Form 13f Holdings Report (13f-hr)

February 06 2020 - 12:19PM

Edgar (US Regulatory)

The Securities and Exchange Commission has not necessarily reviewed the information in this filing and has not determined if it is accurate and complete.

The reader should not assume that the information is accurate and complete.

| |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

|

OMB APPROVAL

|

| | Washington, D.C. 20549

FORM 13F | OMB Number: 3235-0006

Expires: July 31, 2015

Estimated average burden

hours per response: 23.8 |

| Report for the Calendar Year or Quarter Ended: | 12-31-2019 |

| Check here if Amendment: | | Amendment Number: | |

| This Amendment (Check only one.): | | is a restatement. |

| | | adds new holdings entries. |

Institutional Investment Manager Filing this Report:

| Name: | SEI INVESTMENTS CO |

| Address: | 1 FREEDOM VALLEY DRIVE |

| | OAKS | PA | 19456-1100 |

| Form 13F File Number: | | 028-16454 |

The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing

the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood

that all required items, statements, schedules, lists, and tables, are considered integral parts of this form.

Person Signing this Report on Behalf of Reporting Manager:

| Name: | Michael N. Peterson |

| Title: | Executive Vice President |

| Phone: | 610-676-1000 |

Signature, Place, and Date of Signing:

| Michael N. Peterson | Oaks,

PENNSYLVANIA

| 02-06-2020 |

| [Signature] | [City, State] | [Date] |

| Do you wish to provide information pursuant to Special Instruction 5? |

X

Yes No |

Additional Information

SEI Investments Company (SEI) is the parent holding company of certain institutional investment managers, as defined by Section 13(f) of the Securities Exchange Act of 1934, as amended (the "Act"). For purposes of the reporting requirements under Section 13(f) of the Act, and the rules promulgated thereunder, SEI does not exercise, and therefore disclaims, investment discretion with respect to any Section 13(f) securities positions over which its investment operating subsidiaries exercise such discretion. To the extent, however, that SEI's ownership interest in such subsidiaries may nevertheless give rise to a Form 13F obligation for SEI, the information required by Form 13F is reported herein on behalf of the following subsidiaries: SEI Investments Management Corporation ("SIMC"), SEI Trust Company and SEI Investments Canada Company (SEI Canada). Voting authority with respect to the Section 13(f) securities reported herein resides with and is exercised by SEI's operating subsidiaries, unless otherwise indicated. Although SEI has not been delegated voting authority over such Section 13(f) securities, and disclaims such voting authority, pursuant to instruction 12b.viii of Form 13F, and for that purpose only, such Section 13(f) securities are reported as "Sole Voting Authority." SIMC and SEI Canada each serve as an investment adviser to a number of pooled investment vehicles, which may include mutual funds, hedge funds, private equity funds, collective investment trusts and offshore investment funds (together, the "Pooled Investment Vehicles"). In addition, SIMC sponsor and may serve as adviser to, separately managed account programs (SMA Programs) . SIMC and SEI Canada may act as a "manager of managers" whereby each retain, subject to SIMC's and SEI Canada's oversight, respectively, sub-advisers to buy and sell securities on behalf of such Pooled Investment Vehicles and SMA Programs. To the extent that SIMC's and SEI Canada's role as a manager of managers could give rise to a Form 13F obligation, SIMC or SEI Canada has instructed its sub-advisers to file a Form 13F with respect to such securities and has included such sub-advisers in the "list of other managers reporting for this manager" below.

Report Type (Check only one.):

13F HOLDINGS REPORT. (Check here if all holdings of this reporting manager are reported in this report.)

13F NOTICE. (Check here if no holdings reported are in this report, and all holdings are reported by other reporting manager(s).)

X

13F COMBINATION REPORT. (Check here if a portion of the holdings for this reporting manager are reported in this report and a portion are reported by other reporting manager(s).)

