

proxy card are first being made available on or about August [5], 2019 to all holders of our common stock entitled to vote at the

Special Meeting.

Purpose of the Special Meeting

The

purpose of the Special Meeting is to consider and vote on the following proposals:

|

Proposal 1:

|

A proposal, which we refer to as the “Reverse Stock Split proposal,” to adopt and approve an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of our outstanding shares of common stock, at a ratio of not less than 1-for-20 and not greater than 1-for-60, with the exact ratio and effective time of the reverse stock split to be determined by the Board at any time within one year of the date of the Special Meeting (the “Reverse Stock Split”).

|

|

|

|

|

Proposal 2:

|

A proposal, which we refer to as the “2019 Equity Plan proposal,” to approve the Company’s 2019 Equity Incentive Plan (“2019 Equity Plan”).

|

|

|

|

|

Proposal 3:

|

A proposal, which we refer to as the “adjournment proposal,” to approve, if necessary, the adjournment of the Special Meeting to solicit additional proxies in favor of Proposal 1 and Proposal 2.

|

If the Reverse Stock Split proposal is approved by the Company's

stockholders at the Special Meeting, it will be effected, if at all, only upon a subsequent determination by the Board, not later

than the date that is within one year from the date of the Special Meeting, that the Reverse Stock Split is in the best interests

of the Company and our stockholders. The Board may make this determination as soon as immediately following the conclusion of the

Special Meeting, and the Reverse Stock Split could become effective as soon as the business day immediately following the Special

Meeting.

Notwithstanding approval of the Reverse Stock Split proposal

by our stockholders, the Board reserves its right to elect not to proceed with implementing the Reverse Stock Split proposal at

any time prior to the date on which the amendment to our Amended and Restated Certificate of Incorporation becomes effective under

Delaware law, if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of the

Company or its stockholders.

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

Who is entitled to vote at the Special Meeting?

Holders of the Company’s common stock as of the close

of business on the record date, July 12, 2019, will receive notice of, and be eligible to vote at, the Special Meeting and any

adjournment or postponement of the Special Meeting. At the close of business on the record date, the Company had outstanding and

entitled to vote 210,092,687 shares of common stock. No other shares of the Company’s capital stock are entitled to notice

of and to vote at the Special Meeting.

How do I attend the Special Meeting?

All stockholders of record on July 12, 2019 are invited to attend

the Special Meeting. You must bring proof of your identity to attend the special meeting. If you are the beneficial owner of shares

held in the name of your broker, bank or other nominee, you must bring both proof of ownership of shares as of the record date

(e.g., a broker's statement) and a photo ID in order to be admitted to the meeting. If you plan to attend the meeting, we

will have representatives onsite to assist with registration for the event.

What matters will be voted on at the Special Meeting?

The three proposals that are scheduled to be considered and

voted on at the Special Meeting are the Reverse Stock Split proposal, the 2019 Equity Plan proposal and the adjournment proposal.

What are the Board's voting recommendations?

The Board recommends that you vote "FOR" the Reverse

Stock Split proposal, “FOR” the 2019 Equity Plan proposal and "FOR" the adjournment proposal.

Why does the Company need stockholders to vote on the

Reverse Stock Split?

On May 31, 2019, we received a written notification from The

Nasdaq Stock Market LLC (“Nasdaq”) indicating that the Company was not in compliance with Nasdaq Listing Rule 5550(a)(2)

because the minimum bid price of the Company’s shares of common stock was below $1.00 per share for the previous 30 consecutive

business days. We have been provided an initial period of 180 calendar days, or until November 27, 2019, to regain compliance with

the minimum bid price rule. To regain compliance, the closing bid price of the Company’s shares of common stock must meet

or exceed $1.00 per share for at least ten consecutive business days during this 180-day grace period. If we do not regain compliance

with the minimum bid price rule by November 27, 2019, we may be eligible for an additional compliance period of 180 calendar days;

however, such extension is at the discretion of Nasdaq and there can be no assurance that Nasdaq will grant the extension. If we

do not regain compliance with the minimum bid price rule by November 27, 2019 and are not granted an additional compliance period

at that time, Nasdaq will provide written notification to us that our common stock may be delisted. At that time, we may appeal

Nasdaq’s delisting determination to a Nasdaq hearings panel. If we timely appeal, our common stock would remain listed pending

the panel’s decision. There can be no assurance that, if we do appeal the delisting determination by Nasdaq to the panel,

such appeal would be successful.

The Board has determined that an amendment to our Amended and

Restated Certificate of Incorporation to effect the Reverse Stock Split is necessary to the continued listing of our common stock

on Nasdaq and is in the best interests of our stockholders. If approved and implemented, the Board will select a Reverse Stock

Split ratio of not less than 1-for-20 and not greater than 1-for-60, with the exact ratio and effective time of the Reverse Stock

Split to be determined by the Board at any time within one year of the date of the Special Meeting based on various factors, including

the then prevailing market conditions and the existing and expected per share trading prices of our common stock. Pursuant to the

law of our state of incorporation, Delaware, the Board must adopt any amendment to our Amended and Restated Certificate of Incorporation

and submit the amendment to stockholders for approval. Accordingly, the Board is requesting your proxy to vote "FOR"

the Reverse Stock Split proposal and "FOR" the adjournment proposal.

In addition to bringing the per share trading price of our common

stock back above $1.00, we also believe that the Reverse Stock Split will make our common stock more attractive to a broader range

of institutional and other investors, as we have been advised that the current per share trading price of our common stock may

affect its acceptability to certain institutional investors, professional investors and other members of the investing public.

Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing

in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition,

some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive

to brokers.

What is the difference between holding shares as a stockholder

of record and as a beneficial owner?

If, on the Record Date, your shares were registered directly

in your name with our transfer agent, Computershare Inc., you are considered the "stockholder of record" with respect

to those shares.

If, on the Record Date, your shares were held instead in a stock

brokerage account or by a bank or other nominee, those shares are held in "street name" and you are considered the "beneficial

owner" of the shares. As the beneficial owner of those shares, you have the right to direct your broker, bank or nominee how

to vote your shares, and you will receive separate instructions from your broker, bank or other holder of record describing how

to vote your shares.

How can I vote my shares before the Special Meeting?

If

you are a stockholder of record, you may submit a proxy by telephone, via the Internet or by mail.

·

Submitting a Proxy by Telephone:

You

can submit a proxy for your shares by telephone until 11:59 p.m. Eastern Daylight Time on September 9, 2019, by calling the

toll-free telephone number on the enclosed proxy card, 1-800- 652-VOTE (8683). Telephone proxy submission is available 24 hours

a day. Easy-to-follow voice prompts allow you to submit a proxy for your shares and confirm that your instructions have been properly

recorded. Our telephone proxy submission procedures are designed to authenticate stockholders by using individual control numbers.

·

Submitting

a Proxy via the Internet:

You can submit a proxy for your shares via the Internet until 11:59 p.m.

Eastern Daylight Time on September 9, 2019, by accessing the website listed on the enclosed proxy

card,

www.envisionreports.com/SLS

, and following the instructions you will find on the website. Internet proxy submission

is available 24 hours a day. As with telephone proxy submission, you will be given the opportunity to confirm that your

instructions have been properly recorded.

·

Submitting

a Proxy by Mail:

If you choose to submit a proxy for your shares by mail, simply mark the enclosed proxy card,

date and sign it, and return it in the postage paid envelope provided.

By casting your vote in any of the three ways listed above,

you are authorizing the individuals listed on the proxy to vote your shares in accordance with your instructions. You may also

attend the Special Meeting and vote in person.

If you are the beneficial owner of shares,

you should follow the instructions in the materials you received with this proxy statement from the holder of record for your shares

to be voted.

The availability of telephonic or Internet voting will depend

on the bank's or broker's voting process. Please check with your bank or broker and follow the voting procedures your bank or broker

provides to vote your shares. Also, please note that if the holder of record of your shares is a bank, broker or other nominee

and you wish to vote in person at the Special Meeting, you must request a legal proxy from your bank, broker or other nominee that

holds your shares and present that proxy and a photo ID at the Special Meeting; otherwise, you will not be able to vote in person

at the Special Meeting.

If I am the beneficial owner of shares held in "street

name" by my broker, will my broker automatically vote my shares for me?

If you are a beneficial owner of shares registered in the name

of your broker, bank, or other nominee (sometimes referred to as shares held in “street name”) and you do not provide

instructions how to vote your shares, your broker, bank or other nominee may still be able to vote your shares in its discretion.

A broker or other nominee may generally vote in their discretion on “routine” matters. In this regard, Proposals 1

and 3 are considered to be “routine” meaning that if your broker does not receive instructions from you on how to vote

your shares on such routine matter, the broker will have discretion to vote your shares. Proposal 2 is considered to be a “non-routine”

matter meaning that if you do not return voting instructions to your broker by its deadline, the broker will not have the authority

to vote on the matter with respect to your shares. This is generally referred to as a “broker non-vote.”

How will my shares be voted if I give my proxy but do

not specify how my shares should be voted?

If you provide specific voting instructions, your shares will

be voted at the Special Meeting in accordance with your instructions. If you are a stockholder of record and sign and return a

proxy card without giving specific voting instructions, your shares will be voted "FOR" the Reverse Stock Split proposal,

"FOR" the 2019 Equity Plan proposal and "FOR" the adjournment proposal.

What vote is the required to pass each proposal?

The affirmative vote of the holders of a majority of the outstanding

shares of our common stock as of the record date is required to approve the Reverse Stock Split proposal and the affirmative vote

of a majority of the votes cast by stockholders present, in person or by proxy, and entitled to vote at the Special Meeting, is

required to approve the 2019 Equity Plan proposal and the adjournment proposal.

Can I vote in person at the Special Meeting?

Yes. If you hold shares in your own name as a stockholder of

record, you may come to the Special Meeting and cast your vote at the meeting by properly completing and submitting a ballot. If

you are the beneficial owner of shares held in the name of your broker, bank or other nominee, you must first obtain a legal proxy

from your broker, bank or other nominee giving you the right to vote those shares and submit that proxy along with a properly completed

ballot at the meeting; otherwise, you will not be able to vote in person at the Special Meeting.

How can I change my vote?

You may revoke your proxy at any time before it is exercised

by:

|

|

·

|

Delivering to the Corporate Secretary a written notice

of revocation, dated later than the proxy, before the vote is taken at the Special Meeting;

|

|

|

·

|

Delivering to the Corporate Secretary an executed

proxy bearing a later date, before the vote is taken at the Special Meeting;

|

|

|

·

|

Submitting a proxy on a later date by telephone or

via the Internet (only your last telephone or Internet proxy will be counted), before 11:59 p.m. Eastern Daylight Time on

September 9, 2019; or

|

|

|

·

|

Attending the Special Meeting and voting in person

(your attendance at the Special Meeting, in and of itself, will not revoke the proxy).

|

Any written notice of revocation, or later dated proxy, should

be delivered to:

SELLAS Life Sciences Group, Inc.

15 West 38th Street, 10th Floor

New York, New York 10018

Attention: Barbara A. Wood, Corporate Secretary

Alternatively, you may hand deliver a written revocation notice,

or a later dated proxy, to the Secretary at the Special Meeting before we begin voting.

If your shares of the Company common stock are held by a bank,

broker or other nominee, you must follow the instructions provided by the bank, broker or other nominee if you wish to change your

vote.

What are the quorum requirements for the proposals?

In order to take action on the proposals, a quorum, consisting

of the holders of 105,046,344 shares (a majority of the aggregate number of shares of the Company’s common stock issued

and outstanding and entitled to vote as of the record date for the Special Meeting), must be present in person or by proxy. This

is referred to as a "quorum." Proxies marked "Abstain" and broker non-votes (as further discussed below) will

be treated as shares that are present for purposes of determining the presence of a quorum.

What happens if a quorum is not present at the Special

Meeting?

If the shares present in person or represented by proxy at the

Special Meeting are not sufficient to constitute a quorum, the stockholders by a vote of the holders of a majority of votes present

in person or represented by proxy (which may be voted by the proxyholders) may, without further notice to any stockholder (unless

a new record date is set), adjourn the meeting to a different time and place to permit further solicitations of proxies sufficient

to constitute a quorum.

What is an "abstention" and how would it affect

the vote?

An "abstention" occurs when a stockholder sends in

a proxy with explicit instructions to decline to vote regarding a particular matter. Abstentions are counted as present for purposes

of determining a quorum. Abstentions with respect to the Reverse Stock Split proposal will have the same effect as a vote "Against"

the proposals. Abstentions are not considered to be votes cast and therefore will have no impact on the 2019 Equity Plan proposal

and the adjournment proposal.

What is a “broker non-vote and how would it affect

the vote?