List of Other Managers Reporting for this Manager

[If there are no entries in this list, omit this section.]

| Form 13F File Number | Name |

| 028-17130 | 361 Capital, LLC |

| 028-05990 | Acadian Asset Management LLC |

| 028-05508 | AJO, LP |

| 028-10562 | AllianceBernstein L.P. |

| 028-04895 | Analytic Investors, LLC |

| 028-10120 | AQR Capital Management LLC |

| 028-17137 | Arcus |

| 028-13791 | ArrowMark Partners |

| 028-05615 | Axiom International Investors |

| 028-18146 | Benefit Street Partners |

| 028-02951 | Beutel Goodman Capital Management |

| 028-18913 | Blackcrane Capital, LLC |

| 028-12820 | Brigade Capital Management, LP |

| 028-11728 | Causeway |

| 028-11563 | Coho Partners |

| 028-14668 | Copeland Capital Management, LLC |

| 028-10492 | Falcon Point Capital |

| 028-14036 | Fiera Capital Corp. |

| 028-18845 | Fondsmaeglerselskabet Maj Invest A/S |

| 028-12836 | Guggenheim Capital Llc |

| 028-11957 | Hillsdale Investment Management Inc. |

| 028-04211 | Intech Investment Management LLC |

| 028-12634 | Investec Asset Management Ltd. |

| 028-14777 | J O HAMBRO CAPITAL MANAGEMENT LTD |

| 028-11937 | JP Morgan Investment Management |

| 028-17689 | Kettle Hill Capital Management, LLC |

| 028-13608 | LMCG Investments, LLC |

| 028-06580 | LSV Asset Management |

| 028-13124 | Macquarie Investment Management |

| 028-03673 | ManuLife Asset Management LLC |

| 028-17488 | Maple-Brown Abbott |

| 028-13243 | Mar Vista Investment Partners, LLC |

| 028-03743 | Marathon Asset Management, LP |

| 028-04632 | Martingale Asset Management L P |

| 028-13573 | Neuberger Berman Group LLC |

| 028-17435 | NN Investment Partners Holdings N.V. |

| 028-01474 | NWQ Investment Management Company, LLC |

| 028-03042 | PanAgora Asset Management Inc. |

| 028-04558 | Parametric Portfolio Associates LLC |

| 028-12690 | PCJ Investment Counsel Ltd |

| 028-13350 | Poplar Forest Capital LLC |

| 028-01549 | PRINCIPAL GLOBAL INVESTORS |

| 028-14009 | QS Investors LLC |

| 028-19339 | Qtron Investments LLC |

| 028-11173 | Quantiative Management Associates |

| 028-10674 | Ramius Advisors LLC |

| 028-14481 | RWC Asset Management LLP |

| 028-04691 | Schafer Cullen Capital Management Inc. |

| 028-10613 | Snow Capital Management LP |

| 028-11300 | Spectrum Asset Management, Inc. |

| 028-00733 | State Street Bank & Trust |

| 028-10640 | Towle & Co |

| 028-07104 | WCM Investment Management/CA |

| 028-17022 | William Blair & Co |

Form 13F Summary Page

Report Summary:

| Number of Other Included Managers: | 12 |

| Form 13F Information table Entry Total: | 5444 |

| Form 13F Information table Value Total: | 33,525,222 |

| | (thousands) |

|

List of Other Included Managers:

Provide a numbered list of the name(s) and Form 13F number(s) of all institutional investement managers with respect to which this report is filed, other than the manager filing this report.

| No. | Form 13F File Number | Name | CIK |

| 2 | | Ceredex Value Advisors LLC | |

| 4 | | EAM Investors LLC | |

| 8 | | EARNEST Partners LLC | |

| 6 | | Fred Alger Management Inc. | |

| 7 | | Great Lakes Advisors LLC | |

| 8 | | Huntington Steele LLC | |

| 12 | | Jupiter Asset Management Ltd | |

| 14 | 028-16475 | SEI Investments Management Corporation | |

| 15 | 028-10297 | SEI Trust Company | |

| 16 | | Sionna Investment Managers Inc. | |

| 18 | | Todd Asset Management LLC | |

| 19 | 028-16449 | SEI Investments Canada Company | |

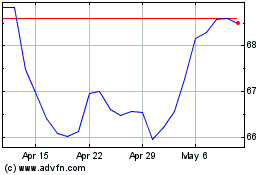

SEI Investments (NASDAQ:SEIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

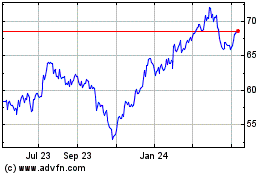

SEI Investments (NASDAQ:SEIC)

Historical Stock Chart

From Apr 2023 to Apr 2024