Brokers, banks or other nominees that are member firms of the

New York Stock Exchange and who hold shares in street name for customers have the discretion to vote those shares with respect

to certain matters if they have not received instructions from the beneficial owners. If a broker that is a record holder of common

stock does return a signed proxy, but is not authorized to vote on one or more matters (with respect to each such matter, a "broker

non-vote"), the shares of common stock represented by such proxy will be considered present at the Special Meeting for purposes

of determining the presence of a quorum. A broker that is a member of the New York Stock Exchange is prohibited, unless the stockholder

provides the broker with written instructions, from giving a proxy on nonroutine matters. Consequently, your brokerage firm or

other nominee will have discretionary authority to vote your shares with respect to routine matters but may not vote your shares

with respect to non-routine matters.

We believe that each of the Reverse Stock Split proposal and

the adjournment proposal are deemed to be a "routine" matter. Therefore, if you are a beneficial owner of shares registered

in the name of your broker or other nominee and you fail to provide instructions to your broker or nominee as to how to vote your

shares on the Reverse Stock Split proposal or the adjournment proposal, your broker or nominee will have the discretion to vote

your shares however they see fit. Accordingly, if you fail to provide voting instructions to your broker or nominee, your broker

or nominee can vote your shares on the Reverse Stock Split proposal or the adjournment proposal in a manner that is contrary to

what you intend. In addition, while we do not expect any broker non-votes on the Reverse Stock Split proposal or the adjournment

proposal, if you do not provide voting instructions and your broker or nominee fails to vote your shares, this will have the same

effect as a vote "Against" the Reverse Stock Split proposal. If you are a beneficial owner of shares registered in the

name of your broker or other nominee, we strongly encourage you to provide voting instructions to the broker or nominee that holds

your shares to ensure that your shares are voted in the manner in which you want them to be voted.

Brokers will not have this discretionary authority with respect

to the approval of the 2019 Equity Plan and because approval of the 2019 Equity Plan requires the affirmative vote of the holders

of a majority of the shares of stock that are present in person or by proxy and entitled to vote at the Special Meeting, broker

non-votes will have no effect.

Can other matters be decided at the Special Meeting?

Other than the Reverse Stock Split proposal, the 2019 Equity

Plan proposal and the adjournment proposal, no other matters will be presented for action by the stockholders at the Special Meeting.

Who will conduct the proxy solicitation and how much will

it cost?

We are soliciting proxies from stockholders on behalf of the

Board and will pay for all costs incurred by it in connection with the solicitation. In addition to solicitation by mail, the directors,

officers and associates of the Company and its subsidiaries may solicit proxies from stockholders of the Company in person or by

telephone, facsimile or email without additional compensation other than reimbursement for their actual expenses.

We have retained The Proxy Advisory Group, LLC, a proxy solicitation

firm, to assist in the solicitation of proxies and to provide related advice and informational support for a service fee, plus

customary disbursements, which are not expected to exceed $25,000in the aggregate. Arrangements also will be made with brokerage

firms and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of stock

held of record by such persons, and we will reimburse such custodians, nominees and fiduciaries for their reasonable out-of-pocket

expenses in connection with the forwarding of solicitation materials to the beneficial owners of our stock.

If

you have any questions or need assistance voting your shares of the Company common stock, please contact The Proxy Advisory Group,

LLC, the Company's proxy solicitor, by calling (212) 616-2180.

PROPOSAL NO. 1

THE REVERSE STOCK SPLIT PROPOSAL

General

The Company is asking stockholders to adopt and approve

the proposal that the Company’s Amended and Restated Certificate of Incorporation be amended, by way of a Certificate

of Amendment, to effect the Reverse Stock Split. The proposed amendment, if effected, will effect a Reverse Stock Split of

the outstanding shares of the Company's common stock at a Reverse Stock Split ratio of not less than 1-for-20 and not greater

than 1-for-60, with the exact ratio and effective time of the Reverse Stock Split to be determined by the Board at any time

within one year of the date of the Special Meeting. The foregoing description of the proposed amendment is a summary and is

subject to the full text of the proposed amendment, which is attached to this proxy statement as Annex A.

If approved by the stockholders, the Reverse Stock Split, if

any, would become effective at a time, and at a ratio, to be designated by the Board of Directors. The Board of Directors may effect

only one Reverse Stock Split as a result of this authorization. The Board of Directors also may determine in its discretion not

to effect the Reverse Stock Split and not to file the Certificate of Amendment. No further action on the part of stockholders will

be required to either implement or abandon the Reverse Stock Split. The determination of the ratio of the Reverse Stock Split will

be based on a number of factors, described further below under the heading “—Criteria to be Used for Determining Whether

to Implement Reverse Stock Split.” The Reverse Stock Split, if approved by stockholders and if deemed by the Board of Directors

to be in the best interests of us and our stockholders, will be effected, if at all, at a time that is not later than the date

that is within one year from the date of the Special Meeting.

As of the July 12, 2019 record date 210,092,687 shares of our

common stock were issued and outstanding. Based on such number of shares of our common stock issued and outstanding, immediately

following the effectiveness of the Reverse Stock Split (and without giving any effect to the payment of cash in lieu of fractional

shares), we will have, depending on the Reverse Stock Split ratio selected by our Board of Directors, issued and outstanding shares

of stock as illustrated in the table under the caption “—Effects of the Reverse Stock Split—Effect on Shares of

Common Stock.”

The Reverse Stock Split will be realized simultaneously for

all outstanding common stock, options to purchase shares of our common stock (including shares available for future grants under

the 2017 Equity Incentive Plan and the 2019 Equity Plan if approved by our stockholders pursuant to Proposal 2) and warrants to

purchase shares of our common stock. The Reverse Stock Split will affect all holders of common stock uniformly and each stockholder

will hold the same percentage of common stock outstanding immediately following the Reverse Stock Split as that stockholder held

immediately prior to the Reverse Stock Split, except for immaterial adjustments that may result from the treatment of fractional

shares as described below. The Reverse Stock Split will not change the par value of our common stock and will not reduce the number

of authorized shares of common stock (see "—Effects of the Reverse Stock Split").

No fractional shares of common stock will be issued as a result

of the Reverse Stock Split. Instead, any stockholder who would have been entitled to receive a fractional share as a result of

the Reverse Stock Split will receive cash payments in lieu of such fractional shares.

Reasons for the Reverse Stock Split

Nasdaq Compliance.

Our common stock is publicly traded

and listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol "SLS." Our Board of Directors authorized

the reverse split of our common stock with the primary intent of increasing the per share trading price of our common stock in

order to ensure that we continue to satisfy the requirements for the continued listing of our common stock on Nasdaq which we believe

helps support and maintain stock liquidity and Company recognition for our stockholders. Accordingly, we believe that effecting

the Reverse Stock Split is in the Company's and our stockholders' best interests.

Companies listed on the Nasdaq are subject to various rules

and requirements imposed by Nasdaq which must be satisfied in order to continue having their stock listed on the exchange (these

are called the Nasdaq’s continued listing standards). One of these standards is the “minimum bid price” requirement

set forth in Marketplace Rule 5450(a)(1), which requires that the bid price of the stock of listed companies be at least $1.00

per share. A listed company risks being delisted and removed from the Nasdaq if the closing bid price of its stock remains below

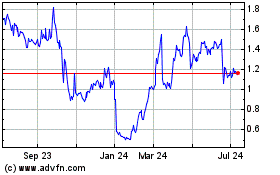

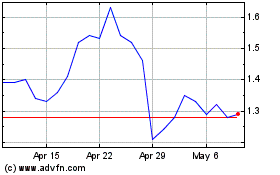

$1.00 per share for an extended period of time. The closing bid price of our common stock has been below $1.00 per share since

April 16, 2019.

On May 31, 2019, we received a letter from Nasdaq indicating

that, based upon the closing bid price of our common stock for the last 30 consecutive business days, we did not meet the minimum

bid price of $1.00 per share required for continued listing on the Nasdaq Capital Market pursuant to Minimum Bid Price Rule. We

have been provided an initial period of 180 calendar days, or until November 27, 2019, to regain compliance with the Minimum Bid

Price Rule. The letter also indicated that if at any time before November 27, 2019 the closing bid price for our common stock is

at least $1.00 for a minimum of ten consecutive business days, Nasdaq will provide written notification to the company that it

complies with the Minimum Bid Price Rule. If we do not regain compliance with the Minimum Bid Price Rule by November 27, 2019,

we may be eligible for an additional compliance period of 180 calendar days; however, such extension is at the discretion of Nasdaq

and there can be no assurance that Nasdaq will grant the extension. If we do not regain compliance with the Minimum Bid Price Rule

by November 27, 2019 and Nasdaq does not grant us an additional compliance period at that time, Nasdaq will provide written notification

to us that our common stock may be delisted. At that time, we may appeal Nasdaq’s delisting determination to a Nasdaq hearings

panel. If we timely appeal, our common stock would remain listed pending the panel’s decision. There can be no assurance

that, if we do appeal the delisting determination by Nasdaq to the panel, such appeal would be successful.

Additional

Potential Investors.

In addition to bringing the per share trading price of our common stock back above $1.00, we also believe

that the Reverse Stock Split will make our common stock more attractive to a broader range of institutional and other investors,

as we have been advised that the current per share trading price of our common stock may affect its acceptability to certain institutional

investors, professional investors and other members of the investing public. Many brokerage houses and institutional investors

have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual

brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function

to make the processing of trades in low-priced stocks economically unattractive to brokers.

Financial Planning Flexibility.

The

Board believes it is in the best interest of the Company to approve the Amendment to effect the Reverse Stock Split of the Company’s

issued and outstanding common stock to give the Company greater flexibility in considering and planning for future potential business

needs. The Reverse Stock Split will result in additional authorized and unissued shares becoming available for general corporate

purposes as the Board may determine from time to time, including for use under its equity compensation plans.

Reducing the number of outstanding shares of our common stock

through the Reverse Stock Split is intended, absent other factors, to increase the per share trading price of our common stock.

However, other factors, such as our financial results, market conditions and the market perception of our business may adversely

affect the per share trading price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if

completed, will result in the intended benefits described above, that the per share trading price of our common stock will increase

following the Reverse Stock Split or that the per share trading price of our common stock will not decrease in the future.

Criteria to be Used for Determining Whether to Implement

Reverse Stock Split

In determining whether to implement the Reverse Stock Split

and which Reverse Stock Split ratio to implement, if any, following receipt of stockholder approval of the amendment to our Amended

and Restated Certificate of Incorporation to effect the Reverse Stock Split, the Board of Directors may consider, among other things,

various factors, such as:

|

|

·

|

the historical trading price and trading volume of

our common stock;

|

|

|

·

|

the Nasdaq Continued Listing Standards requirements;

|

|

|

·

|

the then-prevailing trading price and trading volume

of our common stock and the expected impact of the Reverse Stock Split on the trading market for our common stock in the short-

and long-term; and

|

|

|

·

|

prevailing general market and economic conditions.

|

Certain Risks and Potential Disadvantages Associated with

the Reverse Stock Split

We cannot assure you that the proposed Reverse Stock Split

will increase our stock price

. We expect that the Reverse Stock Split will increase the per share trading price of our

common stock. However, the effect of the Reverse Stock Split on the per share trading price of our common stock cannot be predicted

with any certainty, and the history of reverse stock splits for other companies is varied, particularly since some investors may

view a reverse stock split negatively. It is possible that the per share trading price of our common stock after the Reverse Stock

Split will not increase in the same proportion as the reduction in the number of our outstanding shares of common stock following

the Reverse Stock Split, and the Reverse Stock Split may not result in a per share trading price that would attract investors who

do not trade in lower priced stocks. In addition, although we believe the Reverse Stock Split may enhance the marketability of

our common stock to certain potential investors, we cannot assure you that, if implemented, our common stock will be more attractive

to investors. Even if we implement the Reverse Stock Split, the per share trading price of our common stock may decrease due to

factors unrelated to the Reverse Stock Split, including our future performance. If the Reverse Stock Split is consummated and the

per share trading price of the common stock declines, the percentage decline as an absolute number and as a percentage of our overall

market capitalization may be greater than would occur in the absence of the Reverse Stock Split.

The proposed Reverse Stock Split may decrease the liquidity

of our common stock and result in higher transaction costs

. The liquidity of our common stock may be negatively impacted

by the Reverse Stock Split, given the reduced number of shares that would be outstanding after the Reverse Stock Split, particularly

if the per share trading price does not increase as a result of the Reverse Stock Split. In addition, if the Reverse Stock Split

is implemented, it will increase the number of our stockholders who own "odd lots" of fewer than 100 shares of common

stock. Brokerage commission and other costs of transactions in odd lots are generally higher than the costs of transactions of

more than 100 shares of common stock. Accordingly, the Reverse Stock Split may not achieve the desired results of increasing marketability

of our common stock as described above.

Dilution to existing stockholders if the Company issues new

shares of Common Stoc

k. Although the Reverse Stock Split will not in itself cause dilution to our existing stockholders, the

number of shares the Company will be authorized to issue will not be decreased proportionally. Thus, should the Company decide

to issue new shares of common stock in the future to raise capital, existing stockholders’ ownership will be diluted.

Procedure for Effecting Reverse Stock Split and Exchange

of Stock Certificates

If the Certificate of Amendment is approved by our

stockholders, and if at such time the Board of Directors still believes that the Reverse Stock Split is in the best interests

of the Company and its stockholders, the Board of Directors will determine the ratio of the Reverse Stock Split to be

implemented. We will file the Certificate of Amendment with the Secretary of State of the State of Delaware at such time as

the Board of Directors has determined the appropriate effective time for the Reverse Stock Split (the “Effective

Time”). The Board of Directors may delay effecting the Reverse Stock Split, if at all, until a time that is not later

than one year from the date of the Special Meeting, without re-soliciting stockholder approval. The Reverse Stock Split will become

effective on the date of filing of the Certificate of Amendment with the Secretary of State of the State of Delaware.

Beginning on the effective date of the Reverse Stock Split, each certificate representing pre-Reverse Stock Split shares will

be deemed for all corporate purposes to evidence ownership of post-Reverse Stock Split shares.

If, at any time prior to the filing of the Certificate of Amendment

with the Delaware Secretary of State, notwithstanding stockholder approval, and without further action by the stockholders, the

Board of Directors, in its sole discretion, determines that it is in the Company's best interests and the best interests of the

Company's stockholders to delay the filing of the Certificate of Amendment or abandon the Reverse Stock Split, the Reverse Stock

Split may be delayed or abandoned.

Fractional Shares

Stockholders will not receive fractional shares of common stock

in connection with the Reverse Stock Split. Instead, the transfer agent will aggregate all fractional shares and sell them as soon

as practicable after the Effective Time at the then-prevailing prices on the open market, on behalf of those stockholders who would

otherwise be entitled to receive a fractional share as a result of the Reverse Stock Split. We expect that the transfer agent will

conduct the sale in an orderly fashion at a reasonable pace and that it may take several days to sell all of the aggregated fractional

shares of our common stock. After the transfer agent's completion of such sale, stockholders who would have been entitled to a

fractional share will instead receive a cash payment from the transfer agent in an amount equal to their respective pro rata shares

of the total proceeds of that sale net of any brokerage costs incurred by the transfer agent to sell such stock.

Stockholders will not be entitled to receive interest for the

period of time between the Effective Time and the date payment is made for their fractional share interest. You should also be

aware that, under the escheat laws of certain jurisdictions, sums due for fractional interests that are not timely claimed after

the funds are made available may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders

otherwise entitled to receive such funds may have to obtain the funds directly from the state to which they were paid.

If you believe that you may not hold sufficient shares of the

Company's common stock at the Effective Time to receive at least one share in the Reverse Stock Split and you want to continue

to hold the Company's common stock after the Reverse Stock Split, you may do so by either:

|

|

·

|

purchasing a sufficient number of shares of the Company's

common stock; or

|

|

|

·

|

if you have shares of the Company's common stock in

more than one account, consolidating your accounts;

|

in each case, so that you hold a number of shares of our common

stock in your account prior to the Reverse Stock Split that would entitle you to receive at least one share of common stock in

the Reverse Stock Split. Shares of our common stock held in registered form and shares of our common stock held in "street

name" (that is, through a broker, bank or other holder of record) for the same stockholder will be considered held in separate

accounts and will not be aggregated when effecting the Reverse Stock Split.

Effects of the Reverse Stock Split

General

After the effective date of the Reverse Stock Split, if implemented

by the Board of Directors, each stockholder will own a reduced number of shares of common stock. The principal effect of the Reverse

Stock Split will be to proportionately decrease the number of outstanding shares of our common stock based on the Reverse Stock

Split ratio selected by our Board of Directors. As a matter of Delaware law, the implementation of the Reverse Stock Split does

not require a reduction in the total number of authorized shares of our common stock.

Voting rights and other rights of the holders of our common

stock will not be affected by the Reverse Stock Split, other than as a result of the treatment of fractional shares as described

above. For example, a holder of 2% of the voting power of the outstanding shares of our common stock immediately prior to the effectiveness

of the Reverse Stock Split will generally continue to hold 2% (assuming there is no impact as a result of the payment of cash in

lieu of issuing fractional shares) of the voting power of the outstanding shares of our common stock after the Reverse Stock Split.

The number of stockholders of record will not be affected by the Reverse Stock Split (except to the extent any are cashed out as

a result of holding fractional shares). If approved and implemented, the Reverse Stock Split may result in some stockholders owning

"odd lots" of less than 100 shares of our common stock. Odd lot shares may be more difficult to sell, and brokerage commissions

and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in "round lots"

of even multiples of 100 shares. Our Board of Directors believes, however, that these potential effects are outweighed by the benefits

of the Reverse Stock Split.

Effect on Shares of Common Stock

The following table contains approximate information, based

on share information as of July 17, 2019, relating to our outstanding common stock assuming Reverse Stock Split ratios of 1-for-20,

1-for-40 and 1-for-60, which reflect the low end, middle and high end of the range that our stockholders are being asked to approve.

In addition, the following table sets forth (i) the number of shares of our common stock that would be issued and outstanding,

(ii) the number of shares of our common stock that would be reserved for issuance pursuant to outstanding warrants and options

and (iii) the weighted-average exercise price of outstanding options and warrants, each giving effect to the Reverse Stock Split

and based on securities outstanding as of July 17, 2019.

|

|

|

Number of

Shares

Before

Reverse Stock

Split

|

|

|

Reverse Stock

Split Ratio of

1-for-20

|

|

|

Reverse Stock

Split Ratio of

1-for-40

|

|

|

Reverse

Stock

Split Ratio of

1-for-60

|

|

|

Number of Shares

of Common Stock Issued and Outstanding

|

|

|

225,992,587

|

|

|

|

11,299,629

|

|

|

|

5,649,815

|

|

|

|

3,766,543

|

|

|

Number of Shares of Common

Stock Reserved for Issuance

|

|

|

105,151,046

|

|

|

|

337,757,553

|

|

|

|

343,878,776

|

|

|

|

345,919,184

|

|

|

Weighted Average Exercise Price of Options

|

|

$

|

2.32

|

|

|

$

|

46.40

|

|

|

$

|

92.67

|

|

|

$

|

139.20

|

|

|

Weighted Average Exercise Price of Warrants

|

|

$

|

4.03

|

|

|

$

|

80.60

|

|

|

$

|

161.20

|

|

|

$

|

241.80

|

|

If this Reverse Stock Split Proposal is approved and our Board

of Directors elects to effect the Reverse Stock Split, the number of outstanding shares of common stock will be reduced in proportion

to the ratio of the split chosen by our Board of Directors and we would communicate to the public, prior to the effective

date of the stock split, additional details regarding the Reverse Stock Split, including the specific ratio selected by our Board

of Directors.

After the effective date of the Reverse Stock Split that our

Board of Directors elects to implement, our common stock would have a new committee on uniform securities identification procedures,

or CUSIP number, a number used to identify our common stock.

Our common stock is currently registered under Section 12(b)

of the Securities Exchange Act of 1934, or the Exchange Act, and we are subject to the periodic reporting and other requirements

of the Exchange Act. The Reverse Stock Split will not affect the registration of our common stock under the Exchange Act or the

listing of our common stock on Nasdaq. Following the Reverse Stock Split, our common stock will continue to be listed on Nasdaq

under the symbol "SLS," although it will be considered a new listing with a new CUSIP number.

Effect on Preferred Stock

Pursuant to our Amended and Restated Certificate of Incorporation,

our authorized capital stock includes 5,000,000 shares of Preferred Stock, par value $0.0001 per share. The proposed amendment

to our Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split would not impact the total authorized

number of shares of preferred stock or the par value of the preferred stock.

Effect on Par Value

The proposed amendments to our Amended and Restated Certificate

of Incorporation will not affect the par value of our common stock, which will remain at $0.0001.

Reduction in Stated Capital

As a result of the Reverse Stock Split, upon the Effective Time,

the stated capital on our balance sheet attributable to our common stock, which consists of the par value per share of our common

stock multiplied by the aggregate number of shares of our common stock issued and outstanding, will be reduced in proportion to

the size of the Reverse Stock Split, subject to a minor adjustment in respect of the treatment of fractional shares, and the additional

paid-in capital account will be credited with the amount by which the stated capital is reduced. Our stockholders' equity, in the

aggregate, will remain unchanged.

Effect on Authorized Shares of Common Stock

Currently, we are authorized to issue up to a total of 350,000,000

shares of common stock. On the Record Date, there were 210,082,687 shares of our common stock issued and outstanding, warrants

to purchase 32,781,849 shares of our common stock issued and outstanding (with a weighted average exercise price of $2.07) and

options to purchase 1,210,234 shares of our common stock issued and outstanding under our equity compensation plans (with a weighted

average exercise price of $2.32). This leaves only 105,151,046 shares of our authorized common stock available for future issuance,

both for equity financings and equity compensation.

Effecting the Reverse Stock Split will not change the

total authorized number of shares of common stock. However, the reduction in the issued and outstanding shares, and the

corresponding adjustment of shares issuable pursuant to warrants and options, which would be decreased by a factor of between

20 and 60, would provide more authorized shares available for future issuance. Because holders of our common stock have no

preemptive rights to purchase or subscribe for any unissued stock of the Company, the issuance of additional shares in the

future of authorized common stock that will become newly available as a result of the implementation of the Reverse Stock

Split will reduce the current stockholders’ percentage ownership interest in the total outstanding shares of common

stock.

We may issue additional equity capital in the future to support

our planned clinical research and general operations. The additional available shares that the proposed Reverse Stock Split will

provide will allow us to pursue any such financing. However, with the exception of the reservation of shares for issuance upon

exercise of the our outstanding warrants and the reservation of shares underlying the 2017 Incentive Plan and 2019 Equity Plan,

if it is approved by our stockholders at the Special Meeting, we currently do not have any specific plans, arrangements or understandings

to issue any of the shares of common stock that will be newly available as a result of the implementation of the Reverse Stock

Split.

No Going Private Transaction

Notwithstanding the decrease in the number of outstanding shares

following the proposed Reverse Stock Split, our Board of Directors does not intend for this transaction to be the first step in

a "going private transaction" within the meaning of Rule 13e-3 of the Exchange Act.

Shares Held in Book-Entry and Through a Broker, Bank or

Other Holder of Record

If you hold registered shares of our common stock in a book-entry

form, you do not need to take any action to receive your post-Reverse Stock Split shares of our common stock in registered book-entry

form or your cash payment in lieu of fractional shares, if applicable. If you are entitled to post-Reverse Stock Split shares of

our common stock, a transaction statement will automatically be sent to your address of record as soon as practicable after the

Effective Time indicating the number of shares of our common stock you hold. In addition, if you are entitled to a payment of cash

in lieu of fractional shares, a check will be mailed to you at your registered address as soon as practicable after the Effective

Time. By signing and cashing this check, you will warrant that you owned the shares of the Company's common stock for which you

received a cash payment.

At the Effective Time, we intend to treat stockholders holding

shares of our common stock in "street name" (that is, through a broker, bank or other holder of record) in the same manner

as registered stockholders. Brokers, banks or other holders of record will be instructed to effect the Reverse Stock Split for

their beneficial holders holding shares of our common stock in "street name"; however, these brokers, banks or other

holders of record may apply their own specific procedures for processing the Reverse Stock Split. If you hold your shares of our

common stock with a broker, bank or other holder of record, and you have any questions in this regard, we encourage you to contact

your holder of record.

Shares Held in Certificated Form

If you hold any of your shares of our common stock in certificated

form (the "Old Certificate(s)"), you will receive a transmittal letter from our transfer agent as soon as practicable

after the Effective Time. The transmittal letter will be accompanied by instructions specifying how you can deliver your Old Certificate(s)

so that you are in a position to freely trade your post-Reverse Stock Split shares of our common stock, which will be in a book-entry

form, evidenced by a transaction statement that will be sent to your address of record as soon as practicable after your delivery

of a letter of transmittal and your Old Certificate, together with any payment of cash in lieu of fractional shares to which you

are entitled. Until surrendered as contemplated herein, a stockholder's Old Certificate(s) shall be deemed at and after the Effective

Time to represent the number of full shares of our common stock resulting from the Reverse Stock Split.

YOU SHOULD NOT SEND YOUR OLD CERTIFICATES NOW. YOU SHOULD

SEND THEM ONLY AFTER YOU RECEIVE THE LETTER OF TRANSMITTAL FROM OUR TRANSFER AGENT.

Vote Required

Under Delaware law, the affirmative vote of a majority of the

shares of common stock issued and outstanding and entitled to vote at the Special Meeting is required to adopt and approve the

amendment to our Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split. Because adoption and approval

of the amendment to our Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split requires a majority

of the outstanding shares, an abstention with respect to the Reverse Stock Split proposal will have the same effect as a vote "Against"

the proposal.

The Company’s Board of Directors recommends that you vote

"FOR" the Reverse Stock Split proposal.

No Appraisal Rights

Under the Delaware General Corporation Law, our stockholders

are not entitled to dissenter's rights or appraisal rights with respect to the Reverse Stock Split described in this proposal and

we will not independently provide our stockholders with any such rights.

Interest of Certain Persons in Matters to be Acted Upon

No officer or director has any substantial interest, direct

or indirect, by security holdings or otherwise, in the Reverse Stock Split that is not shared by all of our other stockholders.

Certain U.S. Federal Income Tax Consequences of the Reverse

Stock Split

The following discussion is a general summary of certain U.S.

federal income tax consequences of the Reverse Stock Split that may be relevant to holders of our common stock that hold such stock

as a capital asset for U.S. federal income tax purposes (generally, property held for investment). This summary is based upon the

provisions of the Internal Revenue Code of 1986, as amended (the "Code"), Treasury regulations promulgated thereunder,

administrative rulings and judicial decisions as of the date hereof, all of which may change, possibly with retroactive effect,

resulting in U.S. federal income tax consequences that may differ from those discussed below.

This discussion applies only to holders that are U.S. Holders

(as defined below) and does not address all aspects of federal income taxation that may be relevant to such holders in light of

their particular circumstances or to holders that may be subject to special tax rules, including: (i) holders subject to the

alternative minimum tax; (ii) banks, insurance companies, or other financial institutions; (iii) tax-exempt organizations;

(iv) dealers in securities or commodities; (v) regulated investment companies or real estate investment trusts; (vi) partnerships

(or other flow-through entities for U.S. federal income tax purposes and their partners or members); (vii) traders in securities

that elect to use a mark-to-market method of accounting for their securities holdings; (viii) U.S. Holders (as defined below)

whose "functional currency" is not the U.S. dollar; (ix) persons holding our common stock as a position in a hedging

transaction, "straddle," "conversion transaction" or other risk reduction transaction; (x) persons who

acquire shares of our common stock in connection with employment or other performance of services; or (xi) U.S. expatriates.

If a partnership (including any entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds shares

of our common stock, the tax treatment of a holder that is a partner in the partnership generally will depend upon the status of

the partner and the activities of the partnership.

We have not sought, and will not seek, an opinion of counsel

or a ruling from the Internal Revenue Service ("IRS") regarding the U.S. federal income tax consequences of the Reverse

Stock Split and there can be no assurance that the IRS will not challenge the statements and conclusions set forth below or a court

would not sustain any such challenge. The following summary does not address any U.S. state or local or any foreign tax consequences,

any estate, gift or other non-U.S. federal income tax consequences, or the Medicare tax on net investment income.

EACH HOLDER OF COMMON STOCK SHOULD CONSULT SUCH HOLDER'S TAX

ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO SUCH HOLDER.

For purposes of the discussion below, a "U.S. Holder"

is a beneficial owner of shares of our common stock that for U.S. federal income tax purposes is: (1) an individual citizen

or resident of the United States; (2) a corporation (including any entity taxable as a corporation for U.S. federal income

tax purposes) created or organized in or under the laws of the United States, any state or political subdivision thereof; (3) an

estate the income of which is subject to U.S. federal income taxation regardless of its source; or (4) a trust, if (i) a

court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S.

persons have the authority to control all substantial decisions of the trust, or (ii) the trust has a valid election in effect

to be treated as a U.S. person.

The Reverse Stock Split is intended to be treated as a "recapitalization"

for U.S. federal income tax purposes. As a result, a U.S. Holder generally should not recognize gain or loss upon the Reverse Stock

Split, except with respect to cash received in lieu of a fractional share of our common stock, as discussed below. A U.S. Holder's

aggregate tax basis in the shares of our common stock received pursuant to the Reverse Stock Split should equal the aggregate tax

basis of the shares of our common stock surrendered (excluding any portion of such basis that is allocated to any fractional share

of our common stock), and such U.S. Holder's holding period in the shares of our common stock received should include the holding

period in the shares of our common stock surrendered. Treasury regulations promulgated under the Code provide detailed rules for

allocating the tax basis and holding period of the shares of our common stock surrendered to the shares of our common stock received

pursuant to the Reverse Stock Split. Holders of shares of our common stock acquired on different dates and at different prices

should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

A U.S. Holder that receives cash in lieu of a fractional share

of our common stock pursuant to the Reverse Stock Split should recognize capital gain or loss in an amount equal to the difference

between the amount of cash received and the U.S. Holder's tax basis in the shares of our common stock surrendered that is allocated

to such fractional share. Such capital gain or loss should be long term capital gain or loss if the U.S. Holder's holding period

for our common stock surrendered exceeded one year at the Effective Time.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMEND

A VOTE "FOR" PROPOSAL NO. 1 RELATING TO THE AMENDMENT OF OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT

A REVERSE STOCK SPLIT.

PROPOSAL 2: APPROVAL OF THE COMPANY’S 2019 EQUITY INCENTIVE

PLAN

We are requesting that you vote to approve the adoption of the

SELLAS Life Sciences Group, Inc. 2019 Equity Incentive Plan (the “2019 Equity Plan”), which was approved by our Board

of Directors on July 26, 2019 effective upon stockholder approval at the Special Meeting. If this proposal is approved:

|

|

·

|

10,000,000 new shares of our common stock

will be reserved for issuance under the 2019 Equity Plan;

|

|

|

·

|

our 2017 Equity Incentive Plan (the “2017

Plan”) will be terminated;

|

|

|

·

|

up to 1,210,234 additional shares may

be issued if awards outstanding under the 2017 Plan are cancelled or expire on or after the date of the Special Meeting of stockholders;

and

|

|

|

·

|

on the first day of the Company’s

fiscal years 2020, 2021, 2022, and 2023, the number of Shares that may be issued from time to time pursuant to the 2019 Equity

Plan, shall be increased by an amount equal to the lesser of (i) 5% of the number of outstanding shares of Common Stock as of the

end of the prior fiscal year; and (ii) an amount determined by the Board of Directors or an authorized committee.

|

The 2019 Equity Plan includes the following provisions:

|

|

·

|

No Liberal Share Recycling

.

Shares that are withheld to satisfy any tax withholding obligation related to any stock award or for payment of the exercise price

or purchase price of any stock award under the 2019 Equity Plan will not again become available for issuance under the 2019 Equity

Plan.

|

|

|

|

|

|

|

·

|

No Discounted Options or Stock Appreciation

Rights

.

Stock options and stock appreciation rights may not be granted with exercise prices lower than the fair market

value of the underlying shares on the grant date except to replace equity awards due to a corporate transaction.

|

|

|

|

|

|

|

·

|

No Repricing without Stockholder

Approval

.

Other than in connection with corporate reorganizations or restructurings, at any time when the exercise price

of a stock option or strike price of a stock appreciation right is above the fair market value of a share, the Company will not,

without stockholder approval, reduce the exercise price of such stock option or strike price of such stock appreciation right and

will not exchange such stock option or stock appreciation right for a new award with a lower (or no) purchase price or for cash.

|

|

|

|

|

|

|

·

|

No Transferability

.

Equity

awards generally may not be transferred, except by will or the laws of descent and distribution, unless approved by the Board of

Directors or an authorized committee.

|

|

|

|

|

|

|

·

|

No Dividends Paid Prior to Vesting

.

The 2019 Equity Plan prohibits, for all award types, the payment of dividends or dividend equivalents before the vesting of the

underlying award but permits accrual of such dividends or dividend equivalents to be paid upon vesting.

|

|

|

|

|

|

|

·

|

Limits on Director Grants.

The 2019 Equity Plan limits the number of shares to be granted to any non-employee director in any calendar year such that the

aggregate grant date fair value of the equity grant taken together with any cash fees paid by the Company to such non-employee

director for services on the Board will not exceed $400,000, except with respect to the calendar year in which a non-employee director

is first appointed or elected to the Board of Directors.

|

Why We Are Requesting Stockholder Approval of the 2019 Equity

Plan

We believe that our future success depends, in large part, upon

our ability to maintain a competitive position in attracting, retaining and motivating persons who are expected to make important

contributions to the Company by providing such persons with equity ownership opportunities and performance-based incentives. The

life sciences industry is highly competitive, and our results are largely attributable to the talents, expertise, efforts and dedication

of our employees. Our compensation program, including the granting of equity compensation, is the primary means by which we attract

and recruit new employees, as well as retain our most experienced and skilled employees.

Equity compensation is also fundamental to our compensation

philosophy and core objectives of paying for performance and aligning the interests of employees with those of stockholders. A

significant portion of our employees’ compensation is provided in the form of equity. We believe that equity awards, and

the potential they hold for appreciation through an increase in our stock price, support our pay-for-performance philosophy, provide

further incentive to our employees to focus on creating long-term stockholder value and create an ownership culture that links

employees’ interests with those of our stockholders and our long-term results, performance, and financial condition.

As of July 17, 2019, 100% of our outstanding stock options were

underwater, with a weighted-average exercise price for 1,210,234 options outstanding under the 2017 Plan of $2.32 per share and

individual option exercise prices ranging up to $5.50 per share, and with a weighted-average exercise price for 10,171 options

outstanding under a prior Company equity award plan of $1,240.55 per share and individual option exercise prices ranging up to

$2,328.00 per share as compared to the $0.14 per share closing price of our common stock on Nasdaq on July 17, 2019. Accordingly,

we believe that our employees currently have a very limited opportunity to participate in any future appreciation in the value

of our common stock. For example, if the value of our common stock tripled from its closing price on Nasdaq of $0.14 on July 17,

2019 to $0.42 per share, our employees would be entitled to realize none of the increased equity value of the Company on a fully

diluted basis assuming full acceleration of all vesting provisions. We believe that such a limited opportunity to participate in

appreciation in the value of our common stock results in such outstanding options holding insufficient retention value for our

employees, puts us at risk of not being able to retain our most experienced and skilled employees and provides for insufficient

alignment of our employees’ interests with those of our stockholders.

As of July 17, 2019 we had 476,124 shares available for grant

under the 2017 Plan, representing less than 1% of the sum of (i) the total number of our shares of common stock outstanding,

plus (ii) the total number of shares of common stock issuable under outstanding equity incentive awards, plus (iii) the total number

of shares available for grant under the 2017 Plan. As of July 17, 2019, we had 12,758 restricted stock units outstanding outside

the 2017 Plan. During the years ended December 31, 2017 and 2018 and the six months ended June 30, 2019, we granted equity

awards with respect to 0, 482,500 and 940,000 shares, respectively, to employees, non-employee directors and consultants. The following

table sets forth a summary of outstanding stock options granted under our 2017 Plan, our shares available for grant under our 2017

Plan, and related information for employees and nonemployees as of July 17, 2019:

|

Options

Outstanding

|

|

|

Shares

Available

for Grant

|

|

|

Weighted

Average Exercise

Price of Options

Outstanding

|

|

|

Weighted

Average

Remaining

Contractual Term

of Options

Outstanding

(years)

|

|

|

Aggregate

Intrinsic Value (in

thousands)

|

|

|

|

1,210,234

|

|

|

|

476,124

|

|

|

$

|

2.32

|

|

|

|

9.45

|

|

|

$

|

0

|

|

Without the 2019 Equity Plan, we believe that we would not have

sufficient shares available for grant under the 2017 Plan to make meaningful equity incentive grants to any potential new employees

and we would not be able to adequately complete our anticipated annual Company-wide equity award grants for fiscal year 2020. Without

the 2019 Equity Plan, we believe that we would be forced to rely on providing cash-settled awards for a portion of our incentive-based

compensation in order to retain our most experienced and skilled employees, which we believe would put us at a competitive disadvantage

in our industry and would not be in our stockholders’ best interests as it would remove incentives aligning the interests

of our employees and our senior leaders with those of our stockholders to drive company-wide performance and create long-term stockholder

value.

In determining the terms of the 2019 Equity Plan, we considered

several factors, including the number of shares needed for annual employee option grants over the next two to three years, which

we estimated at 4% to 8% of our outstanding stock at the time of such grants, the number of option shares needed for new hires

over the next two to three years, including anticipated executive level hires in senior commercial, financial and clinical positions,

and potential performance grants to employees to align employee interests with specified program, strategic and financial priorities.

The 2019 Equity Plan is being submitted to you for approval

at the Special Meeting in order to ensure favorable federal income tax treatment for grants of incentive stock options under Section

422 of the Internal Revenue Code of 1986, as amended (the “Code”). Approval by our stockholders of the 2019 Equity

Plan is also required by the listing rules of Nasdaq.

In the event the Reverse Stock Split proposal included in this